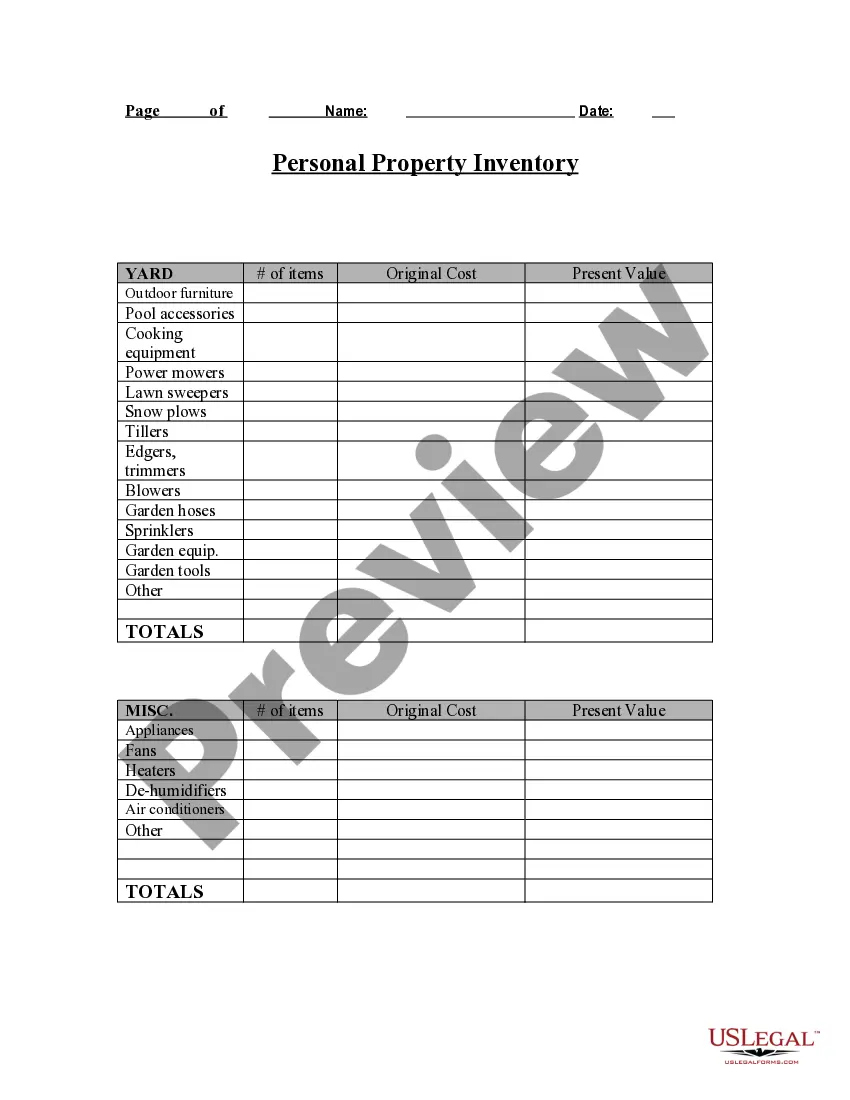

This form addresses important considerations that may effect the legal rights and obligations of the parties in a property-related matter, such as insurance and estate planning. This questionnaire enables those seeking legal help to effectively identify and value their personal property in an organized manner. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

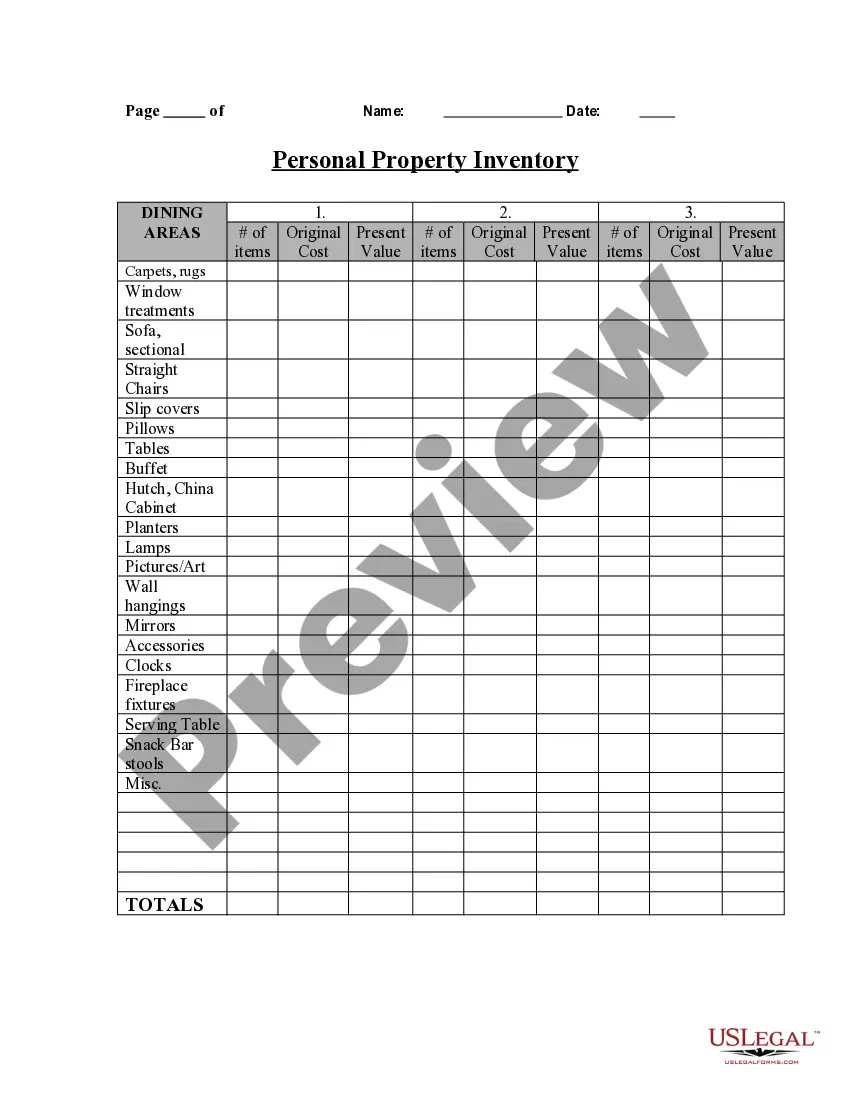

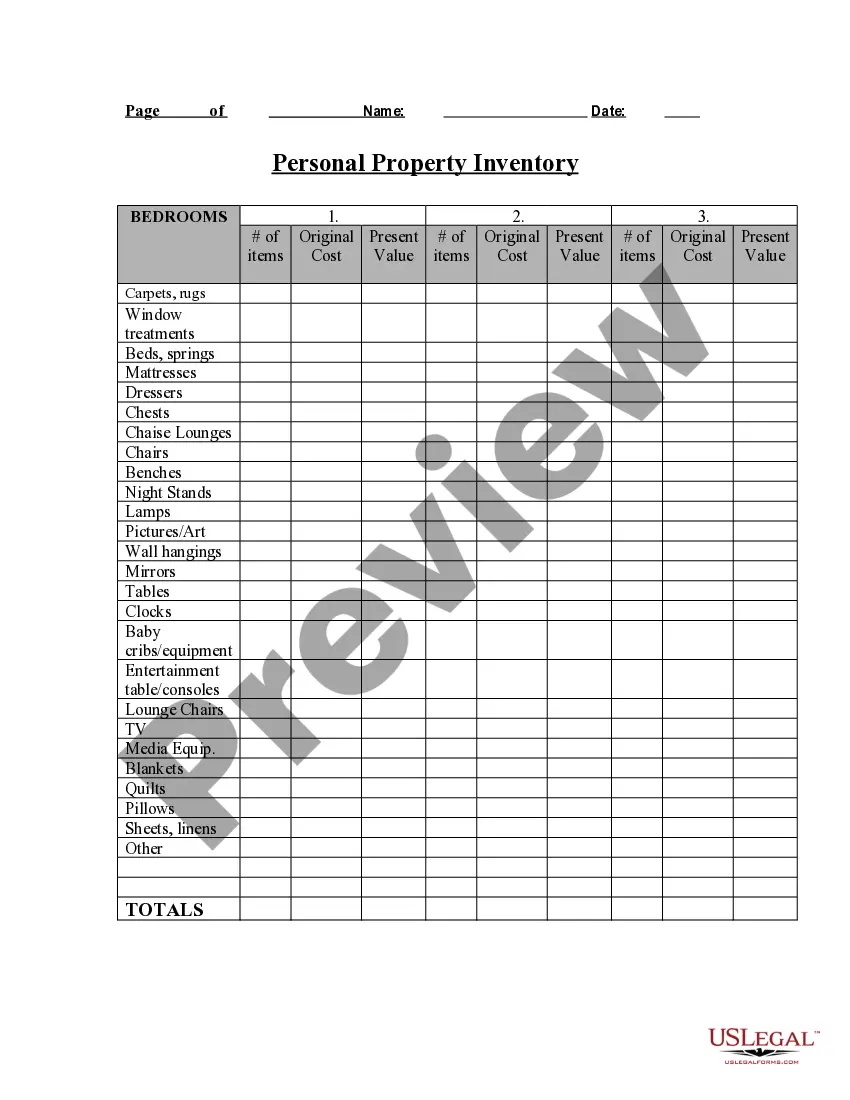

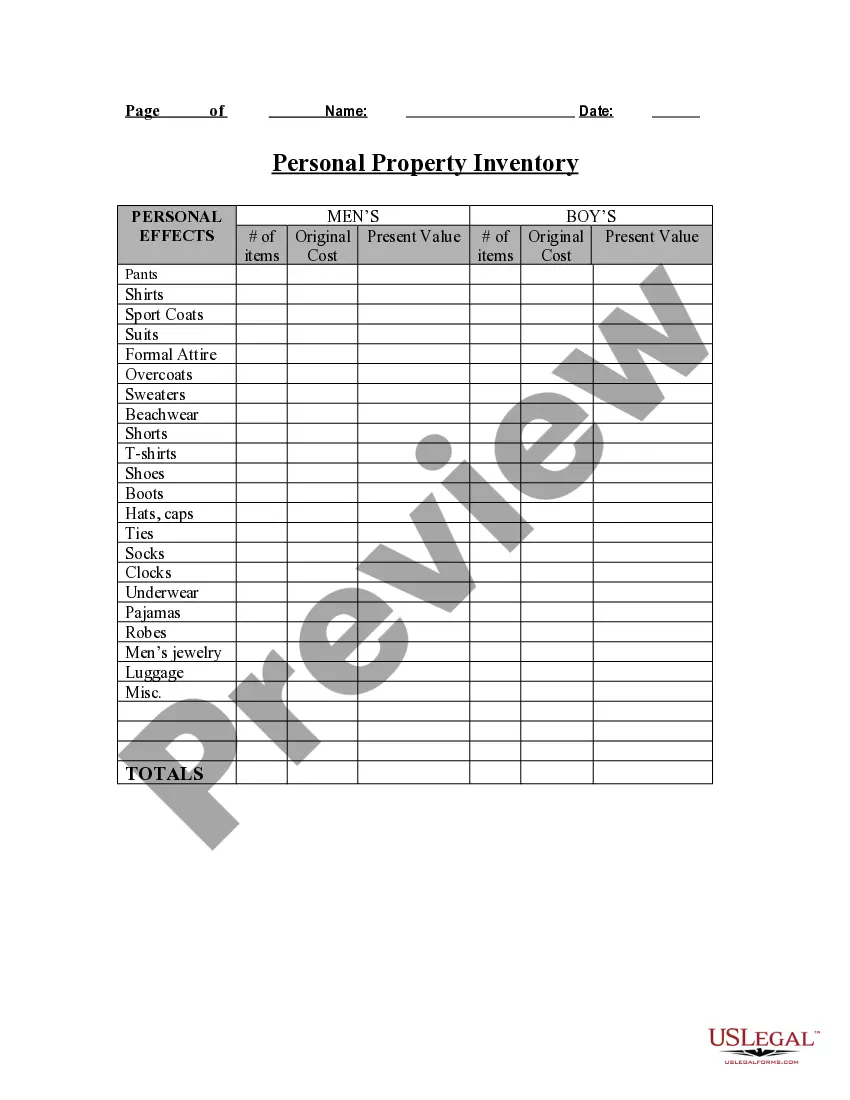

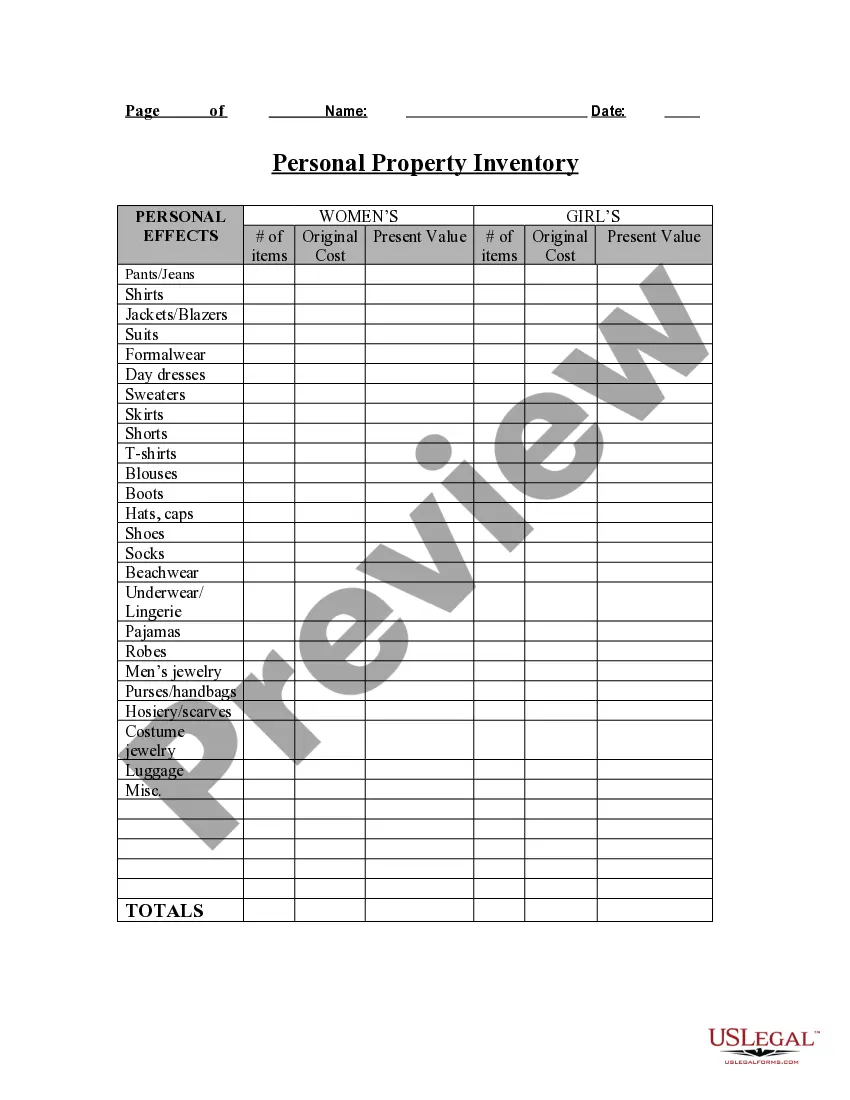

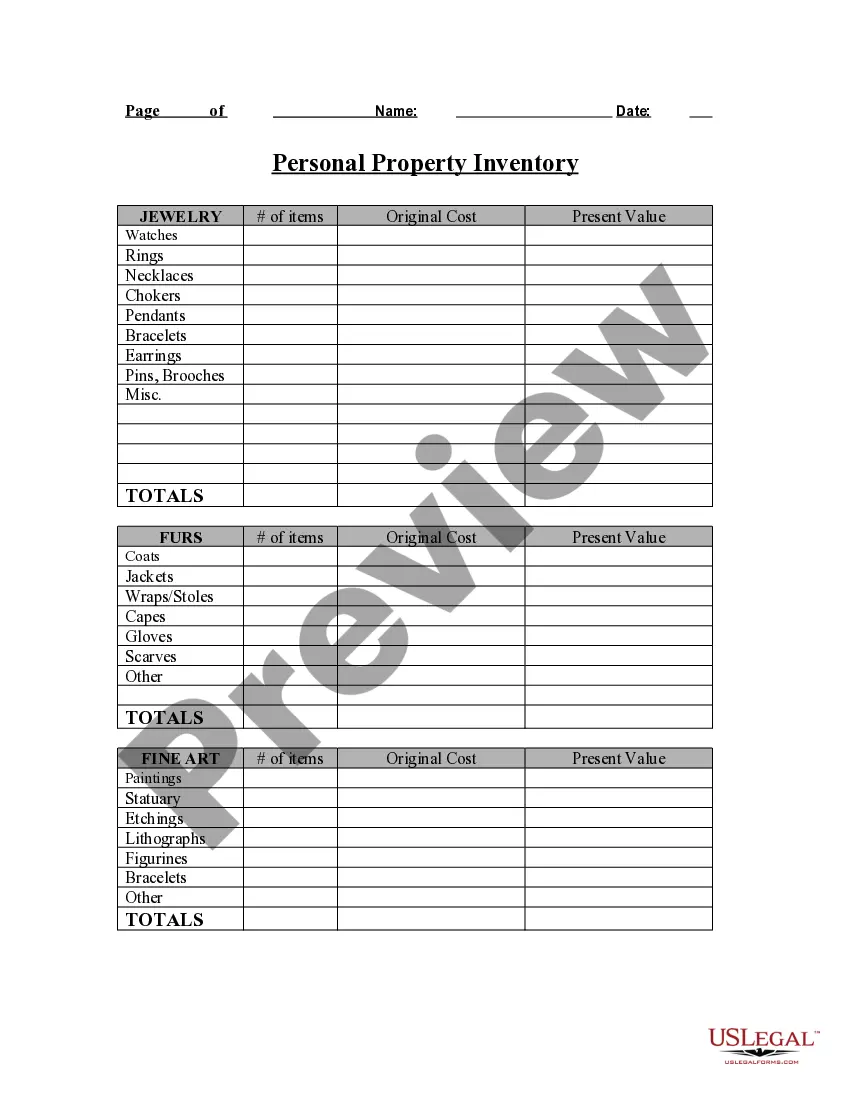

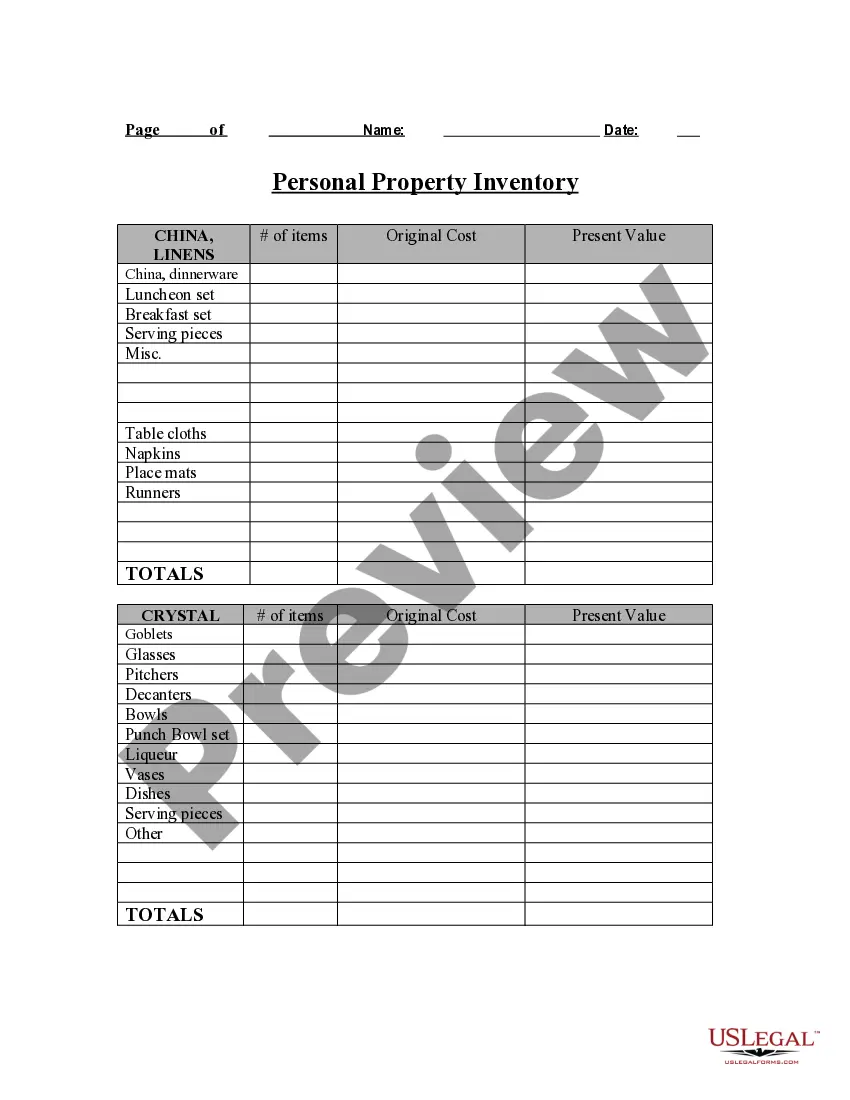

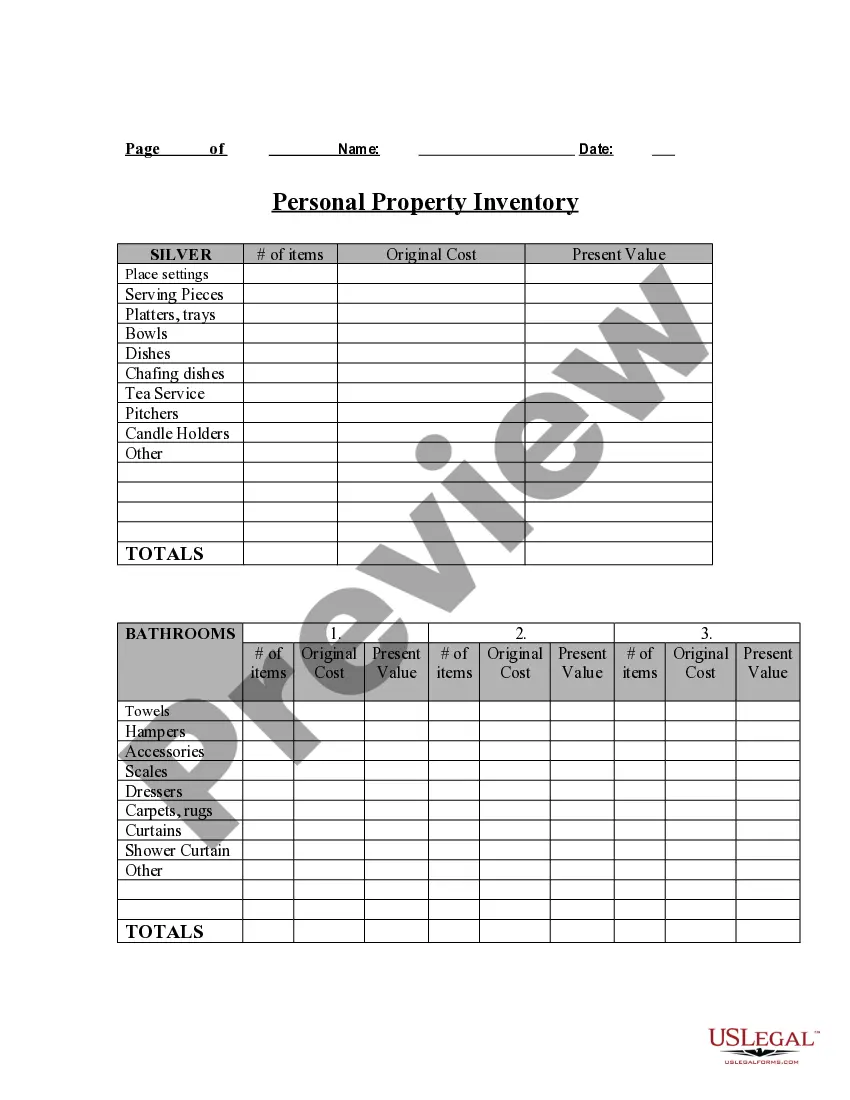

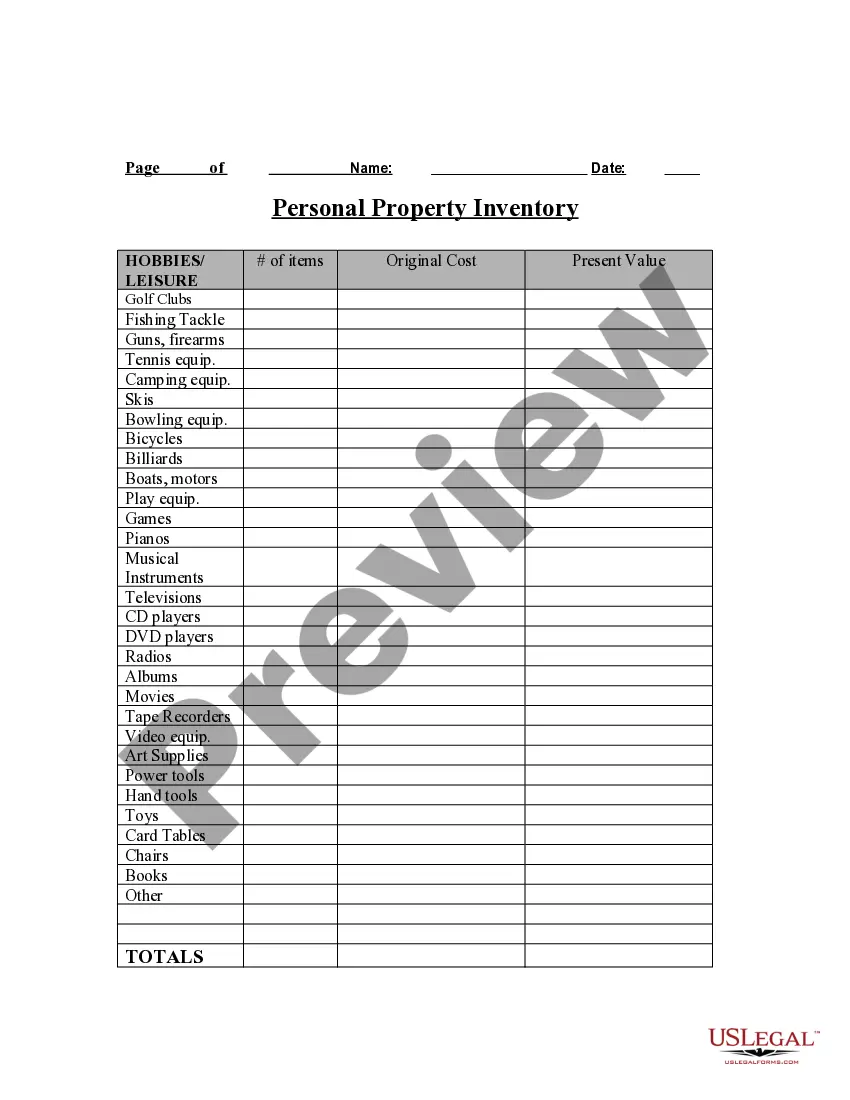

Wayne Michigan Personal Property Inventory Questionnaire is a comprehensive and essential document used to gather detailed information regarding an individual's personal property for various purposes, including insurance claims, estate planning, and financial assessments. This questionnaire acts as a systematic tool to record, organize, and evaluate personal belongings, ensuring their accurate documentation and valuation. It captures information about household items, valuables, electronics, jewelry, artwork, furniture, appliances, and other possessions. The Wayne Michigan Personal Property Inventory Questionnaire is vital for individuals residing in Wayne, Michigan, as it enables them to properly assess the value of their personal property, ensuring adequate insurance coverage and protection against unforeseen events. This questionnaire acts as a record of personal belongings in case of theft, fire, natural disaster, or any unfortunate incidents. Different types of Wayne Michigan Personal Property Inventory Questionnaires may include: 1. Standard-Purpose Personal Property Inventory Questionnaire: This type of questionnaire aims to cover a wide range of personal items typically found in residences, such as furniture, appliances, electronics, and household goods. It facilitates the documentation of everyday possessions, aiding in determining the overall value of personal property. 2. Valuables-Specific Personal Property Inventory Questionnaire: This type of questionnaire focuses on high-value items like jewelry, artwork, collectibles, antiques, and other valuable possessions. It provides a more detailed description of these items, including their estimated value, origin, purchase date, and supporting documentation. 3. Estate-Planning Personal Property Inventory Questionnaire: Specifically designed for estate planning purposes, this questionnaire goes beyond the scope of traditional inventories. It encompasses various aspects related to personal property, including heirlooms, inheritance plans, estate tax considerations, and distribution preferences among beneficiaries. This document plays a crucial role in ensuring a smooth probate process and accurate estate valuations. 4. Insurance Claim Personal Property Inventory Questionnaire: This type of questionnaire is created specifically for insurance purposes. It assists policyholders in documenting their personal property and assists insurance companies in accurately estimating the value and replacement cost of belongings when filing a claim. This questionnaire can expedite the claims process and help ensure a fair settlement. In conclusion, Wayne Michigan Personal Property Inventory Questionnaire is a vital tool for individuals residing in Wayne, Michigan, to document and assess their personal property value. It provides the necessary structure and information needed for insurance claims, estate planning, financial assessments, and general asset management. By utilizing different types of questionnaires designed to fit various needs, individuals can ensure a comprehensive and accurate inventory of their belongings.