Title: Understanding Nassau, New York Complaints Regarding Insurer's Failure to Pay Claims Introduction: Nassau, New York, is a vibrant county located on Long Island known for its rich history, diverse communities, and bustling urban centers. Unfortunately, like any other region, individuals and businesses in Nassau sometimes experience issues with insurance claim settlements. This article will delve into the various types of complaints that can arise in Nassau, NY, when insurers fail to pay claims. Keywords for this article: Nassau, New York, complaints, insurer, failure to pay-claim, types of complaints. 1. Complaints of Denied Claims: Many policyholders in Nassau, New York, face the frustrating situation of having their insurance claims denied by their insurer. These complaints often arise due to various reasons, such as policy exclusions, insufficient coverage, or ambiguous policy language. 2. Delayed Claim Settlements: Another common complaint in Nassau, NY, is the significant delay in receiving claim settlements from insurance companies. Customers may face financial hardships as a result, especially when relying on the insurance proceeds to cover expenses or rebuild after a loss. 3. Unfair Claim Valuations: Complaints may also arise when policyholders believe that insurance companies undervalue their claims. Insurers often use independent adjusters to assess the damage or loss, but sometimes, these valuations are disputed by the claimants, leading to dissatisfaction and complaints. 4. Disputes over Policy Interpretations: Insurance policies can be complex, and misinterpretations or disagreements regarding policy terms and conditions can give rise to complaints. Policyholders in Nassau, New York, may feel that the insurer's refusal to pay their claim is based on a flawed interpretation of the policy, leading to disputes and unresolved issues. 5. Lack of Communication and Transparency: Effective communication between policyholders and insurers is crucial during the claim settlement process. Complaints may arise in Nassau, NY, when insurers fail to provide timely updates, ignore policyholders' inquiries, or lack transparency regarding claim processing, leaving individuals feeling neglected and frustrated. 6. Failure to Act in Good Faith: Insurance companies have a duty to act in good faith when handling claims. Failure to meet this obligation can be grounds for complaints. Nassau, New York, residents may experience bad faith practices, such as unreasonable claim denials or unjustified delays, leading them to seek justice and compensation. Conclusion: Nassau, New York, residents and businesses rely on insurance coverage to protect themselves from various risks. However, when insurers fail to fulfill their obligations, complaints can arise in different forms. Whether it's denied claims, delayed settlements, unfair valuations, disputes over policy interpretations, lack of communication, or bad faith practices, experiencing difficulties with insurers can be challenging. By understanding these types of complaints, individuals and businesses in Nassau can better navigate the claims process and seek appropriate action when necessary.

Nassau New York Complaint regarding Insurer's Failure to Pay Claim

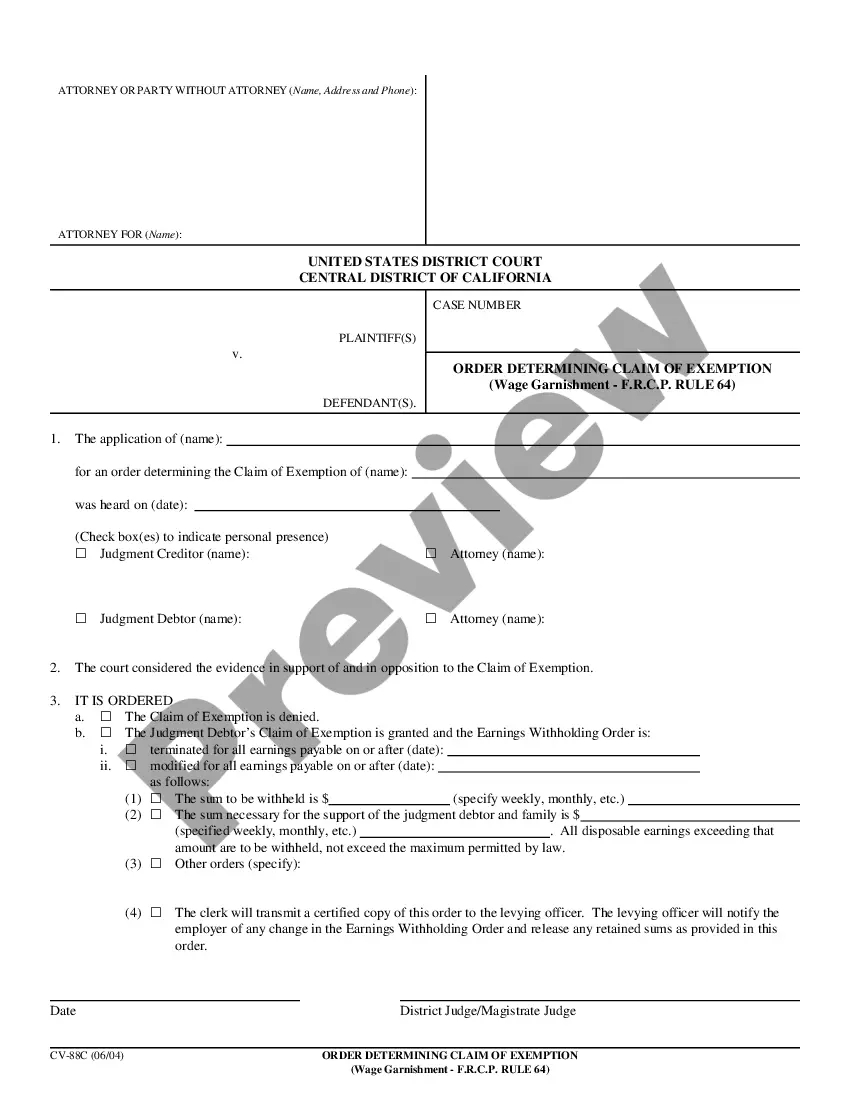

Description

How to fill out Nassau New York Complaint Regarding Insurer's Failure To Pay Claim?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Nassau Complaint regarding Insurer's Failure to Pay Claim suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Apart from the Nassau Complaint regarding Insurer's Failure to Pay Claim, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Nassau Complaint regarding Insurer's Failure to Pay Claim:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Nassau Complaint regarding Insurer's Failure to Pay Claim.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!