Kings New York Clawback Guaranty is a legal and financial concept designed to protect investors and creditors in various business transactions, particularly those related to real estate. This guarantee is typically included in contracts, agreements, or loan documentation to provide additional security and mitigate the risk of potential financial losses. In essence, the Kings New York Clawback Guaranty is a legally binding agreement where a guarantor pledges to repay certain funds or assets in the event of specific predefined circumstances. These circumstances usually involve the occurrence of a default, fraud, misrepresentation, or any other situation that negatively impacts the investment or loan agreement. Here are a few types of Kings New York Clawback Guaranty: 1. Property Acquisition Clawback Guaranty: This type of guaranty applies to real estate transactions, primarily in cases where an investor purchases a property or a portfolio of properties. The guarantor guarantees to repay a portion of the investment or the entire investment amount if certain pre-established conditions are met, such as failing to maintain the property, not fulfilling rental occupancy requirements, or breaching contractual obligations. 2. Construction Financing Clawback Guaranty: This type of guaranty is often utilized in construction projects, where lenders or investors provide financing for the development of a property. The guarantor pledges to reimburse the lender or investor in the event of project delays, cost overruns, contractor defaults, or any other circumstance that jeopardizes the successful completion of the construction project. 3. Business Acquisition Clawback Guaranty: In the context of mergers and acquisitions, this type of guaranty is incorporated to protect the purchaser or investor. It ensures that the seller or target company's existing owners will be held financially responsible for any misrepresentation of the company's financial condition, undisclosed liabilities, or breaches of warranties and representations. 4. Loan Repayment Clawback Guaranty: This variation of the guaranty is commonly used in loan agreements, where the guarantor agrees to repay the lender if the borrower fails to meet repayment terms or defaults on the loan. The Kings New York Clawback Guaranty provides greater assurance and protection for investors, lenders, and creditors. It discourages potential wrongdoings, encourages responsible business practices, and serves as a deterrent against fraudulent activities.

Kings New York Clawback Guaranty

Description

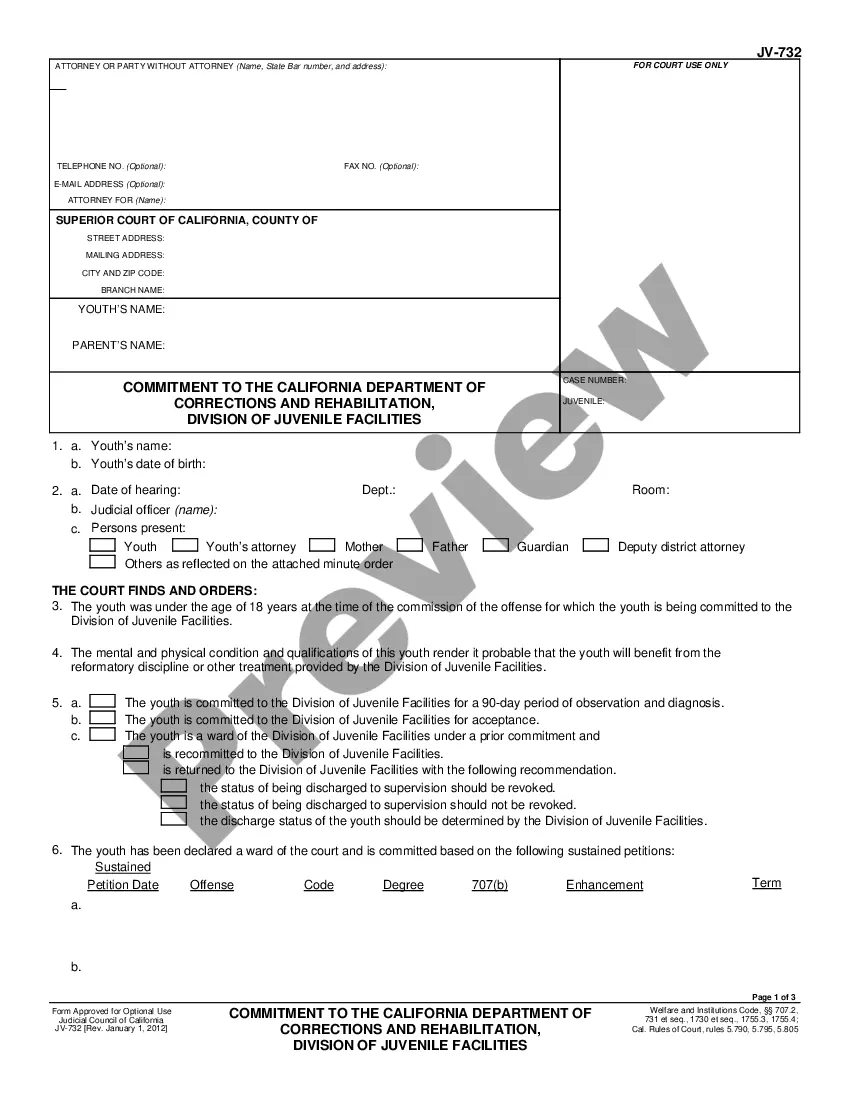

How to fill out Kings New York Clawback Guaranty?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Kings Clawback Guaranty, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Kings Clawback Guaranty, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Clawback Guaranty:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Kings Clawback Guaranty and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!