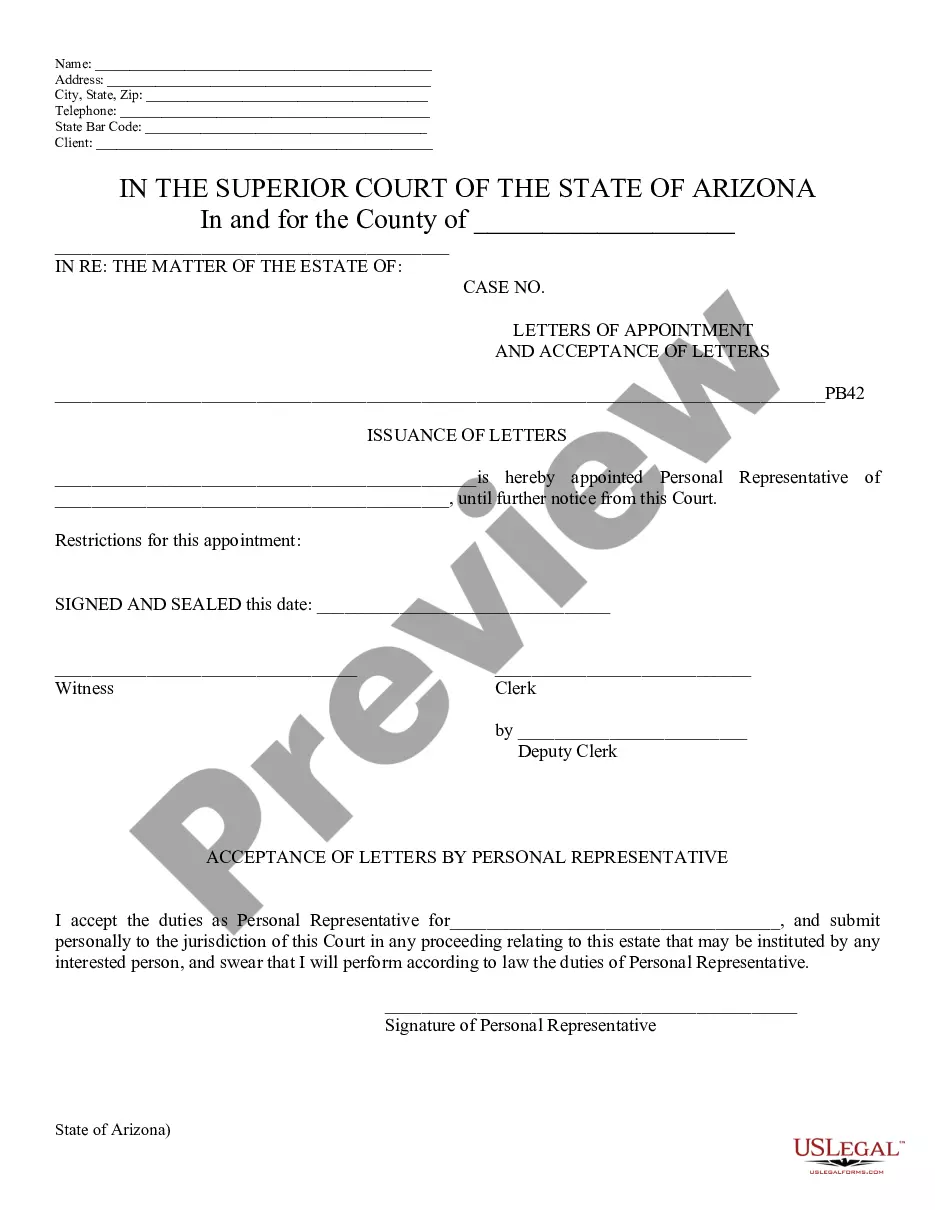

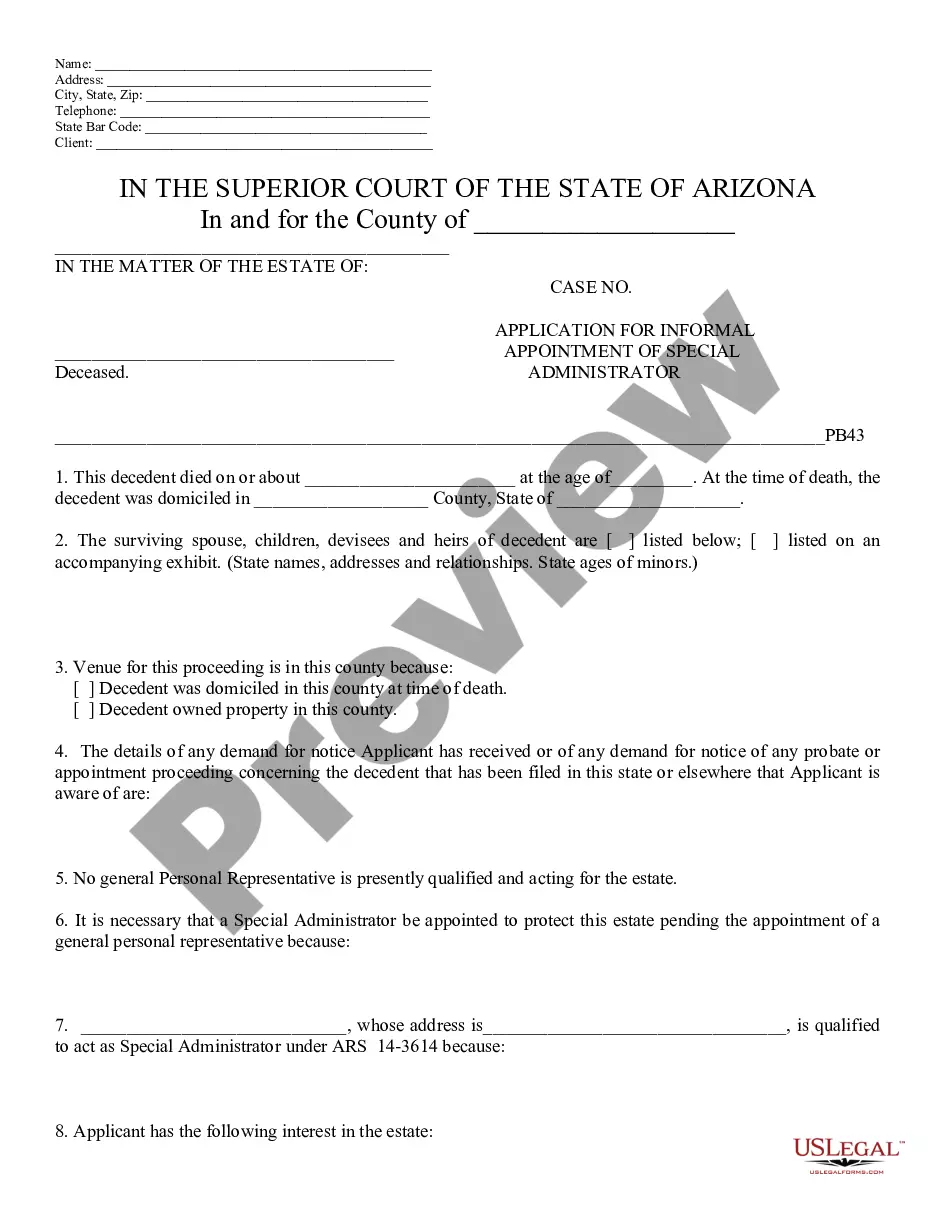

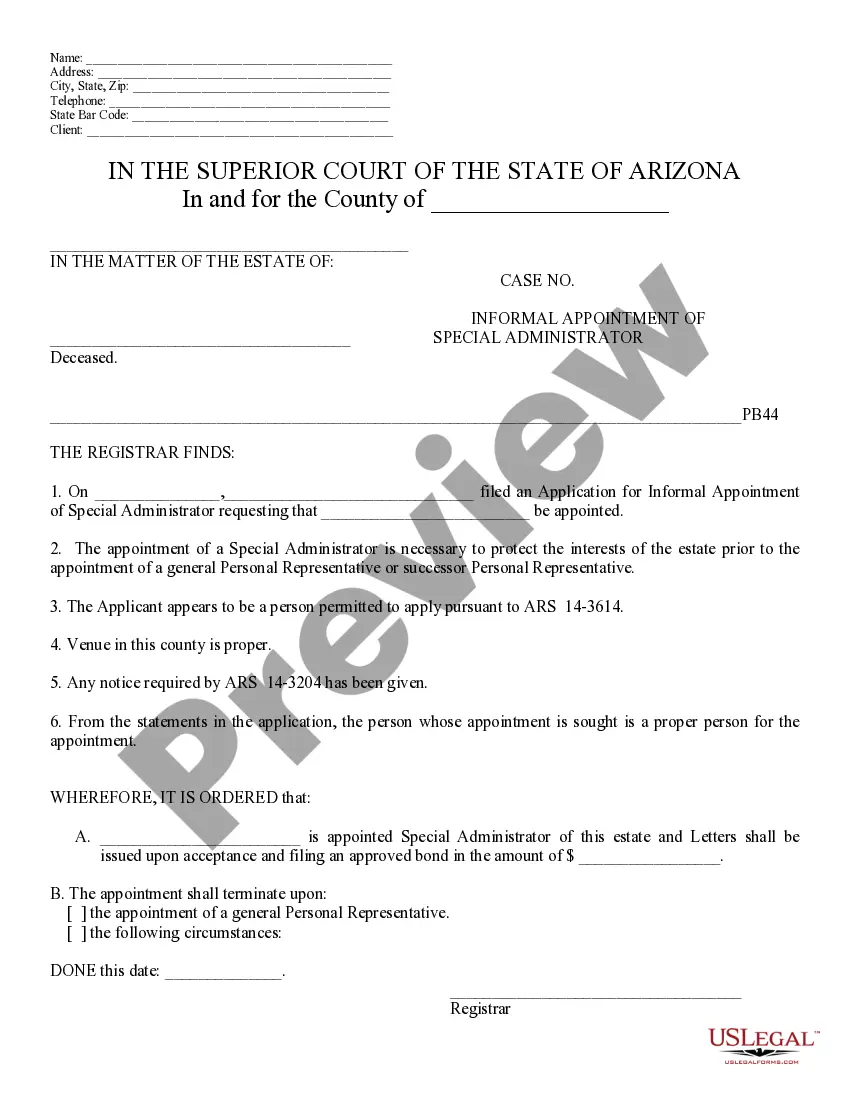

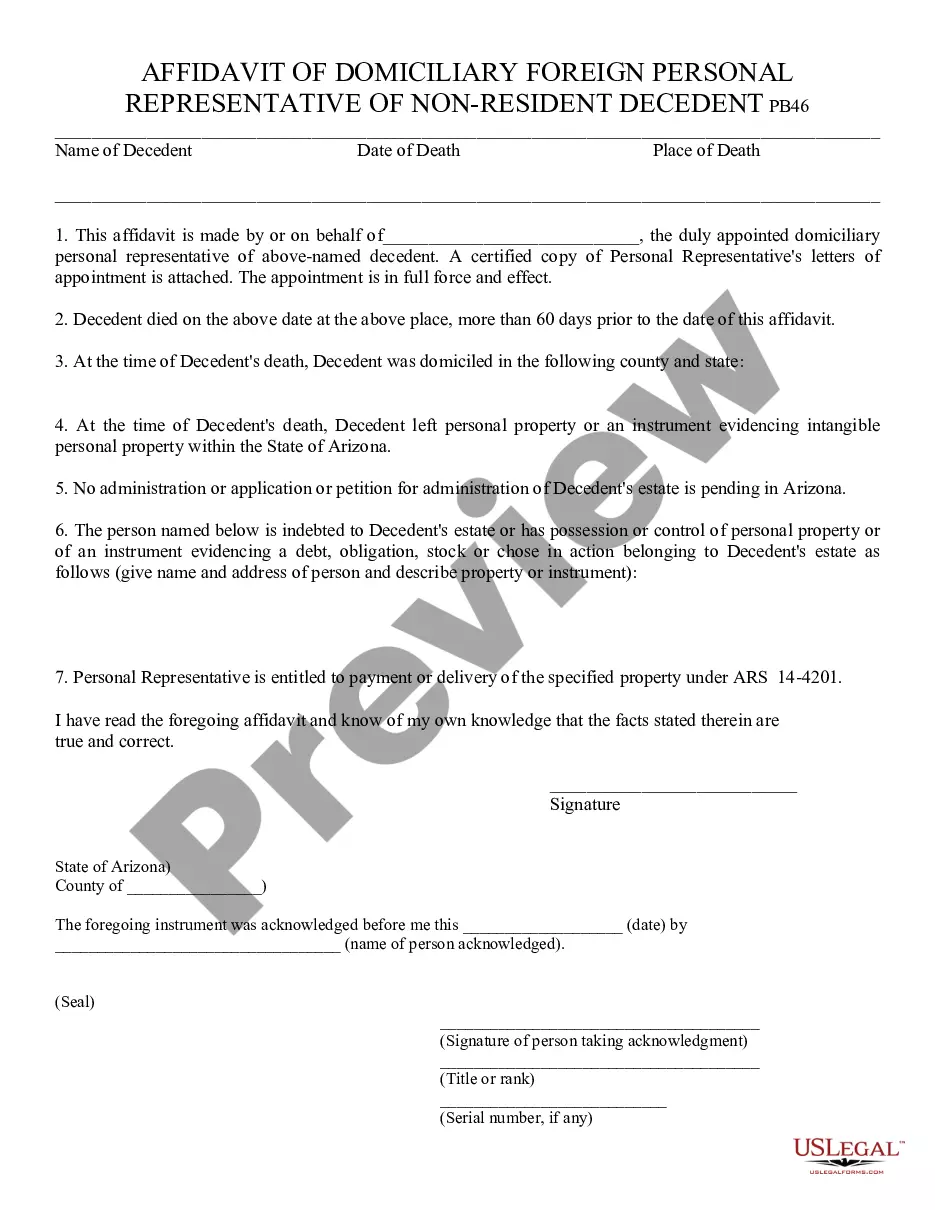

The Harris Texas Subscription Agreement — A Section 3C1 Fund is a legally binding document that outlines the terms and conditions for investors looking to subscribe to the Harris Texas 3C1 Fund. This fund operates under Section 3(c)(1) of the Investment Company Act of 1940, which allows it to have up to 100 accredited investors. The subscription agreement serves as an essential tool to establish a relationship between the fund and its investors. It includes detailed provisions that govern the subscription process and provide clarity on various aspects of the investment. Some relevant keywords associated with the Harris Texas Subscription Agreement — A Section 3C1 Fund are: 1. Subscription process: The agreement outlines the steps and requirements for investors to subscribe to the fund, including the completion of subscription forms, investor qualification verification, and submission of the required documentation. 2. Accredited investors: As per Section 3(c)(1), the fund can only accept accredited investors who meet certain net worth or income thresholds. The agreement defines the criteria that investors must meet to be eligible for investment in the fund. 3. Investment terms: The agreement specifies the terms of the investment, such as the minimum and maximum investment amounts, the duration of the investment, and any lock-up periods during which investors cannot redeem their shares. 4. Risk disclosures: To ensure transparency, the agreement includes a section that outlines the risks associated with investing in the Harris Texas 3C1 Fund. This may cover market risks, liquidity risks, and other potential risks specific to the fund's investment strategy. 5. Transferability and assignment: The agreement may outline the conditions under which investors can transfer or assign their interests in the fund, including any restrictions or approval requirements imposed by the fund manager. Different types of Harris Texas Subscription Agreement — A Section 3C1 Fund may exist based on variations in investment strategies or specific provisions unique to certain funds. Some examples of such variations could include: 1. Harris Texas Subscription Agreement — A Section 3C1 Equity Fund: This type of fund focuses on investing in equity securities, such as stocks or shares of companies, and its subscription agreement may include additional clauses specific to equity investments. 2. Harris Texas Subscription Agreement — A Section 3C1 Real Estate Fund: This fund specializes in real estate investments and may have specific provisions related to property acquisitions, lease agreements, and regulatory compliance in the real estate sector. 3. Harris Texas Subscription Agreement — A Section 3C1 Hedge Fund: A hedge fund operates differently from traditional investment funds, utilizing various investment strategies to generate returns. The subscription agreement for a hedge fund may include provisions related to leverage, short selling, derivatives trading, or any other specific strategies employed by the fund. It is important to note that the specific types of Harris Texas Subscription Agreement — A Section 3C1 Fund mentioned above are hypothetical examples and not reflective of actual offerings. The content generated is intended to illustrate the potential variations in subscription agreements within the broader context of Section 3C1 funds.

Harris Texas Subscription Agreement - A Section 3C1 Fund

Description

How to fill out Harris Texas Subscription Agreement - A Section 3C1 Fund?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Harris Subscription Agreement - A Section 3C1 Fund meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Harris Subscription Agreement - A Section 3C1 Fund, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Harris Subscription Agreement - A Section 3C1 Fund:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Subscription Agreement - A Section 3C1 Fund.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!