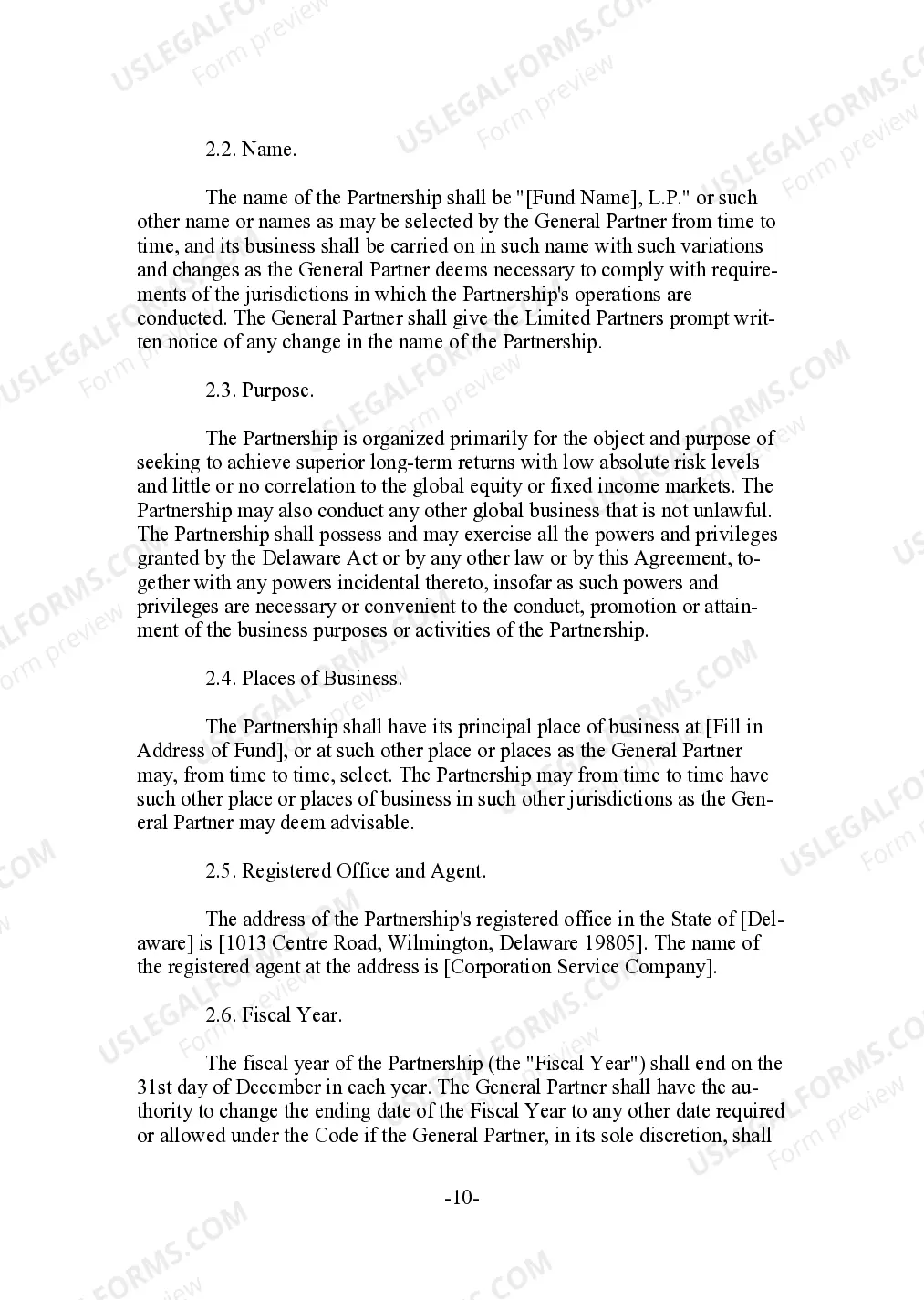

Los Angeles California Limited Partnership Agreement for Hedge Fund is a legal document that outlines the terms and conditions under which a hedge fund operates in Los Angeles, California. This agreement is specifically tailored for a limited partnership structure, where the hedge fund is formed by at least one general partner and one or more limited partners. The agreement covers various aspects related to the formation, management, and operation of the hedge fund. It outlines the roles and responsibilities of the general partner and the limited partners, as well as the rights and obligations of each party involved. Additionally, it defines the investment strategies, objectives, and policies of the fund. Keywords: Los Angeles California, limited partnership agreement, hedge fund, legal document, terms and conditions, limited partnership structure, general partner, limited partners, formation, management, operation, roles and responsibilities, rights and obligations, investment strategies, objectives, policies. There can be different types of Los Angeles California Limited Partnership Agreements for Hedge Funds, depending on specific requirements or circumstances. Some variations include: 1. Single General Partner Agreement: This type of agreement is used when there is only one general partner responsible for managing the fund. 2. Multiple General Partner Agreement: In this scenario, there are multiple general partners who share the management responsibilities and decision-making authority of the hedge fund. 3. Master-Feeder Agreement: This agreement is employed when there is a master fund that acts as the main investment vehicle, while feeder funds channel investments into the master fund. This structure helps to pool resources and manage various investor classes efficiently. 4. Side Letter Agreement: A side letter agreement is an additional document that provides specific terms, rights, or privileges granted to certain limited partners. It supplements the main partnership agreement and addresses unique requirements or arrangements. 5. Redemption Agreement: This type of agreement outlines the terms and conditions under which limited partners may redeem their interests in the hedge fund. It covers aspects such as notice periods, valuation methodologies, and restrictions on redemptions. These are just a few examples of the different types of Los Angeles California Limited Partnership Agreements for Hedge Funds. The selection of the appropriate agreement depends on the structure, goals, and strategies of the hedge fund, as well as the preferences of the partners involved.

Los Angeles California Limited Partnership Agreement for Hedge Fund

Description

How to fill out Los Angeles California Limited Partnership Agreement For Hedge Fund?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Los Angeles Limited Partnership Agreement for Hedge Fund, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities related to document execution straightforward.

Here's how you can locate and download Los Angeles Limited Partnership Agreement for Hedge Fund.

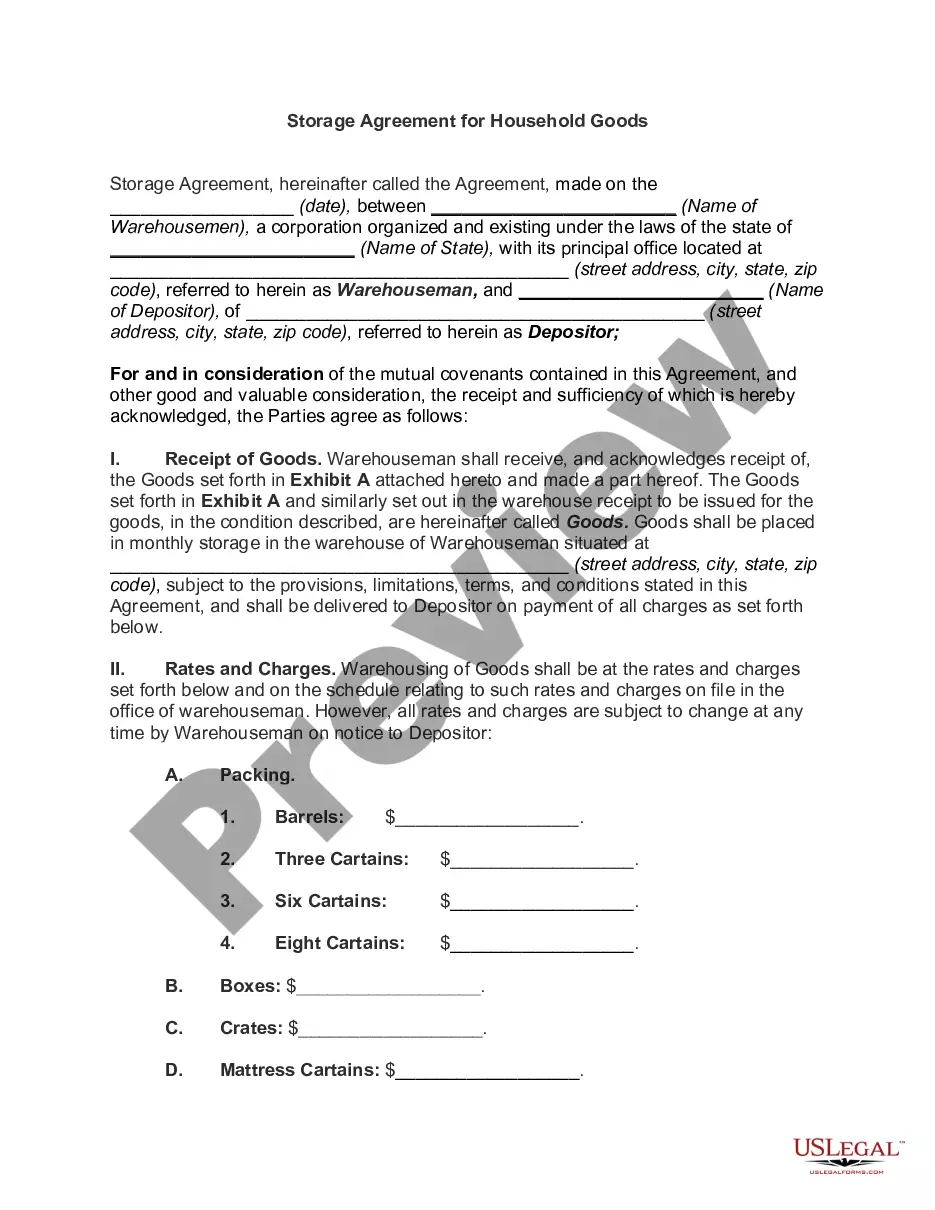

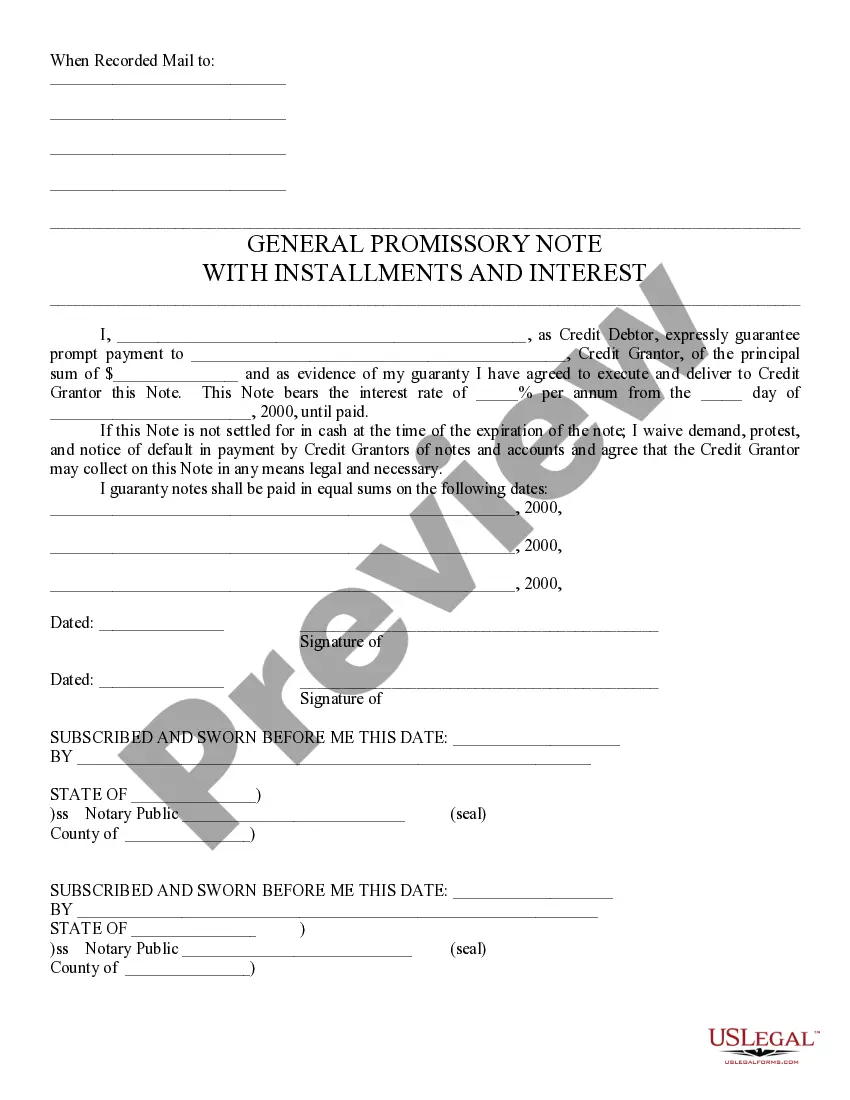

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related forms or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Los Angeles Limited Partnership Agreement for Hedge Fund.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Los Angeles Limited Partnership Agreement for Hedge Fund, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to deal with an exceptionally difficult situation, we recommend using the services of a lawyer to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!