San Antonio, Texas is a vibrant city located in the southern part of the state. It is known for its rich history, diverse culture, and modern growth. As a major economic hub, the city has implemented various measures to prevent money laundering activities, including the San Antonio Texas Form of Anti-Money Laundering Policy. The San Antonio Texas Form of Anti-Money Laundering Policy is a comprehensive set of guidelines and regulations aimed at detecting and deterring money laundering activities within the city's financial institutions, businesses, and professional service providers. The policy is designed to protect the integrity of the local economy, ensure compliance with relevant laws and regulations, and safeguard against criminal activities related to illicit funds. Key elements of the San Antonio Texas Form of Anti-Money Laundering Policy include: 1. Know Your Customer (KYC) Procedures: Financial institutions and businesses are required to establish and maintain robust KYC procedures to identify and verify the identity of their customers. This helps in preventing the use of false identities and ensures transparency in financial transactions. 2. Suspicious Activity Reporting: The policy mandates that businesses and financial institutions actively monitor their transactions and report any suspicious activities that may indicate money laundering or other illicit financial activities. Timely reporting of such activities contributes to the overall effort in combating money laundering. 3. Customer Due Diligence: To prevent money laundering, financial institutions and businesses are expected to conduct thorough due diligence on their customers. This includes obtaining relevant identification and financial information, assessing risk levels associated with clients, and conducting ongoing monitoring when necessary. 4. Employee Training and Awareness: Financial institutions and businesses are required to provide training to their employees to recognize and report any suspicious activities that may be indicative of money laundering. Regular training helps create awareness and ensures that staff members are equipped to identify and handle potential money laundering situations. 5. Record-Keeping: The policy emphasizes the importance of maintaining accurate and up-to-date records of all financial transactions. This includes records of customer identification, transaction details, and any supporting documentation. Proper record-keeping is crucial for audit purposes and aids in investigating suspicious activities if required. While the San Antonio Texas Form of Anti-Money Laundering Policy sets a standard framework for preventing money laundering, it may be adapted and implemented differently by different types of businesses and institutions. Some examples of specific forms of the policy may include: 1. San Antonio Texas Form of Anti-Money Laundering Policy for Banks: This policy would cater specifically to banking institutions, outlining procedures, and protocols tailored to the unique nature of banking services. 2. San Antonio Texas Form of Anti-Money Laundering Policy for Real Estate: Real estate agencies and property developers may have their unique policy to address money laundering risks associated with real estate transactions, such as cash transactions or property flipping. 3. San Antonio Texas Form of Anti-Money Laundering Policy for Casinos: Given the presence of casinos in San Antonio, specific policies may be in place to tackle money laundering risks associated with gambling activities, cash handling, and prize payouts. In conclusion, the San Antonio Texas Form of Anti-Money Laundering Policy is an essential mechanism in safeguarding the local economy from illicit financial activities. By implementing robust procedures, training employees, and promoting awareness, the policy aims to maintain the integrity of financial transactions and counter money laundering risks effectively.

San Antonio Texas Form of Anti-Money Laundering Policy

Description

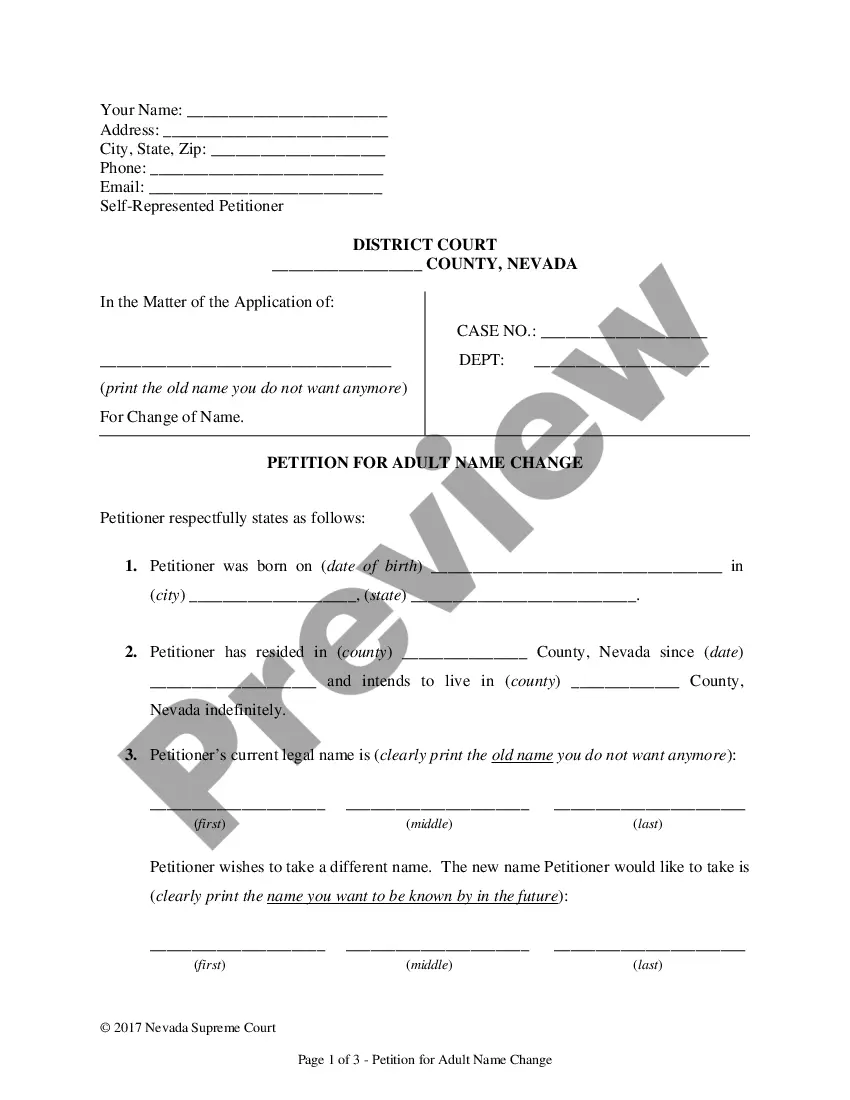

How to fill out San Antonio Texas Form Of Anti-Money Laundering Policy?

Drafting papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft San Antonio Form of Anti-Money Laundering Policy without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid San Antonio Form of Anti-Money Laundering Policy on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the San Antonio Form of Anti-Money Laundering Policy:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!