Allegheny Pennsylvania is a county located in the southwestern part of the state of Pennsylvania, United States. It is the second-most populous county in Pennsylvania, with Pittsburgh being its county seat. Allegheny County is known for its rich history, beautiful landscapes, and diverse economy. If you are a taxpayer residing in Allegheny County, you may need to request a copy of your tax form or individual income tax account information for various reasons. The Allegheny County Department of Finance handles such requests and ensures the privacy and accuracy of taxpayer information. The tax forms and account information can be obtained by submitting a formal request to the appropriate department. Different types of Allegheny Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information may include: 1. Individual Income Tax Return Copy Request: This type of request is made by taxpayers who need a copy of their previously filed individual income tax return for a specific tax year. It may be required for record-keeping purposes, mortgage applications, or to rectify any discrepancies in tax filings. 2. Wage and Tax Statement (W-2) Copy Request: If you misplaced or did not receive your W-2 form from your employer, you can request a copy of it from the Allegheny County Department of Finance. The W-2 form is crucial for accurately reporting your income and ensuring compliance with tax regulations. 3. Request for Tax Account Information: This type of request is made by taxpayers who need specific details about their tax account, such as balances, payments, and any outstanding liabilities. It helps individuals stay on top of their tax obligations and ensures they have the necessary information for financial planning purposes. To request a copy of your tax form or individual income tax account information in Allegheny Pennsylvania, you need to follow the designated procedure. Generally, you will be required to complete a formal request form and provide appropriate identification and supporting documentation, such as a valid photo ID, Social Security number, and relevant tax years or periods. You may also have to pay a nominal fee to cover administrative costs. It is essential to carefully review the requirements and process outlined by the Allegheny County Department of Finance to ensure your request is properly submitted and processed in a timely manner. Additionally, you can visit their official website or contact their customer service helpline for more information and guidance on the specific types of request forms available and any additional documents needed.

Allegheny Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Allegheny Pennsylvania Request For Copy Of Tax Form Or Individual Income Tax Account Information?

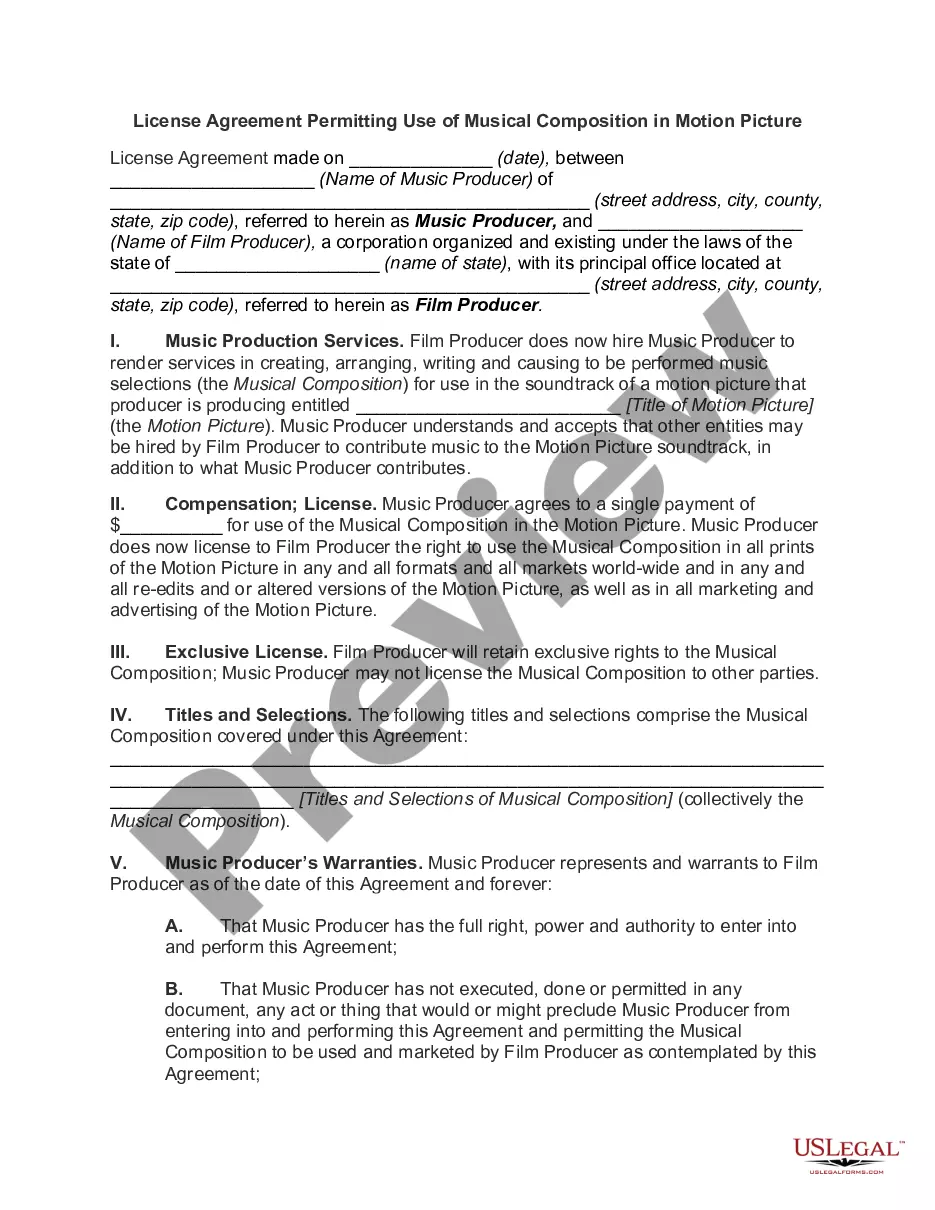

Do you need to quickly draft a legally-binding Allegheny Request for Copy of Tax Form or Individual Income Tax Account Information or maybe any other document to take control of your own or business affairs? You can go with two options: hire a professional to write a legal paper for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including Allegheny Request for Copy of Tax Form or Individual Income Tax Account Information and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

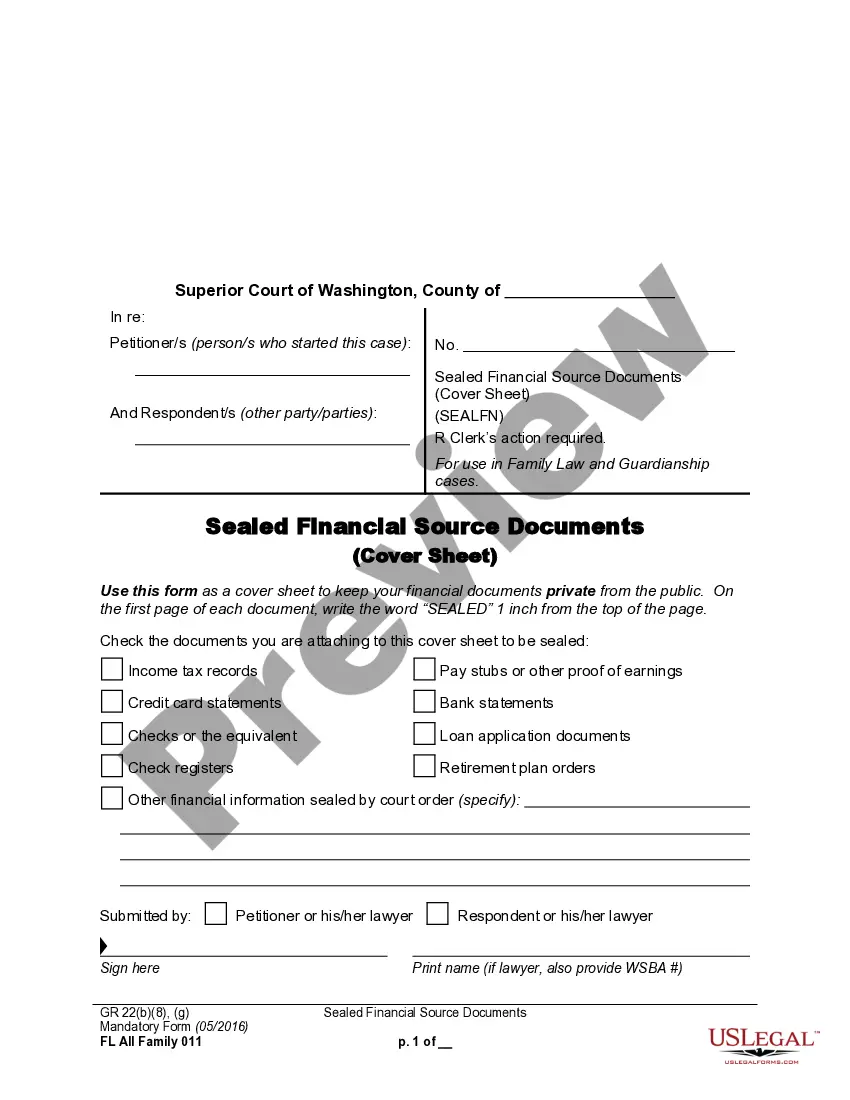

- To start with, double-check if the Allegheny Request for Copy of Tax Form or Individual Income Tax Account Information is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by using the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Allegheny Request for Copy of Tax Form or Individual Income Tax Account Information template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!