Kings New York Tax Release Authorization is a document that grants permission to individuals or organizations to release tax-related information to authorized parties. This authorization is necessary for specific financial or legal purposes such as tax planning, audits, or loan applications. It ensures that only authorized individuals can access the confidential tax information of a taxpayer. The Kings New York Tax Release Authorization form includes detailed personal information such as the taxpayer's name, social security number, address, and contact details. It also specifies the duration of authorization, which could be a specific period or an indefinite timeframe. This is crucial as it allows the taxpayer to control and limit the release of their tax information to avoid any privacy concerns. There are several types of Kings New York Tax Release Authorization forms, each catering to different scenarios and requirements. Some common types include: 1. Individual Tax Release Authorization: This authorization is granted by an individual taxpayer, allowing specific individuals or organizations to access their personal tax information for designated purposes. 2. Joint Tax Release Authorization: This type of authorization is used when married couples or domestic partners want to grant access to their joint tax information to financial advisors, attorneys, or other authorized parties. 3. Business Tax Release Authorization: This form is designed for businesses or corporations, enabling authorized individuals or organizations to access their tax-related information for legal, financial, or audit purposes. 4. Third-Party Tax Release Authorization: This authorization allows the taxpayer to designate a trusted third party, such as a tax professional or an attorney, to represent them in matters related to their taxes. This form enables the third party to access and disclose the taxpayer's tax information. By utilizing the Kings New York Tax Release Authorization, taxpayers can maintain control over their tax information while allowing necessary parties to access it under specific circumstances. It serves as a crucial legal document that ensures the privacy and security of taxpayers' sensitive financial details.

Kings New York Tax Release Authorization

Description

How to fill out Kings New York Tax Release Authorization?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life scenario, finding a Kings Tax Release Authorization meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Kings Tax Release Authorization, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Kings Tax Release Authorization:

- Check the content of the page you’re on.

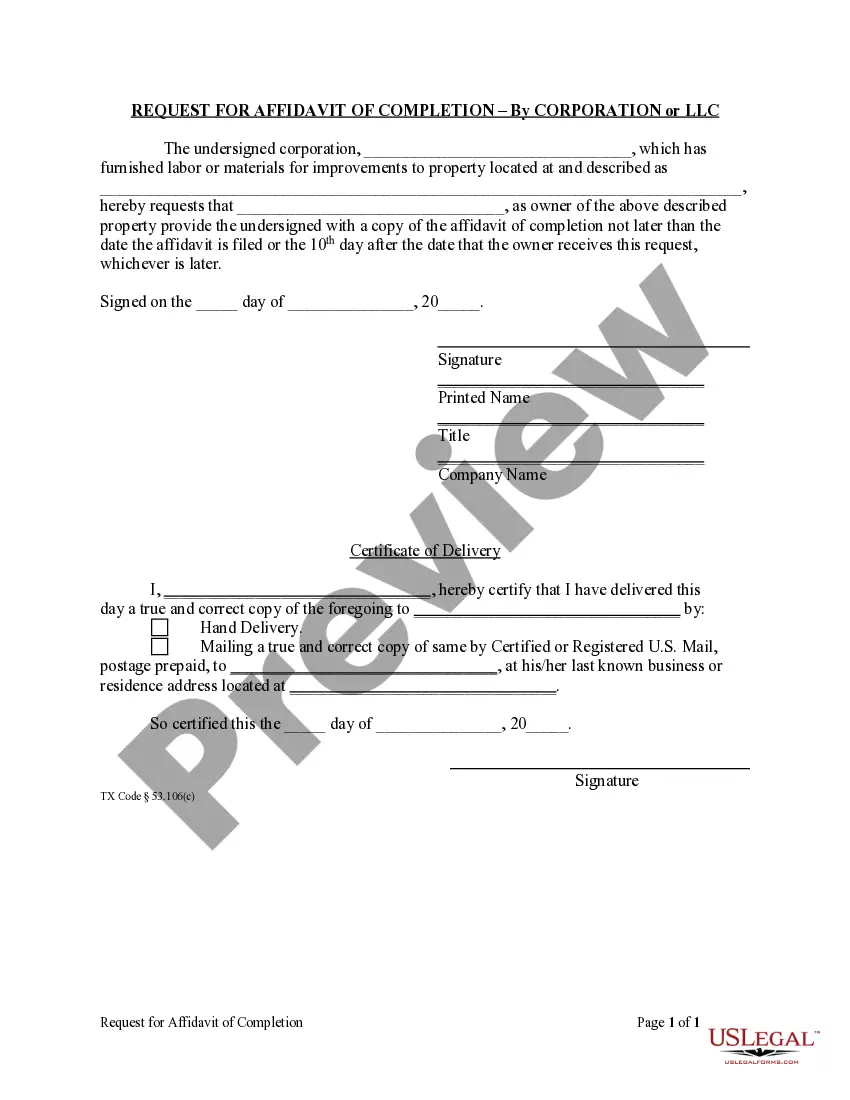

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Kings Tax Release Authorization.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!