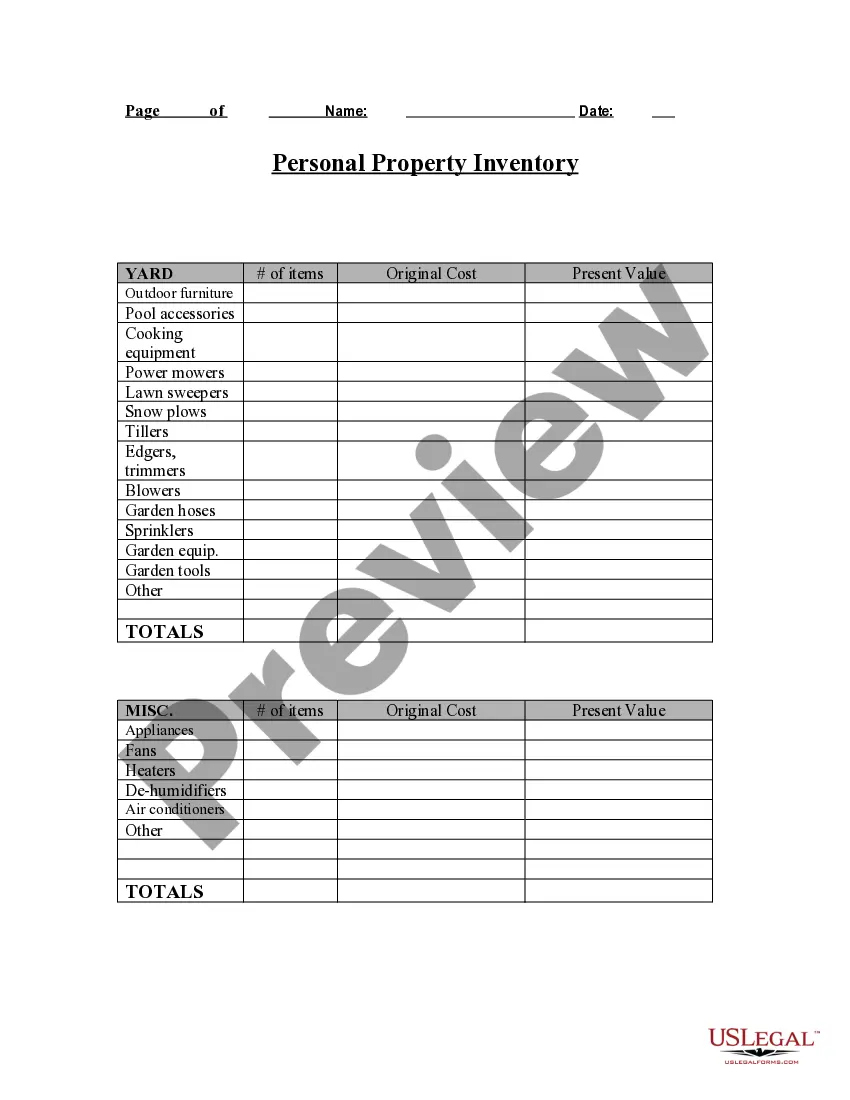

This form addresses important considerations that may effect the legal rights and obligations of the parties in a property-related matter, such as insurance and estate planning. This questionnaire enables those seeking legal help to effectively identify and value their personal property in an organized manner. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

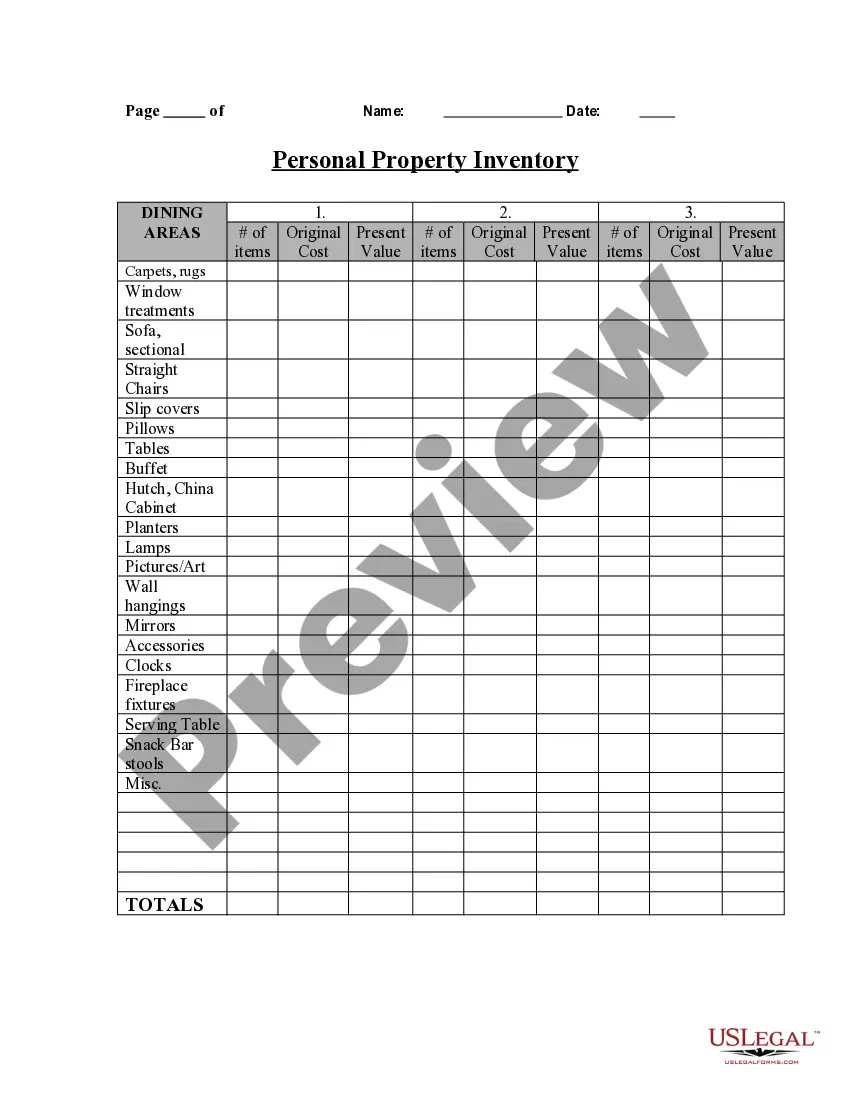

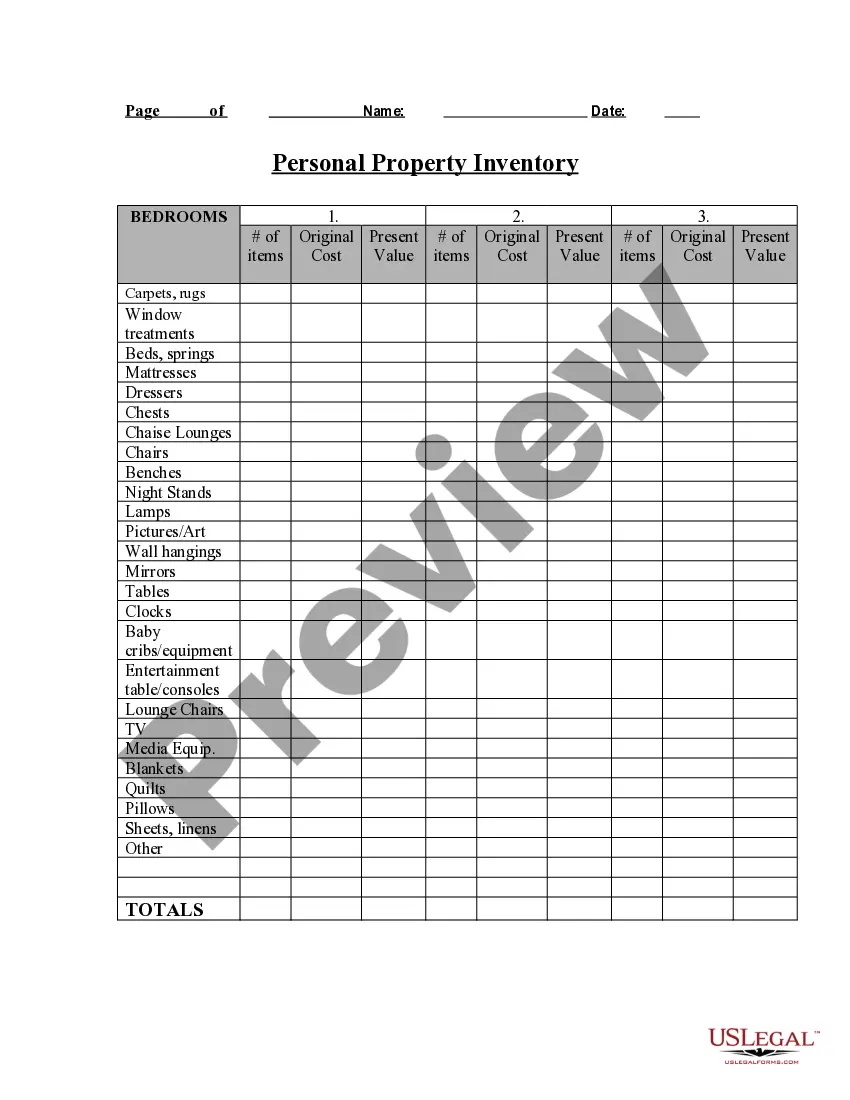

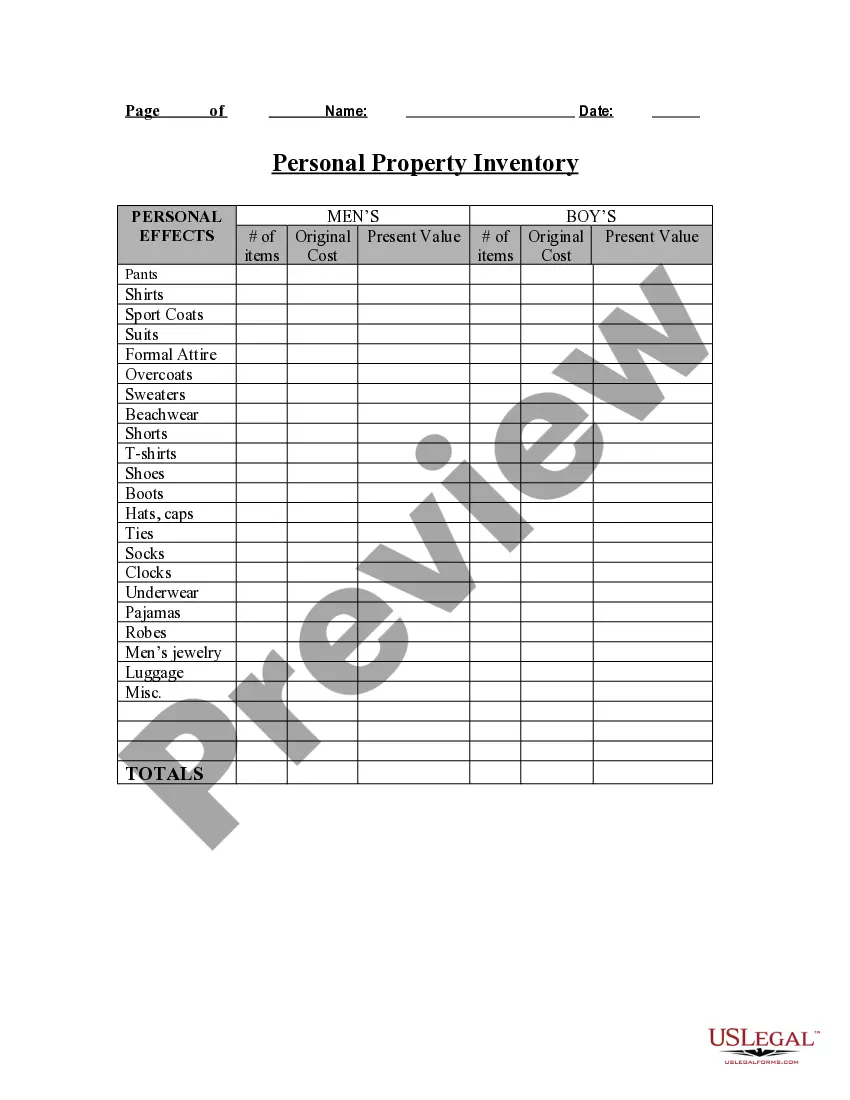

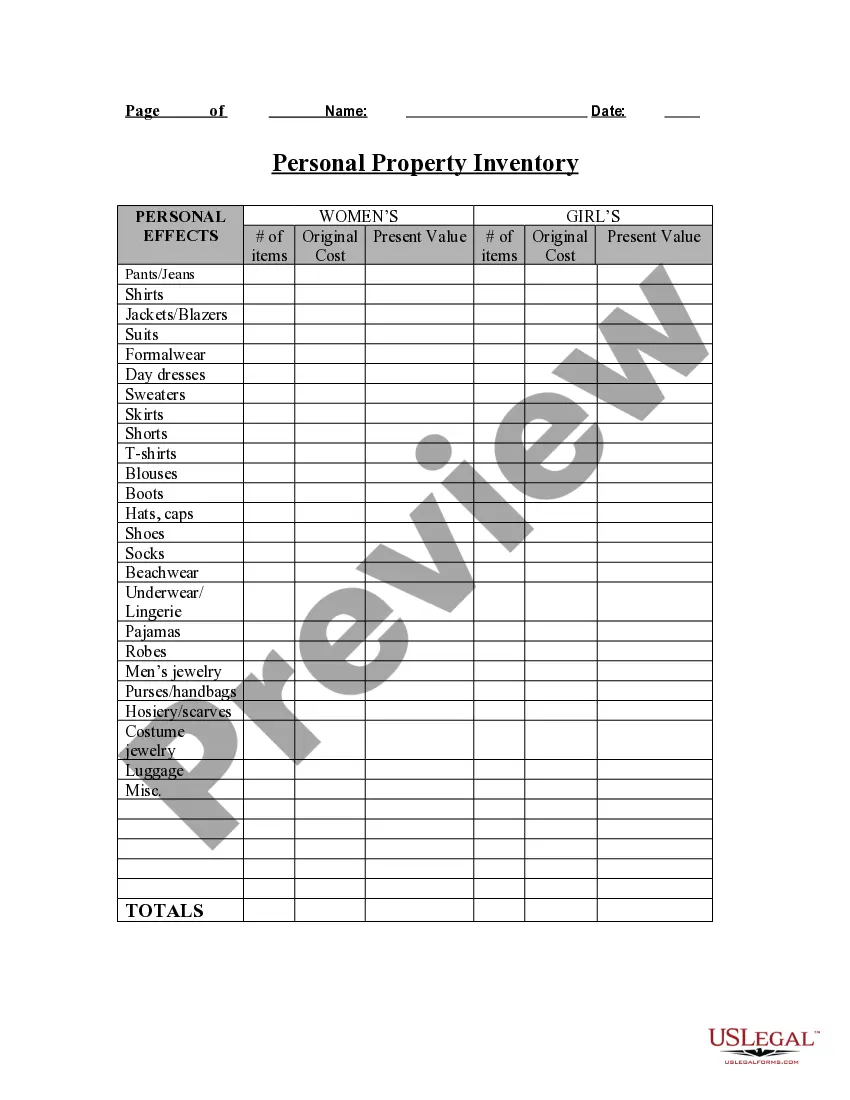

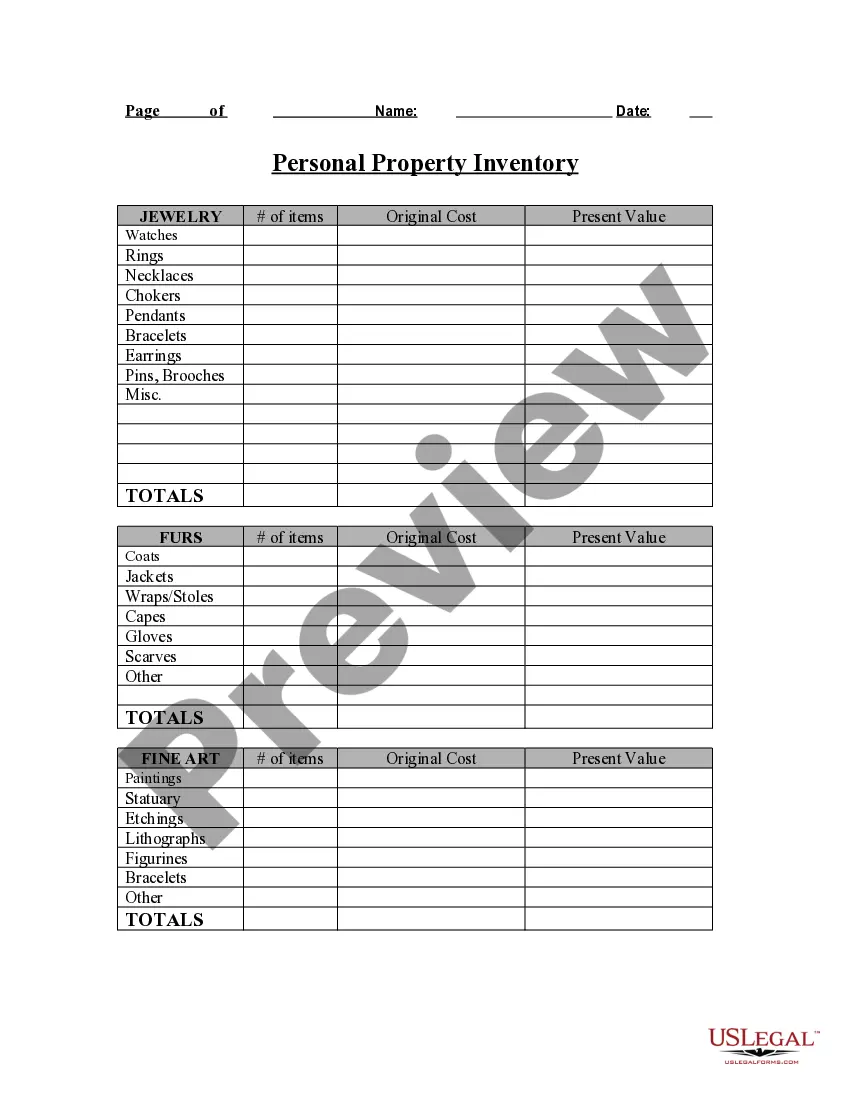

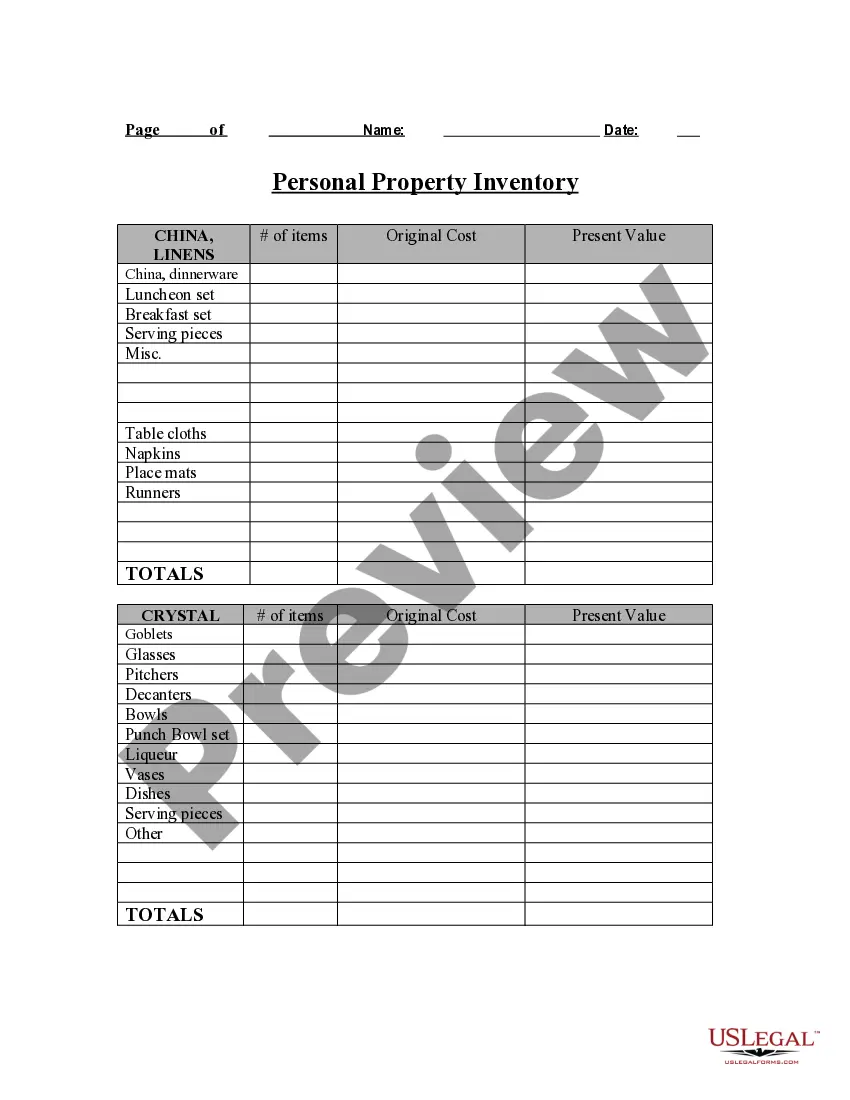

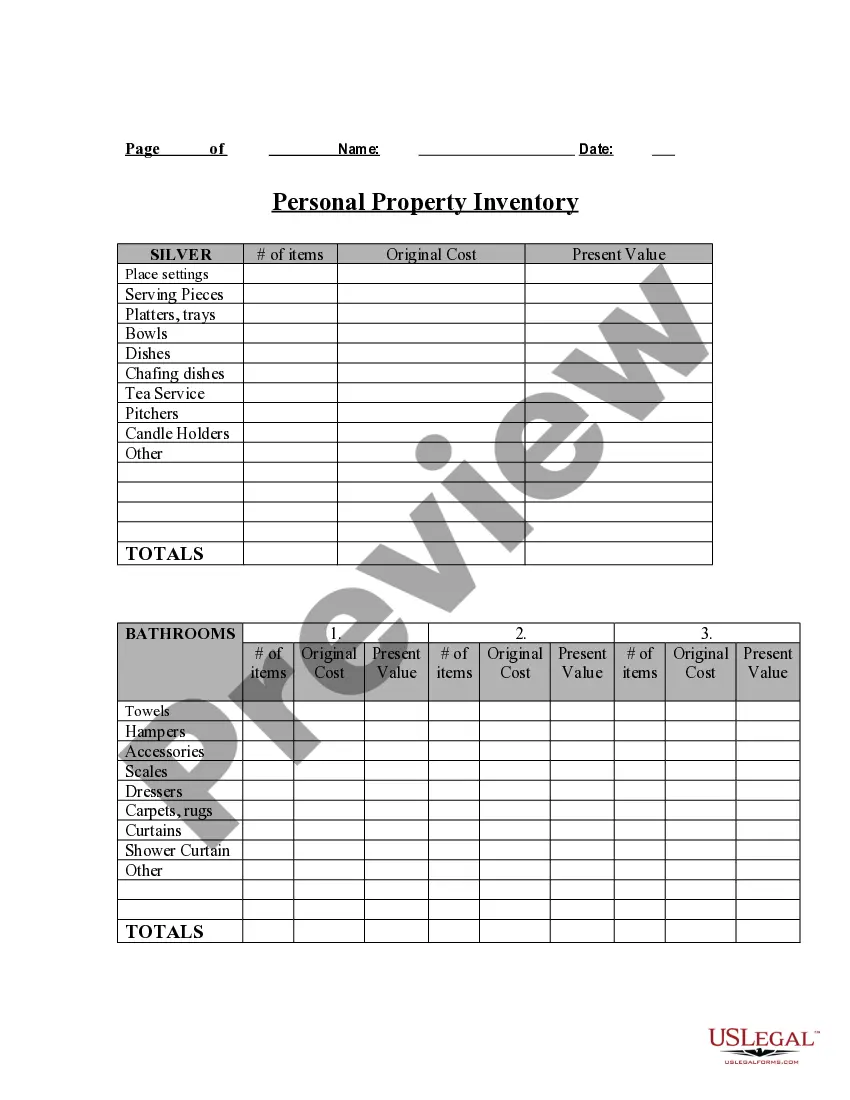

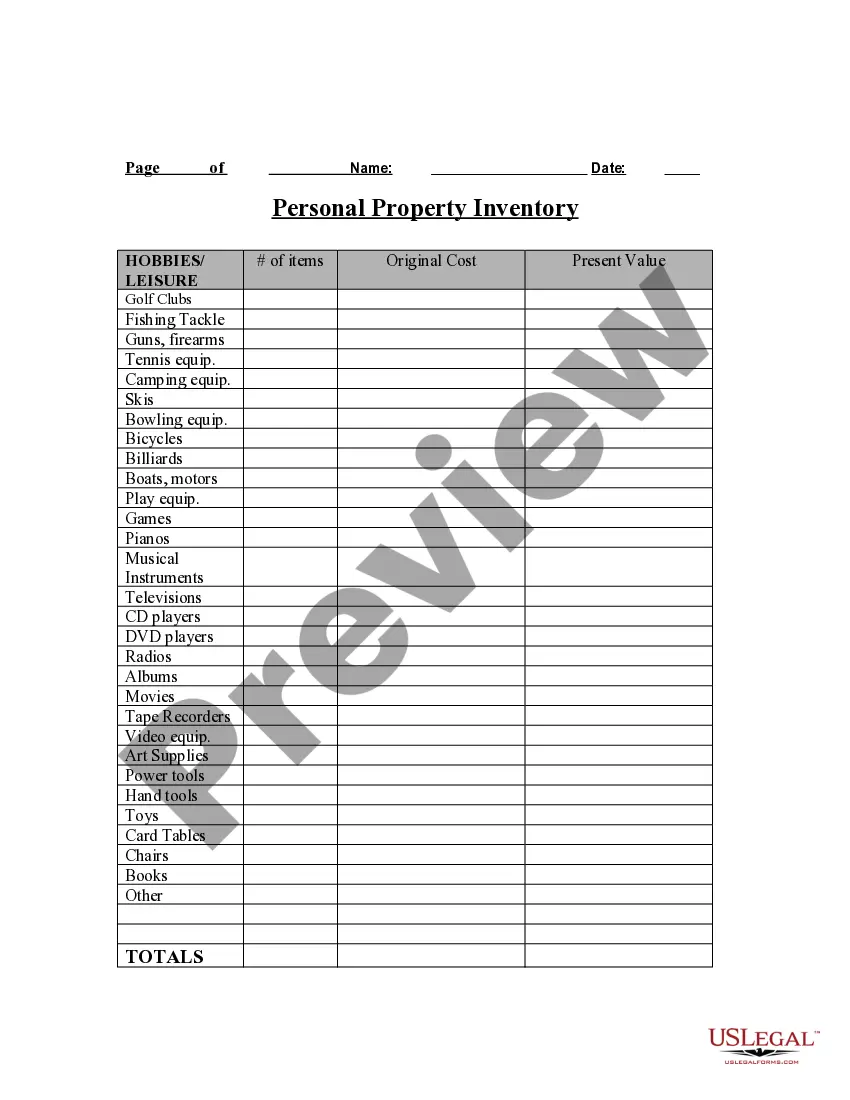

The Montgomery Maryland Personal Property Inventory Questionnaire is a comprehensive document used to assess and catalog an individual's personal belongings and assets for insurance, estate planning, or other purposes. It serves as a detailed inventory of a person's possessions, helping them accurately determine the value of their personal property. This questionnaire prompts individuals to provide essential information about their belongings, including a description of each item, its condition, and its estimated value. It covers various categories such as furniture, electronics, jewelry, artwork, vehicles, and other valuable possessions. Gathering this information is vital in cases of theft, damage, or loss, as it enables individuals to provide accurate details to their insurance companies or legal advisors. In Montgomery Maryland, various types of Personal Property Inventory Questionnaires may exist to cater to specific needs or circumstances. These could include: 1. Estate Planning Inventory Questionnaire: Designed to assist individuals in organizing and planning the distribution of assets to beneficiaries, this questionnaire enables thorough documentation of personal property, simplifying the probate process. 2. Home Inventory Questionnaire: Focusing on household possessions, this questionnaire creates a detailed record of all items within a residential property. It aids in ensuring accurate insurance coverage and expediting the claims process in the event of damage or loss caused by fire, natural disasters, or theft. 3. Business Personal Property Inventory Questionnaire: This questionnaire is developed to help business owners assess and document valuable assets and equipment used for business operations. It helps determine appropriate insurance coverage and facilitates filing accurate claims in case of unforeseen events. 4. Moving Inventory Questionnaire: Specifically designed to assist individuals during relocation, this type of questionnaire ensures a smooth transition by carefully listing and tracking personal property throughout the moving process. It can be essential for insurance coverage or claims related to potential damages or losses incurred during transportation. The Montgomery Maryland Personal Property Inventory Questionnaire plays a crucial role in safeguarding personal property, ensuring appropriate insurance coverage, facilitating estate planning, and simplifying legal proceedings. Completing this detailed questionnaire provides individuals with peace of mind and serves as an invaluable resource for managing their personal belongings in various situations.