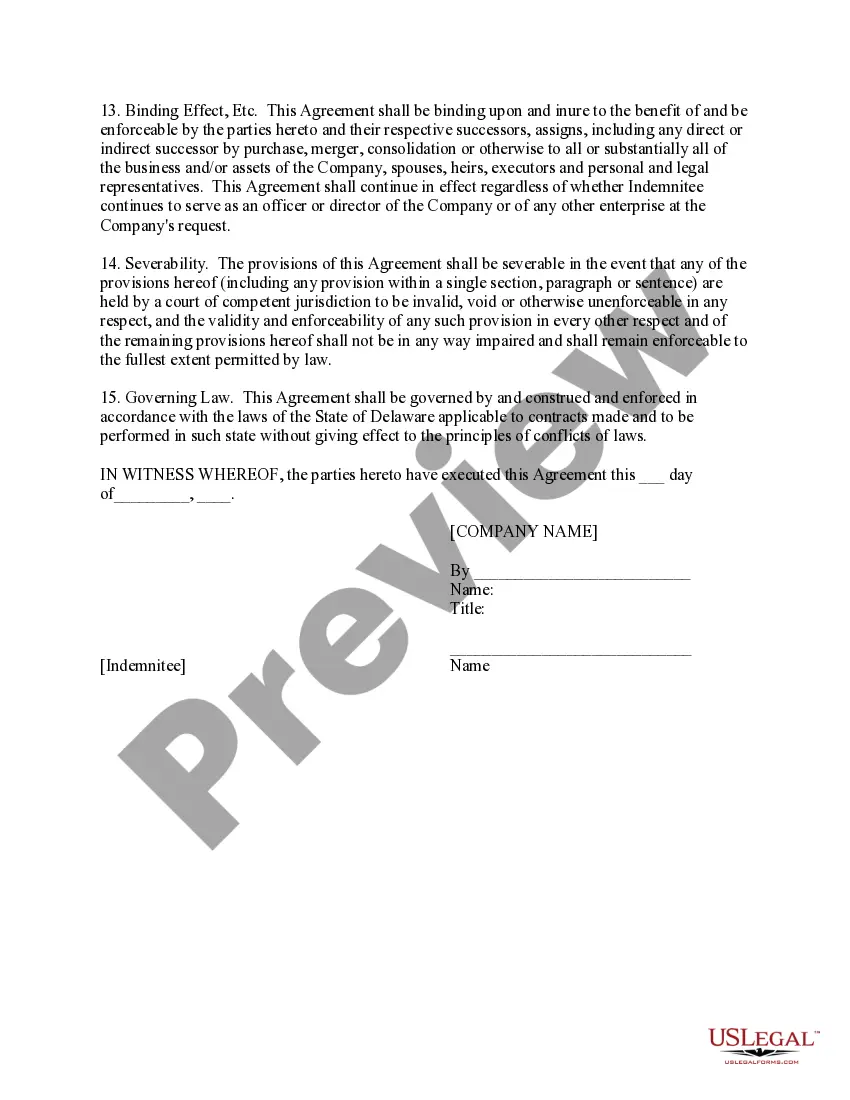

Travis Texas Indemnification Agreement for a Delaware Corporation is a legal document designed to protect directors, officers, employees, and agents ("indemnities") of a Delaware corporation from potential liabilities, expenses, and damages incurred while acting in their official capacities for the corporation. This agreement aims to provide indemnification to such individuals, ensuring their financial security and encouraging them to act in the best interests of the corporation. Keywords: Travis Texas, Indemnification Agreement, Delaware Corporation, directors, officers, employees, agents, liabilities, expenses, damages, indemnification, financial security, acting in the best interests. There are different types of Travis Texas Indemnification Agreements for Delaware Corporations, which can be classified as follows: 1. Indemnification Agreement for Directors: This type of agreement specifically outlines the indemnification provisions for directors of the Delaware corporation. It may include provisions regarding the scope of indemnification, reimbursement for legal expenses, advancements of expenses, and procedures for making indemnification claims. 2. Indemnification Agreement for Officers: Similar to the director's agreement, an indemnification agreement for officers focuses on providing indemnification protection to officers of the Delaware corporation. It typically covers the same types of provisions as the director's agreement. 3. Indemnification Agreement for Employees: This agreement extends indemnification provisions to employees of the Delaware corporation. It ensures that employees are protected from potential liabilities and expenses incurred during the course of their employment, subject to the terms and conditions outlined in the agreement. 4. Indemnification Agreement for Agents: This type of agreement applies to agents representing the Delaware corporation, such as attorneys, auditors, or consultants. It provides indemnity for agents against claims, losses, and expenses resulting from actions taken on behalf of the corporation. Each type of Travis Texas Indemnification Agreement for a Delaware Corporation is tailored to the specific role and responsibilities of the individual being indemnified. These agreements are crucial for attracting and retaining qualified directors, officers, employees, and agents, as they provide an extra layer of protection and instill confidence in their actions on behalf of the corporation.

Travis Texas Indemnification Agreement for a Delaware Corporation

Description

How to fill out Travis Texas Indemnification Agreement For A Delaware Corporation?

Creating forms, like Travis Indemnification Agreement for a Delaware Corporation, to manage your legal affairs is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for different scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Travis Indemnification Agreement for a Delaware Corporation template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Travis Indemnification Agreement for a Delaware Corporation:

- Make sure that your document is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Travis Indemnification Agreement for a Delaware Corporation isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!