Hennepin County, Minnesota Tax Release Authorization is a legal document that grants an individual or entity permission to access tax-related information and records on behalf of another individual or business in Hennepin County, Minnesota. It is an essential tool in facilitating tax-related communication and ensuring compliance with tax laws. The Hennepin County Tax Release Authorization form allows authorized parties to obtain copies of tax returns, payment histories, assessments, and any other relevant information from the Hennepin County Department of Revenue. This authorization is particularly useful in situations involving tax filings, audits, disputes, and financial planning, where individuals or businesses may require access to tax records but may not be the primary taxpayer. There are several types of Hennepin County Tax Release Authorization, each serving a specific purpose: 1. Individual Tax Release Authorization: This form allows an individual to authorize a specific person or entity, such as a tax professional or family member, to access their tax records for personal matters, including filing tax returns, resolving tax issues, or providing financial advice. 2. Business Tax Release Authorization: This type of authorization grants a designated representative, such as an accountant or business partner, access to a company's tax information, enabling them to manage tax-related matters on behalf of the business. It includes access to tax returns, payment histories, and other relevant information. 3. Estate Tax Release Authorization: This form grants authorization to an executor or administrator of an estate to access and obtain relevant tax records and information associated with the deceased individual's estate. This is crucial for accurately filing estate tax returns and settling any outstanding tax obligations. 4. Power of Attorney Tax Release Authorization: In situations where an individual may be unable to manage their tax affairs due to physical or mental incapacity, this type of authorization allows a trusted person to act as their legally appointed representative, making decisions and accessing tax records on their behalf. It's important to note that Hennepin County Tax Release Authorization forms must be completed accurately and signed by all necessary parties involved. Additionally, the authorized person or entity must always comply with strict confidentiality and data protection regulations to ensure the security of the sensitive tax-related information they access.

Hennepin Minnesota Tax Release Authorization

Description

How to fill out Hennepin Minnesota Tax Release Authorization?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Hennepin Tax Release Authorization without expert assistance.

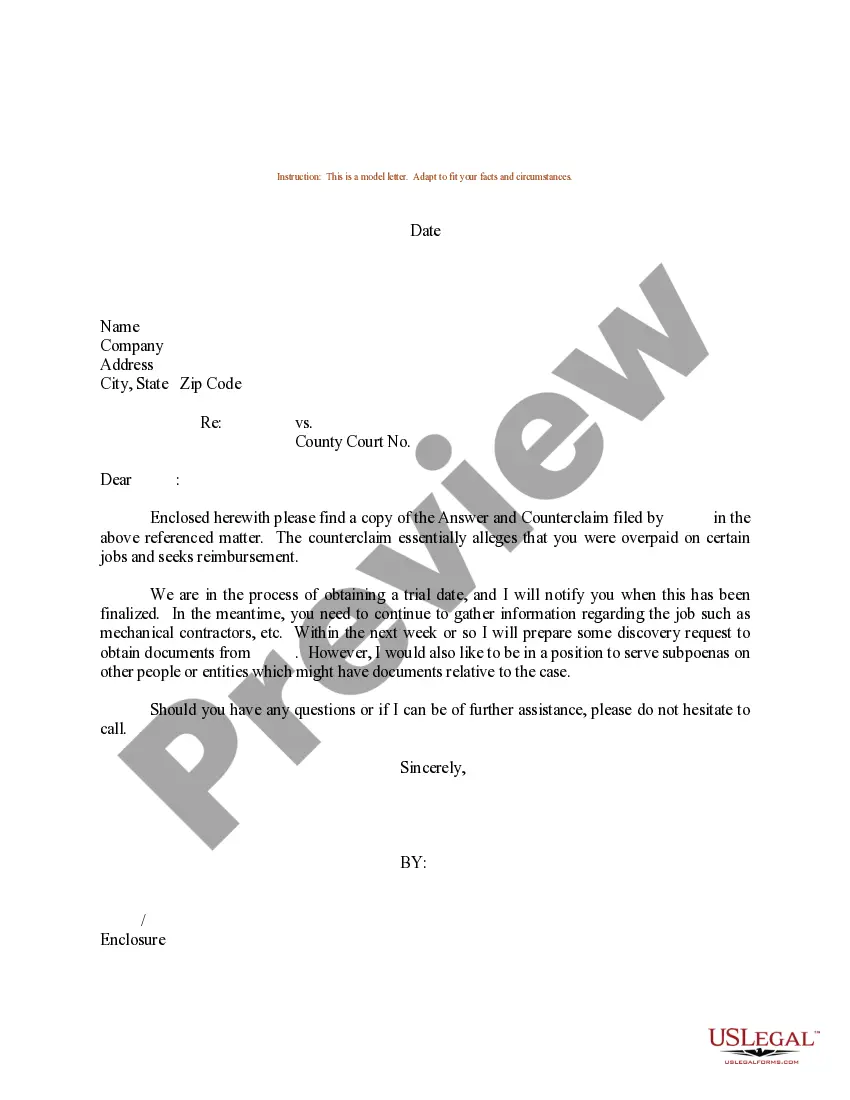

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Hennepin Tax Release Authorization by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Hennepin Tax Release Authorization:

- Look through the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

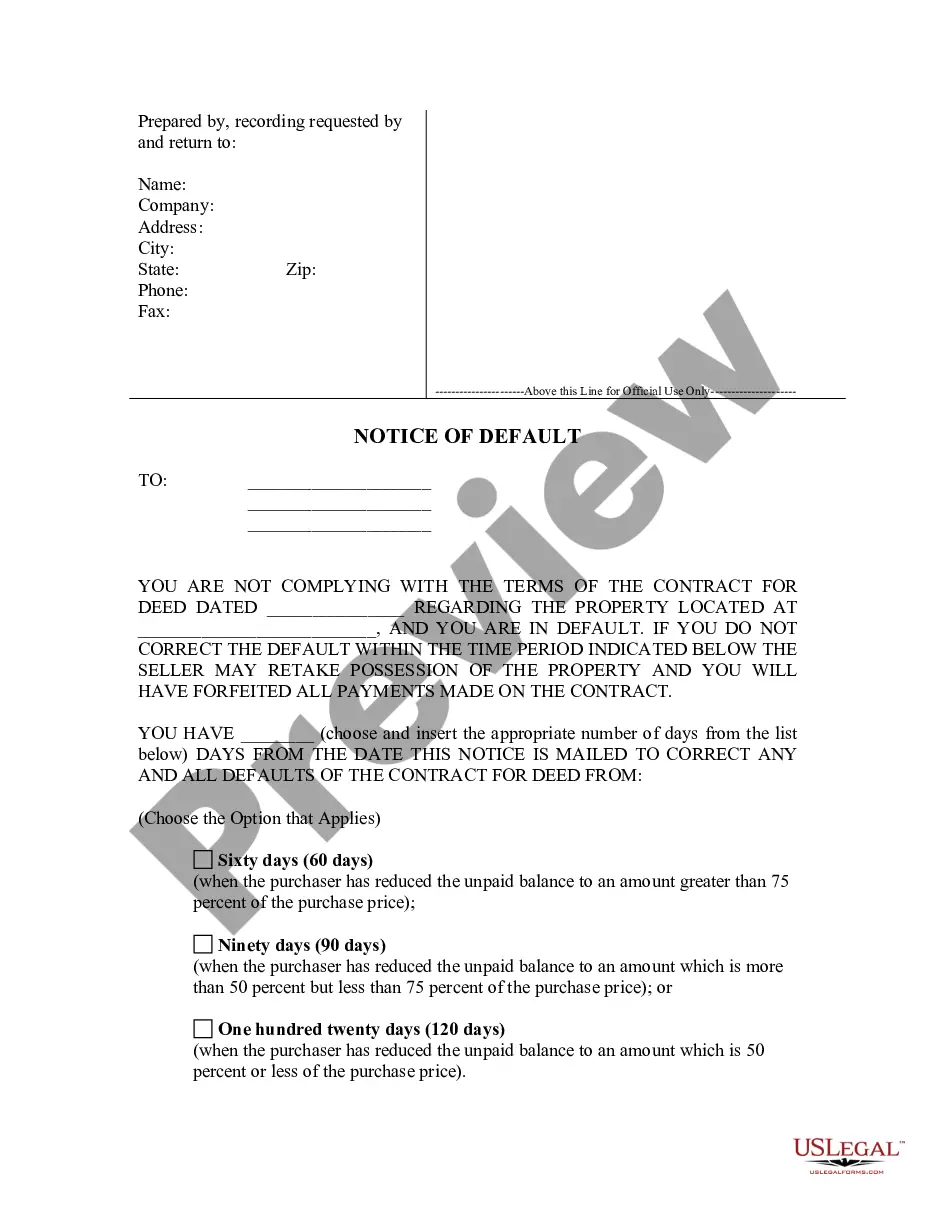

Tax forfeiture is the process by which the state takes ownership of a property if property taxes are not paid. In Minnesota the tax forfeiture process generally takes up to 3 years for homestead classified properties, and is outlined below.

You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.gov.

Tax forfeited parcels are properties on which delinquent property taxes were not paid, title to the land and buildings was forfeited and title is now vested in the State of Minnesota. Following a review period per Minnesota Statutes, these properties are open to the public to purchase.

Real property tax rates at 1% to 2% of assessed value Under Section 233 of the Local Government Code of 1991, the following rates of basic real property tax are prescribed based on assessed values of real properties in the Philippines: 1% for province; and, 2% for city or municipality within Metro Manila area.

Court action. If you don't pay after we've sent a final notice, we'll apply to the Magistrates' Court for a summons to be issued against you for the full amount of council tax you owe. This costs us £93 which we'll add to the amount you owe.

Property taxes are calculated using the Current Value Assessment of a property, as determined by the Municipal Property Assessment Corporation (MPAC), and multiplying it by the combined municipal and education tax rates for the applicable class of property.

Copies of specified lien records can be ordered through the Minnesota Business and Lien System (MBLS) online for a fee; ordering copies requires an account. Debtor Name Look-Ups provide a quick and easy way to find liens immediately.

Accordingly, if you don't pay your property taxes in Minnesota, a court will eventually enter a tax judgment that gives the state a future vested interest in the property, subject to your right of redemption (see below). Once the redemption period expires, the home is forfeited to the state.

Copies of specified lien records can be ordered through the Minnesota Business and Lien System (MBLS) online for a fee; ordering copies requires an account. Debtor Name Look-Ups provide a quick and easy way to find liens immediately.

Real estate taxes are the same as real property taxes. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes (or real property taxes) are typically used to help pay for local and state services.