Allegheny Pennsylvania Limited Partnership Agreement for Hedge Fund is a legal document that governs the operations, management, and partnership structure of a hedge fund based in Allegheny, Pennsylvania. This partnership agreement outlines the terms and conditions agreed upon by the general partners and limited partners involved in the hedge fund. It establishes the rights, responsibilities, and obligations of each party, ensuring a transparent and efficient operation of the fund. The agreement typically covers various essential aspects, including capital contributions, profit distribution, decision-making processes, management fees, withdrawal and redemption procedures, investment strategies, and dispute resolution mechanisms. It also includes provisions regarding the dissolution and liquidation of the fund, as well as guidelines for the admission of new partners. As for the types of Allegheny Pennsylvania Limited Partnership Agreements for Hedge Funds, there might be specific variations depending on various factors such as the fund's investment strategy, target market, or particular regulatory requirements. Examples of different types could include: 1. Equity Long-Short Partnership Agreement: This type of agreement outlines the fund's strategy of taking both long and short positions in equity securities, aiming to profit from discrepancies in stock prices. 2. Event-Driven Partnership Agreement: This agreement concentrates on investing in opportunities arising from corporate events such as mergers, acquisitions, bankruptcies, or restructuring, aiming to benefit from price movements resulting from these occurrences. 3. Macro Partnership Agreement: These types of agreements focus on macroeconomic analysis and aim to generate returns by capitalizing on major economic trends, currency fluctuations, and geopolitical events. 4. Multi-Strategy Partnership Agreement: This agreement encompasses various investment strategies, allowing the fund to diversify its portfolio and potentially mitigate risks. Each type of partnership agreement will include specific provisions tailored to the fund's investment approach and objectives, all while adhering to the laws and regulations governing hedge funds in Allegheny, Pennsylvania. In conclusion, the Allegheny Pennsylvania Limited Partnership Agreement for Hedge Fund is a comprehensive legal document that establishes the partnership structure and defines the terms of operation for hedge funds in the region. This agreement ensures the smooth functioning and compliance of the fund while protecting the interests of both general and limited partners.

Allegheny Pennsylvania Limited Partnership Agreement for Hedge Fund

Description

How to fill out Allegheny Pennsylvania Limited Partnership Agreement For Hedge Fund?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Allegheny Limited Partnership Agreement for Hedge Fund, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the current version of the Allegheny Limited Partnership Agreement for Hedge Fund, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Limited Partnership Agreement for Hedge Fund:

- Glance through the page and verify there is a sample for your area.

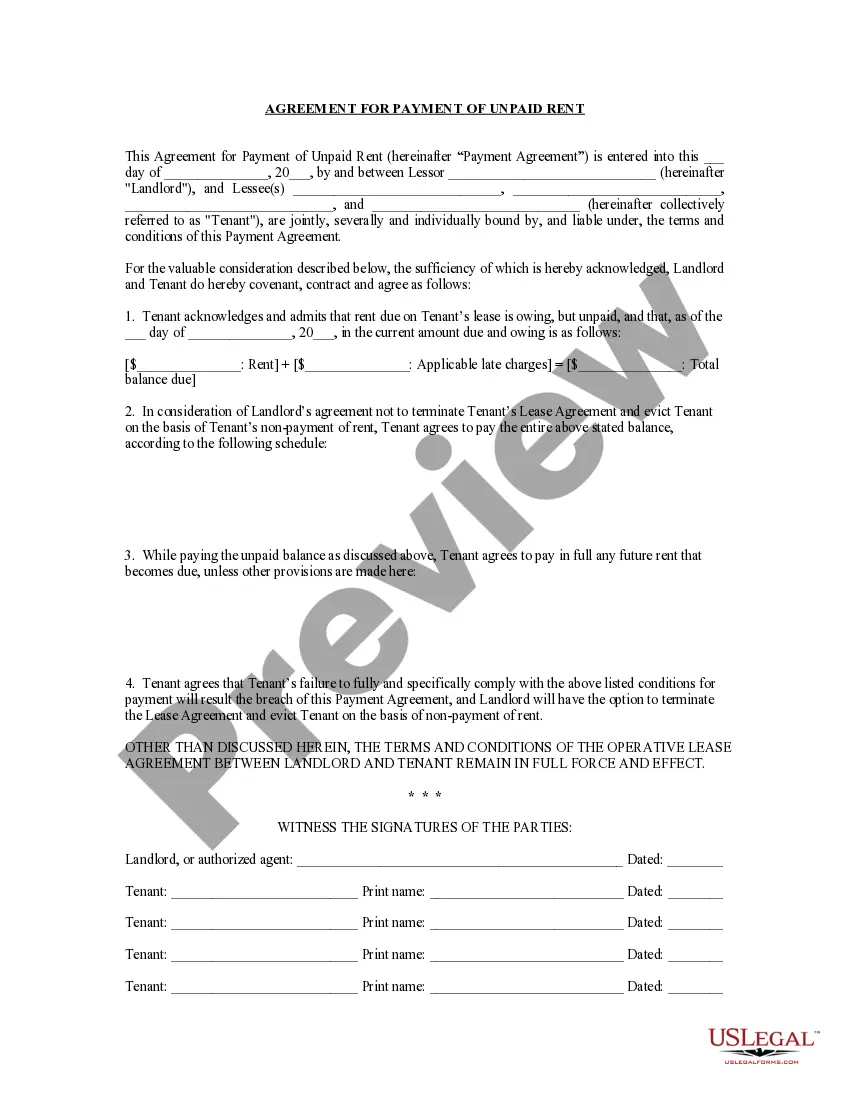

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Allegheny Limited Partnership Agreement for Hedge Fund and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!