Title: Tarrant Texas Complaint Regarding Insurer's Failure to Pay Claim: A Comprehensive Discussion Introduction: Tarrant, Texas, like any other region, encounters situations where individuals face disputes with insurance companies over claim settlements. This article aims to provide a detailed description of Tarrant Texas complaints regarding an insurer's failure to pay a claim. It will shed light on common types of complaints residents may encounter and will explore possible solutions for resolving such issues. Key Points: 1. Types of Tarrant Texas Complaints Regarding Insurer's Failure to Pay Claims: a. Delayed Claim Settlements: This type of complaint arises when an insurer takes an unreasonable amount of time to process and finalize a claim, causing financial distress and inconvenience to the policyholder. b. Wrongful Claim Denials: Policyholders may submit a legitimate claim following an incident, only to receive an unwarranted denial from their insurer. This can lead to frustration and financial strain, particularly in emergency situations. c. Underpayment: Some policyholders may face situations where an insurance company offers an insufficient settlement, undervaluing the actual damages suffered. This may involve disagreements regarding repairs, replacement costs, or compensation for personal injuries. 2. Common Reasons for Insurance Claim Disputes: a. Policy Interpretation: Disputes can arise due to the interpretation of policy terms and conditions. Sometimes, policyholders may feel their insurer is misinterpreting the policy or applying exclusions that should not be relevant to their claim. b. Lack of Documentation: Insurers may request various supporting documents, such as medical bills, repair estimates, or police reports. Failure to provide these documents promptly or in the required format can result in delays or claim denials. c. Inadequate Investigation: If an insurer fails to conduct a thorough investigation into a claim, it can lead to delayed processing or an unfair denial. This may happen due to negligence or an incomplete analysis of the evidence presented. 3. Steps to File a Complaint: a. Gather Documentation: Make sure to gather and organize all relevant documentation, including policy details, claim forms, communication records, and evidence supporting your claim. b. Contact the Insurer: Initially, attempt to resolve the issue directly with the insurance company's designated claims department or customer service. Clearly communicate your concerns and provide necessary details to support your case. c. Escalate the Complaint: If the insurer's response remains unsatisfactory, or you receive no response at all, consider escalating the complaint to a higher authority within the company, such as a claims supervisor or manager. d. File a Complaint with Regulatory Authorities: If your efforts remain futile, you may need to file a complaint with appropriate regulatory bodies like the Texas Department of Insurance, ensuring you provide a comprehensive account of the issue and all supporting documentation. Conclusion: Tarrant, Texas, residents may encounter various complaints when dealing with an insurer's failure to pay claims. Understanding the different types of complaints and the potential causes of disputes can empower policyholders to take appropriate action. By following the necessary steps and providing sufficient documentation, individuals can increase the chances of ultimately resolving their complaint satisfactorily. Remember, seeking legal advice may be beneficial when facing complex claim disputes.

Tarrant Texas Complaint regarding Insurer's Failure to Pay Claim

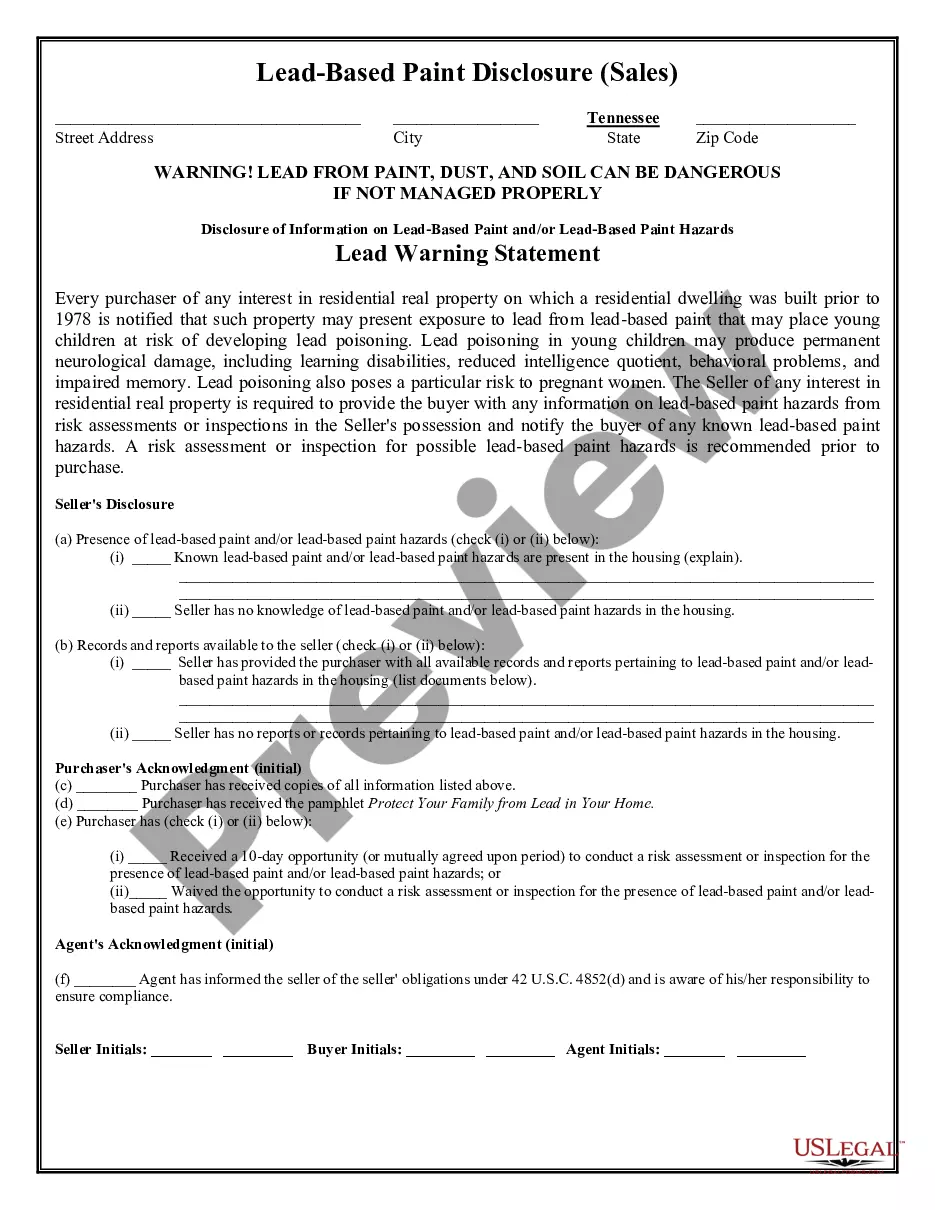

Description

How to fill out Tarrant Texas Complaint Regarding Insurer's Failure To Pay Claim?

Preparing papers for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Tarrant Complaint regarding Insurer's Failure to Pay Claim without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Tarrant Complaint regarding Insurer's Failure to Pay Claim by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Tarrant Complaint regarding Insurer's Failure to Pay Claim:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!