Title: Understanding Different Types of Fairfax Virginia Complaints Regarding Insurer's Failure to Pay Claims Introduction: In Fairfax, Virginia, policyholders who face issues regarding their insurance claims may file complaints against their insurers for failure to pay. These complaints are essential in holding insurers accountable and ensuring policyholders receive the coverage they are entitled to. In this article, we will delve into the various types of Fairfax Virginia complaints related to an insurer's failure to pay claims. 1. Denial of Claim Complaint: One type of complaint frequently lodged by Fairfax, Virginia residents involves the insurer outright denying their claim. Policyholders may encounter instances where the insurer disputes coverage, asserting that the damage or incident falls outside the policy's terms. These complaints highlight situations where the policyholder feels unjustly denied their rightful coverage. 2. Delayed Payment Complaint: Another common complaint revolves around delayed payment. In such cases, policyholders might have successfully proved their eligibility for a claim, but the insurer continuously postpones the payment. This can cause distress and financial hardships to individuals who depend on swift claim settlements for crucial expenses, repairs, or medical treatments. 3. Underpayment Complaint: Policyholders may also file a complaint if they believe the insurer undervalued the claim settlement amount. This occurs when the insurer assesses the damages or losses suffered by the policyholder and offers a settlement amount that the policyholder considers insufficient. These complaints emphasize the need for fair and accurate valuations to ensure proper compensation. 4. Bad Faith Complaint: In situations where the insurer's intent is brought into question, policyholders may file a bad faith complaint. This type of complaint alleges that the insurer has intentionally and unreasonably delayed, denied, or undervalued the claim without a valid reason, treating the policyholder unfairly. Bad faith complaints aim to protect policyholders from unethical practices from the insurer. 5. Confusing Policy Language Complaint: Policyholders may face difficulties understanding their insurance policy's terms and conditions, ultimately leading to claim denials or other issues. These complaints focus on the insurer's failure to provide clear and understandable policy language, potentially misleading policyholders about their coverage. Addressing such complaints highlights the importance of transparent and comprehensible policies. Conclusion: Fairfax, Virginia complaints for an insurer's failure to pay claims can take various forms, including claim denial, delayed payments, underpayment, bad faith, and confusing policy language. By understanding these different types, policyholders can better navigate their complaints and seek appropriate action to resolve their issues. It is crucial for insurers to address and resolve these complaints promptly, ensuring fair treatment for policyholders and upholding the integrity of the insurance industry.

Fairfax Virginia Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Fairfax Virginia Complaint Regarding Insurer's Failure To Pay Claim?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Fairfax Complaint regarding Insurer's Failure to Pay Claim, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Complaint regarding Insurer's Failure to Pay Claim from the My Forms tab.

For new users, it's necessary to make several more steps to get the Fairfax Complaint regarding Insurer's Failure to Pay Claim:

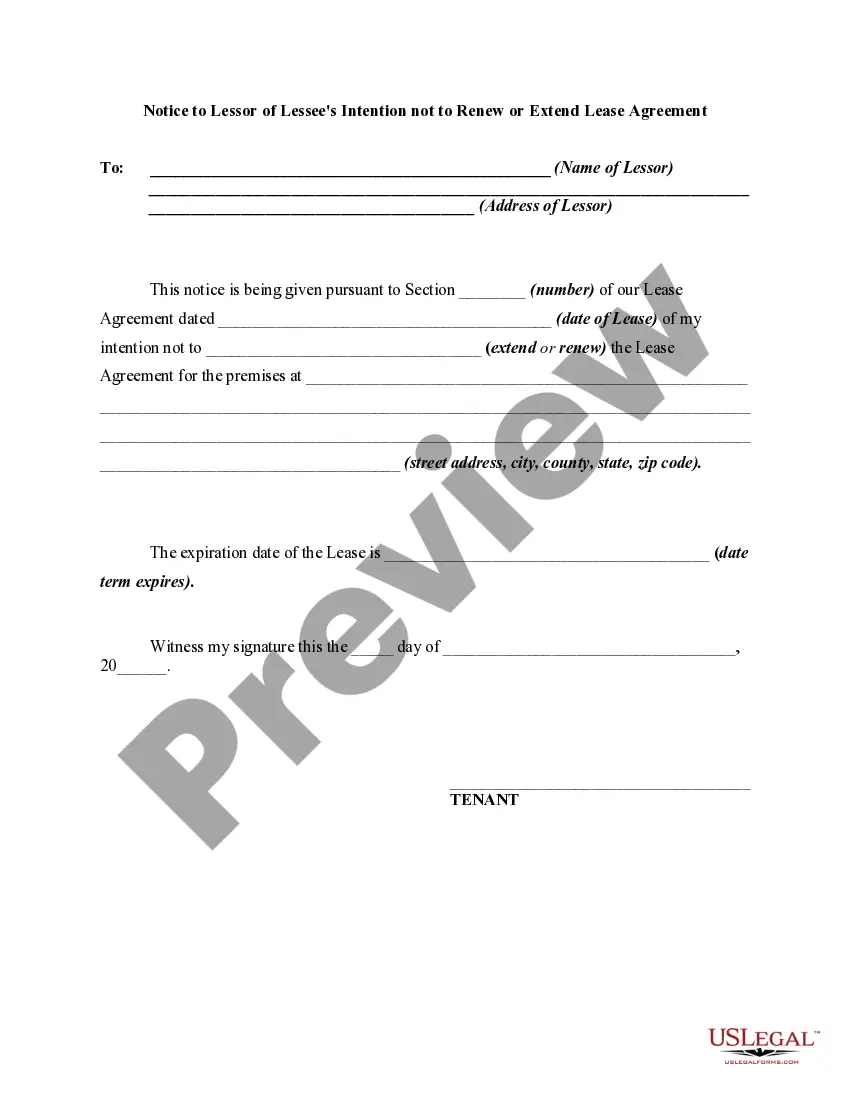

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!