Nassau New York Form of Anti-Money Laundering Compliance Policy aims to provide a comprehensive framework for financial organizations operating in Nassau, New York to prevent and detect money laundering activities. This policy is crucial in ensuring regulatory compliance and maintaining the integrity of the financial system. Adhering to such policies is vital for financial institutions to avoid legal repercussions, reputational damage, and financial losses associated with money laundering. The Nassau New York Form of Anti-Money Laundering Compliance Policy encompasses various measures and procedures that financial organizations must undertake to combat money laundering. It includes comprehensive customer due diligence processes, regular risk assessments, staff training programs, and the establishment of internal controls and reporting mechanisms. This policy also covers the monitoring of transactions and the reporting of suspicious activities to the relevant authorities. Different types of the Nassau New York Form of Anti-Money Laundering Compliance Policy may be categorized based on the nature and scale of the financial institution. Large banks and multinational organizations may have more extensive policies compared to smaller financial firms. The policy may also vary depending on the nature of the services offered, such as retail banking, investment banking, or money services businesses. Additionally, the Nassau New York Form of Anti-Money Laundering Compliance Policy may further classify different sectors within the financial industry, including but not limited to banks, credit unions, insurance companies, brokerages, and investment firms. Each sector may have specific policy requirements tailored to their respective operations and risk profiles. Keywords: Nassau New York, Anti-Money Laundering Compliance Policy, financial organizations, regulatory compliance, money laundering activities, legal repercussions, reputational damage, financial losses, customer due diligence, risk assessments, staff training, internal controls, reporting mechanisms, monitoring transactions, suspicious activities, large banks, multinational organizations, small financial firms, retail banking, investment banking, money services businesses, sector-specific policies, banks, credit unions, insurance companies, brokerages, investment firms.

Nassau New York Form of Anti-Money Laundering Compliance Policy

Description

How to fill out Nassau New York Form Of Anti-Money Laundering Compliance Policy?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Nassau Form of Anti-Money Laundering Compliance Policy, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Form of Anti-Money Laundering Compliance Policy from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Nassau Form of Anti-Money Laundering Compliance Policy:

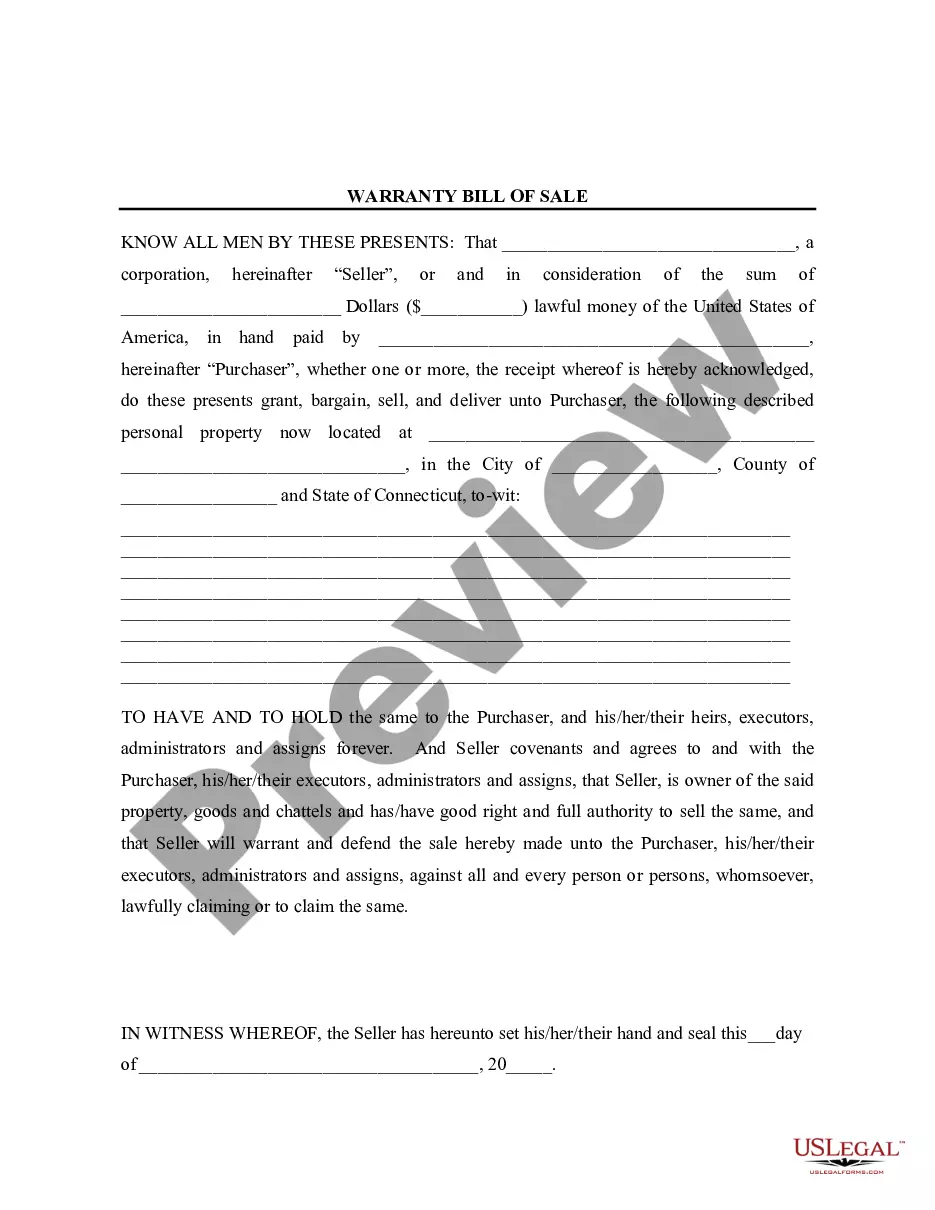

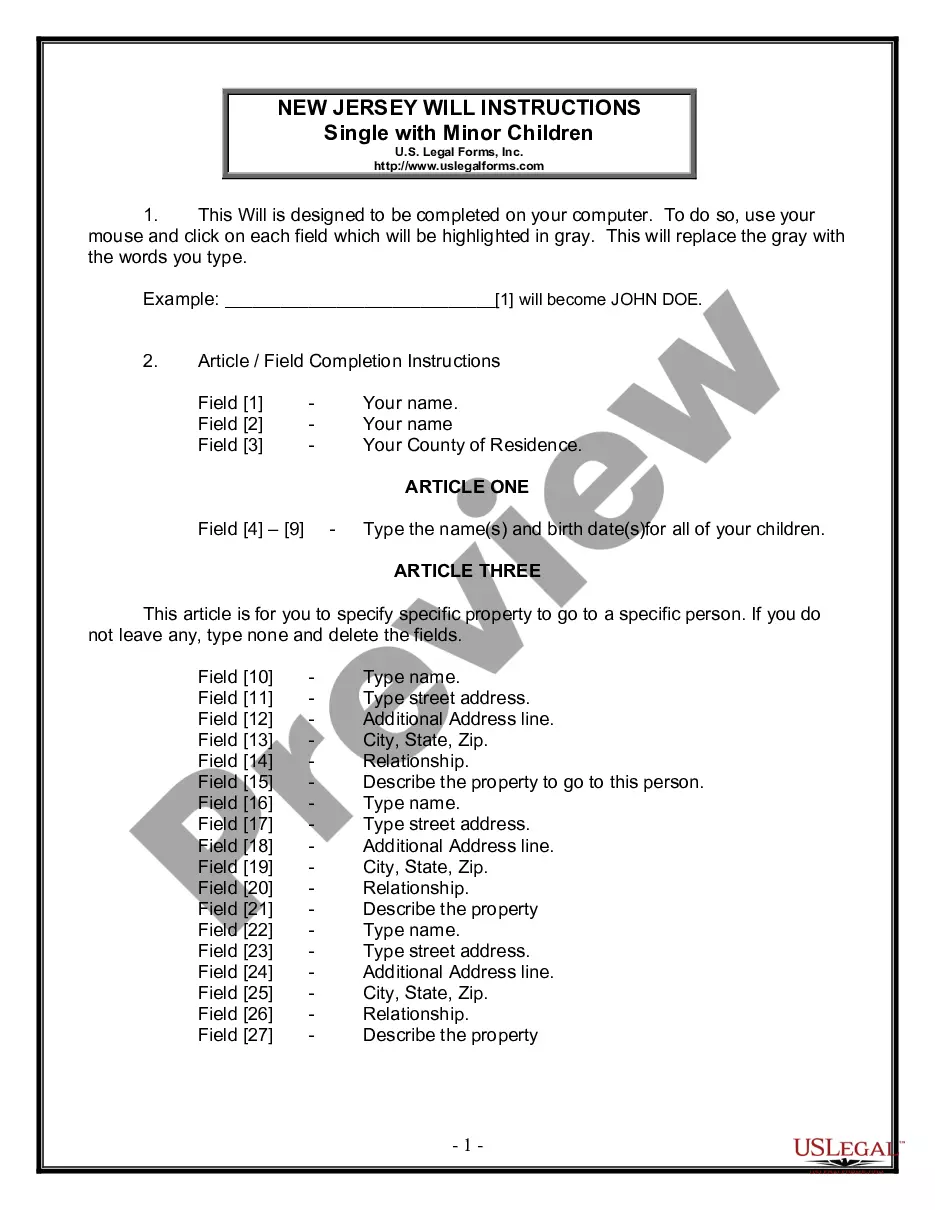

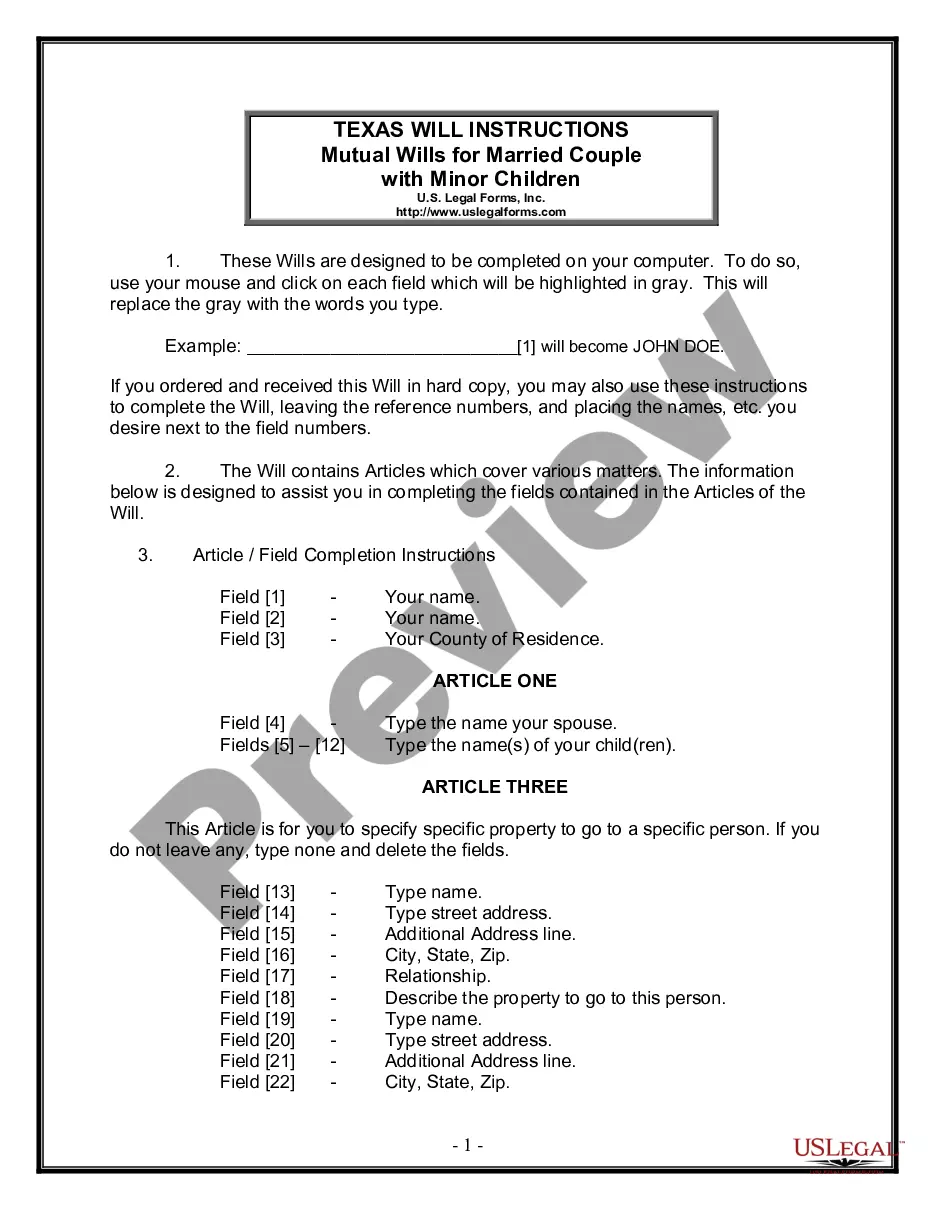

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!