Kings New York Request for Copy of Tax Form or Individual Income Tax Account Information is a service provided by the state of New York that allows individuals to obtain copies of their tax forms or access their individual income tax account information. This service is essential for residents of Kings County, New York, who need to retrieve these documents for various purposes such as filing tax returns, applying for loans, or addressing any tax-related issues. Individuals can request a copy of their tax form, such as the W-2 or 1099 form, by submitting a formal request to the Kings New York Tax Department. This request can be made online through their official website or by mail. It is important to provide accurate personal information, including full name, social security number, and contact details, to ensure proper identification and processing of the request. Apart from obtaining copies of tax forms, individuals can also access their individual income tax account information through this service. This includes details about tax payments, refunds, any outstanding tax liabilities, and other relevant financial information. Having access to this information allows individuals to monitor their tax history and ensure compliance with tax obligations. The Kings New York Tax Department offers different types of tax forms and individual income tax account information. Some common forms that individuals may request include: 1. W-2 form: This form provides details about the wages earned and taxes withheld by an individual's employer during a specific tax year. 2. 1099 form: This form is used to report income received from various sources other than an employer, such as freelance work or investment earnings. 3. Form 1040: This is the standard individual income tax return form used to report income, deductions, and determine the tax liability. 4. Form IT-201: This is the New York State resident income tax return form that individuals need to file to report their income and calculate their state tax liability. It is crucial to provide accurate and specific information while requesting tax forms or individual income tax account information from Kings New York. This helps avoid any delays or errors in processing the request. Additionally, individuals should keep in mind that there may be specific deadlines to request these documents, especially when related to tax return filings.

Kings New York Request for Copy of Tax Form or Individual Income Tax Account Information

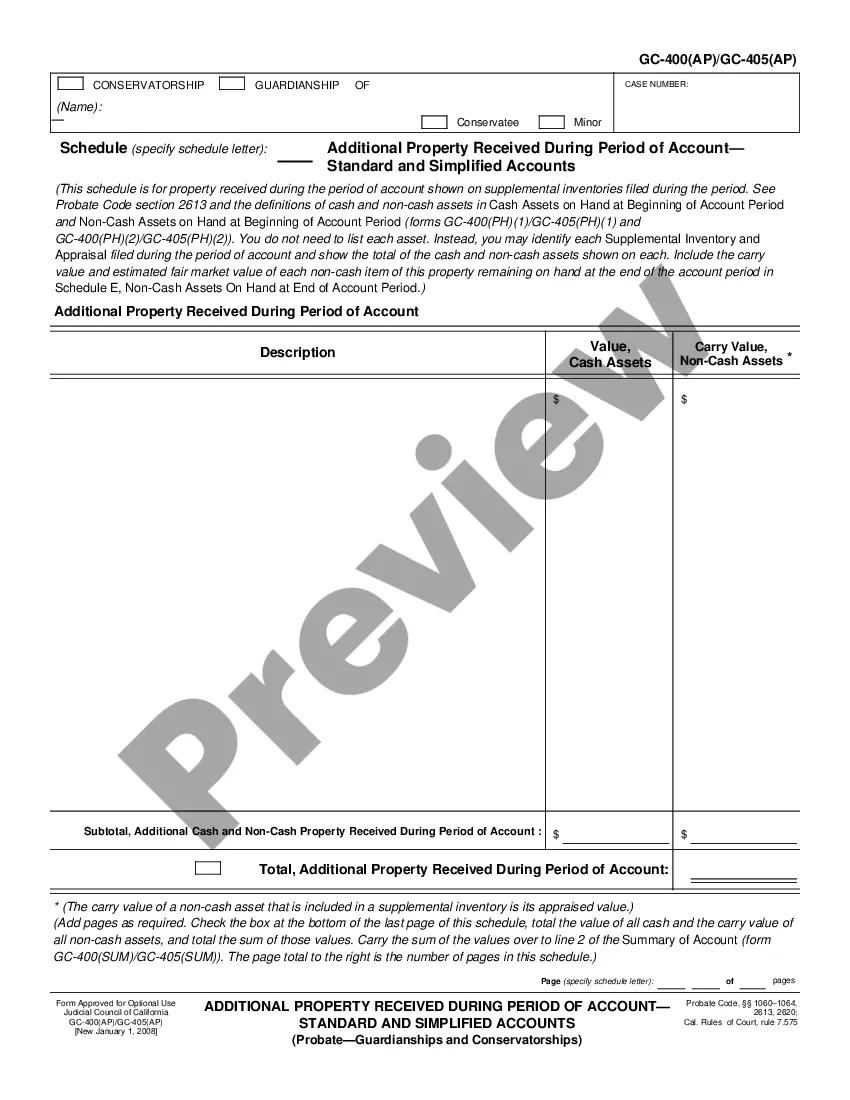

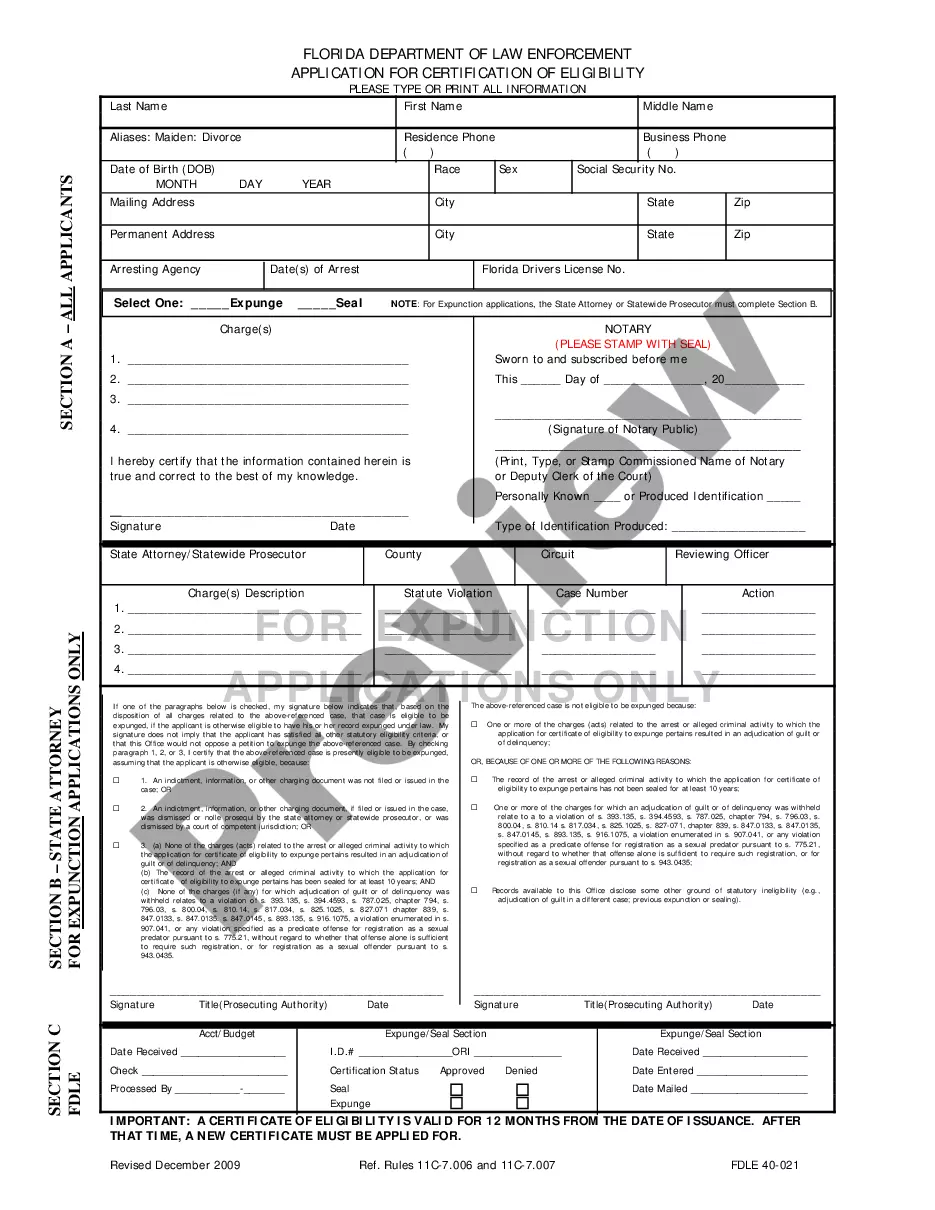

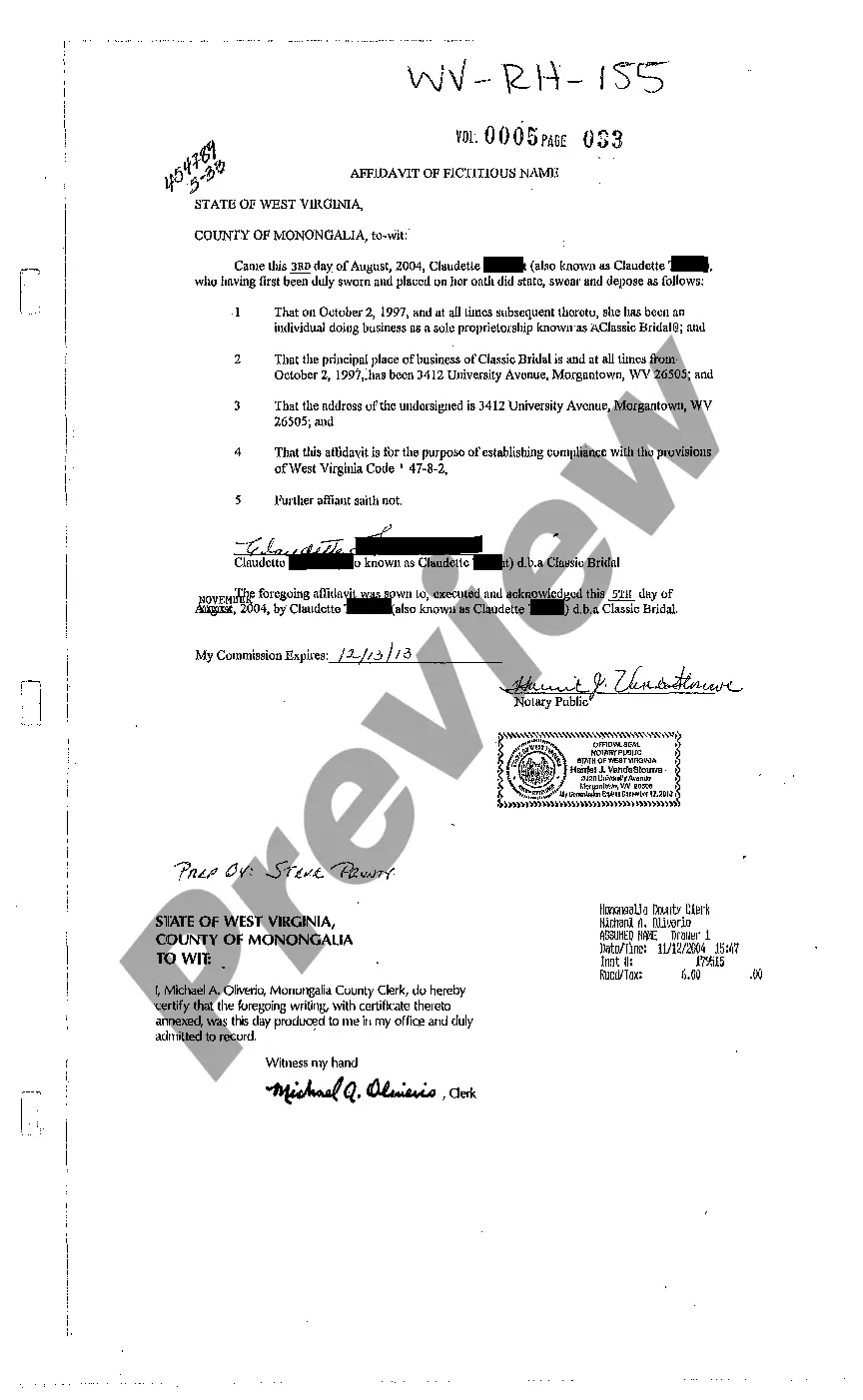

Description

How to fill out Kings New York Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Kings Request for Copy of Tax Form or Individual Income Tax Account Information, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Kings Request for Copy of Tax Form or Individual Income Tax Account Information, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Request for Copy of Tax Form or Individual Income Tax Account Information:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Kings Request for Copy of Tax Form or Individual Income Tax Account Information and save it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!