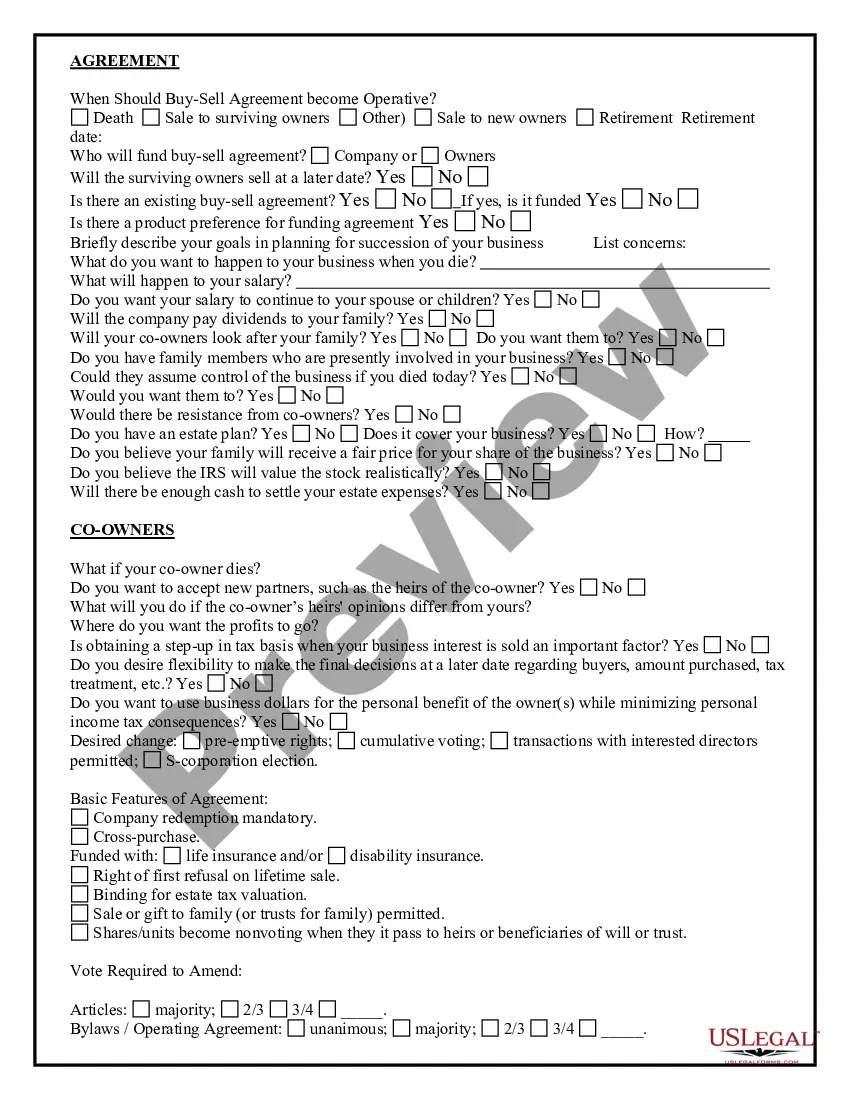

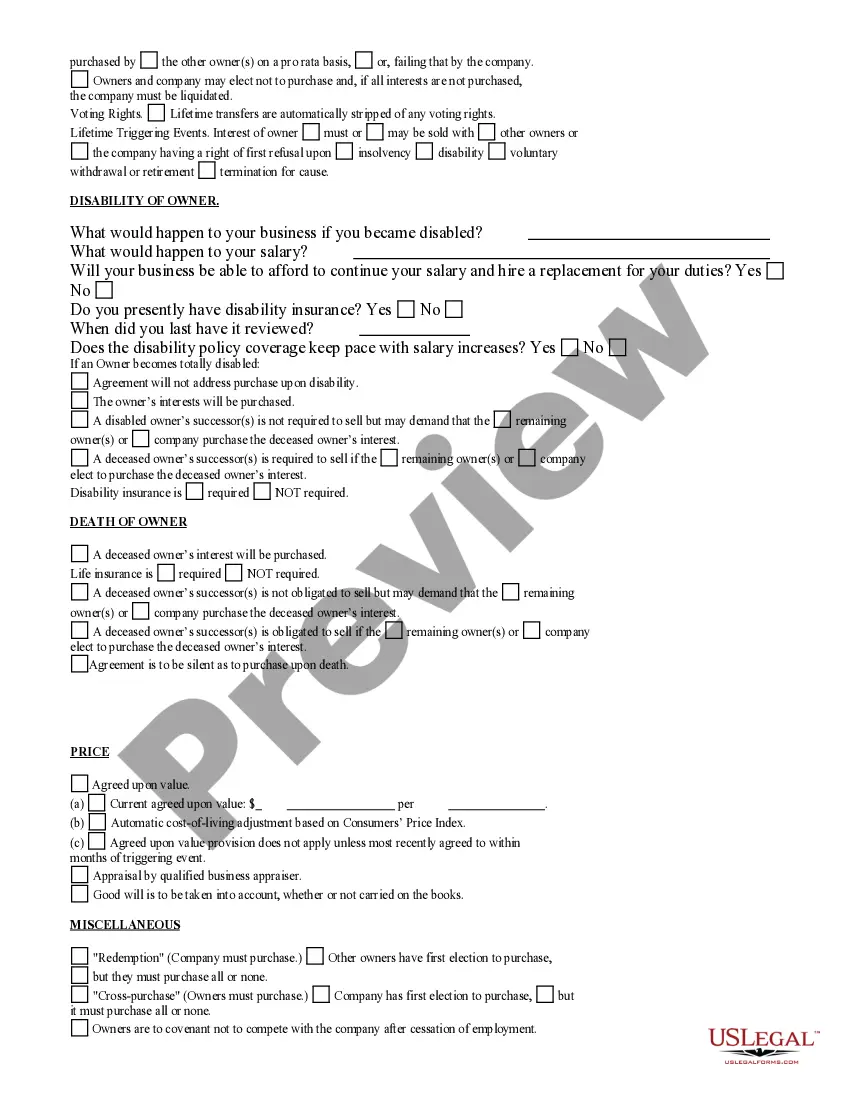

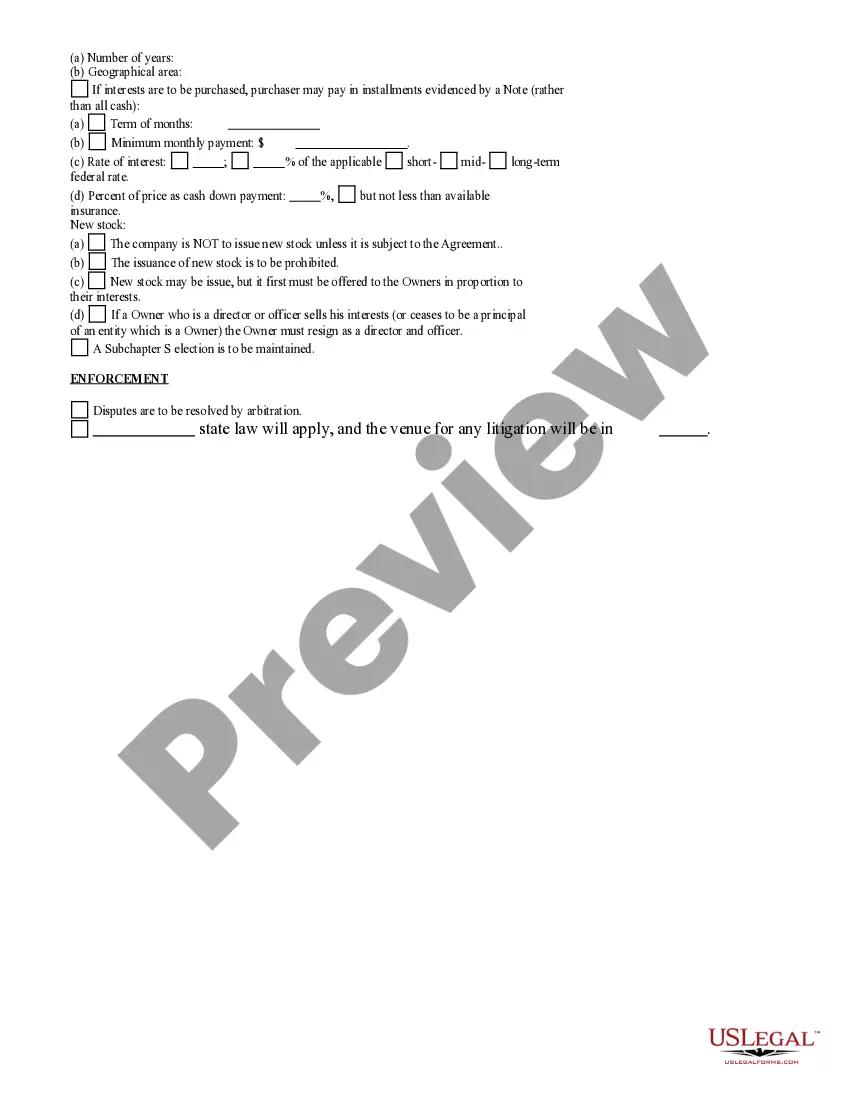

This form addresses important considerations that may effect the legal rights and obligations of the parties in a buy-sell agreement. It is a tool to help assure the orderly transfer of interests in the partnership or corporation. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

Dallas Texas Buy Sell Agreement Questionnaire is a comprehensive legal document designed to facilitate the buying and selling of businesses or business interests in Dallas, Texas. This questionnaire serves as a crucial tool for protecting the rights and interests of parties involved in the transaction and ensuring a smooth and efficient transfer of ownership. The questionnaire begins by capturing essential information about the buyer and seller, including their legal names, contact details, and business entities involved. It may also require details about the business being sold, such as its name, address, industry, and any relevant licenses or permits. One crucial aspect of the Dallas Texas Buy Sell Agreement Questionnaire is the identification and valuation of the business assets. This may include tangible assets like equipment, inventory, and properties, as well as intangible assets such as intellectual property, contracts, customer lists, and goodwill. The questionnaire outlines the specific terms and conditions under which these assets will be transferred from the seller to the buyer. Additionally, the questionnaire may address potential contingencies and scenarios that could impact the sale. This might include provisions for financing arrangements, non-compete agreements, warranties, representations, and any special conditions unique to the transaction. Different types of Dallas Texas Buy Sell Agreement Questionnaires may include: 1. Standard Buy Sell Agreement Questionnaire: This is the most common type of questionnaire designed to cover the essential aspects of a business sale in Dallas, Texas. 2. Business Purchase Agreement Questionnaire: This type of questionnaire is specifically tailored to the purchase of an entire business, including all assets and liabilities associated with it. 3. Merger or Acquisition Agreement Questionnaire: This questionnaire is used in situations where two businesses are merging or one company is acquiring another. It incorporates specific clauses and provisions to address the complexities of such transactions. 4. Stock Purchase Agreement Questionnaire: This type of questionnaire is focused on the purchase of stock in a corporation rather than buying the entire business. It outlines the terms of the stock acquisition, including price, conditions, and transfer procedures. In conclusion, the Dallas Texas Buy Sell Agreement Questionnaire is a crucial tool in facilitating the buying and selling of businesses in Dallas, Texas. It covers various aspects of the transaction and can be customized to suit different types of business sales, including standard agreements, mergers or acquisitions, business purchases, and stock purchases.Dallas Texas Buy Sell Agreement Questionnaire is a comprehensive legal document designed to facilitate the buying and selling of businesses or business interests in Dallas, Texas. This questionnaire serves as a crucial tool for protecting the rights and interests of parties involved in the transaction and ensuring a smooth and efficient transfer of ownership. The questionnaire begins by capturing essential information about the buyer and seller, including their legal names, contact details, and business entities involved. It may also require details about the business being sold, such as its name, address, industry, and any relevant licenses or permits. One crucial aspect of the Dallas Texas Buy Sell Agreement Questionnaire is the identification and valuation of the business assets. This may include tangible assets like equipment, inventory, and properties, as well as intangible assets such as intellectual property, contracts, customer lists, and goodwill. The questionnaire outlines the specific terms and conditions under which these assets will be transferred from the seller to the buyer. Additionally, the questionnaire may address potential contingencies and scenarios that could impact the sale. This might include provisions for financing arrangements, non-compete agreements, warranties, representations, and any special conditions unique to the transaction. Different types of Dallas Texas Buy Sell Agreement Questionnaires may include: 1. Standard Buy Sell Agreement Questionnaire: This is the most common type of questionnaire designed to cover the essential aspects of a business sale in Dallas, Texas. 2. Business Purchase Agreement Questionnaire: This type of questionnaire is specifically tailored to the purchase of an entire business, including all assets and liabilities associated with it. 3. Merger or Acquisition Agreement Questionnaire: This questionnaire is used in situations where two businesses are merging or one company is acquiring another. It incorporates specific clauses and provisions to address the complexities of such transactions. 4. Stock Purchase Agreement Questionnaire: This type of questionnaire is focused on the purchase of stock in a corporation rather than buying the entire business. It outlines the terms of the stock acquisition, including price, conditions, and transfer procedures. In conclusion, the Dallas Texas Buy Sell Agreement Questionnaire is a crucial tool in facilitating the buying and selling of businesses in Dallas, Texas. It covers various aspects of the transaction and can be customized to suit different types of business sales, including standard agreements, mergers or acquisitions, business purchases, and stock purchases.