Maricopa, Arizona Subscription Agreement for an Equity Fund: The Maricopa, Arizona Subscription Agreement for an Equity Fund is a legally binding document that sets forth the terms and conditions of an investment in an equity fund located in Maricopa, Arizona. This agreement outlines the relationship between the investor and the equity fund, detailing the rights and responsibilities of both parties. Key elements of the Maricopa, Arizona Subscription Agreement for an Equity Fund include: 1. Parties: The agreement identifies the parties involved, including the investor and the equity fund, along with their respective addresses and contact information. 2. Subscription Amount: The agreement specifies the amount of money the investor agrees to contribute to the equity fund. This could be a one-time investment or multiple installments over a specific period. 3. Payment Terms: The agreement establishes the payment terms, including the due date and acceptable methods of payment for the subscription amount. 4. Representations and Warranties: The investor is required to make certain representations and warranties to the equity fund, acknowledging their eligibility to invest and providing accurate information about their financial status and investment objectives. 5. Transferability of Subscription: The agreement outlines whether the subscription is transferable or not, and any restrictions or conditions associated with transferring the investment to another party. 6. Disbursement of Funds: The agreement details how and when the equity fund will use the subscription amount, investment strategies, and any associated fees or expenses. 7. Confidentiality and Non-Disclosure: The agreement may include provisions that protect the confidentiality of sensitive information shared between the investor and the equity fund. 8. Governing Law and Jurisdiction: The agreement specifies the jurisdiction and governing law under which any disputes or claims arising from the agreement will be resolved. Different types of Maricopa, Arizona Subscription Agreement for an Equity Fund: 1. Individual Subscription Agreement: This type of agreement is entered into by individuals who wish to invest in an equity fund in Maricopa, Arizona. 2. Corporate Subscription Agreement: This agreement is specific to corporations or other types of business entities seeking to invest in an equity fund based in Maricopa, Arizona. 3. Institutional Subscription Agreement: This type of agreement is designed for institutional investors, such as pension funds or endowments, interested in investing in a Maricopa, Arizona equity fund. 4. Limited Partnership Subscription Agreement: When an equity fund is structured as a limited partnership, this agreement outlines the terms for limited partners who wish to subscribe to the fund. By utilizing a Maricopa, Arizona Subscription Agreement for an Equity Fund, investors can ensure a clear understanding of the terms and conditions surrounding their investment, while equity funds can benefit from a legally binding framework that ensures compliance and protects both parties' rights.

Maricopa Arizona Subscription Agreement for an Equity Fund

Description

How to fill out Maricopa Arizona Subscription Agreement For An Equity Fund?

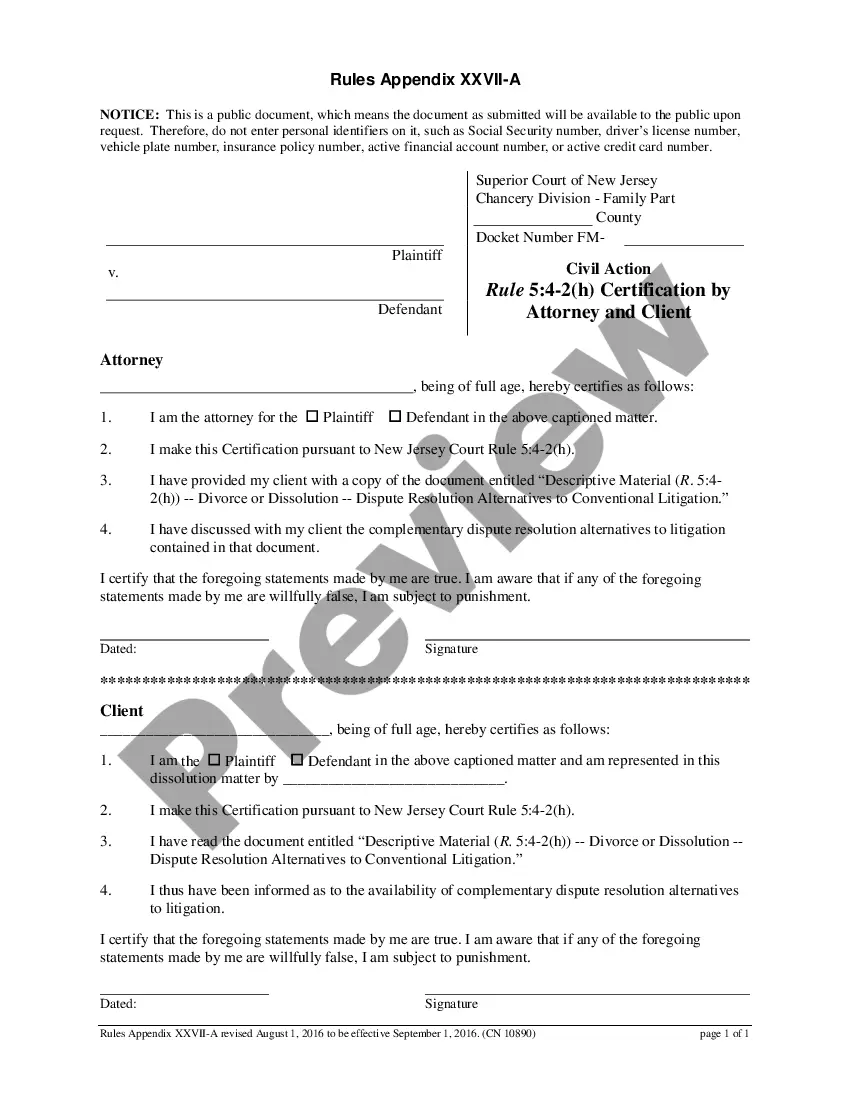

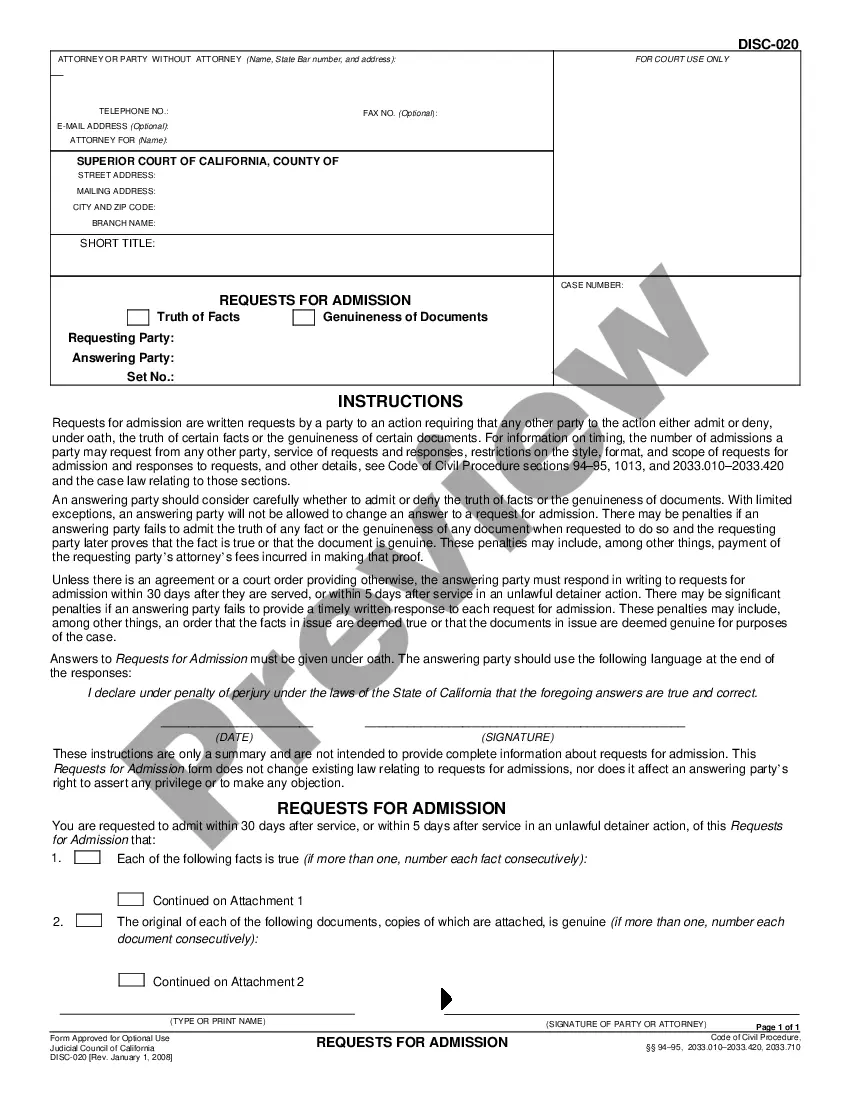

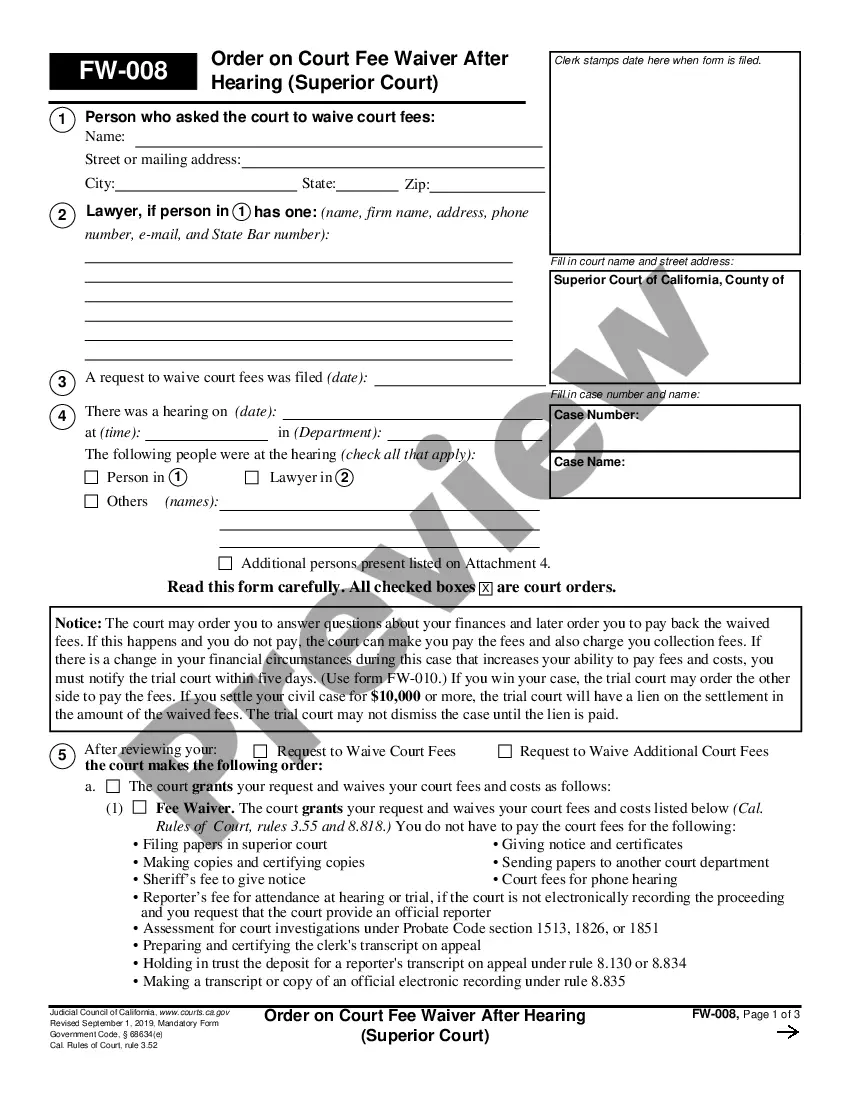

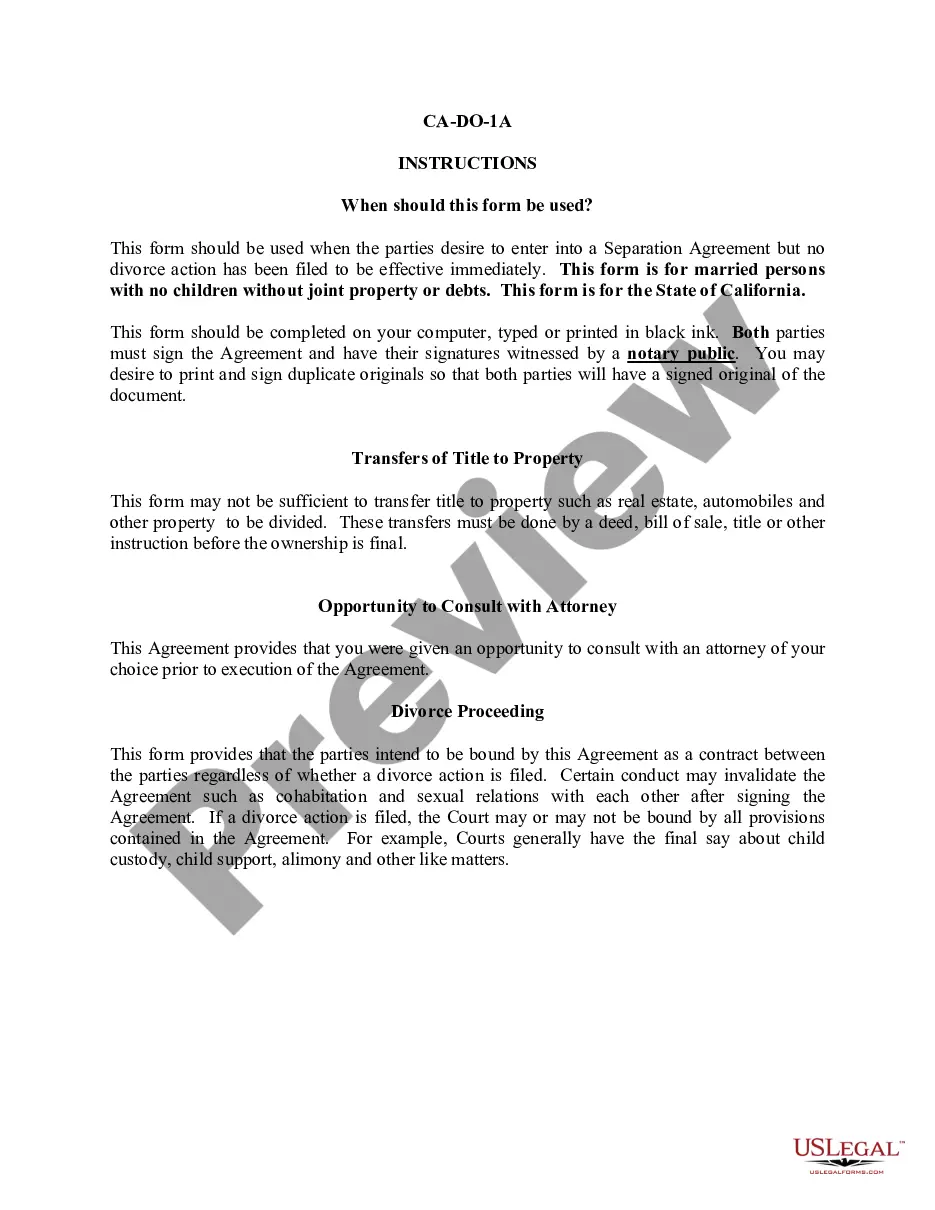

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Maricopa Subscription Agreement for an Equity Fund, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the recent version of the Maricopa Subscription Agreement for an Equity Fund, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Subscription Agreement for an Equity Fund:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Maricopa Subscription Agreement for an Equity Fund and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Subscription refers to the process of investors signing up and committing to invest in a financial instrument, before the actual closing of the purchase.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

The agreement typically describes in detail the rights and obligations of each shareholders and the legitimate pricing of shares. One of the differences between share subscription agreement and shareholders agreement is that the shareholders' agreement is drafted in greater detail.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

The subscription agreement is used to keep track of how many shares have been sold and at what price the shares sold at for a privately held company. The subscription agreement details all the information about the transaction, such as the number of shares and price, and confidentiality provisions.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Regulation D lets companies doing specific types of private placements raise capital without needing to register the securities with the SEC.

A subscription line, also called a credit facility, is a loan taken out mostly by closed-end private market funds, in particular by private equity funds. The loan is secured against a fund's investors' commitments, generally without recourse to the actual underlying investments in the fund.

A subscription right allows existing shareholders in a company to purchase shares of the secondary offeringusually at a discounted pricebefore shares are offered to investors in the broader market.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

What Is Subscribed? The term subscribed refers to newly issued securities that an investor agrees or intends to buy prior to the official issue date. When investors subscribe, they expect to own the number of shares they designate once the offering is complete.