Nassau New York Limited Liability Company (LLC) Formation Questionnaire is a comprehensive document that is specifically designed to gather all the necessary information required for forming an LLC in Nassau County, New York. This detailed questionnaire assists individuals or entities seeking to establish their own LLC in ensuring that all the vital details are provided accurately and completely. By completing this questionnaire, individuals can initiate the process of forming an LLC in Nassau County smoothly. Keywords: Nassau New York, Limited Liability Company, LLC, Formation Questionnaire, forming an LLC, Nassau County Different types of Nassau New York Limited Liability Company (LLC) Formation Questionnaire: 1. Basic Information Section: This section of the questionnaire aims to collect general details about the LLC, such as the desired name, purpose, and address of the business, as well as information about the registered agent. It may also inquire about the duration of the LLC and whether it will have multiple members or a single-member structure. 2. Membership and Ownership Structure: The Membership and Ownership section focuses on obtaining information about the LLC's members and their respective ownership percentages. It may ask for details like the name, address, and contact information of each member, along with their contribution to the company. 3. Management Structure: This part of the questionnaire inquires about the preferred management structure of the LLC. It may inquire whether the LLC will be managed by its members, appoint a manager, or have a board of directors. 4. Capital Contributions: The Capital Contributions section aims to gather information regarding the initial capital investment made by each member, including both cash and non-cash contributions. This helps establish the financial structure and obligations within the LLC. 5. Operating Agreement: The Operating Agreement segment focuses on determining whether an operating agreement will be established for the LLC, which outlines the rules and regulations that govern the company's operations. Questions related to the desired terms and provisions of the operating agreement may be included in this section. 6. Taxation and Employer Identification Number (EIN): This section aims to gather details about the LLC's desired taxation structure, whether it will be a disregarded entity, partnership, or corporation for tax purposes. It may also inquire about the need for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). By providing thorough and accurate responses to the Nassau New York Limited Liability Company Formation Questionnaire, individuals or entities can ensure a smooth and expedited process for forming their LLC in Nassau County, New York.

Nassau New York Limited Liability Company - LLC - Formation Questionnaire

Description

How to fill out Nassau New York Limited Liability Company - LLC - Formation Questionnaire?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Nassau Limited Liability Company - LLC - Formation Questionnaire without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Nassau Limited Liability Company - LLC - Formation Questionnaire by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Nassau Limited Liability Company - LLC - Formation Questionnaire:

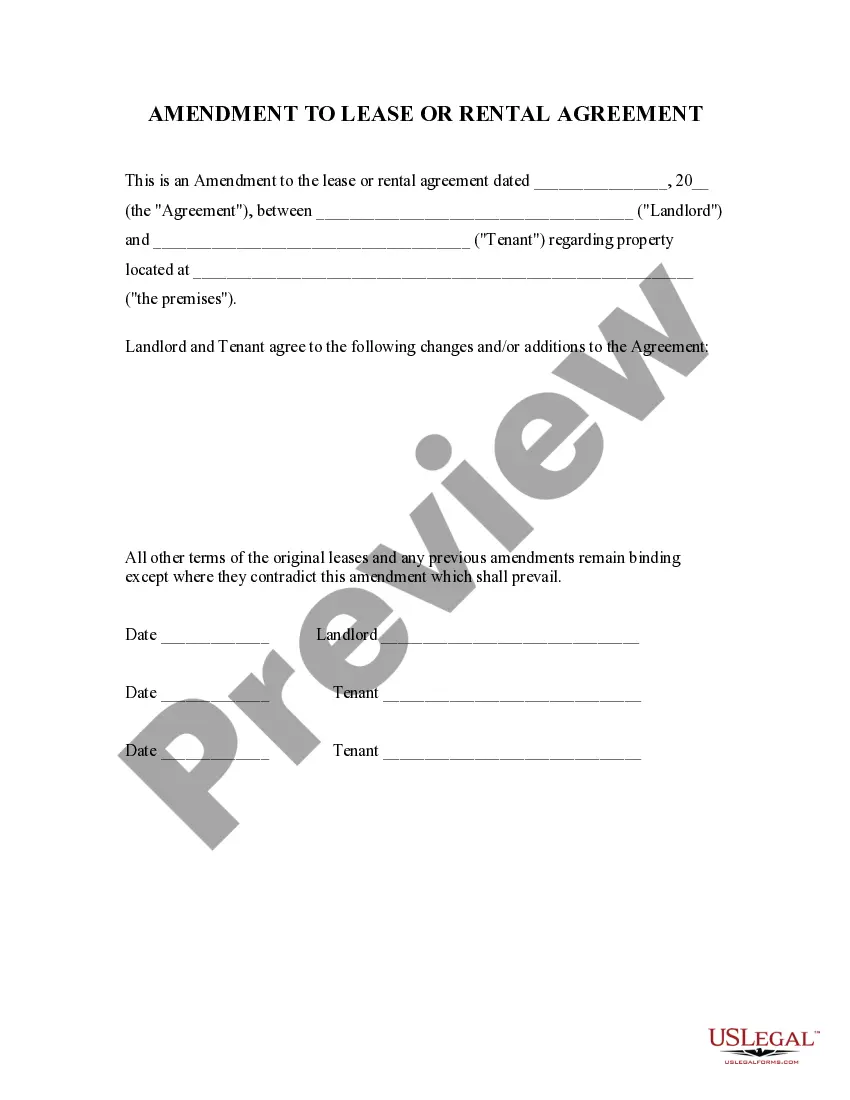

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!