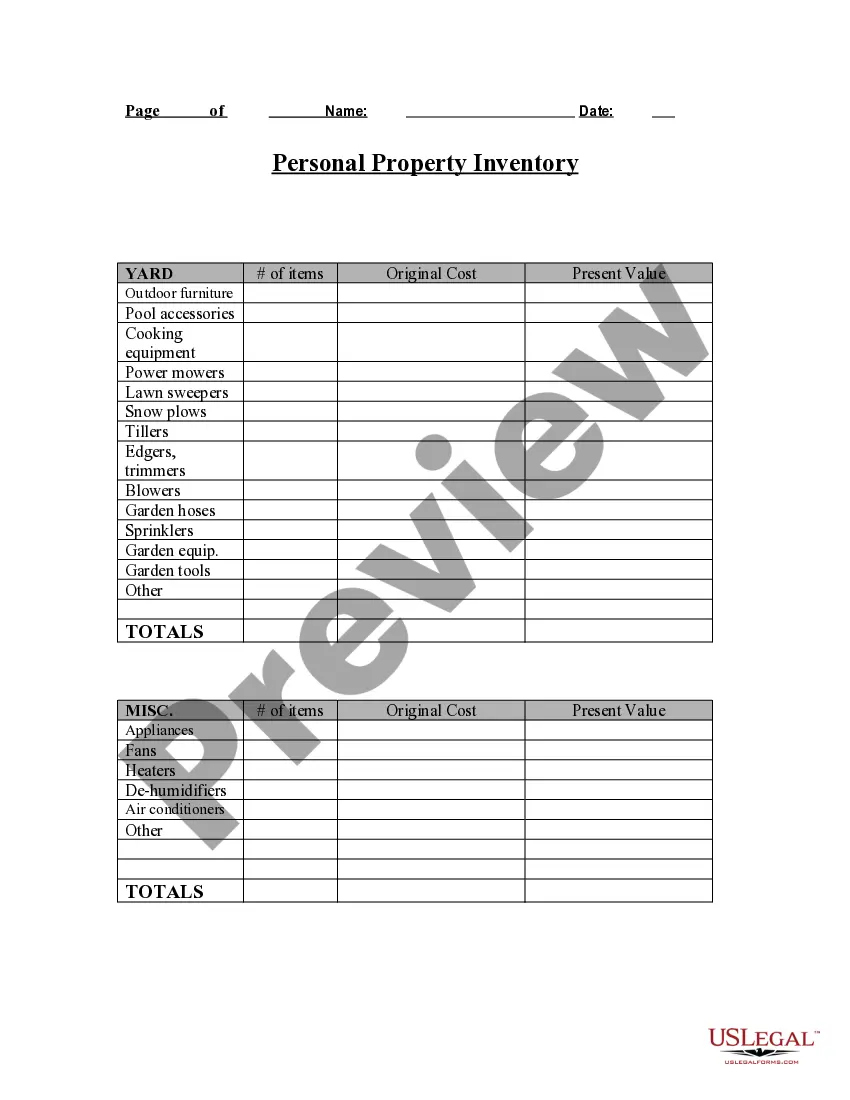

This form addresses important considerations that may effect the legal rights and obligations of the parties in a property-related matter, such as insurance and estate planning. This questionnaire enables those seeking legal help to effectively identify and value their personal property in an organized manner. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

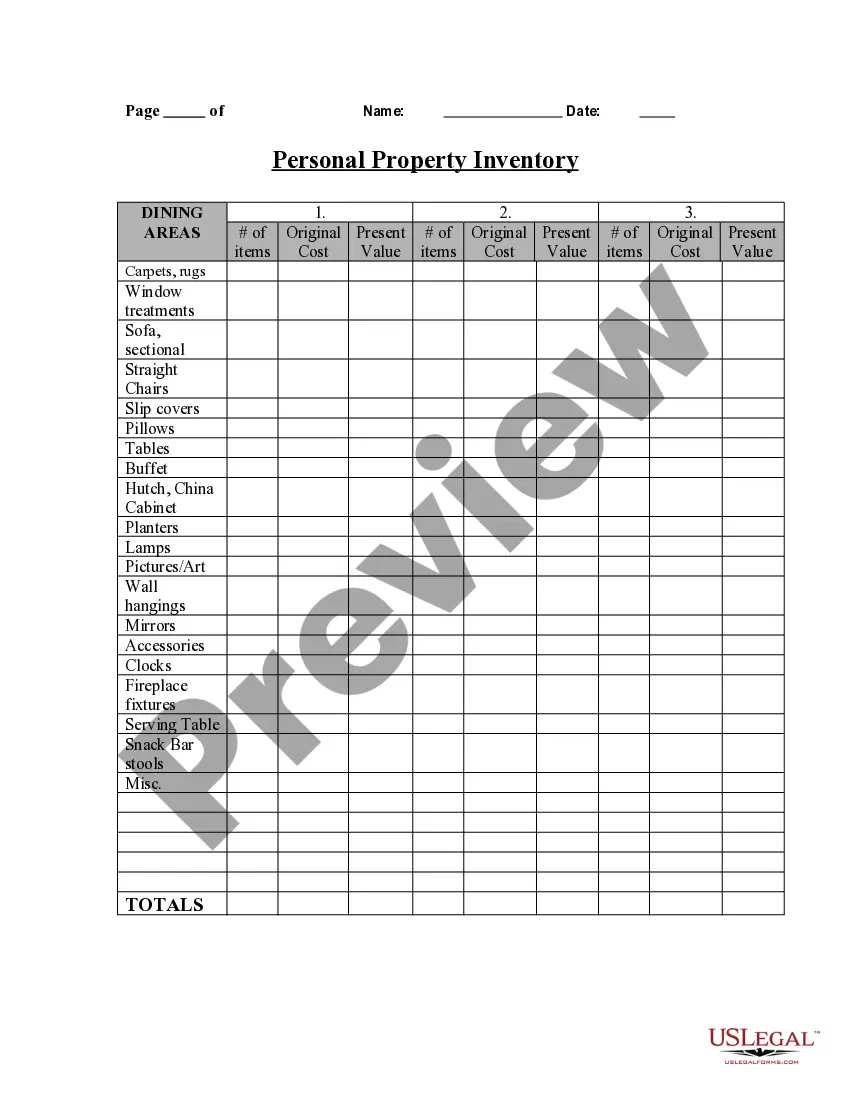

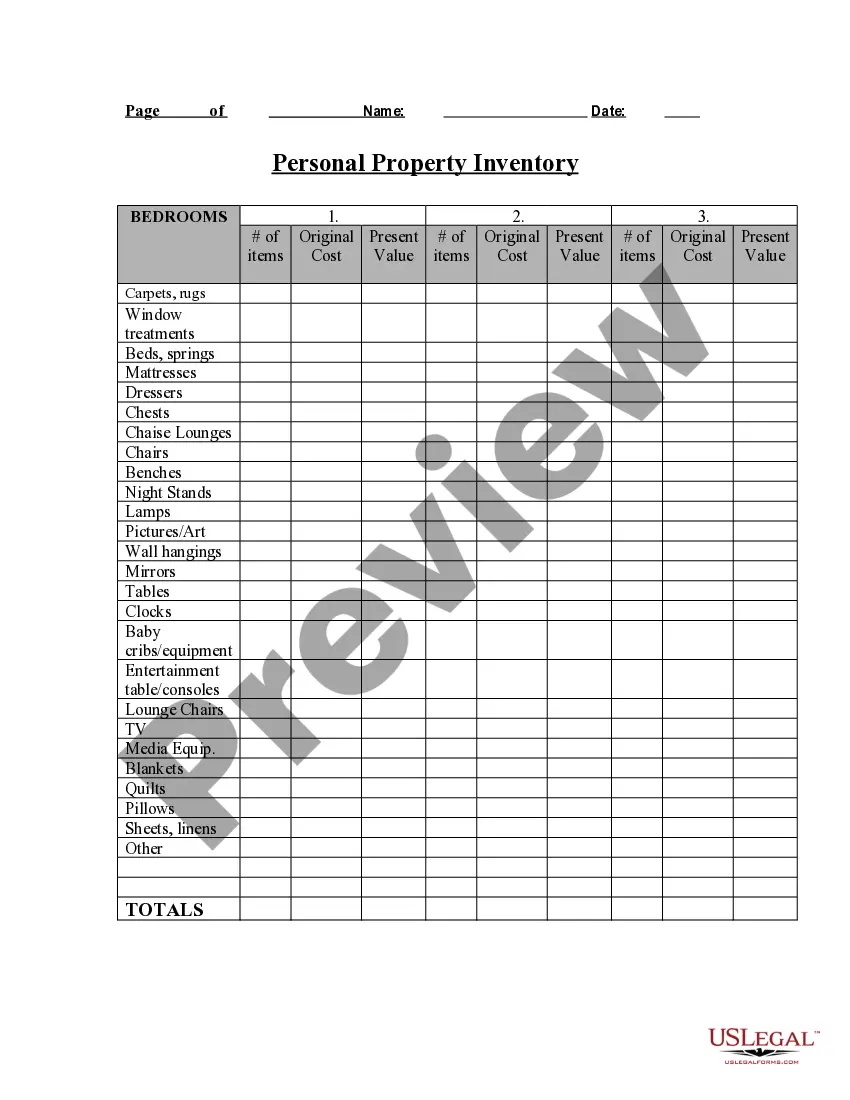

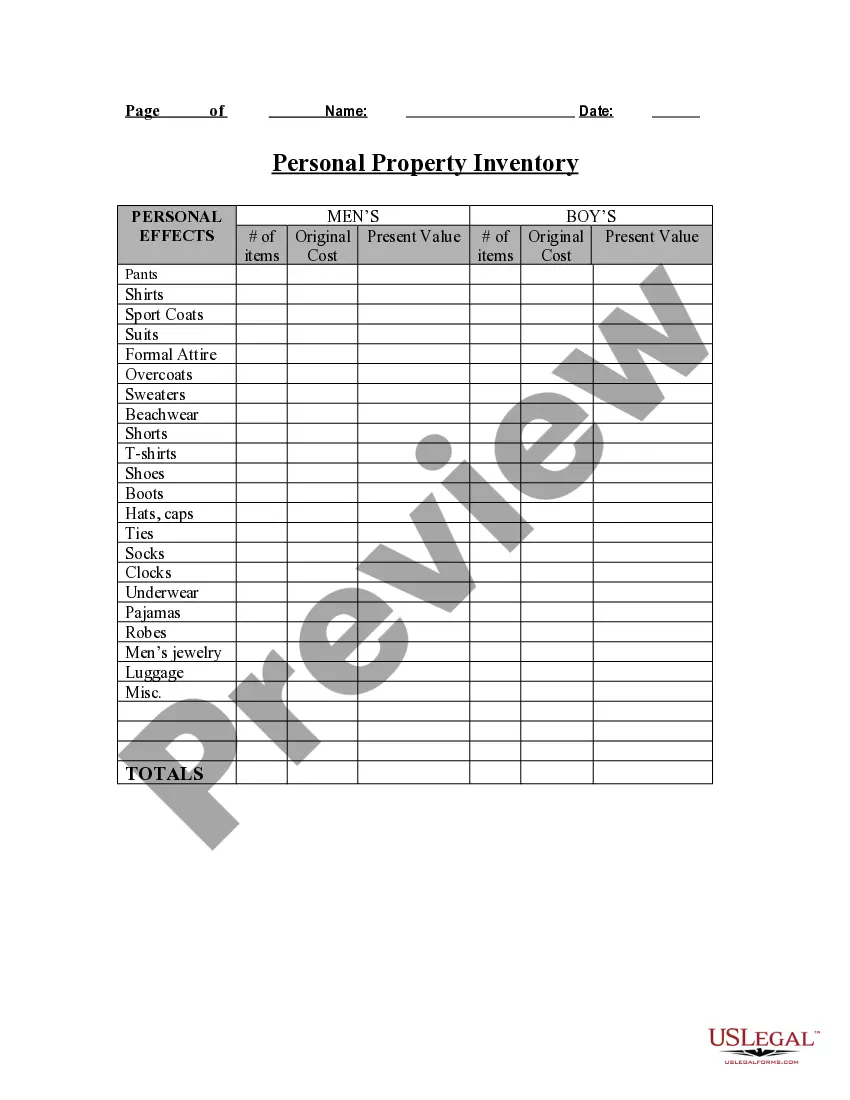

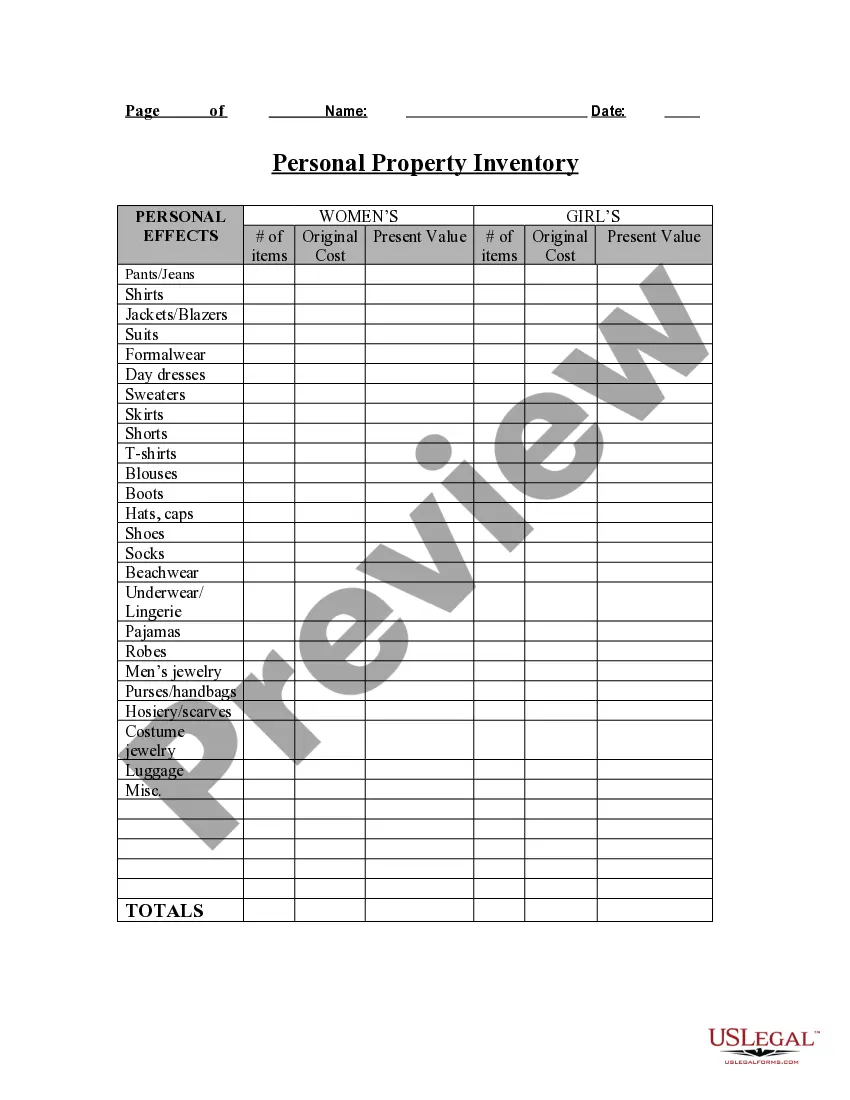

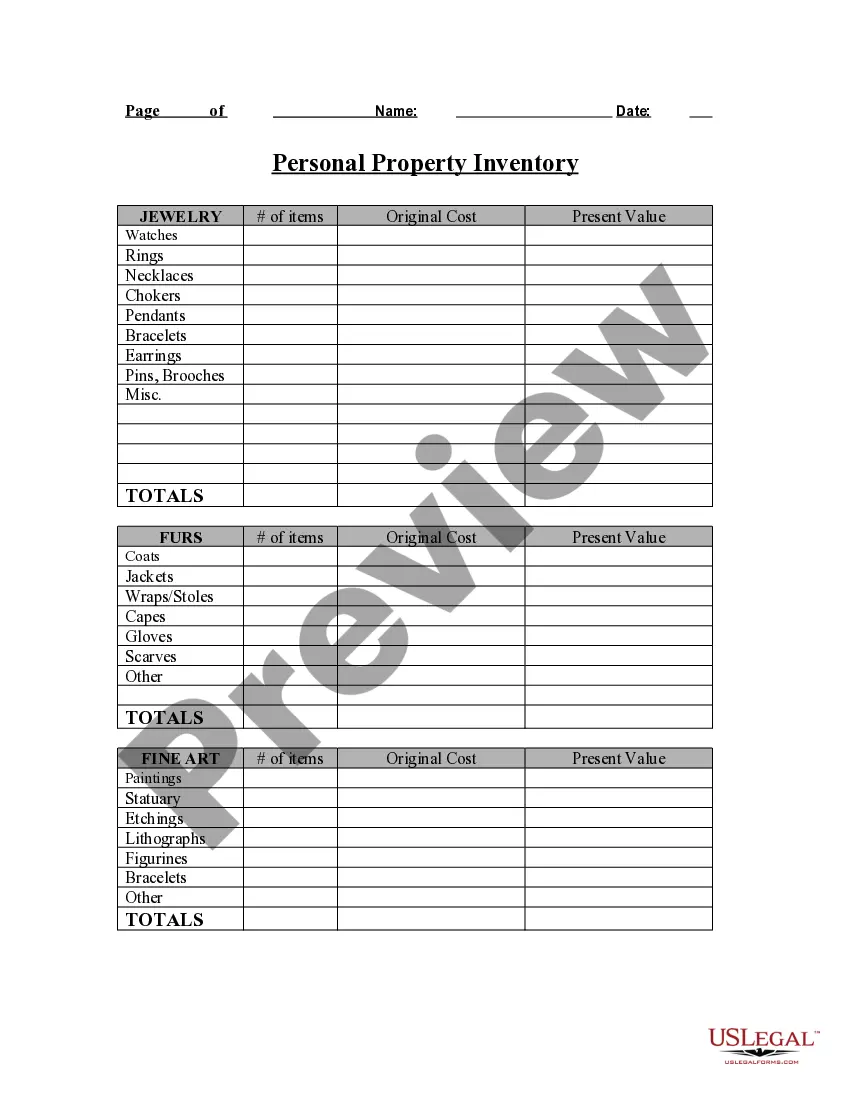

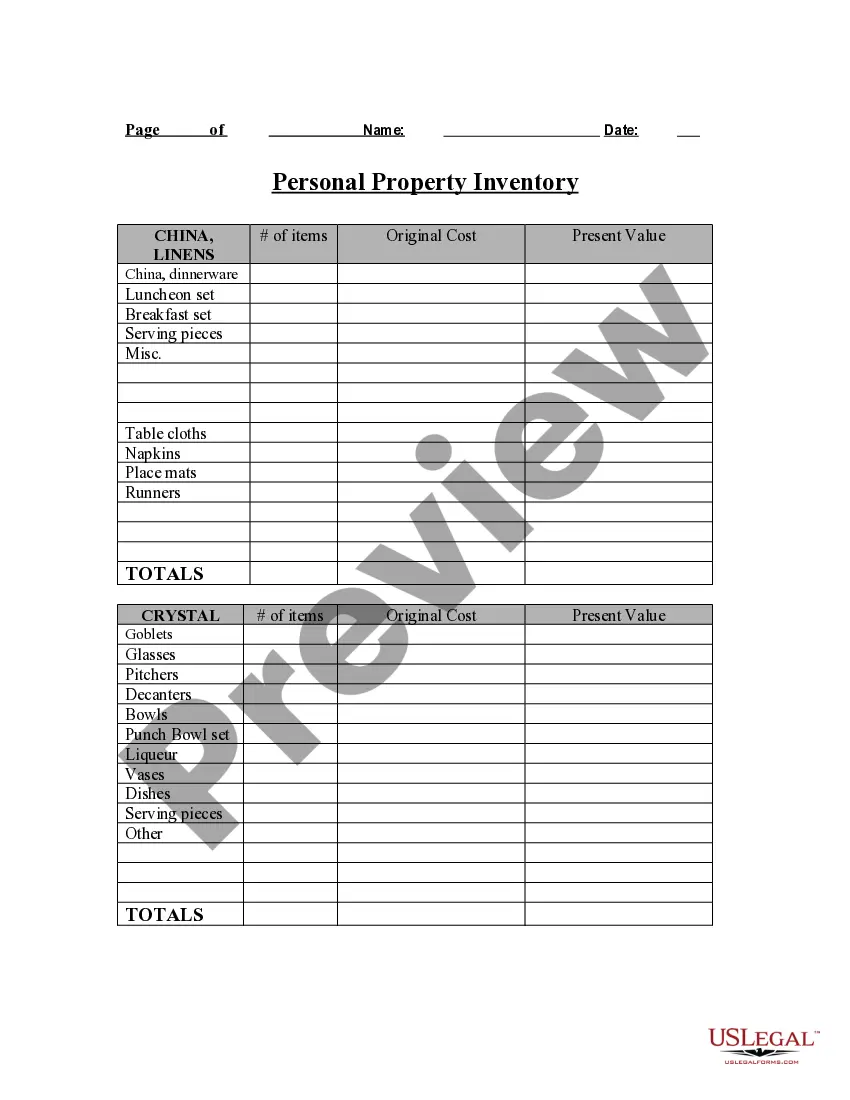

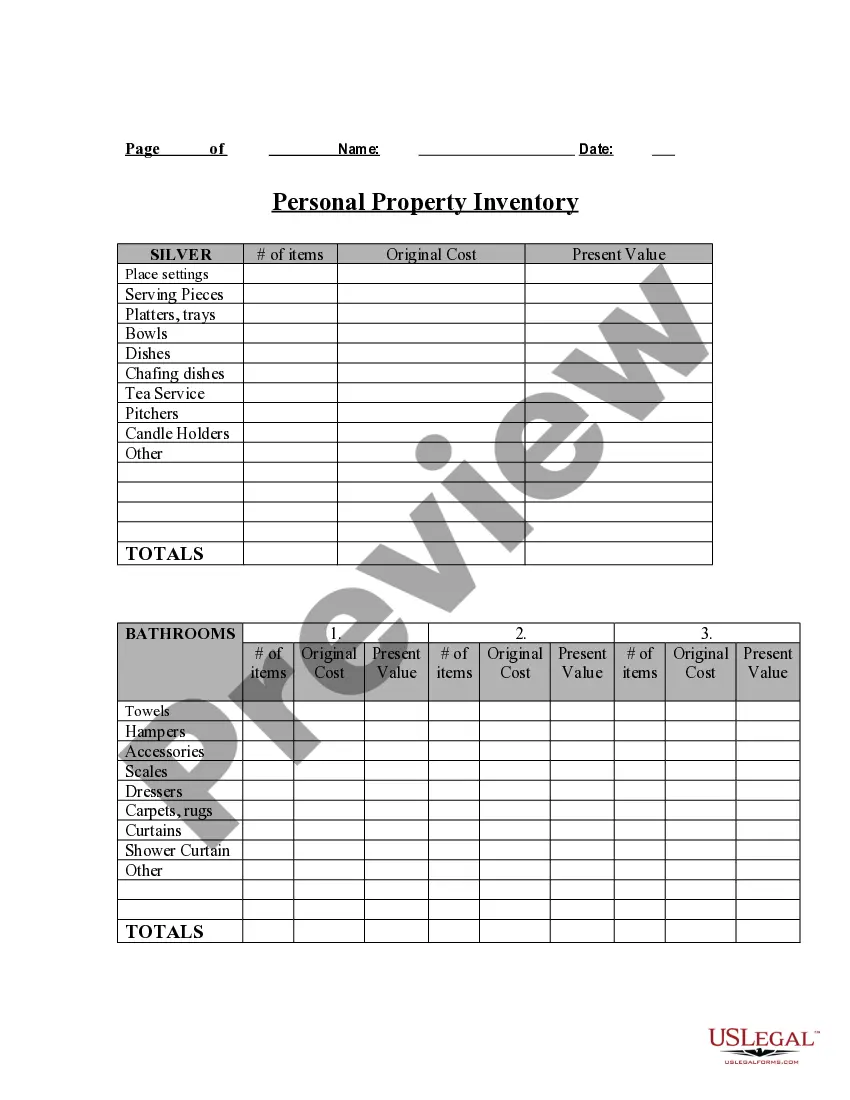

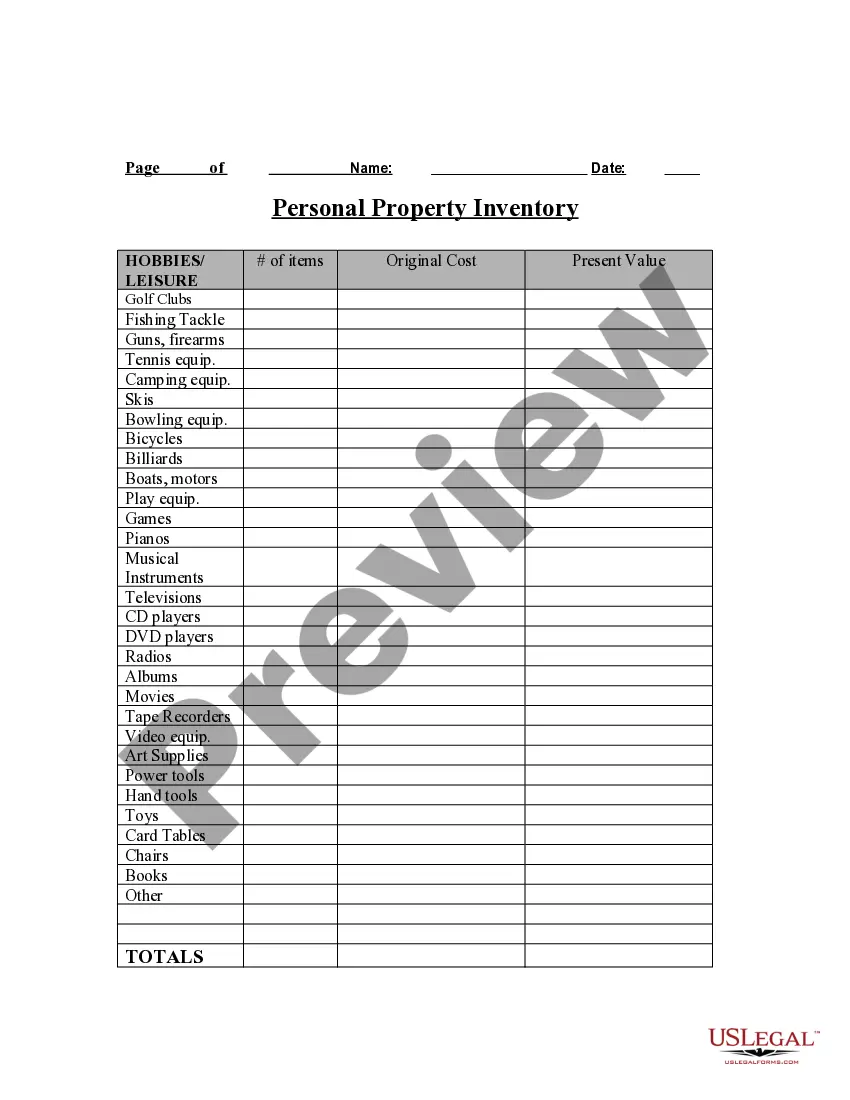

Contra Costa California Personal Property Inventory Questionnaire is a comprehensive document designed to assist individuals in accurately documenting their personal belongings for insurance or legal purposes. It serves as an inventory checklist to record all significant items, their description, value, and condition. By completing this questionnaire, individuals can adequately assess the worth of their belongings, ensuring that they have proper insurance coverage and are prepared in case of theft, damage, or loss. The Contra Costa California Personal Property Inventory Questionnaire consists of various sections that capture different categories of personal assets. These categories may include but are not limited to: 1. Furniture and Appliances: This section covers items such as sofas, beds, tables, chairs, refrigerators, washers, dryers, etc. for a complete inventory of household furnishings. 2. Electronics and Entertainment: Here, individuals can record electronic devices like televisions, computers, laptops, gaming consoles, cameras, audio systems, and any other entertainment equipment. 3. Jewelry and Accessories: This category involves valuable items like jewelry, watches, purses, wallets, sunglasses, and other accessories, where each item's description, estimated value, and any relevant documentation can be noted. 4. Collectibles and Artwork: For individuals having artwork, antiques, stamps, coins, sports memorabilia, and other collectible items, this section offers an opportunity to document such valuable possessions. 5. Clothing and Personal Items: This section focuses on clothing, shoes, bags, and personal hygiene items that may have considerable monetary or sentimental value. 6. Sports and Recreation: Covers equipment and gear related to various sports, hobbies, or recreational activities such as skiing, golf, camping, fishing, etc. 7. Vehicles and Transportation: Individuals with vehicles can record details related to cars, motorcycles, boats, RVs, and trailers, including their make, model, year, and vehicle identification number (VIN). 8. Home and Property: This section allows individuals to document property-related information, including home improvements, landscaping, outdoor furniture, and recreational facilities like pools or spas. It is worth mentioning that while the Contra Costa California Personal Property Inventory Questionnaire provides a comprehensive template for documenting personal belongings, each insurance company or legal entity may have specific requirements or additional questionnaires tailored to their needs. Therefore, individuals should contact their insurance provider or legal counsel to ensure compliance with any specific forms or guidelines they may require.Contra Costa California Personal Property Inventory Questionnaire is a comprehensive document designed to assist individuals in accurately documenting their personal belongings for insurance or legal purposes. It serves as an inventory checklist to record all significant items, their description, value, and condition. By completing this questionnaire, individuals can adequately assess the worth of their belongings, ensuring that they have proper insurance coverage and are prepared in case of theft, damage, or loss. The Contra Costa California Personal Property Inventory Questionnaire consists of various sections that capture different categories of personal assets. These categories may include but are not limited to: 1. Furniture and Appliances: This section covers items such as sofas, beds, tables, chairs, refrigerators, washers, dryers, etc. for a complete inventory of household furnishings. 2. Electronics and Entertainment: Here, individuals can record electronic devices like televisions, computers, laptops, gaming consoles, cameras, audio systems, and any other entertainment equipment. 3. Jewelry and Accessories: This category involves valuable items like jewelry, watches, purses, wallets, sunglasses, and other accessories, where each item's description, estimated value, and any relevant documentation can be noted. 4. Collectibles and Artwork: For individuals having artwork, antiques, stamps, coins, sports memorabilia, and other collectible items, this section offers an opportunity to document such valuable possessions. 5. Clothing and Personal Items: This section focuses on clothing, shoes, bags, and personal hygiene items that may have considerable monetary or sentimental value. 6. Sports and Recreation: Covers equipment and gear related to various sports, hobbies, or recreational activities such as skiing, golf, camping, fishing, etc. 7. Vehicles and Transportation: Individuals with vehicles can record details related to cars, motorcycles, boats, RVs, and trailers, including their make, model, year, and vehicle identification number (VIN). 8. Home and Property: This section allows individuals to document property-related information, including home improvements, landscaping, outdoor furniture, and recreational facilities like pools or spas. It is worth mentioning that while the Contra Costa California Personal Property Inventory Questionnaire provides a comprehensive template for documenting personal belongings, each insurance company or legal entity may have specific requirements or additional questionnaires tailored to their needs. Therefore, individuals should contact their insurance provider or legal counsel to ensure compliance with any specific forms or guidelines they may require.