The Lima Arizona Tax Release Authorization is an essential document used for granting someone permission to access and obtain tax information on behalf of an individual or business in Lima, Arizona. This authorization is crucial when additional parties need to retrieve tax-related documents or data for various purposes, such as tax preparation, audits, or financial planning. The Lima Arizona Tax Release Authorization serves as a legal consent form that enables designated individuals or entities to request and receive tax records from the Arizona Department of Revenue or the Internal Revenue Service (IRS). It ensures that confidential financial information is only accessible to authorized persons or organizations, preventing any unauthorized disclosure. There are different types of Lima Arizona Tax Release Authorization, depending on the specific purpose or situation. Some of these variations include: 1. Individual Tax Release Authorization: This form permits a designated person, typically an accountant, tax preparer, or financial advisor, to access and review an individual's tax information. It allows them to gather necessary documents, verify income details, deductions, and other related data. 2. Business Tax Release Authorization: This specific authorization form is required when someone needs access to a company's tax records. It allows authorized parties, such as certified public accountants (CPA's) or business partners, to retrieve critical financial information, including income statements, expense reports, and balance sheets. 3. Estate Tax Release Authorization: In cases involving deceased individuals or estates, this authorization allows a trustee, executor, or attorney to obtain tax-related information to fulfill their legal responsibilities. The form gives them access to the deceased person's tax records, enabling them to accurately determine the estate's tax liabilities or assets. 4. Non-Resident Tax Release Authorization: For individuals who reside outside of Lima, Arizona, but have taxable income derived from within Pima County, this authorization allows their designated representative to access and retrieve tax information related to their Bio-based activities. It is essential for ensuring compliance with local tax regulations. In conclusion, the Lima Arizona Tax Release Authorization is a critical legal document that authorizes designated individuals or entities to access and obtain tax-related information on behalf of individuals or businesses. The various types of authorization forms cater to specific circumstances and enable authorized parties to fulfill their responsibilities effectively while maintaining the confidentiality of sensitive financial information.

Pima Arizona Tax Release Authorization

Description

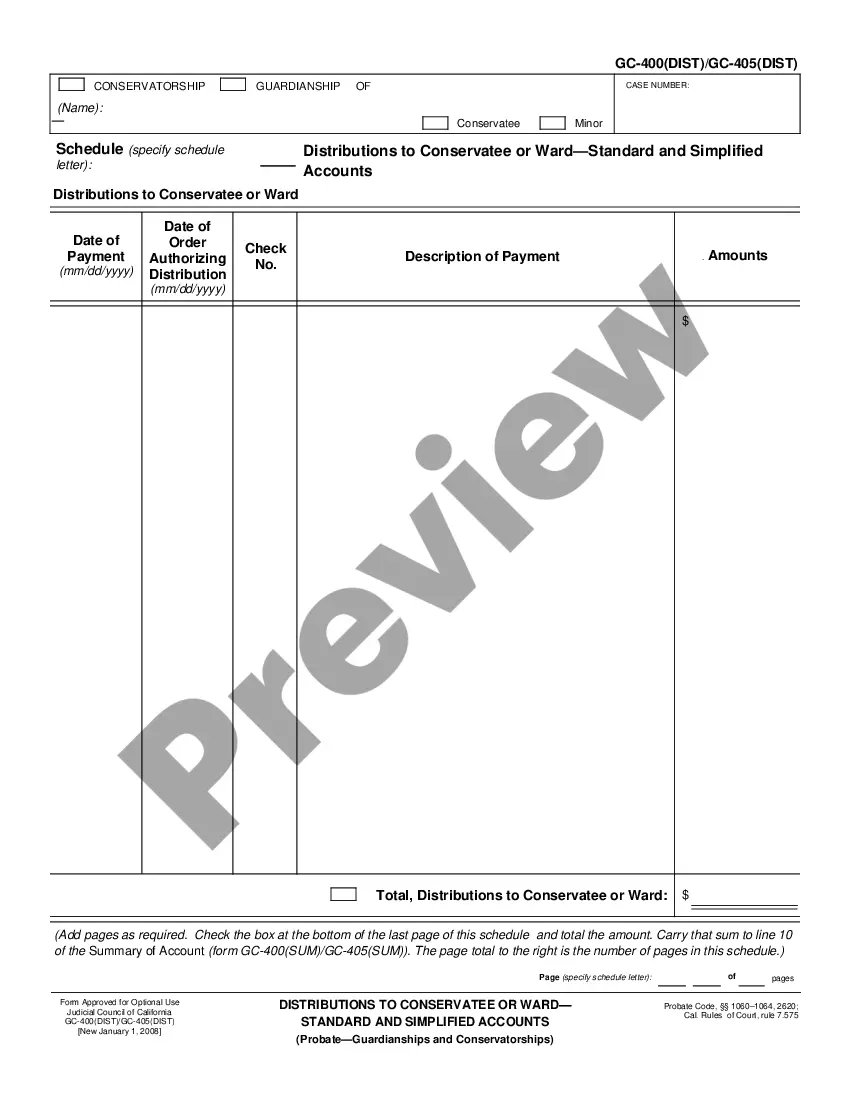

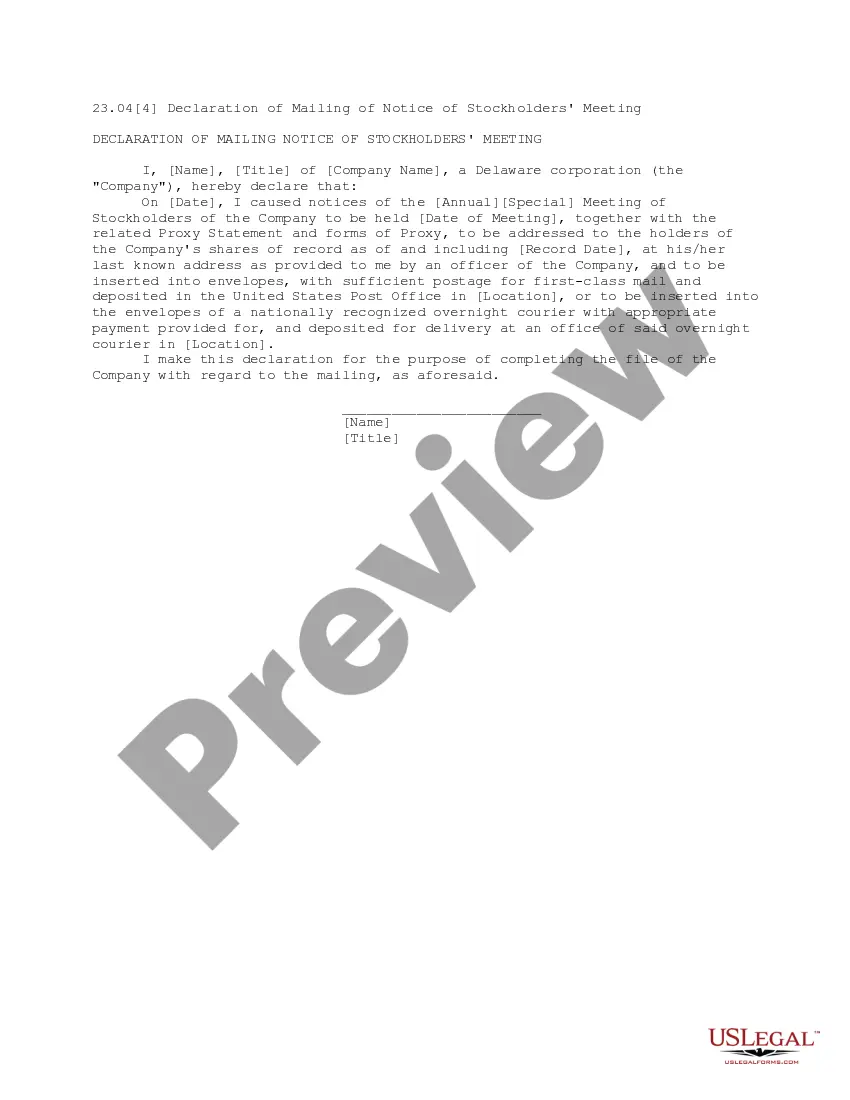

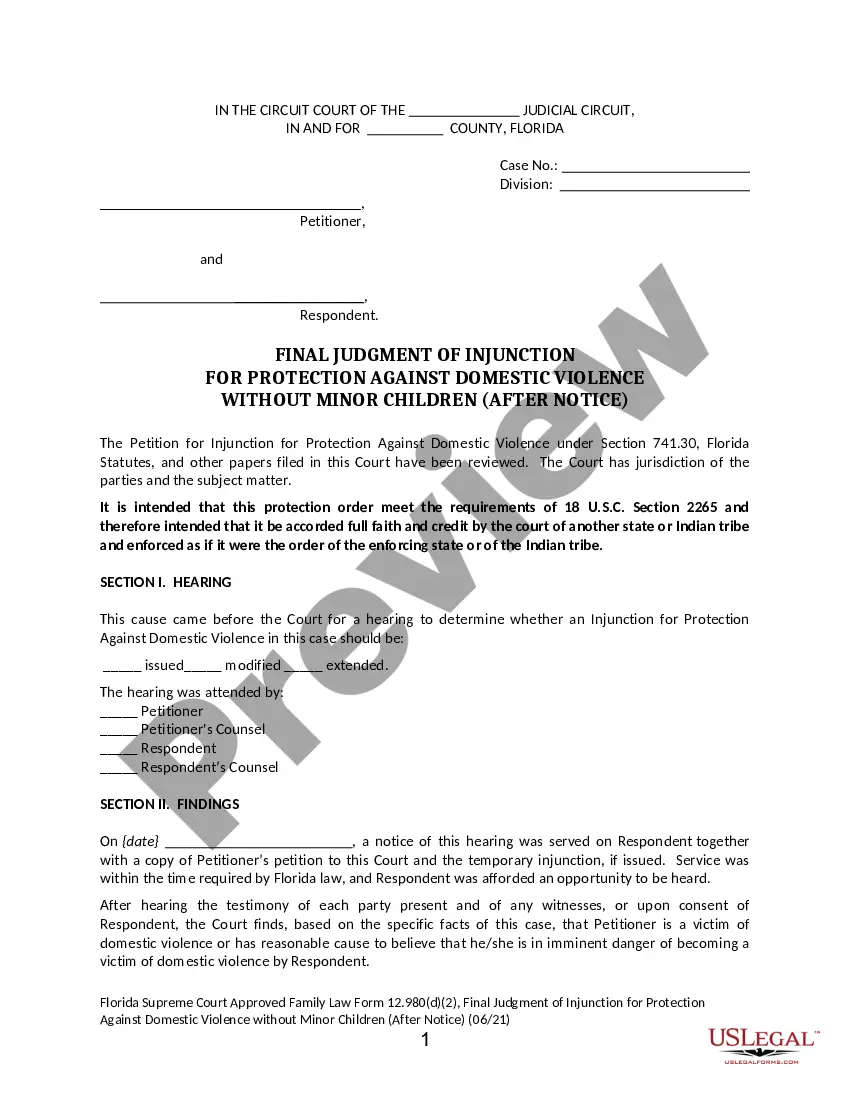

How to fill out Pima Arizona Tax Release Authorization?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Pima Tax Release Authorization is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Pima Tax Release Authorization. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima Tax Release Authorization in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Property tax rates in Pima County are the second highest of any county in Arizona. The average effective property tax rate in Pima County is 1.01%. That is higher than the state average, and the typical Pima County homeowner pays $1,753 annually in property taxes, which is also above average statewide.

Please include your state code or reference number on your check. All other correspondence should be sent to 240 N. Stone Ave, Tucson, Arizona, 85701.

The American Dream Act AZ proposes the elimination of property taxes for those who are 65 and older. Folks need only prove their age, their Arizona residency and that they use the property as the primary home.

(520) 724-7770 Monday - Friday a.m. - p.m.

Please include your state code or reference number on your check. All other correspondence should be sent to 240 N. Stone Ave, Tucson, Arizona, 85701.

By statute, the County is required each year to collect property taxes for the various jurisdictions in Pima County that are authorized to levy such taxes. More than $1.4 billion in property taxes were levied by all jurisdictions throughout the county for fiscal year 2021/22.

Health and Community Services Medical Examiner.Behavioral Health.Pima Animal Care Center.Community & Workforce Development (CWD)Attractions & Tourism Office.Kino Sports Complex.Pima County Wireless Integrated Network (PCWIN)Office of Emergency Management.

Pay in person You may bring your payment to the Treasurer's Office located in downtown Phoenix at 301 W Jefferson St, Suite #100, Phoenix, AZ 85003.

Contact Board of Supervisors Rex Scott, District 1. (520) 724-2738. email district1@pima.gov. Matt Heinz, District 2. (520) 724-8126. email district2@pima.gov. Sharon Bronson, District 3. (520) 724-8051. email district3@pima.gov. Steve Christy, District 4. (520) 724-8094. email district4@pima.gov. Adelita Grijalva, District 5.

Accepted forms of payment online are: Visa, Master Card, Discover credit and debit cards, Paypal, eChecks and other digital wallets for your convenience. The minimum acceptable payment is the greater of $10 or 10% of the installment due. Certificate payments or redemptions CAN NOW be made using our online vendor.