Santa Clara California Letter regarding Wage Statement is an important document that employers in Santa Clara, California are required to provide to their employees, according to state labor laws. This letter outlines detailed information related to an employee's wages, ensuring transparency and compliance with legal requirements. The Santa Clara California Letter regarding Wage Statement typically includes several key elements. Firstly, it provides the employee's personal details such as their full name, address, and social security number. It also includes information about the employer, including the company name, address, and contact details. One crucial aspect covered in the wage statement is the employee's earnings. It outlines the total number of hours worked during the pay period, including regular hours and any overtime hours, if applicable. It includes details such as the rate of pay, the gross wages earned, and any deductions made from the employee's wages, such as taxes, healthcare contributions, or retirement plan contributions. Furthermore, the wage statement also specifies the net wages — the amount the employee actually receives after deductions. It may also include additional information, such as the employee's pay frequency (weekly, bi-weekly, monthly), the pay period covered by the statement, and the date of payment. Additionally, it's essential for employers to name the different types of Santa Clara California Letter regarding Wage Statement to ensure compliance. Some common types include: 1. Regular Wage Statement: This is the standard wage statement that employers provide to employees whose wages are paid according to the regular pay schedule. 2. Overtime Wage Statement: This type of wage statement is provided to employees who have worked overtime hours during the pay period. It specifically details the regular hours worked, overtime hours worked, and the corresponding rates of pay. 3. Commission-Based Wage Statement: Employers who pay their employees based on a commission structure provide this type of wage statement. It highlights the total sales or services rendered, the commission rate, and the resulting commission earned for the period. 4. Piece-Rate Wage Statement: For employees paid based on the number of pieces produced or tasks completed, this wage statement is generated. It specifies the total number of pieces or tasks completed, the rate per piece or task, and the resulting wages earned. In summary, the Santa Clara California Letter regarding Wage Statement is a detailed document that plays a vital role in ensuring fair labor practices. It provides employees with transparent information about their earnings, deductions, and other relevant details. Employers must carefully prepare and provide accurate and compliant wage statements to maintain compliance with Santa Clara labor laws.

Santa Clara California Letter regarding Wage Statement

Description

How to fill out Santa Clara California Letter Regarding Wage Statement?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Santa Clara Letter regarding Wage Statement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Letter regarding Wage Statement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Santa Clara Letter regarding Wage Statement:

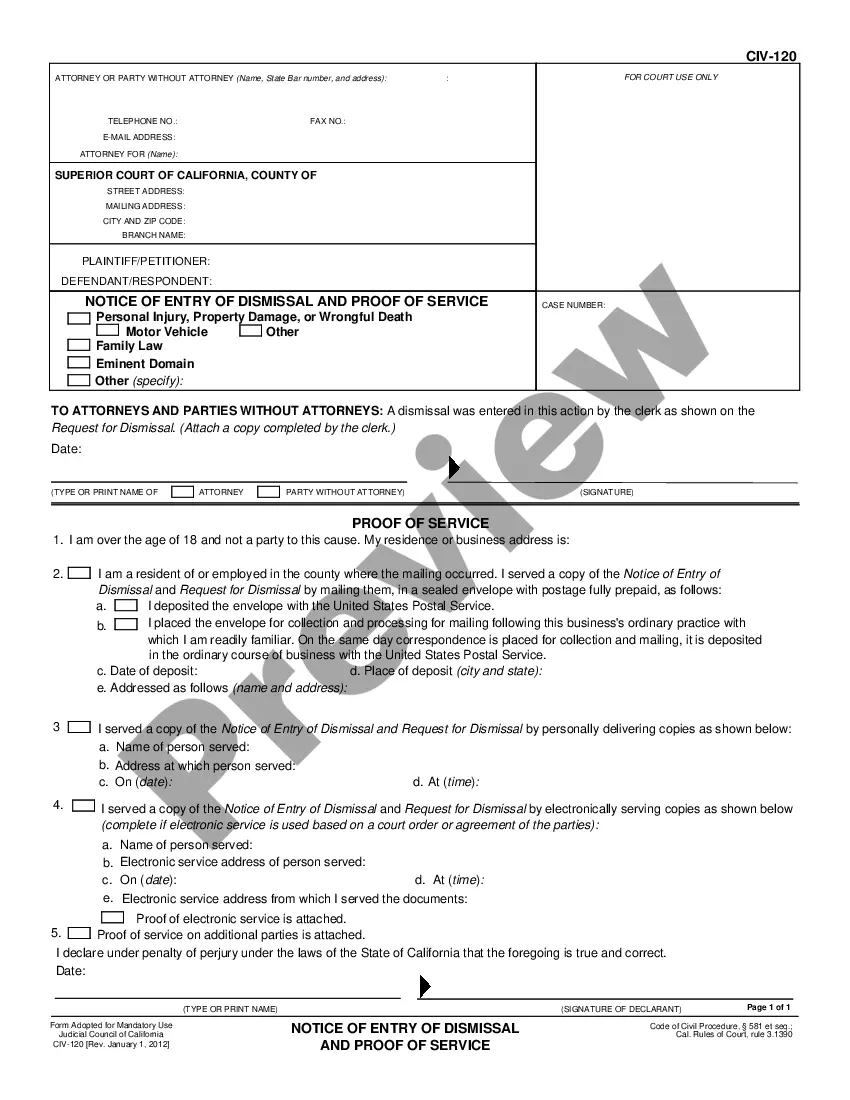

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

About Form W-2, Wage and Tax Statement.

A copy of your W-2 can be accessed by logging onto the IRS' Get Your Tax Record webpage. Through this link you will be provided a transcript of your W-2 which also includes "Form 1099 series, Form 1098 series, and Form 5498 series; however, state or local information isn't included with the Form W-2 information."

If you are an employee of a company and will receive a W-2 for your income taxes, it will be sent to you automatically each year by your employer. Your employer will also submit a copy of your W-2 with the IRS.

IRS Wage Statement If you are unable to use establish an account with the IRS, you can obtain copies of W2s by mail with IRS Form 4506-T. This form is available through the BCC Financial Aid Office or through the IRS.

To get copies of your current tax year federal Form W-2 contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Transcript You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.You can also use Form 4506-T, Request for Transcript of Tax Return.

About Form W-2, Wage and Tax Statement.

Transcript You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page.You can also use Form 4506-T, Request for Transcript of Tax Return.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.