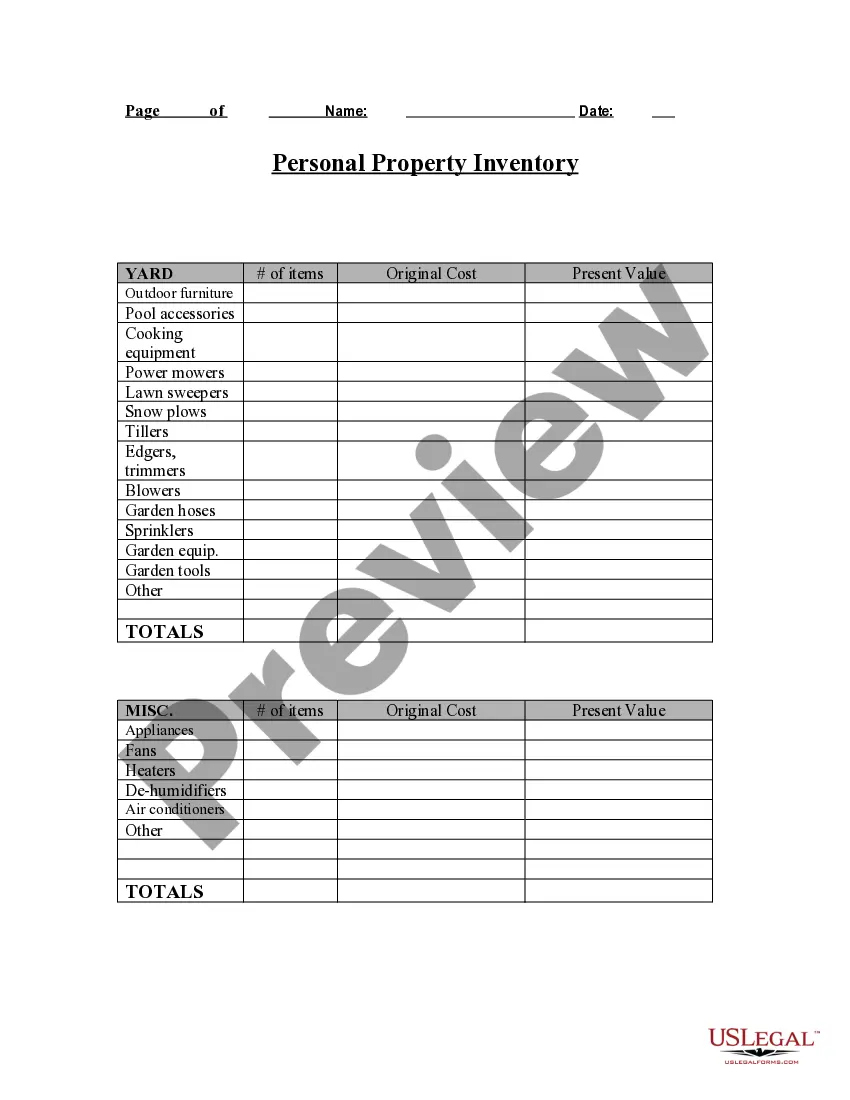

This form addresses important considerations that may effect the legal rights and obligations of the parties in a property-related matter, such as insurance and estate planning. This questionnaire enables those seeking legal help to effectively identify and value their personal property in an organized manner. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

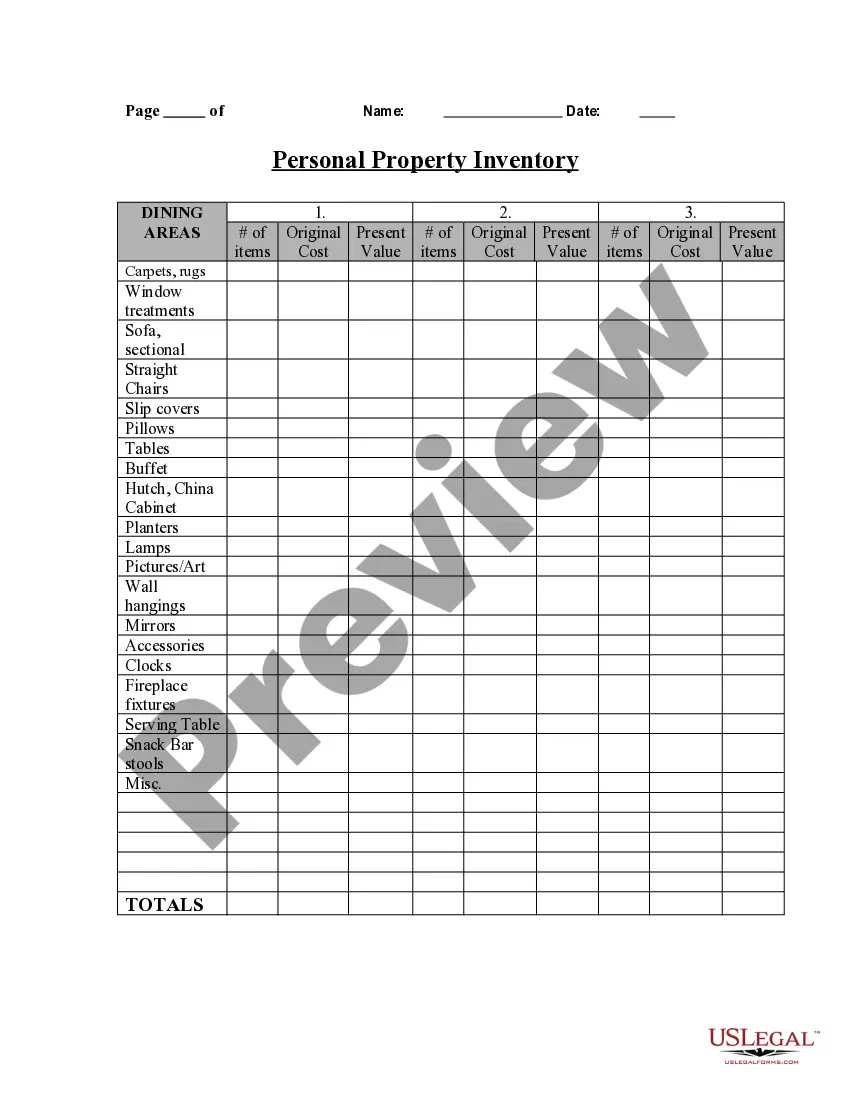

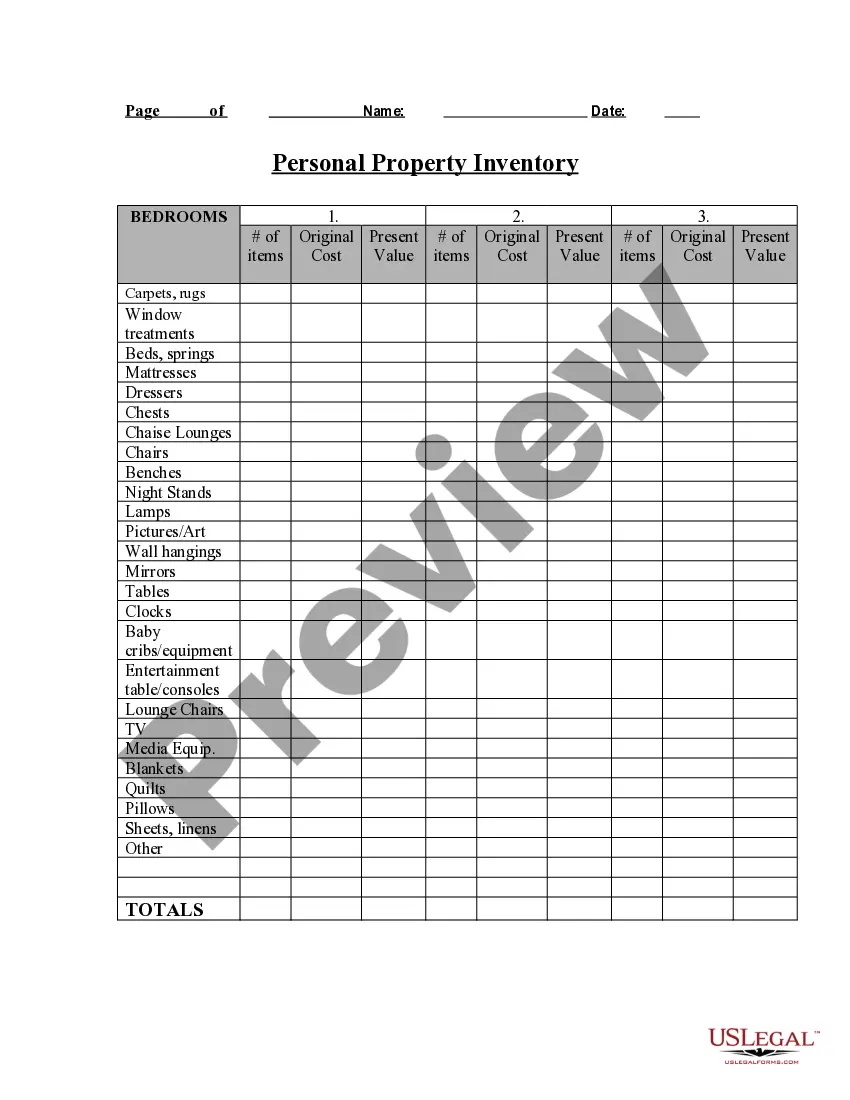

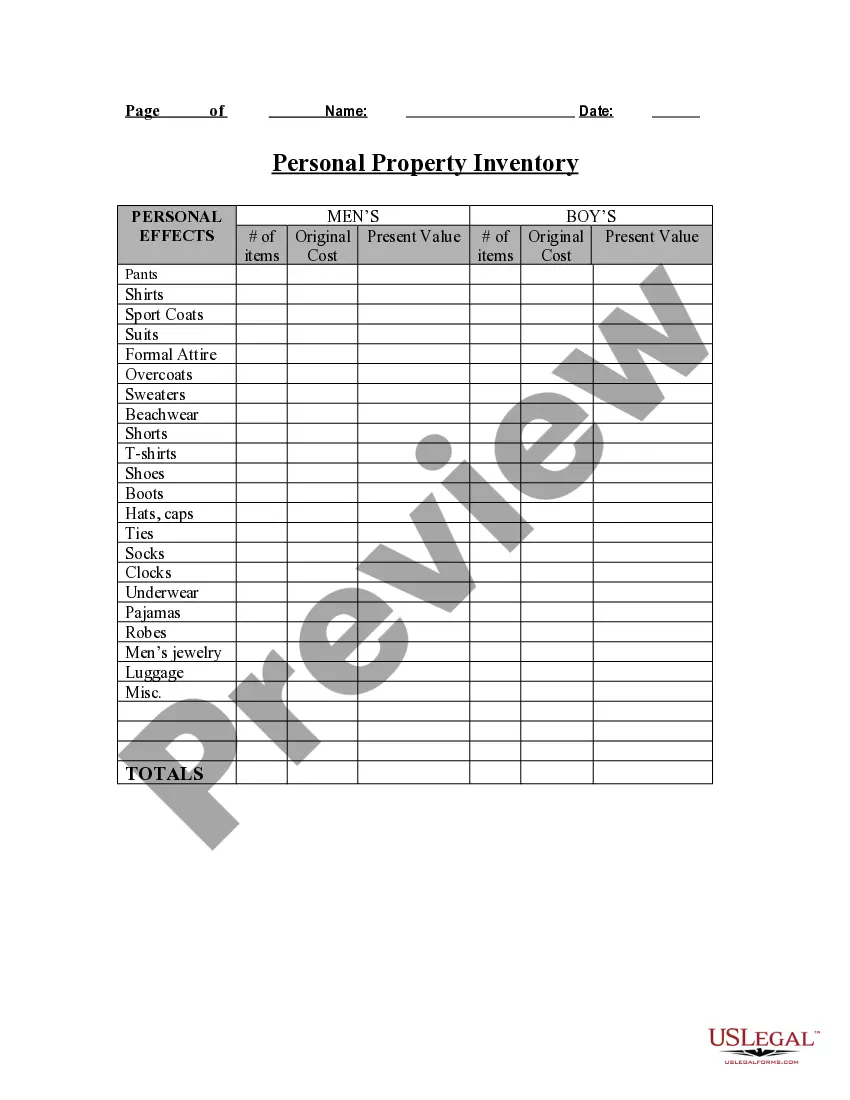

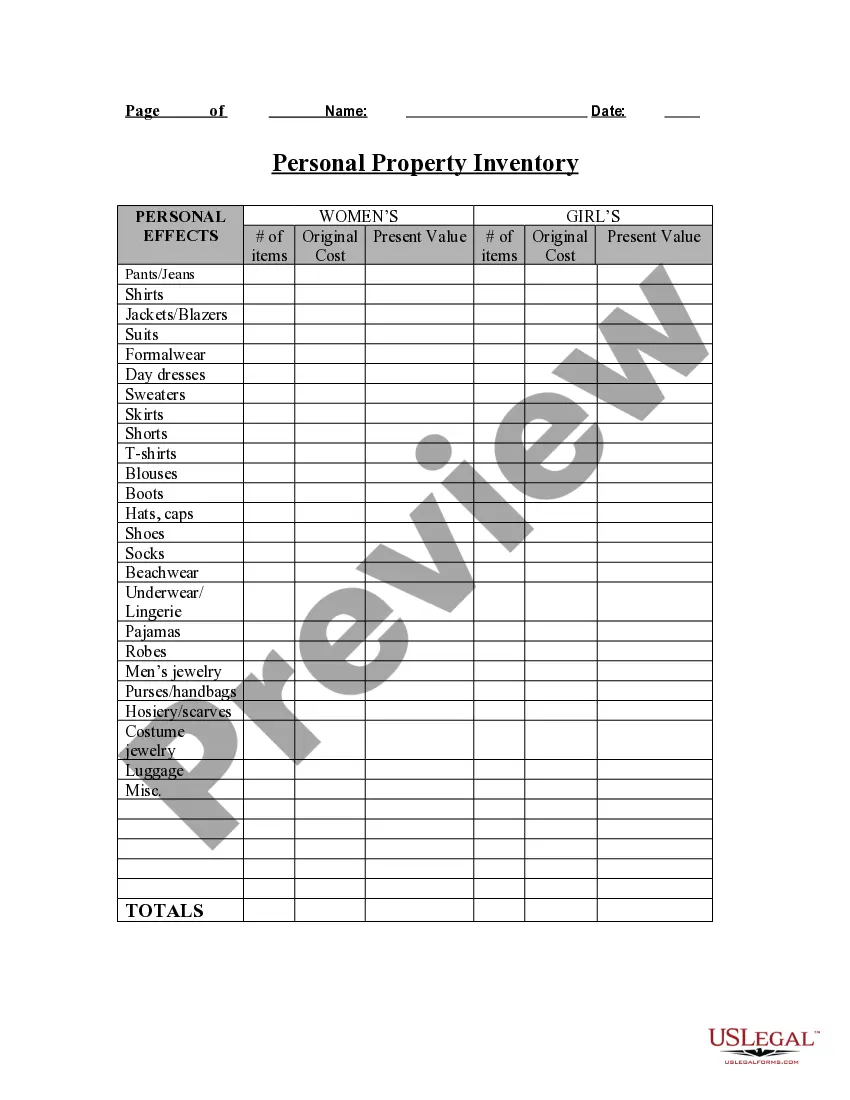

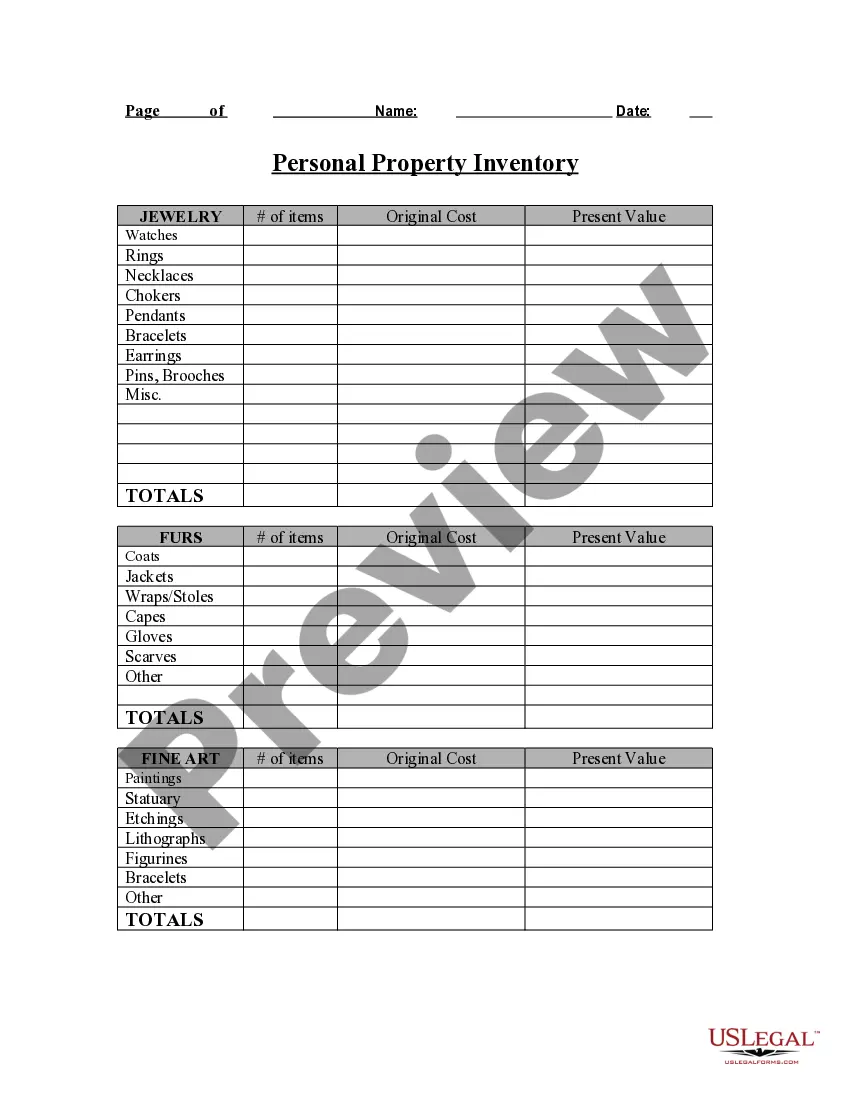

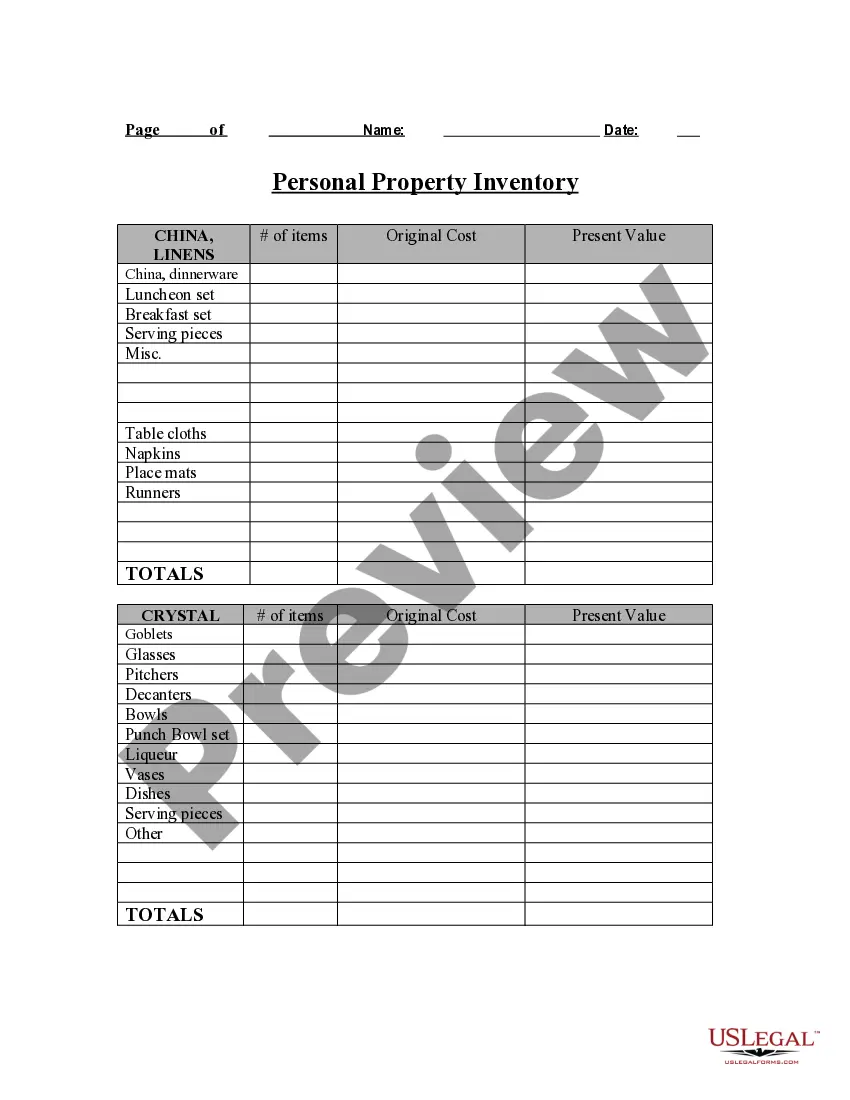

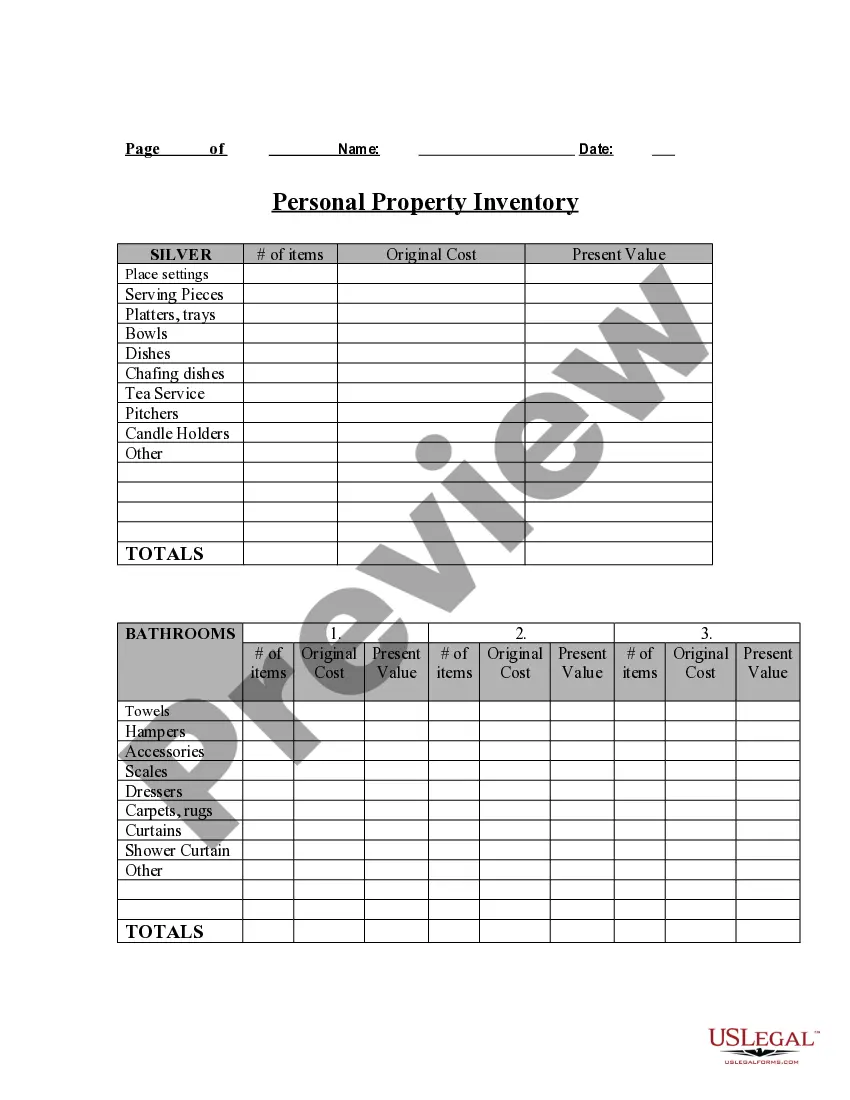

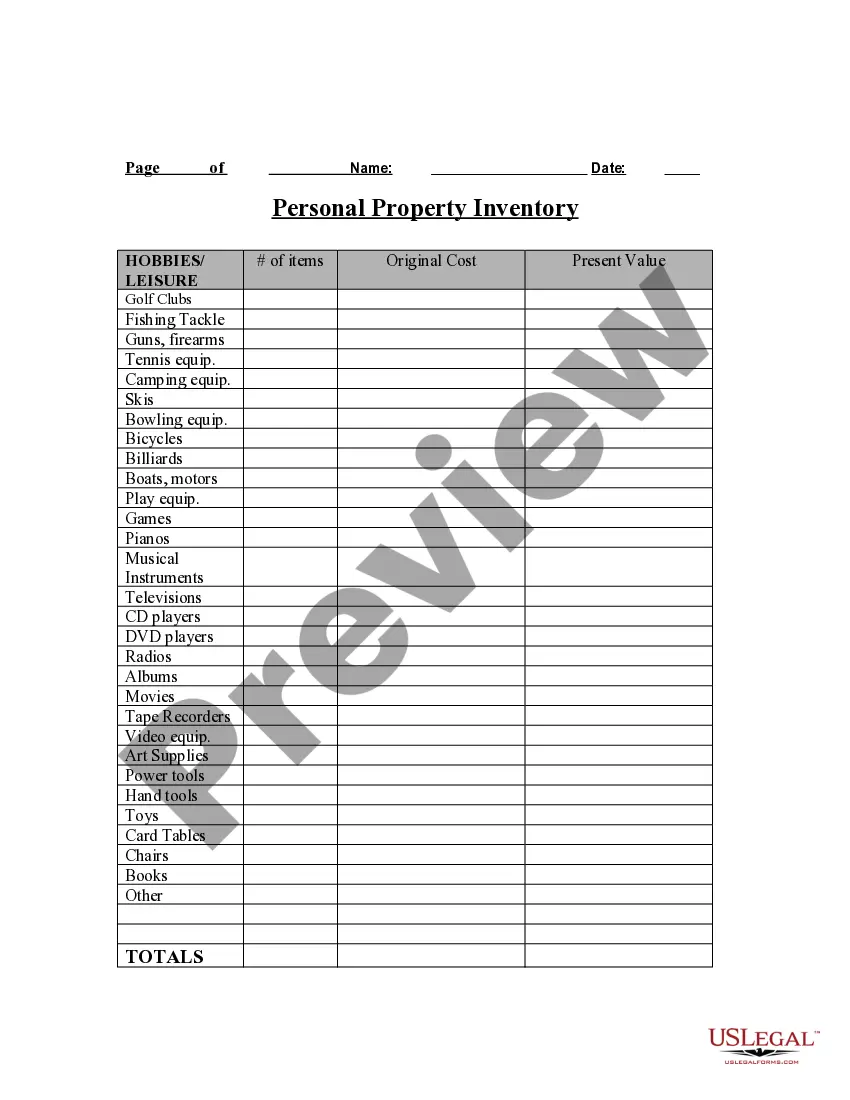

Houston Texas Personal Property Inventory Questionnaire is a comprehensive and detailed document designed to assist individuals in creating an inventory of their personal belongings for various purposes. This questionnaire acts as a valuable tool for homeowners, renters, insurance companies, and estate planners to accurately assess the value of personal property, determine insurance coverage, and aid in the settlement of claims in the event of theft, damage, or loss. The Houston Texas Personal Property Inventory Questionnaire serves as an organized checklist, enabling individuals to create a comprehensive record of their possessions. It typically covers a wide range of personal property categories, such as furniture, electronics, appliances, artwork, jewelry, clothing, collectibles, and more. This document also allows the inclusion of specific details, such as the make, model, serial numbers, purchase dates, and estimated values of the items. Different types of Houston Texas Personal Property Inventory Questionnaires may vary depending on the intended purpose or target audience. Here are a few common variations: 1. Residential Personal Property Inventory Questionnaire: This type is specifically designed for homeowners or renters to assess and document their personal property's value. It typically includes general household items, furniture, appliances, and personal belongings. 2. Business Personal Property Inventory Questionnaire: This questionnaire targets business owners and helps them catalog their company's assets, including office equipment, computer systems, furniture, machinery, and other business-related items. 3. Estate Planning Personal Property Inventory Questionnaire: Estate planners or executors of an estate utilize this variant to create a detailed inventory of the deceased's personal belongings. It aids in the fair distribution of assets and serves as a vital document during probate proceedings. 4. Insurance Claim Personal Property Inventory Questionnaire: Insurance companies provide this questionnaire to policyholders to facilitate the accurate estimation of personal property value. In the event of a claim for theft, damage, or loss, this inventory ensures a smooth claims process and helps avoid disputes over reimbursement. In conclusion, the Houston Texas Personal Property Inventory Questionnaire is a comprehensive document used to catalog personal belongings accurately. It offers various types tailored for homeowners, renters, estate planners, and insurance purposes. By diligently completing this questionnaire, individuals can protect their assets, streamline insurance processes, and ensure fair settlements in case of any unfortunate events.Houston Texas Personal Property Inventory Questionnaire is a comprehensive and detailed document designed to assist individuals in creating an inventory of their personal belongings for various purposes. This questionnaire acts as a valuable tool for homeowners, renters, insurance companies, and estate planners to accurately assess the value of personal property, determine insurance coverage, and aid in the settlement of claims in the event of theft, damage, or loss. The Houston Texas Personal Property Inventory Questionnaire serves as an organized checklist, enabling individuals to create a comprehensive record of their possessions. It typically covers a wide range of personal property categories, such as furniture, electronics, appliances, artwork, jewelry, clothing, collectibles, and more. This document also allows the inclusion of specific details, such as the make, model, serial numbers, purchase dates, and estimated values of the items. Different types of Houston Texas Personal Property Inventory Questionnaires may vary depending on the intended purpose or target audience. Here are a few common variations: 1. Residential Personal Property Inventory Questionnaire: This type is specifically designed for homeowners or renters to assess and document their personal property's value. It typically includes general household items, furniture, appliances, and personal belongings. 2. Business Personal Property Inventory Questionnaire: This questionnaire targets business owners and helps them catalog their company's assets, including office equipment, computer systems, furniture, machinery, and other business-related items. 3. Estate Planning Personal Property Inventory Questionnaire: Estate planners or executors of an estate utilize this variant to create a detailed inventory of the deceased's personal belongings. It aids in the fair distribution of assets and serves as a vital document during probate proceedings. 4. Insurance Claim Personal Property Inventory Questionnaire: Insurance companies provide this questionnaire to policyholders to facilitate the accurate estimation of personal property value. In the event of a claim for theft, damage, or loss, this inventory ensures a smooth claims process and helps avoid disputes over reimbursement. In conclusion, the Houston Texas Personal Property Inventory Questionnaire is a comprehensive document used to catalog personal belongings accurately. It offers various types tailored for homeowners, renters, estate planners, and insurance purposes. By diligently completing this questionnaire, individuals can protect their assets, streamline insurance processes, and ensure fair settlements in case of any unfortunate events.