Collin Texas is a county located in the state of Texas, United States. It is part of the Dallas-Fort Worth Retroflex and is known for its rapidly growing population, diverse economy, and high standard of living. With its strong economic base and attractive business opportunities, Collin Texas has emerged as one of the fastest-growing counties in the country. Taxpayers residing in Collin Texas can request a copy of their tax form or individual income tax account information through the Collin County Tax Office. These requests can be made using specific forms or online platforms, depending on the type of information required. Here are some of the different types of requests commonly made in Collin Texas: 1. Request for Copy of Tax Form: Taxpayers who need copies of their previously filed tax forms can submit a request to the Collin County Tax Office. Commonly requested forms include Form 1040 (Individual Income Tax Return), Form 1099 (Miscellaneous Income), and Form W-2 (Wage and Tax Statement). 2. Request for Individual Income Tax Account Information: This type of request is made by taxpayers who require detailed information about their income tax accounts. It may include details such as tax payments made, refunds received, and any outstanding balances owed to the tax office. 3. Request for Tax Return Transcript: Taxpayers who need a record of their tax return information, but not an actual copy of the tax form, can request a tax return transcript. This transcript provides an overview of the taxpayer's filed tax return, including income reported, deductions claimed, and credits applied. To initiate any of these requests, individuals should contact the Collin County Tax Office directly, either in person or via phone or email. The tax office staff will guide taxpayers through the necessary steps and provide the appropriate forms or online resources to complete the request. It is important to provide accurate personal information and any supporting documentation required to ensure a smooth and timely processing of the request. Overall, Collin Texas offers various avenues for taxpayers to obtain copies of their tax forms or individual income tax account information. By efficiently facilitating these requests, the Collin County Tax Office contributes to maintaining a transparent and accountable tax system that supports the county's growth and development.

Collin Texas Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Collin Texas Request For Copy Of Tax Form Or Individual Income Tax Account Information?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Collin Request for Copy of Tax Form or Individual Income Tax Account Information.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Collin Request for Copy of Tax Form or Individual Income Tax Account Information will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Collin Request for Copy of Tax Form or Individual Income Tax Account Information:

- Make sure you have opened the right page with your localised form.

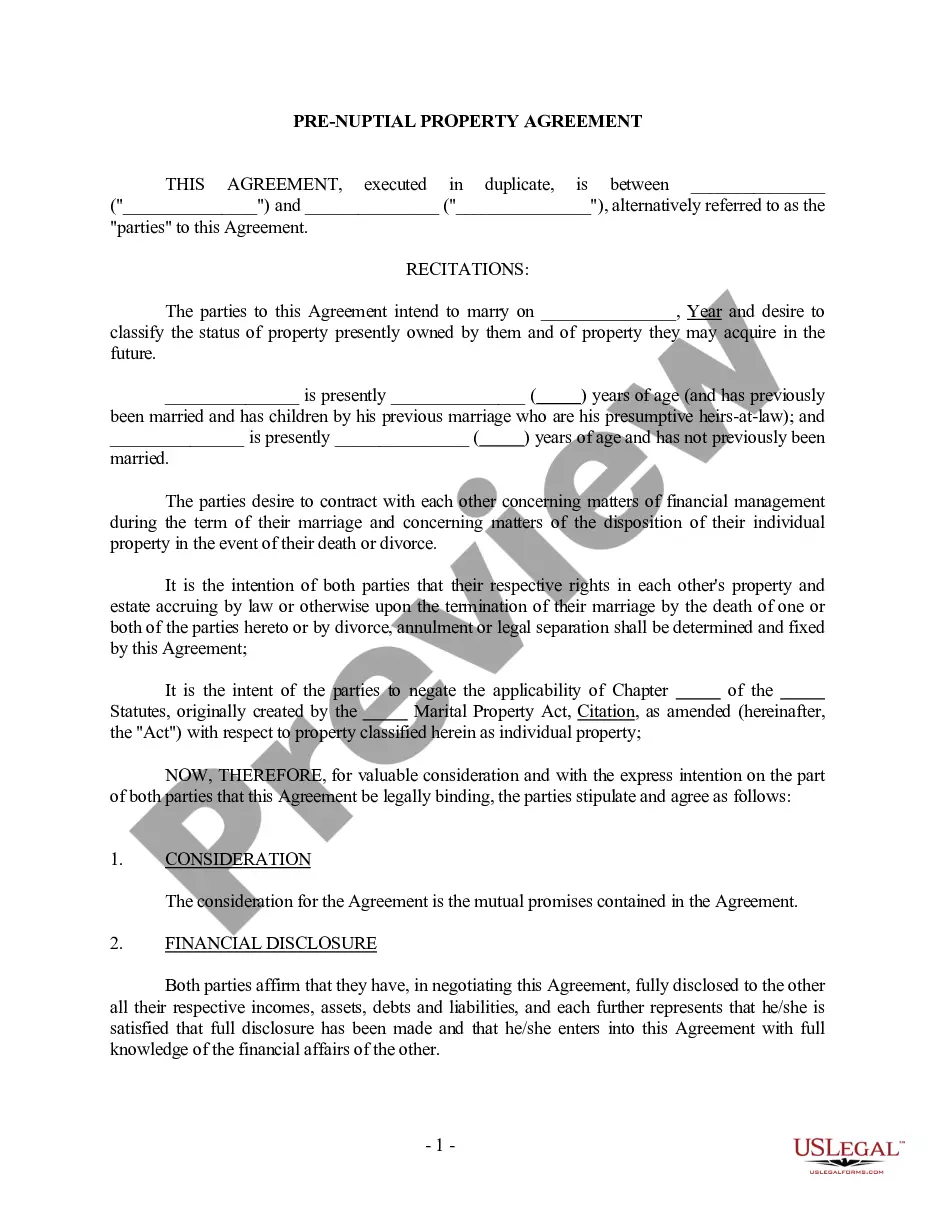

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Collin Request for Copy of Tax Form or Individual Income Tax Account Information on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!