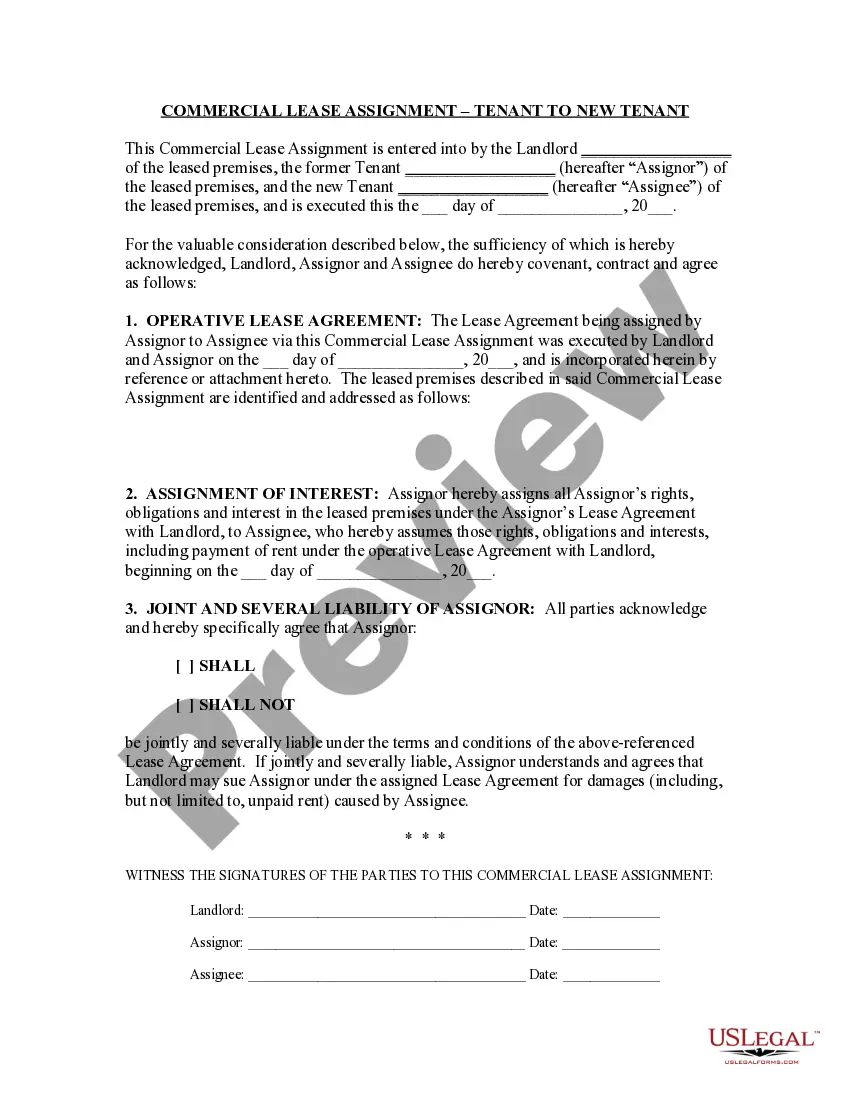

A San Antonio Texas Subscription Agreement for an Equity Fund is a legally binding document detailing the terms and conditions for an investor to subscribe and contribute to an equity fund based in San Antonio, Texas. This agreement outlines the rights, obligations, and responsibilities of both the investor and the equity fund, ensuring a clear understanding and alignment between the parties involved. Keywords: San Antonio Texas, Subscription Agreement, Equity Fund, investor, contribute, legally binding, terms and conditions, rights, obligations, responsibilities, understanding, alignment. In San Antonio, Texas, there may be different types of Subscription Agreements for Equity Funds to cater to various investor preferences and investment strategies. Some of these types may include: 1. Individual Investor Subscription Agreement: This type of agreement is specifically designed for individual investors who wish to contribute their personal funds to the equity fund. It outlines the agreed subscription amount, payment terms, and other relevant details specific to individual investors. 2. Institutional Investor Subscription Agreement: Institutional investors, such as pension funds, endowments, or insurance companies, may require a specialized subscription agreement to meet their unique requirements. This type of agreement may include additional provisions related to reporting, compliance, and other considerations specific to institutional investors. 3. Accredited Investor Subscription Agreement: Accredited investors, who meet specific financial criteria, may have access to different investment opportunities or terms. An agreement tailored for accredited investors may include provisions related to their status, verification procedures, and any additional benefits or requirements applicable to them. 4. Limited Partner Subscription Agreement: In the case of private equity funds structured as limited partnerships, there might be a specific subscription agreement for limited partners. This agreement typically outlines the limited partner's capital commitment, distribution waterfall, governance structure, and other essential details related to their participation in the fund. 5. Fund-of-Funds Subscription Agreement: For investors who prefer to invest in multiple equity funds through a fund-of-funds structure, a subscription agreement specific to this arrangement may be required. It would outline the terms and conditions governing the investment in the fund-of-funds, along with any unique provisions applicable to this type of investment approach. Each type of Subscription Agreement for an Equity Fund in San Antonio, Texas, aims to provide clarity and protection for both the investor and the fund, ensuring that all parties are aware of their rights and responsibilities throughout their partnership.

San Antonio Texas Subscription Agreement for an Equity Fund

Description

How to fill out San Antonio Texas Subscription Agreement For An Equity Fund?

Draftwing forms, like San Antonio Subscription Agreement for an Equity Fund, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for a variety of scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the San Antonio Subscription Agreement for an Equity Fund template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting San Antonio Subscription Agreement for an Equity Fund:

- Ensure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the San Antonio Subscription Agreement for an Equity Fund isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!