This form addresses important considerations that may effect the legal rights and obligations of the parties during the process of incorporating a business. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

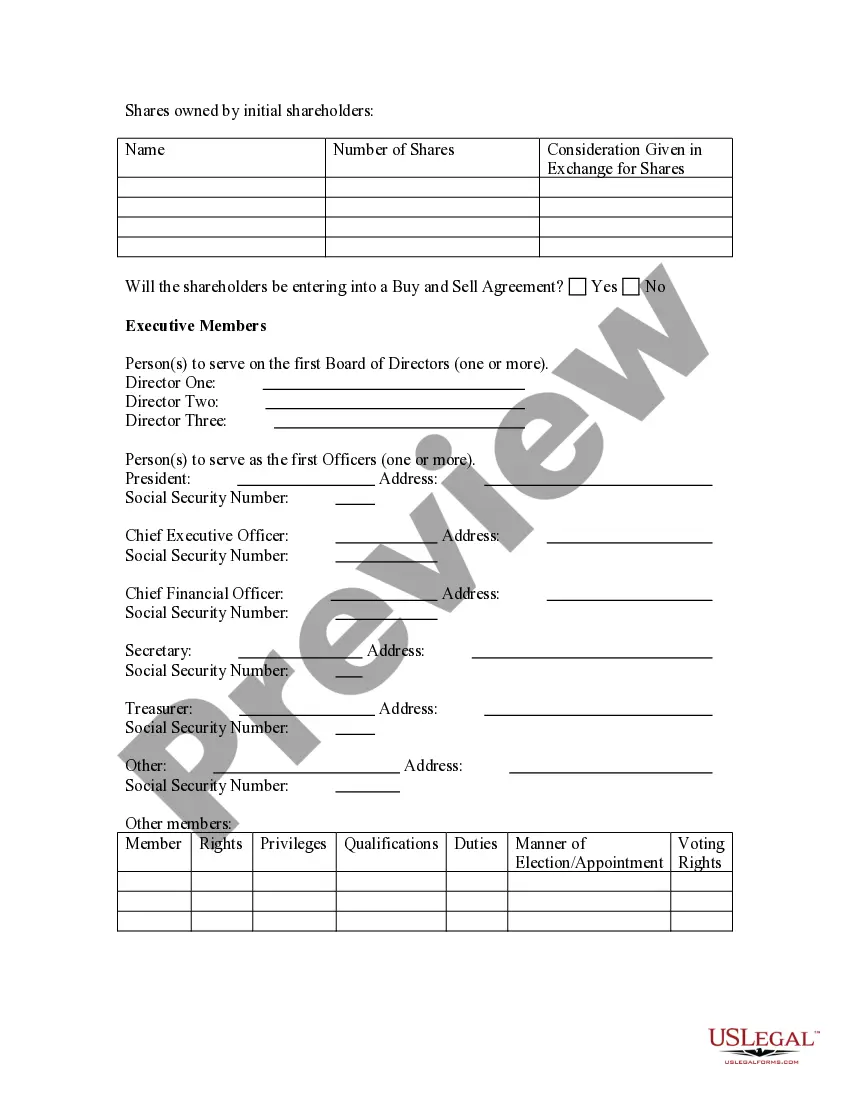

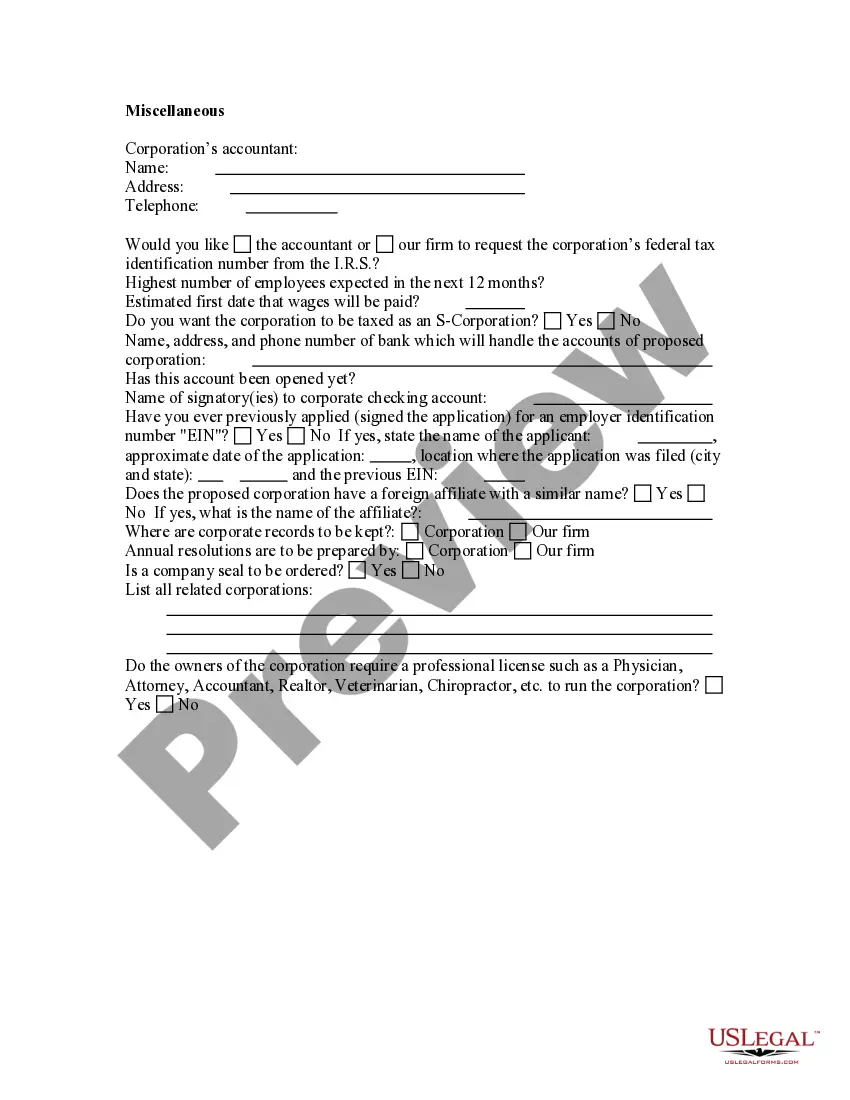

Montgomery Maryland Business Incorporation Questionnaire is a comprehensive document used for assisting entrepreneurs and aspiring business owners in navigating the legal requirements for setting up a business in Montgomery, Maryland. This questionnaire aims to gather vital information and serve as a guide during the business incorporation process. It ensures business owners stay compliant with state regulations, including licensing, taxation, and reporting obligations. The Montgomery Maryland Business Incorporation Questionnaire comprises several sections allowing individuals to provide relevant details necessary for forming a legal business entity. It typically includes the following key areas: 1. Business Information: This section collects details about the proposed business, such as the business name, type of entity (sole proprietorship, partnership, LLC, or corporation), and a brief description of the business activities. 2. Principal Office and Registered Agent: The questionnaire requires the designated principal office address and the registered agent's information, who serves as the official contact person for legal and tax matters on behalf of the business. 3. Ownership and Management: This part seeks information on the owners or shareholders, their percentage of ownership, and details regarding the management structure, including the officers and directors of the company. 4. Licensing and Permits: Business owners need to list the specific industry licenses, permits, or certifications required to operate legally in Montgomery, Maryland. 5. Taxation: This section covers various tax-related inquiries, including federal employer identification number (EIN) application, state and local tax registration, and Maryland business taxes. 6. Employment and Labor: The questionnaire prompts business owners to provide information regarding the hiring process, workers' compensation insurance, and compliance with employment laws. 7. Intellectual Property: If applicable, this section covers questions related to patents, trademarks, copyrights, or any other intellectual property rights associated with the business. 8. Finance and Funding: Business owners are asked to clarify the source of funding and banking details for the business, including the opening of a business bank account. Different types of Montgomery Maryland Business Incorporation Questionnaires may be catered to specific business entity types. For instance, there may be separate questionnaires for forming a limited liability company (LLC), a corporation, or a sole proprietorship. These variations would focus on capturing entity-specific information required by the state for legal compliance and governance purposes. In conclusion, the Montgomery Maryland Business Incorporation Questionnaire streamlines the business formation process by gathering all the necessary information essential for starting a business in Montgomery County, Maryland. It simplifies the legal requirements and promotes adherence to state regulations, enabling entrepreneurs to set up their ventures with confidence and ensure a smooth and compliant operation.Montgomery Maryland Business Incorporation Questionnaire is a comprehensive document used for assisting entrepreneurs and aspiring business owners in navigating the legal requirements for setting up a business in Montgomery, Maryland. This questionnaire aims to gather vital information and serve as a guide during the business incorporation process. It ensures business owners stay compliant with state regulations, including licensing, taxation, and reporting obligations. The Montgomery Maryland Business Incorporation Questionnaire comprises several sections allowing individuals to provide relevant details necessary for forming a legal business entity. It typically includes the following key areas: 1. Business Information: This section collects details about the proposed business, such as the business name, type of entity (sole proprietorship, partnership, LLC, or corporation), and a brief description of the business activities. 2. Principal Office and Registered Agent: The questionnaire requires the designated principal office address and the registered agent's information, who serves as the official contact person for legal and tax matters on behalf of the business. 3. Ownership and Management: This part seeks information on the owners or shareholders, their percentage of ownership, and details regarding the management structure, including the officers and directors of the company. 4. Licensing and Permits: Business owners need to list the specific industry licenses, permits, or certifications required to operate legally in Montgomery, Maryland. 5. Taxation: This section covers various tax-related inquiries, including federal employer identification number (EIN) application, state and local tax registration, and Maryland business taxes. 6. Employment and Labor: The questionnaire prompts business owners to provide information regarding the hiring process, workers' compensation insurance, and compliance with employment laws. 7. Intellectual Property: If applicable, this section covers questions related to patents, trademarks, copyrights, or any other intellectual property rights associated with the business. 8. Finance and Funding: Business owners are asked to clarify the source of funding and banking details for the business, including the opening of a business bank account. Different types of Montgomery Maryland Business Incorporation Questionnaires may be catered to specific business entity types. For instance, there may be separate questionnaires for forming a limited liability company (LLC), a corporation, or a sole proprietorship. These variations would focus on capturing entity-specific information required by the state for legal compliance and governance purposes. In conclusion, the Montgomery Maryland Business Incorporation Questionnaire streamlines the business formation process by gathering all the necessary information essential for starting a business in Montgomery County, Maryland. It simplifies the legal requirements and promotes adherence to state regulations, enabling entrepreneurs to set up their ventures with confidence and ensure a smooth and compliant operation.