Title: Lima Arizona Complaint Regarding Insurer's Failure to Pay Claim: A Detailed Overview Introduction: In Lima, Arizona, a complaint regarding an insurer's failure to pay a claim can arise when policyholders feel their legitimate claims are being wrongfully denied, delayed, or underpaid. This article provides a comprehensive understanding of Lima Arizona complaints related to an insurer's failure to pay claims, discussing common issues, possible causes, and potential solutions. Keywords: Lima Arizona, complaint, insurer, failure to pay, claim, policyholders, wrongful denial, delayed payment, underpaid claims, issues, causes, solutions. Types of Complaints: 1. Wrongful Denial Complaints: Policyholders in Lima, Arizona, may file complaints when their claims are denied despite meeting all necessary requirements. These complaints often involve disputes regarding policy interpretation, exclusions, or conflicting information from the insurer. Keywords: wrongful denial, policy interpretation, exclusions, conflicting information. 2. Delayed Payment Complaints: Complaints arising from delayed claim payments occur when insurers fail to process, investigate, or settle claims within a reasonable timeframe. This can cause additional financial hardships for policyholders, especially when relying on the insurance payout for immediate remediation. Keywords: delayed payment, process, investigate, settle, reasonable timeframe, financial hardships. 3. Underpaid Claims Complaints: Policyholders in Lima, Arizona, may file complaints if they believe their claims have been unjustly undervalued or underpaid by the insurance company. This can happen due to inadequate assessment, undervalued property estimation, depreciation miscalculations, or improper application of deductibles. Keywords: underpaid claims, undervalued, inadequate assessment, property estimation, depreciation, deductibles. Common Issues: 1. Complex Policy Language: Many Lima Arizona complaints regarding an insurer's failure to pay claims stem from complex policy language. Policyholders may find it challenging to understand the coverage, resulting in misinterpretation and potential denials. Keywords: complex policy language, coverage, misinterpretation. 2. Insufficient Investigation: Insurers failing to conduct proper investigations into submitted claims can lead to delays and denials. Without a thorough appraisal process, the insurer might miss crucial details or evidence, resulting in claim disputes and further inconveniences for policyholders. Keywords: insufficient investigation, delays, denials, appraisal process, claim disputes. 3. Lack of Transparency: The lack of open communication, transparency, and clarity from insurers regarding claim processing can leave policyholders feeling frustrated and deceived. Inadequate explanations for denials or delays contribute to a growing number of complaints in Lima, Arizona. Keywords: lack of transparency, communication, clarity, explanations, frustrations, deceived. Possible Solutions: 1. Seek Legal Assistance: If a policyholder faces difficulty in resolving the complaint directly with the insurer, seeking guidance from a legal professional experienced in insurance claims can help navigate the process and protect their rights. Keywords: legal assistance, guidance, insurance claims, rights. 2. File a Complaint with Arizona Insurance Regulatory Agency: Policyholders should consider filing a formal complaint with the Arizona Department of Insurance if they believe their claim has been unfairly denied or delayed. The department can investigate the complaint and potentially mediate a resolution. Keywords: formal complaint, Arizona Department of Insurance, unfair denial, delay, investigation, resolution, mediation. 3. Review and Understand Policy: Policyholders must thoroughly review their insurance policy, seeking clarification from the insurer for any ambiguous language or misunderstandings. Understanding policy terms and exclusions can prevent potential claim rejections. Keywords: review policy, understand, clarification, ambiguous language, misunderstandings, terms, exclusions. Conclusion: Lima Arizona complaints related to an insurer's failure to pay claims encompass wrongful denials, delayed payments, and underpaid claims. Policyholders facing such issues should prioritize seeking legal assistance, filing formal complaints, and reviewing their policies for maximum protection and resolution of their claims. Keywords: Lima Arizona, complaints, insurer, failure to pay, claims, policyholders, protection, resolution.

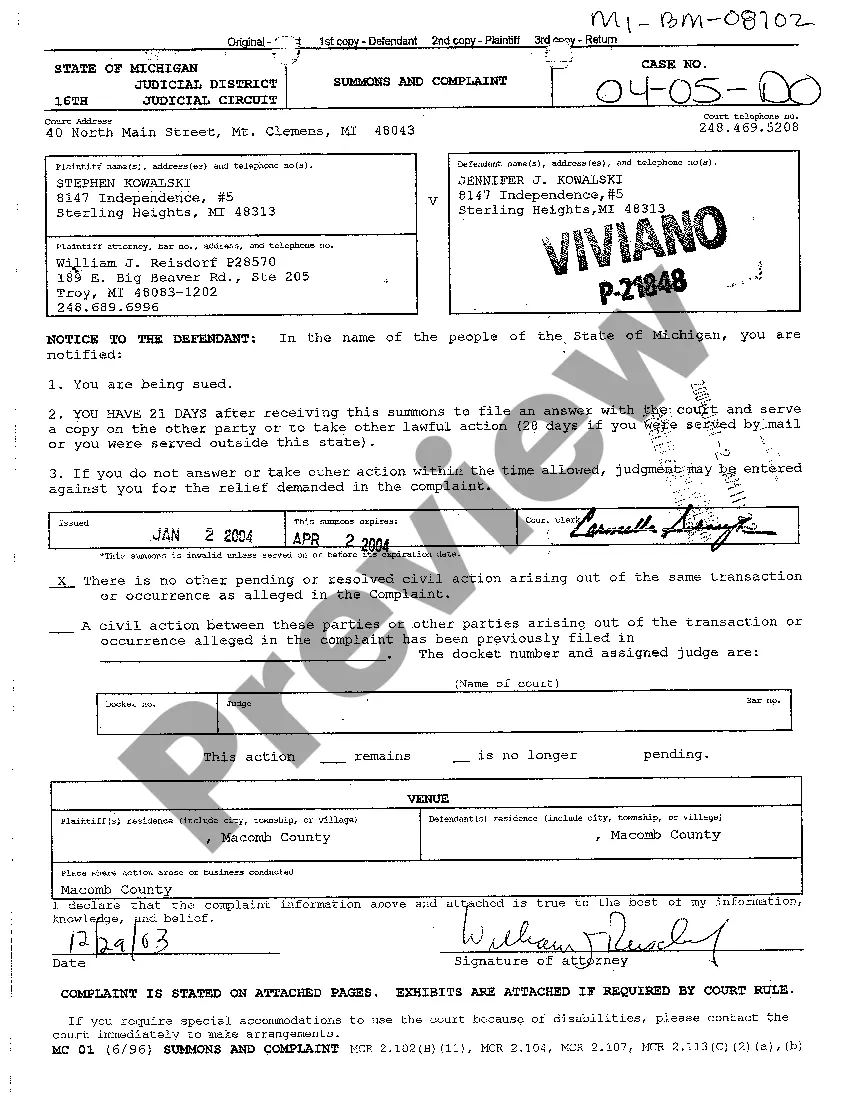

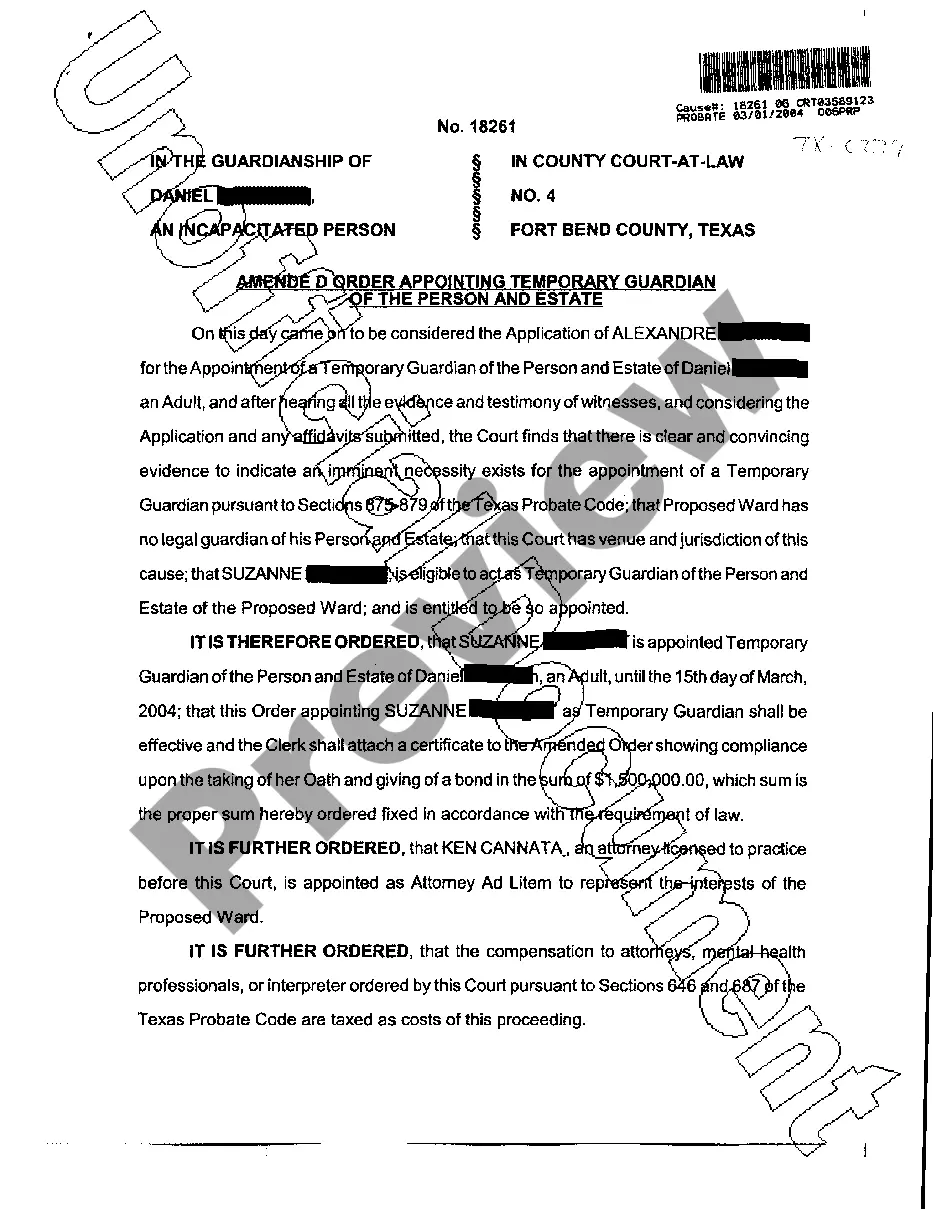

Pima Arizona Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Pima Arizona Complaint Regarding Insurer's Failure To Pay Claim?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Pima Complaint regarding Insurer's Failure to Pay Claim, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the recent version of the Pima Complaint regarding Insurer's Failure to Pay Claim, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Pima Complaint regarding Insurer's Failure to Pay Claim:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Pima Complaint regarding Insurer's Failure to Pay Claim and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

To report attorney misconduct you must contact the State Bar of Arizona. Once a report of attorney misconduct is received, the State Bar of Arizona will make a determination if the conduct warrants the filing of a formal complaint.

File a Consumer Complaint: If you believe you have been the victim of consumer fraud, you may file a consumer complaint. For consumer inquiries, or to request a complaint form, call (602) 542-5763 (Phoenix), (520) 628-6648 (Tucson), or toll-free outside of metro Phoenix, (800) 352-8431.

Arizona Attorney General Mark Brnovich Office of the Attorney General Phoenix Office. 2005 N Central Ave. Phoenix, AZ 85004-2926. (602) 542-5025.Tucson Office. 400 West Congress. South Building, Suite 315.Prescott Office. 1000 Ainsworth Dr. Suite A-210.Attorney General Information. AGInfo@azag.gov. (602) 542-5025.

Complaints are used by the Attorney General's Office to learn about misconduct and to determine whether to investigate a company. However, the Attorney General's Office cannot provide legal advice or assistance to individuals.

The Arizona Constitution, Article 15, Section 5 provides that domestic and foreign insurers are subject to licensing, control and supervision by a department of insurance, as prescribed by law. Arizona Revised Statutes, Title 20, outlines insurance law and establishes the Department of Insurance (Department).

If you are not sure whether the Arizona Department of Insurance is the right place for your question or problem, contact our Consumer Protection Division: Phone: (602) 364-2499 or (800) 325-2548 (in Arizona but outside Phoenix)Email: insurance.consumers@difi.az.gov.

Call 602-223-2000 and request to speak to a supervisor in the area of the incident. This service is also available 24 hours a day, year round.

It costs $16.00 to file a small claims complaint and $9.00 for a defendant to file an answer. Other filings or actions in the case may have additional fees. For those with low incomes, the filing fee may be waived by filling out a fee waiver form.

Small claim suits cannot exceed $3,500. All cases are heard by either a judge or hearing officer, who then makes a decision. The decision is final and binding on both parties. There is no right to a jury trial or an appeal in small claims cases.

Small claim suits cannot exceed $3,500. All cases are heard by either a judge or hearing officer, who then makes a decision. The decision is final and binding on both parties. There is no right to a jury trial or an appeal in small claims cases.