Wayne Michigan General Liens Questionnaire is a vital document used in Wayne County, Michigan to gather information regarding potential liens on a property. This comprehensive questionnaire aims to ensure a clear and accurate understanding of the property's lien status, ultimately aiding in the property transaction process. Keywords: Wayne Michigan, General Liens Questionnaire, Wayne County, potential liens, property transaction There are no different types of Wayne Michigan General Liens Questionnaire as it serves as a standardized form to collect specific information related to property liens. This detailed questionnaire covers essential aspects involved in assessing property liens, including but not limited to: 1. Property Identification: The questionnaire typically requires accurate property information such as address, legal description, tax parcel number, and other identifying details to establish a clear connection. 2. Lien holders: It provides sections to list down the names, addresses, and contact details of all known lien holders, including mortgage lenders, judgment creditors, contractors, and any other parties with a potential claim on the property. 3. Lien Types: The questionnaire usually includes options to identify different types of liens, such as traditional mortgage liens, tax liens, mechanic's liens, property association liens, and more. This helps in determining the extent of potential lien claims and identifying parties responsible for those liens. 4. Lien Amounts and Dates: It prompts for entering the amounts owed for each type of lien, as well as the dates when those liens were recorded or became effective. This information helps assess the priority and validity of each lien. 5. Payment Status: The questionnaire may inquire about the current payment status of liens, including whether they are satisfied, partially paid, or unpaid. Any ongoing negotiations or settlements are also typically requested. 6. Supporting Documentation: To substantiate the information provided, the questionnaire may require attaching relevant documents such as mortgage agreements, release certificates, judgment copies, or lien notices. This ensures transparency and accuracy in lien assessment. By completing Wayne Michigan General Liens Questionnaire diligently, property owners, buyers, and real estate professionals can effectively evaluate potential encumbrances and make informed decisions regarding property transactions while ensuring legal compliance in Wayne County, Michigan.

Wayne Michigan General Liens Questionnaire

Description

How to fill out Wayne Michigan General Liens Questionnaire?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Wayne General Liens Questionnaire meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Apart from the Wayne General Liens Questionnaire, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Wayne General Liens Questionnaire:

- Check the content of the page you’re on.

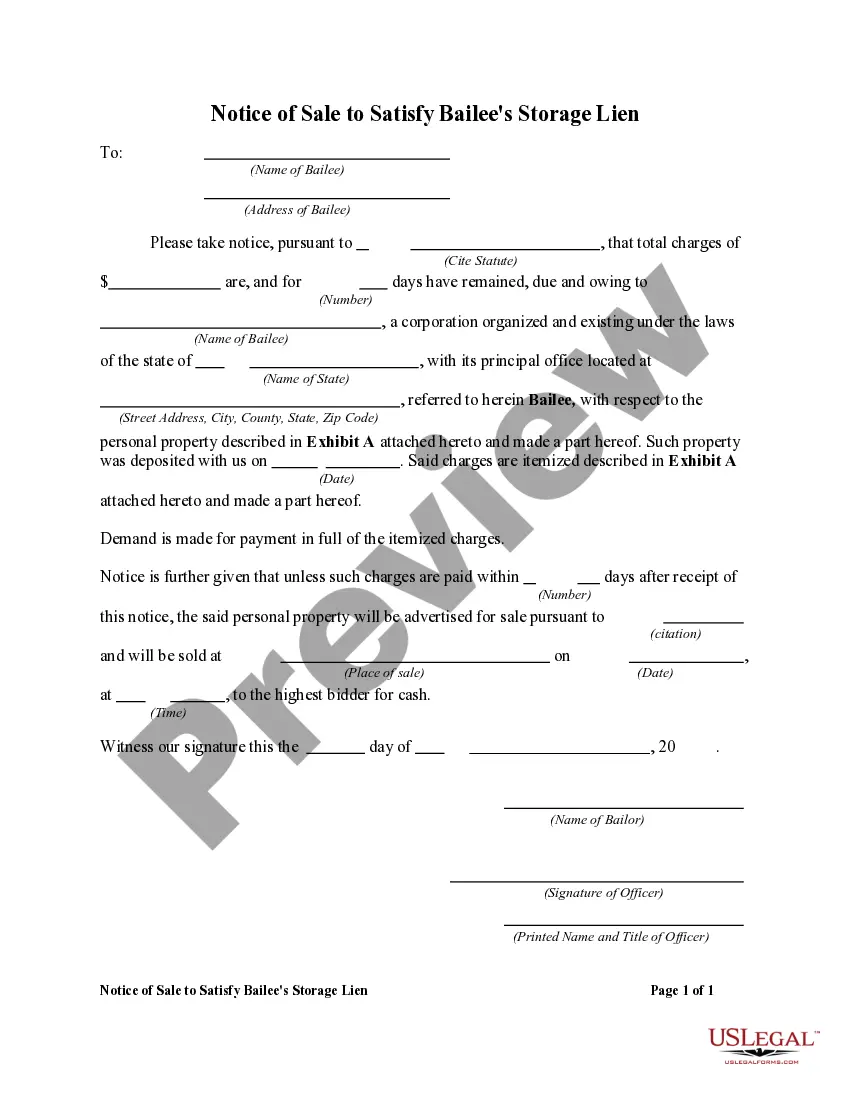

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Wayne General Liens Questionnaire.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!