Title: San Jose, California Complaints Regarding Insurer's Failure to Pay Claim: Types and Detailed Description Introduction: San Jose, California, a bustling city nestled in the heart of Silicon Valley, is known for its thriving tech industry, cultural diversity, and picturesque scenery. However, even in this vibrant city, individuals may encounter challenges when dealing with insurers who fail to pay their claims. This article explores the different types of San Jose, California complaints regarding an insurer's failure to pay a claim, and provides a detailed description of each type. 1. Personal Injury Insurance Claim Complaints: When individuals sustain injuries due to accidents, they often rely on their insurance coverage to provide compensation for medical bills, lost wages, and other related expenses. However, some insurers may wrongfully deny or delay payment, leaving policyholders struggling to recover. Personal injury insurance claim complaints in San Jose, California are frequently related to motor vehicle accidents, slip and fall incidents, or other forms of negligence. 2. Homeowner's Insurance Claim Complaints: Homeowners who suffer property damage, such as fire, theft, or storm-related incidents, rely on their insurer to promptly pay for repairs or replacement costs. Unfortunately, insurers may improperly assess the damage, underpay, or delay payment, causing significant financial burdens on policyholders. Homeowner's insurance claim complaints in San Jose, California often revolve around disputes regarding coverage, settlement amounts, or lack of communication from the insurer. 3. Business Interruption Insurance Claim Complaints: Business interruption insurance is designed to assist companies that experience significant financial losses due to unforeseen circumstances such as natural disasters, equipment failure, or government-mandated closures. In San Jose, California, businesses may encounter disputes when insurers fail to recognize or compensate for the full extent of their losses, making it incredibly challenging to recover and resume operations. 4. Disability Insurance Claim Complaints: Individuals who are unable to work due to illness, injury, or disability depend on disability insurance benefits to cover their lost income. Some insurers, however, may wrongfully deny or terminate these claims, leaving policyholders struggling to make ends meet. San Jose, California complaints regarding disability insurance generally involve disputes over medical documentation, qualifying criteria, or denial without proper investigation. 5. Life Insurance Claim Complaints: The loss of a loved one is already emotionally challenging, and when life insurance companies do not honor their contractual obligations, it further exacerbates the situation. San Jose, California complaints related to life insurance often concern denied claims, alleged fraud, misrepresentation, or delays in payout, depriving beneficiaries of much-needed financial support during difficult times. Conclusion: San Jose, California complaints regarding an insurer's failure to pay claims encompass a wide range of situations and can severely impact individuals, businesses, and families. Whether it involves personal injury, homeownership, business interruptions, disability, or life insurance, the unfair denial, delay, or underpayment of claims by insurers creates significant hardships. Seeking legal assistance from experienced professionals can often help in rectifying these situations and ensuring fair compensation for policyholders.

San Jose California Complaint regarding Insurer's Failure to Pay Claim

Description

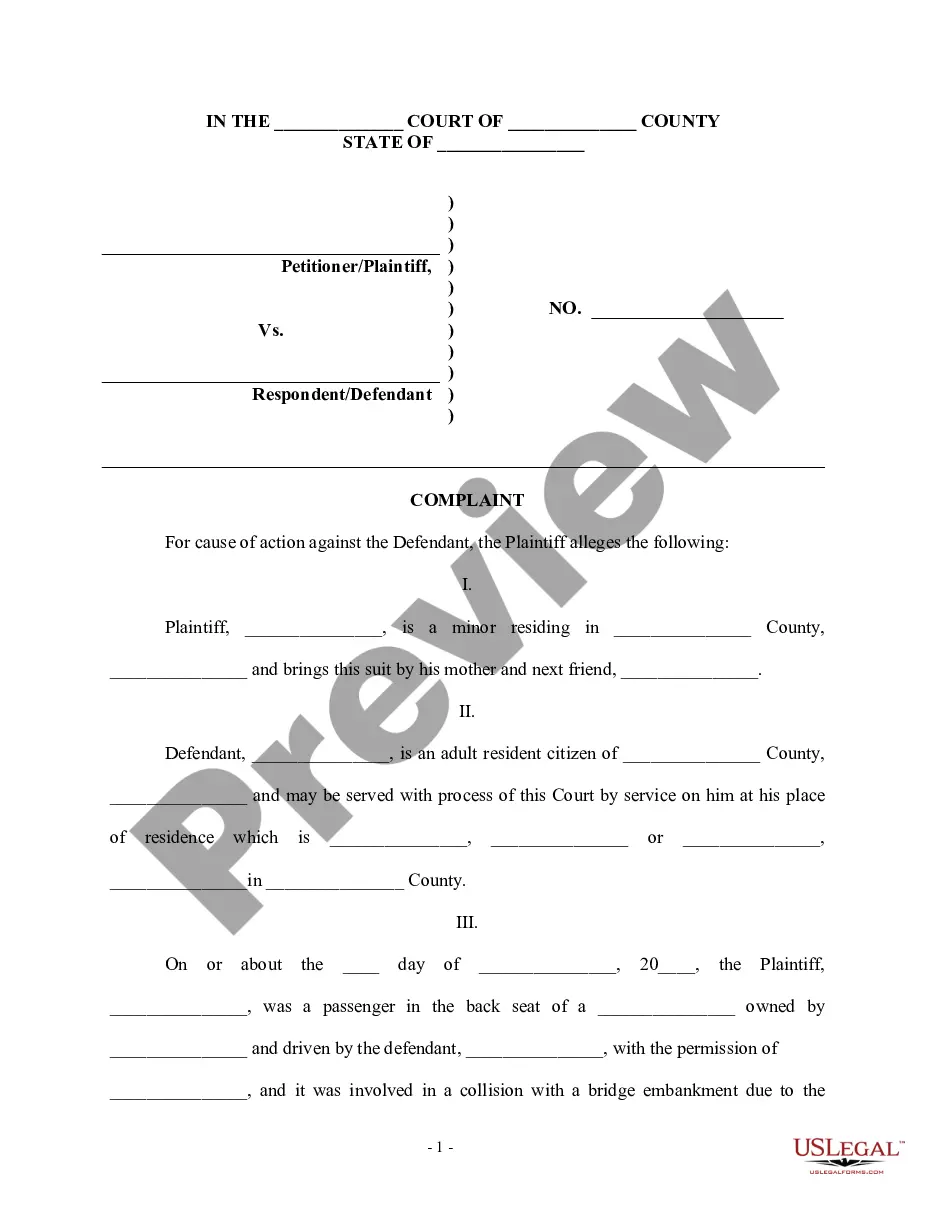

How to fill out San Jose California Complaint Regarding Insurer's Failure To Pay Claim?

Draftwing documents, like San Jose Complaint regarding Insurer's Failure to Pay Claim, to manage your legal affairs is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for a variety of cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the San Jose Complaint regarding Insurer's Failure to Pay Claim form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting San Jose Complaint regarding Insurer's Failure to Pay Claim:

- Make sure that your template is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the San Jose Complaint regarding Insurer's Failure to Pay Claim isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our service and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!