This form addresses important considerations that may effect the legal rights and obligations of the parties in a lot or land sale matter. This questionnaire enables those seeking legal help to effectively identify and prepare their issues and problems. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

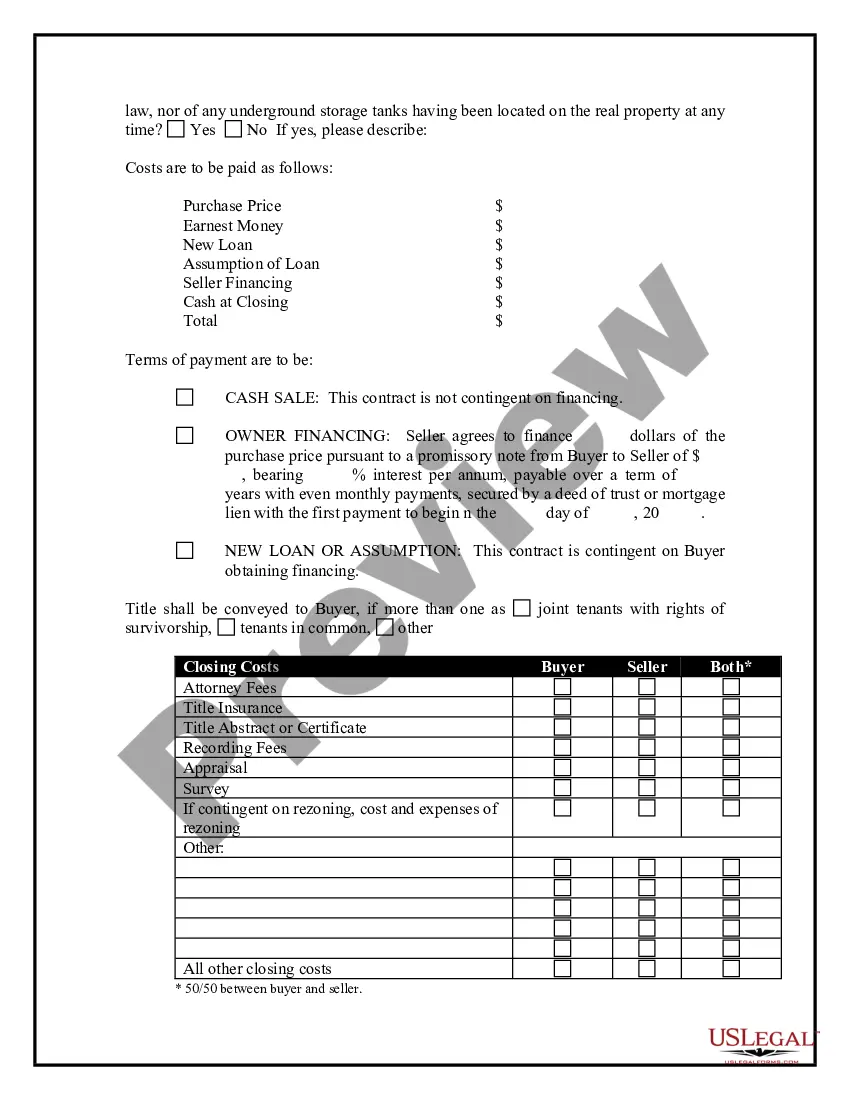

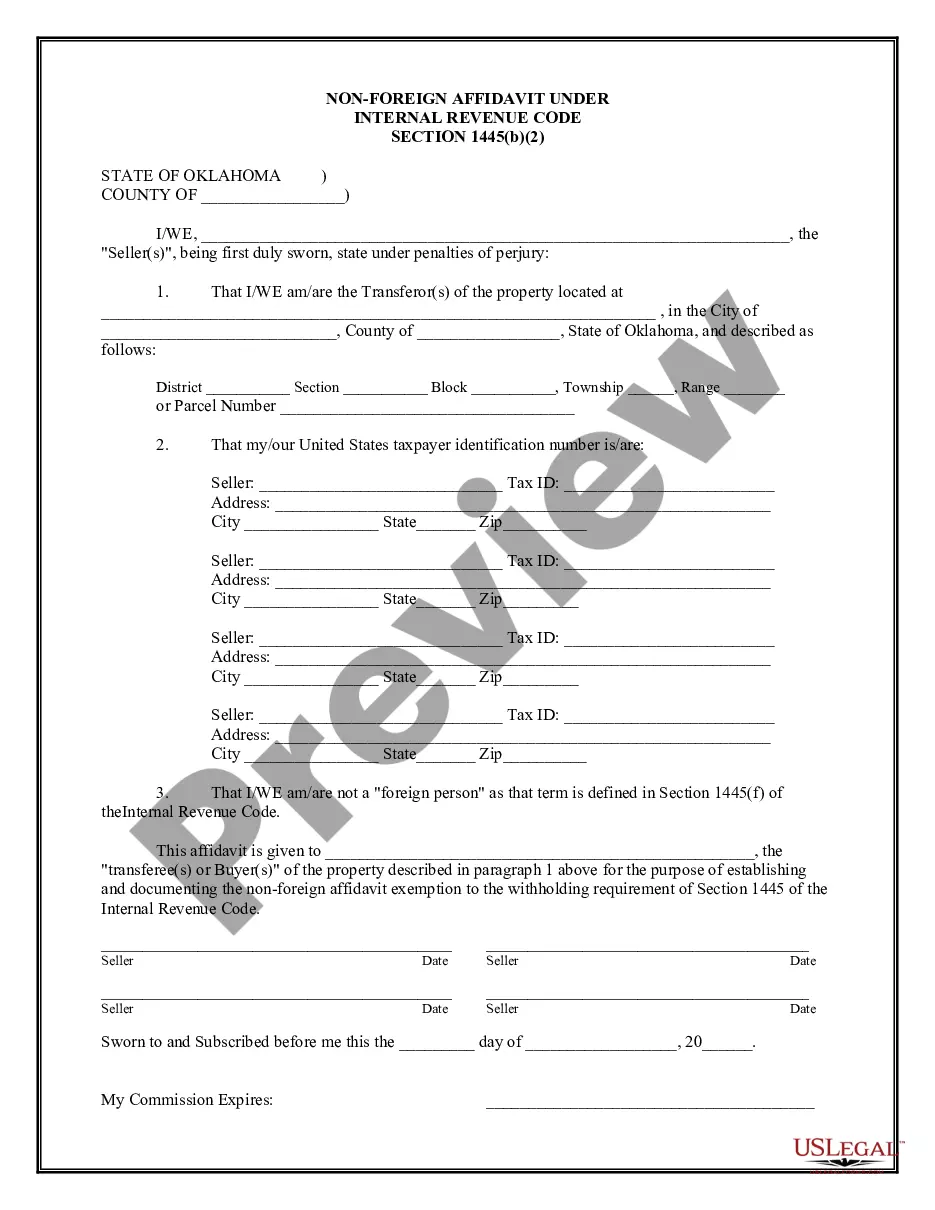

San Jose California Purchase or Sale of Real Property — Land or Lo— - Questionnaire is a comprehensive document designed to gather essential information related to the purchase or sale of real property in San Jose, California. This questionnaire is crucial for both buyers and sellers as it helps ensure a transparent and smooth transaction process. Here are some of the key elements typically included in this questionnaire: 1. Personal Information: Collects personal details of the buyer and seller, such as names, addresses, contact information, and legal identification. 2. Property Details: Requests information about the land or lot being bought or sold, including address, APN (Assessor's Parcel Number), lot size, legal description, zoning information, and any existing structures or improvements on the property. 3. Title and Ownership: Inquires about the current titleholder(s) of the property, including any co-owners or joint tenants. Also, investigates potential liens, encumbrances, or easements on the property. 4. Purchase/Sale Agreement: Includes questions related to the terms of the agreement, purchase price, down payment, financing arrangements, closing date, and any contingencies. 5. Disclosures: Addresses disclosures required by law, such as lead-based paint, earthquake hazard zones, environmental hazards, or special assessments. 6. Due Diligence: Asks for information related to property inspections, survey reports, zoning restrictions, land use permits, building permits, or any ongoing legal disputes involving the property. 7. Financing and Insurance: Gathers data on the buyer's financing arrangements, mortgage details, loan type, insurance coverage, and the name of the lender or insurance provider. 8. Seller's Representations and Warranties: Requires the seller to provide accurate and truthful information about the property's condition, any known defects, past repairs or renovations, and any ongoing maintenance issues. Types of San Jose California Purchase or Sale of Real Property — Land or Lo— - Questionnaire: 1. Residential Property Questionnaire: Specifically designed for the purchase or sale of residential land or lots, including single-family homes, townhouses, or condominium units. 2. Commercial Property Questionnaire: Tailored for the purchase or sale of commercial land or lots, such as office buildings, retail spaces, warehouses, or industrial sites. 3. Vacant Land Questionnaire: Used when buying or selling vacant land or lots without any buildings or structures. It covers zoning regulations, permitted land uses, utilities availability, and potential development plans. 4. Investment Property Questionnaire: Geared towards the purchase or sale of investment properties, including rental units, multi-family buildings, or income-producing properties. It focuses on rental history, current leases, and financial performance. 5. Agricultural Land Questionnaire: Applicable when dealing with the purchase or sale of agricultural land or lots, such as farms, vineyards, or orchards. It gathers information about crop production, water rights, soil composition, and existing agricultural structures. Remember, while this content provides a general overview, each questionnaire may vary based on specific requirements, legal obligations, or additional provisions determined by the parties involved or their legal representatives.