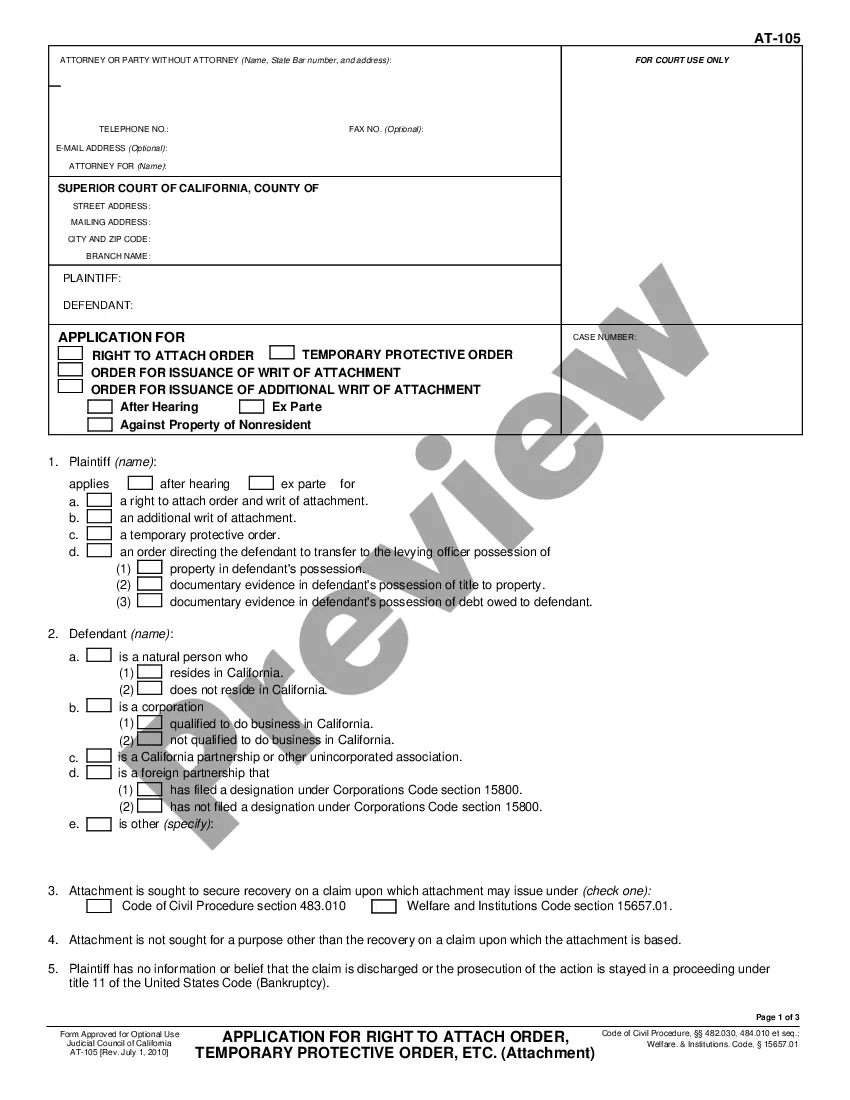

Dallas Texas Tax Release Authorization is a legal document that allows an individual or organization to authorize the release of their tax information to a designated third party. This authorization is important in various situations, such as filing taxes on behalf of someone else, seeking professional assistance for tax-related matters, or conducting financial transactions that require access to tax records. The Dallas Texas Tax Release Authorization grants permission for the Internal Revenue Service (IRS) or the Texas Comptroller's Office to disclose tax return information to the authorized party. This information typically includes details about income, deductions, credits, tax payments, and any other relevant financial data. There are several types of Dallas Texas Tax Release Authorization, each tailored to specific circumstances. These include: 1. Individual Tax Release Authorization: This type of authorization is used by individual taxpayers who need to grant access to their tax information to a specific person or organization. It may be required when utilizing the services of a tax professional, such as a certified public accountant (CPA) or an enrolled agent. 2. Business Tax Release Authorization: This form of authorization is applicable to businesses, allowing them to authorize a designated representative to access their tax records for accurate filing, compliance purposes, or tax planning. It may be necessary in situations where multiple parties need to handle tax matters on behalf of the business, such as tax attorneys or business partners. 3. Power of Attorney Tax Release Authorization: This type of authorization goes beyond simply accessing tax information and grants the authorized party more extensive powers to act on behalf of the taxpayer. It allows them to perform various actions like signing agreements, correspond with tax authorities, and resolve tax-related issues. This type of authorization is often utilized in cases of incapacitation, illness, or when individuals are unable to manage their tax affairs themselves. Regardless of the type of Dallas Texas Tax Release Authorization, it is crucial to ensure that the authorized party is trustworthy and has the necessary qualifications to handle tax-related matters responsibly. It is advisable to consult with legal and tax professionals when seeking assistance or advice related to tax release authorization, to ensure compliance with state and federal regulations while safeguarding sensitive financial information. In conclusion, Dallas Texas Tax Release Authorization is a legal document that grants permission to access an individual or business's tax information by a designated third party. By utilizing this authorization, individuals and businesses can seek professional assistance, manage tax affairs more efficiently, or enable others to act on their behalf in tax-related matters.

Dallas Texas Tax Release Authorization

Description

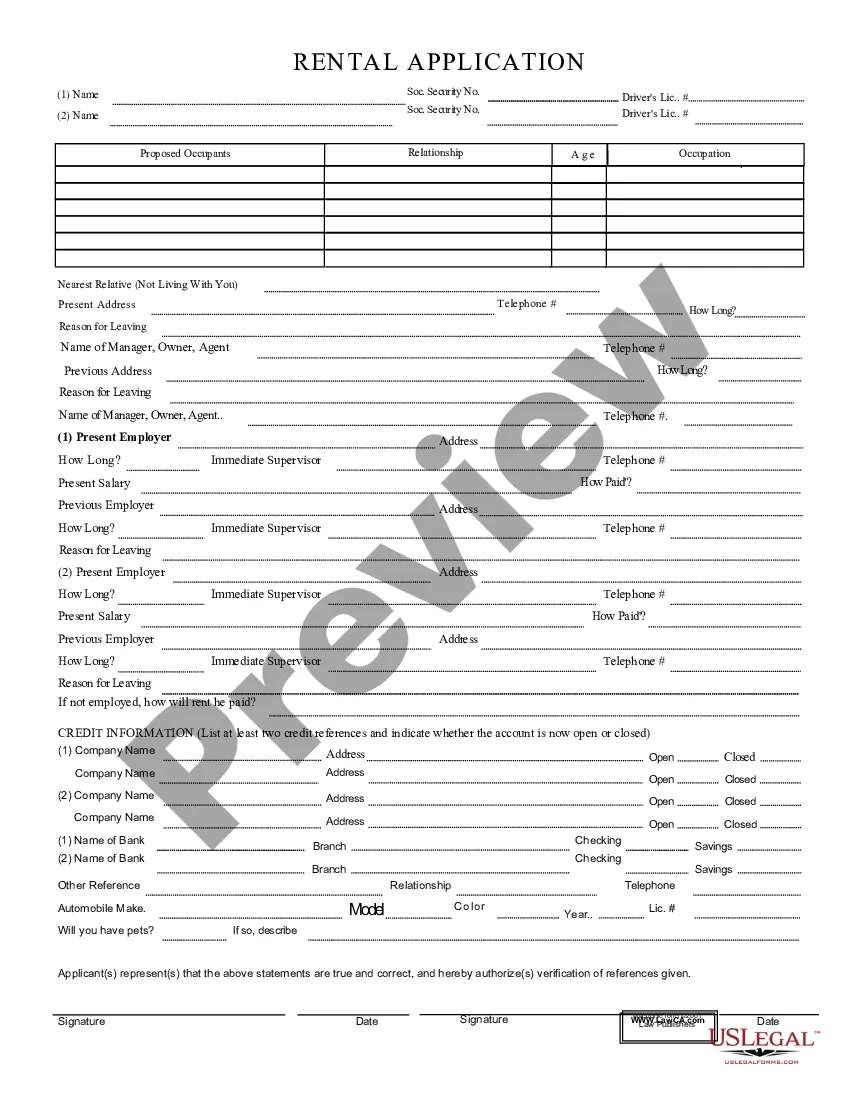

How to fill out Dallas Texas Tax Release Authorization?

Draftwing documents, like Dallas Tax Release Authorization, to manage your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for various scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Dallas Tax Release Authorization form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Dallas Tax Release Authorization:

- Make sure that your document is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Dallas Tax Release Authorization isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!