Queens New York Tax Release Authorization

Description

How to fill out Queens New York Tax Release Authorization?

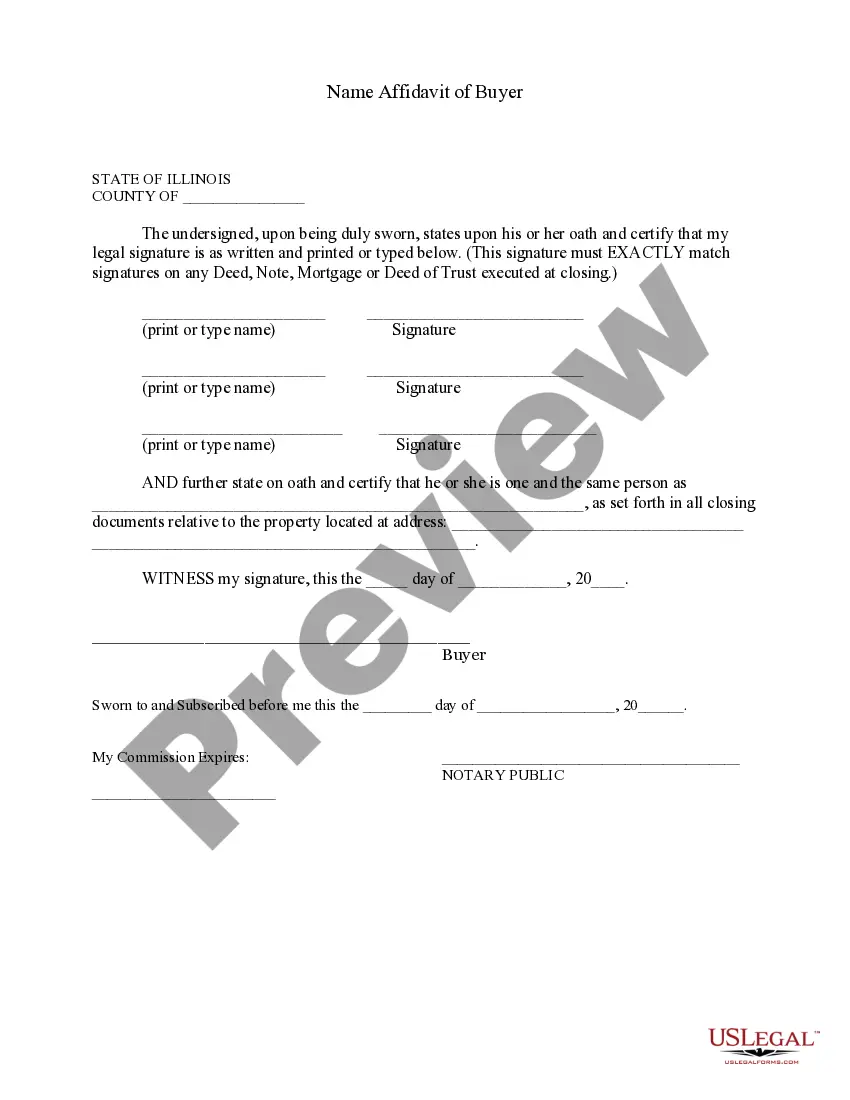

Creating paperwork, like Queens Tax Release Authorization, to take care of your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for a variety of cases and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Queens Tax Release Authorization template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Queens Tax Release Authorization:

- Make sure that your form is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Queens Tax Release Authorization isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our service and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Tax Returns and/or Tax Information. DTF-505.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

A tax information authorization gives that person the legal right to review some confidential taxpayer information. A TIA relationship does not allow the representative to act on a taxpayer's behalf to resolve their tax issues with FTB.

Tax Information Authorization You can use Form 8821 to allow the IRS to discuss your tax matters with designated third parties and, where necessary, to disclose your confidential tax return information to those designated third parties on matters other than just the processing of your current tax return.

What taxpayers should do if they get a letter or notice from the... Don't ignore it.Don't panic.Don't reply unless instructed to do so.Do take timely action.Do review the information.Do respond to a disputed notice.Do remember there is usually no need to call the IRS.Do avoid scams.

The Internal Revenue Service (IRS) will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment.

More In Forms and Instructions Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Delete or revoke prior tax information authorizations.

The IRS sends these identity verification letters to taxpayers after receiving an e-filed/paper-filed tax return, before processing a refund. Sometimes this is to randomly verify identification as a measure to prevent identity theft and to test and strengthen IRS internal controls.

DTF-948 or DTF-948-O (Request for Information) Checklist for acceptable proof of wages and withholding. Checklist for acceptable proof of a child or dependent. For other checklists, see Recordkeeping for individuals.

If we offset your New York State tax refund, we will send you a DTF-160, Account Adjustment Notice, detailing: the amount we offset, the agency we sent your money to, and. contact information for that agency.