Suffolk New York Clawback Guaranty is a legal provision that can be found within certain contracts, specifically in the state of New York, to protect creditors in the event of a default or bankruptcy. A clawback guaranty allows creditors to "claw back" or recoup funds or assets previously distributed to a debtor, ensuring that the creditor has a higher chance of recovering their investment. There are several types of Suffolk New York Clawback Guaranties, each serving different purposes and providing varying levels of protection for creditors. Here are some key types: 1. Real Estate Clawback Guaranty: This type of guarantee is commonly used in real estate transactions where a property is purchased or developed with financing. It ensures that if the borrower defaults or goes bankrupt, the lender can recover any profits or distributions made by the borrower during the loan period. 2. Ponzi Scheme Clawback Guaranty: Specifically designed to combat Ponzi schemes, this type of guarantee helps defrauded investors recover funds that were unlawfully distributed by the scheme's perpetrators. It enables clawing back profits or returns obtained by early investors, which may be redistributed among all affected investors. 3. Private Equity Clawback Guaranty: In private equity partnerships, this guaranty protects limited partners by reclaiming distributions made to general partners if the overall investment's performance falls short of predetermined thresholds. It ensures that general partners are responsible for returning any profits they received before the agreed-upon return targets are achieved. 4. Bankruptcy Clawback Guaranty: This type of guaranty is incorporated into contracts with companies facing financial distress or bankruptcy. In the event of a bankruptcy filing, it permits creditors to recover payments made to insiders or related parties within a certain time frame preceding the bankruptcy filing. 5. Corporate Debt Clawback Guaranty: Often found in loan agreements, this guaranty allows lenders to claw back payments or assets distributed by a debtor company to its owners or affiliates within a defined period before default. It helps safeguard lenders' interests to increase the chances of repayment. Suffolk New York Clawback Guaranties are essential safeguards for creditors, providing them with an added layer of protection in various legal and financial scenarios. These guaranties aim to prevent unjust enrichment or disproportionate distributions, enabling creditors to retrieve funds or assets that might otherwise be irretrievable due to insolvency or fraudulent activities.

Suffolk New York Clawback Guaranty

Description

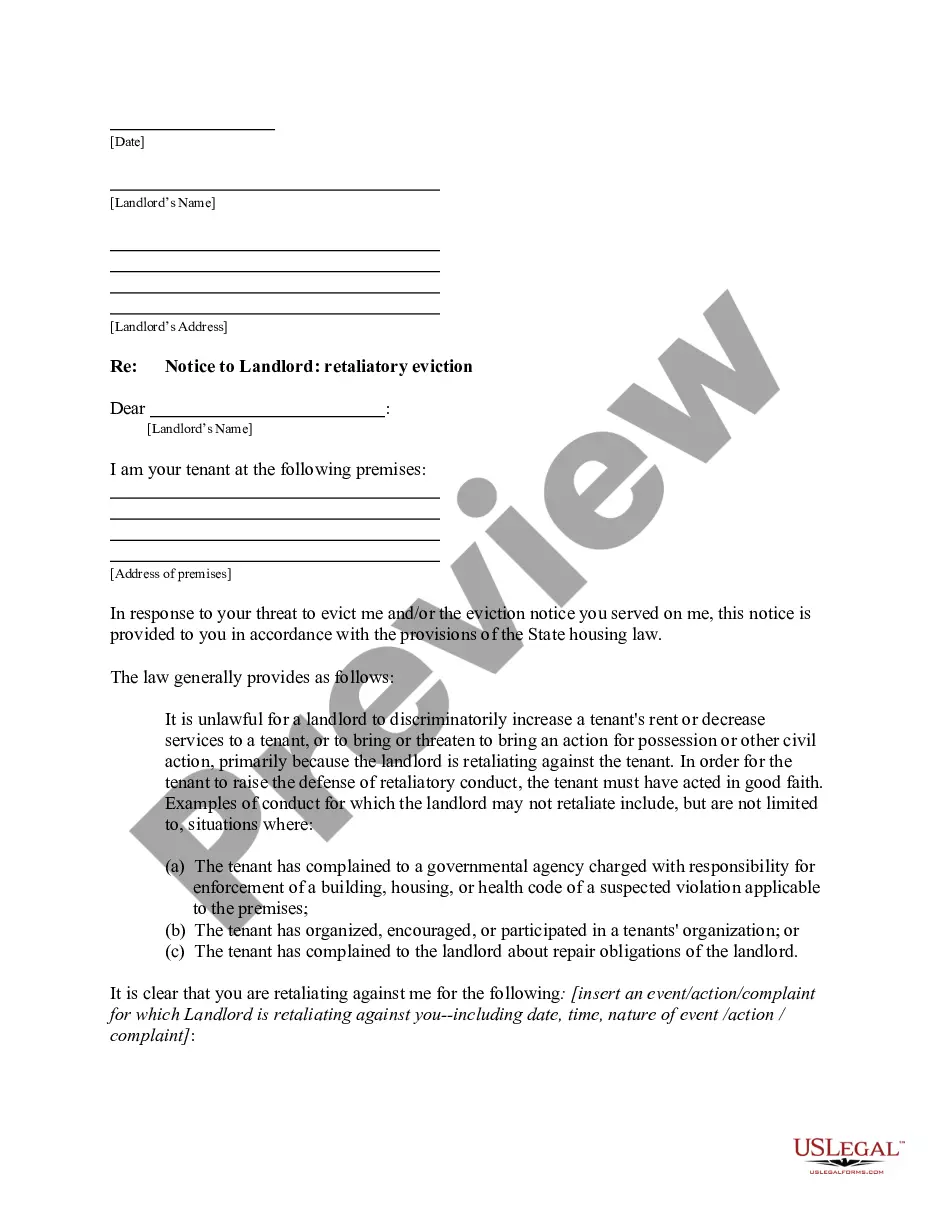

How to fill out Suffolk New York Clawback Guaranty?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Suffolk Clawback Guaranty is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Suffolk Clawback Guaranty. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Clawback Guaranty in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!