The Harris Texas Limited Partnership Agreement for Hedge Fund is a legal document that outlines the key terms and conditions governing the formation and operation of a hedge fund organized as a limited partnership in Harris County, Texas. This agreement serves as a contractual framework between the general partner(s) and the limited partner(s) and provides clarity on various aspects of the partnership structure, investment strategy, profit distribution, rights and duties of each party, amongst other critical provisions. Keywords: Harris Texas, Limited Partnership Agreement, Hedge Fund, general partner(s), limited partner(s), formation, operation, contractual framework, investment strategy, profit distribution, rights, duties, partnership structure. Different types of Harris Texas Limited Partnership Agreements for Hedge Funds: 1. Harris Texas Limited Partnership Agreement with Single General Partner: This type of agreement involves a single general partner who has full control over the operations and decision-making process of the hedge fund. Limited partners have essentially a passive role and are not involved in the day-to-day management of the fund. 2. Harris Texas Limited Partnership Agreement with Multiple General Partners: In this scenario, there are multiple general partners who collectively manage the hedge fund. The decision-making process and responsibilities are shared amongst all the general partners, and limited partners still maintain a passive role. 3. Harris Texas Limited Partnership Agreement with Limited Liability: This type of agreement provides limited liability protection for the general and limited partners. It ensures that the personal assets of the partners are shielded from the hedge fund's liabilities, limiting their risk exposure. 4. Harris Texas Limited Partnership Agreement with Performance-based Compensation: In this agreement, the general partner(s) receive performance-based compensation, such as a share of the profits or a performance fee, based on the hedge fund's success. This incentivizes the general partner(s) to actively manage and grow the fund. 5. Harris Texas Limited Partnership Agreement with Investor Protection Rights: This agreement includes additional provisions to protect the limited partners' interests, such as transparency requirements, reporting obligations, and limitations on the general partner's ability to make certain decisions without limited partner consent. These measures aim to safeguard the limited partners' investments. In conclusion, the Harris Texas Limited Partnership Agreement for Hedge Fund is a critical legal document that lays out the terms, rights, and responsibilities of the general and limited partners involved in a hedge fund organized as a limited partnership in Harris County, Texas. It ensures clarity, security, and accountability within the partnership structure, allowing for a smooth operation and effective management of the hedge fund.

Harris Texas Limited Partnership Agreement for Hedge Fund

Description

How to fill out Harris Texas Limited Partnership Agreement For Hedge Fund?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, finding a Harris Limited Partnership Agreement for Hedge Fund meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Apart from the Harris Limited Partnership Agreement for Hedge Fund, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Harris Limited Partnership Agreement for Hedge Fund:

- Examine the content of the page you’re on.

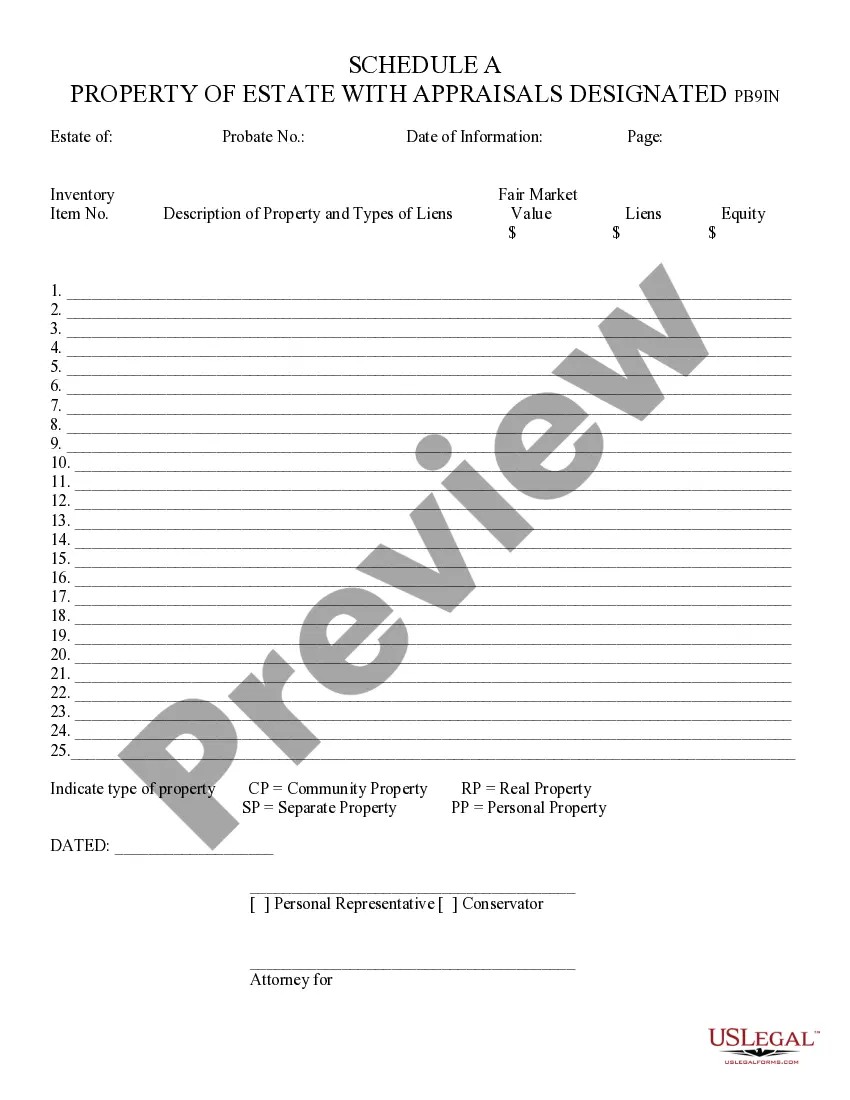

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Limited Partnership Agreement for Hedge Fund.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!