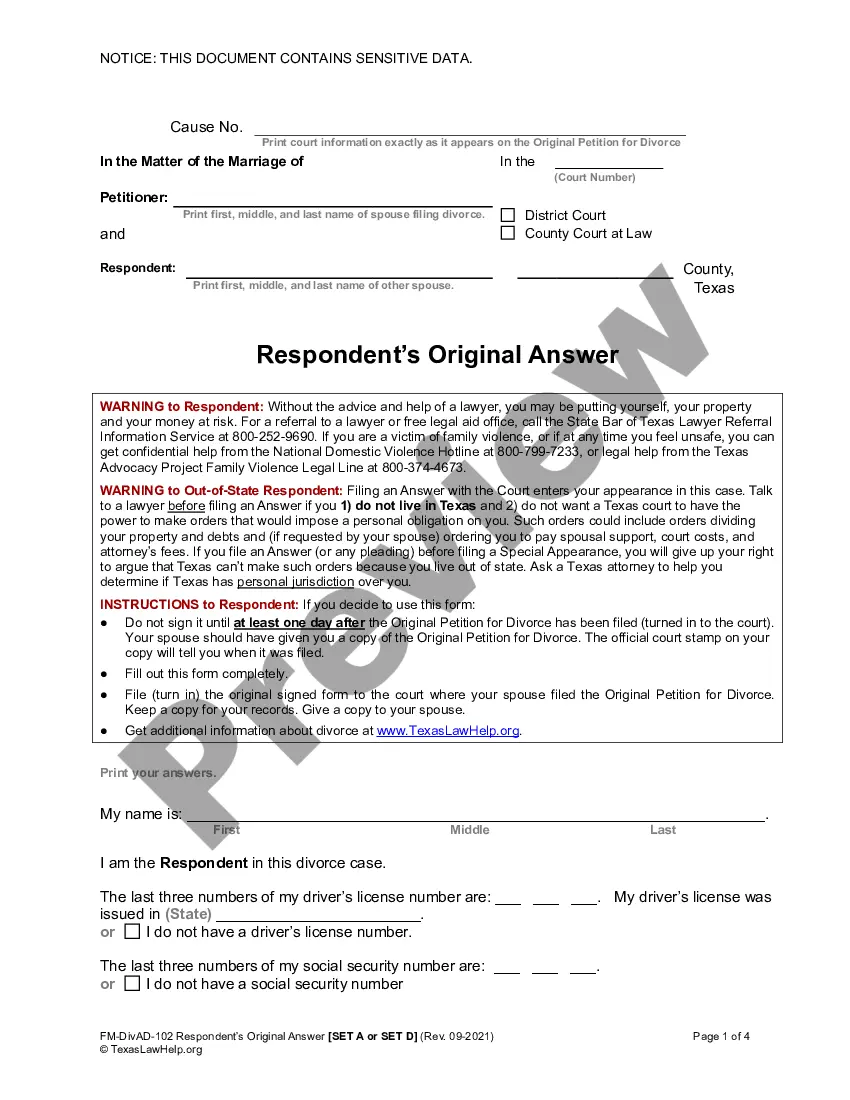

The Harris Texas Tax Release Authorization is an essential document that allows the release of tax information to authorized individuals or entities. This authorization form is required in various tax-related scenarios and is a crucial part of establishing a legal framework for tax information sharing and disclosure. The Harris Texas Tax Release Authorization form is specifically designed for residents of Harris County, Texas, and is used to grant permission to specified individuals or organizations to access tax-related documents, data, and information. This document ensures strict compliance with the regulations and safeguards the privacy of taxpayers while enabling the necessary sharing of information for legitimate purposes. There are different types of Harris Texas Tax Release Authorization forms depending on the purpose and nature of tax information being released. These include: 1. Individual Tax Release Authorization: This form is used when an individual taxpayer grants permission to a designated person, such as a tax preparer, accountant, or attorney, to access and work with their tax-related information. It may include personal details, earnings, deductions, and other relevant financial data. 2. Business Tax Release Authorization: This form is specifically designed for businesses operating within Harris County, Texas. It allows authorized individuals or entities, such as financial consultants, bookkeepers, or legal representatives, to access and review the tax information pertaining to a particular business entity. This may include financial statements, profit and loss records, payroll information, and other relevant documents. 3. Estate Tax Release Authorization: This type of authorization caters to estates and their representatives. It allows an authorized individual, typically an executor or administrator, to access and obtain tax-related information specific to an estate's assets, income, and liabilities. This serves as a means to comply with tax obligations and accurately report the estate's financial affairs. It is important to note that the Harris Texas Tax Release Authorization forms must adhere to strict guidelines and regulations set by the Internal Revenue Service (IRS) and other relevant tax authorities. These guidelines aim to ensure the privacy and security of taxpayer information while facilitating legitimate disclosure for lawful purposes. Overall, the Harris Texas Tax Release Authorization is a critical document enabling the authorized release of tax-related information within the framework of legal compliance. It plays a significant role in safeguarding taxpayer privacy and facilitating accurate reporting and compliance with tax obligations.

Harris Texas Tax Release Authorization

Description

How to fill out Harris Texas Tax Release Authorization?

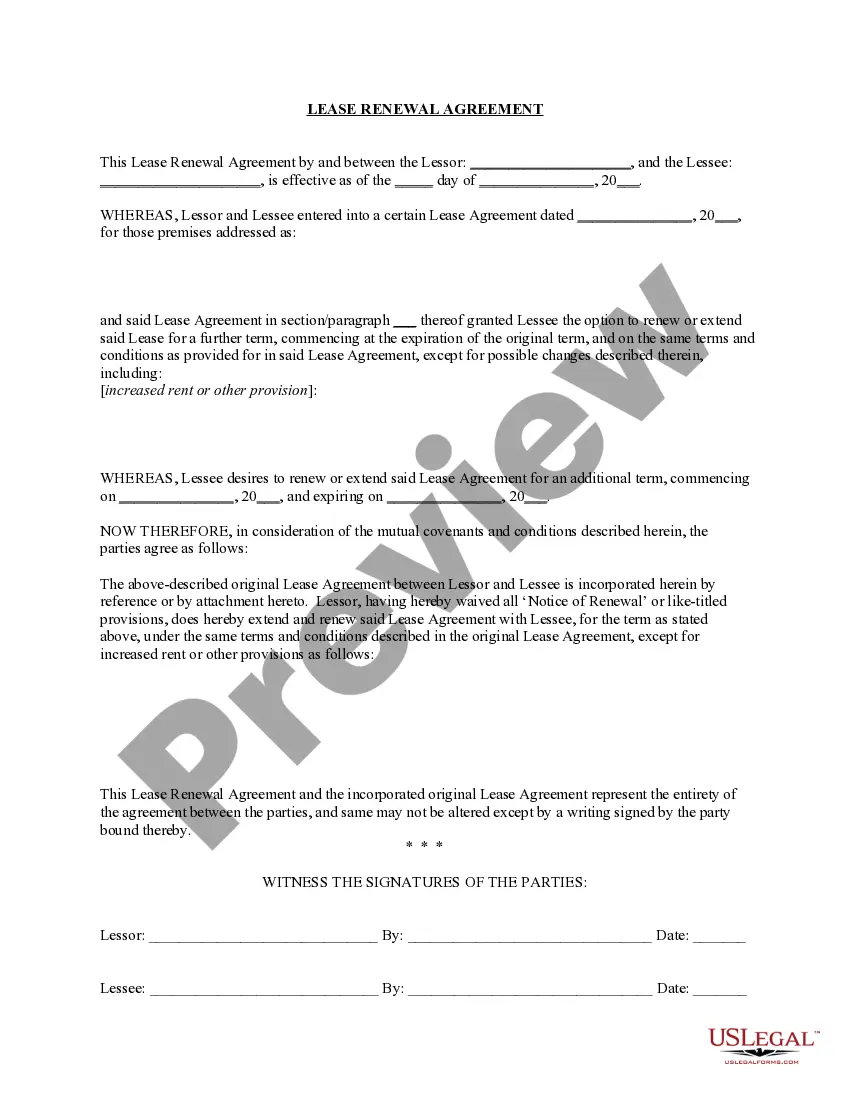

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Harris Tax Release Authorization, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Tax Release Authorization from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Harris Tax Release Authorization:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!