This form addresses important considerations that may effect the legal rights and obligations of the parties during the process of incorporating a business. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

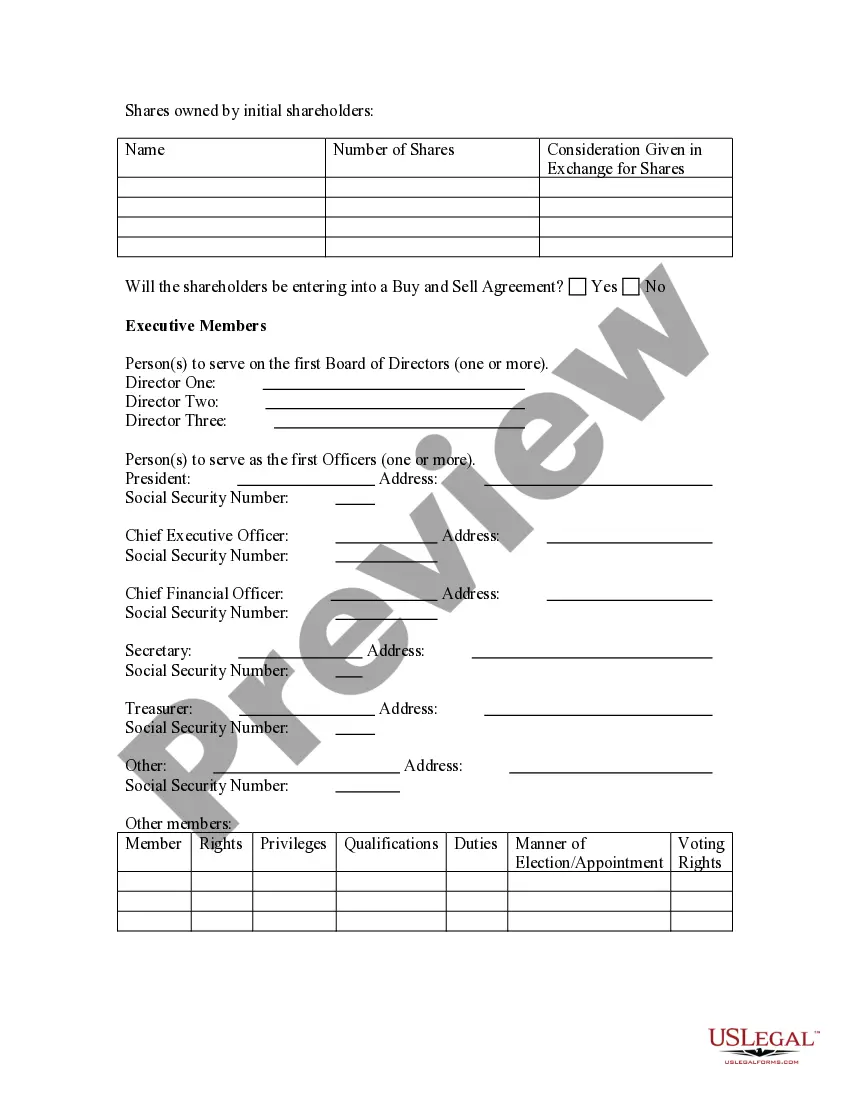

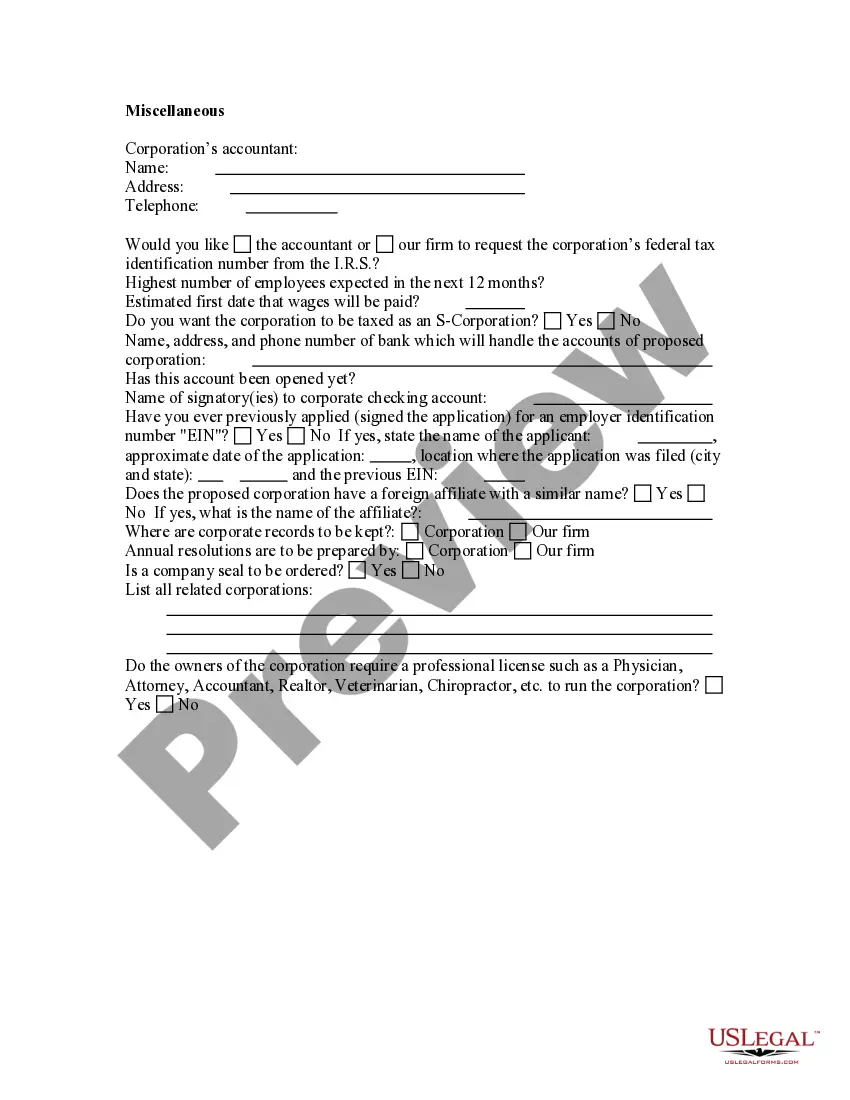

The Franklin Ohio Business Incorporation Questionnaire is a comprehensive document designed to gather essential information for businesses intending to incorporate in Franklin, Ohio. This questionnaire plays a crucial role as it helps streamline the incorporation process and ensures that all necessary details are considered to establish a legal business entity in the city. By answering these questions, entrepreneurs provide the relevant authorities with the necessary information to approve and register their business. The questionnaire begins by gathering basic information about the business, such as the proposed name, type of incorporation (e.g., sole proprietorship, partnership, corporation), and the business owner's personal details. Additionally, it may inquire about the desired business structure, ownership percentages, and whether the owner plans to operate the business from a commercial space or home-based location. Furthermore, the Franklin Ohio Business Incorporation Questionnaire delves into specifics related to business activities, licenses, and permits. Entrepreneurs may need to detail the nature of their business operations, outline the products or services they intend to offer, and clarify whether any specialized permits or licenses are required based on the industry or profession. Tax-related information plays a vital role in the questionnaire as well. Entrepreneurs will likely be prompted to provide their Federal Employer Identification Number (VEIN), tax filing preferences (e.g., quarterly, annually), and any anticipated tax exemptions or credits they may qualify for. Lastly, the questionnaire might address additional considerations such as zoning regulations, insurance requirements, and compliance with local laws. These factors are crucial to ensure the business operates within legal boundaries and adheres to the rules and regulations set forth by the City of Franklin, Ohio. Different types of Franklin Ohio Business Incorporation Questionnaires may exist to cater to specific business structures. For instance, there might be separate questionnaires tailored to sole proprietorship, partnerships, and corporations. This ensures that the questions asked are relevant to the specific type of business entity, facilitating a more targeted and efficient incorporation process.The Franklin Ohio Business Incorporation Questionnaire is a comprehensive document designed to gather essential information for businesses intending to incorporate in Franklin, Ohio. This questionnaire plays a crucial role as it helps streamline the incorporation process and ensures that all necessary details are considered to establish a legal business entity in the city. By answering these questions, entrepreneurs provide the relevant authorities with the necessary information to approve and register their business. The questionnaire begins by gathering basic information about the business, such as the proposed name, type of incorporation (e.g., sole proprietorship, partnership, corporation), and the business owner's personal details. Additionally, it may inquire about the desired business structure, ownership percentages, and whether the owner plans to operate the business from a commercial space or home-based location. Furthermore, the Franklin Ohio Business Incorporation Questionnaire delves into specifics related to business activities, licenses, and permits. Entrepreneurs may need to detail the nature of their business operations, outline the products or services they intend to offer, and clarify whether any specialized permits or licenses are required based on the industry or profession. Tax-related information plays a vital role in the questionnaire as well. Entrepreneurs will likely be prompted to provide their Federal Employer Identification Number (VEIN), tax filing preferences (e.g., quarterly, annually), and any anticipated tax exemptions or credits they may qualify for. Lastly, the questionnaire might address additional considerations such as zoning regulations, insurance requirements, and compliance with local laws. These factors are crucial to ensure the business operates within legal boundaries and adheres to the rules and regulations set forth by the City of Franklin, Ohio. Different types of Franklin Ohio Business Incorporation Questionnaires may exist to cater to specific business structures. For instance, there might be separate questionnaires tailored to sole proprietorship, partnerships, and corporations. This ensures that the questions asked are relevant to the specific type of business entity, facilitating a more targeted and efficient incorporation process.