Montgomery, Maryland Anti-Money Laundering Compliance Policy: A Comprehensive Overview The Montgomery, Maryland Anti-Money Laundering (AML) Compliance Policy encompasses a set of guidelines and regulations designed to prevent and detect money laundering activities within the region. Money laundering refers to the process of disguising the origins of illegally obtained funds to make them appear legitimate. This AML Compliance Policy plays a crucial role in safeguarding the Montgomery community against illegal and illicit financial activities. It is based on both federal regulations, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, as well as state-specific legislation enacted in Maryland. By implementing robust AML controls, Montgomery can mitigate the risks associated with money laundering and the funding of terrorism. The Montgomery, Maryland Anti-Money Laundering Compliance Policy consists of various components, including: 1. Customer Due Diligence (CDD): This component involves thorough identification and verification of customers' identities, including individuals and businesses, to establish their legitimacy and reduce the risk of potential money laundering activities. 2. Know Your Customer (KYC): KYC procedures require financial institutions, businesses, and professionals, such as lawyers and accountants, to gather relevant information about their customers' financial activities and risk profiles. This information aids in monitoring for suspicious or illicit transactions. 3. Suspicious Activity Reporting (SAR): SAR mandates the reporting of any transactions or activities that appear suspicious or potentially linked to money laundering. Financial institutions and designated businesses must promptly file SARS to the appropriate authorities for investigation. 4. AML Training and Awareness: The policy includes training programs and awareness initiatives to educate employees and stakeholders about money laundering risks, detection techniques, and the importance of compliance. Training ensures that individuals involved in financial transactions are vigilant in identifying and reporting suspicious activities. 5. Record Keeping and Document Retention: The policy emphasizes the duty to maintain detailed records of customer transactions, identification documents, and due diligence reports. These records allow for audit trails and provide evidence when addressing compliance issues or investigating potential money laundering activities. 6. Compliance Monitoring and Reporting: Regular internal and external audits, as well as independent compliance reviews, are conducted to assess the effectiveness of the AML program. The policy necessitates the creation of comprehensive reports to regulatory bodies, highlighting any significant findings or changes made to ensure continued compliance. The Montgomery, Maryland Anti-Money Laundering Compliance Policy aims to create a secure financial environment, deterring and combatting illicit activities that could harm the community. By adhering to this policy, financial institutions, businesses, and professionals operating in Montgomery contribute to the collective effort against money laundering and sustain the integrity of the region's financial system. Different types or variations of the Montgomery, Maryland Anti-Money Laundering Compliance Policy may exist based on the nature of the industry or the specific financial institution. However, the core principles mentioned above usually remain consistent across different sectors. Some specialized versions of the policy may be tailored to sectors such as banking, real estate, insurance, or legal services, to address industry-specific risks and regulatory requirements.

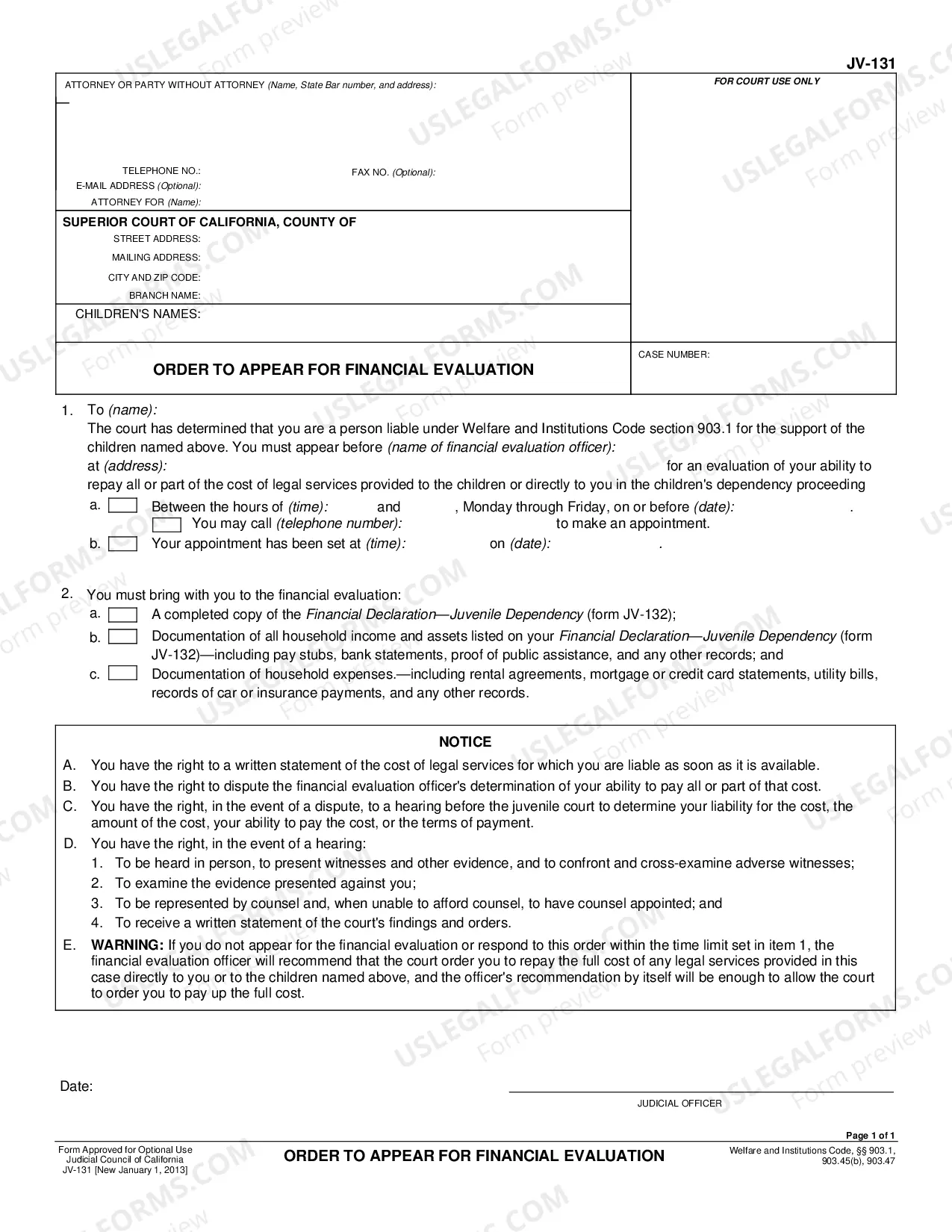

Montgomery Maryland Form of Anti-Money Laundering Compliance Policy

Description

How to fill out Montgomery Maryland Form Of Anti-Money Laundering Compliance Policy?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Montgomery Form of Anti-Money Laundering Compliance Policy is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Montgomery Form of Anti-Money Laundering Compliance Policy. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Form of Anti-Money Laundering Compliance Policy in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!