Maricopa Arizona Term Sheet for Venture Capital Investment is a crucial document that outlines the terms and conditions agreed upon between a startup or an early-stage company and a venture capital firm regarding investment. This term sheet serves as the foundation for the final investment agreement and sets the stage for the relationship between the company and the investors. It contains various key terms, financial arrangements, and provisions that need to be carefully reviewed and negotiated by both parties. Key Elements in Maricopa Arizona Term Sheet for Venture Capital Investment: 1. Funding Amount: The term sheet specifies the total amount of funding the venture capital firm is willing to invest in the company. It is essential for the entrepreneur to analyze this amount as it can directly impact the growth and operations of the business. 2. Valuation: The term sheet determines the pre-money valuation of the company. This is crucial for both the investor and the entrepreneur to agree upon before finalizing the investment. 3. Ownership Stake: The term sheet outlines the ownership percentage the venture capital firm will acquire in exchange for the investment. Negotiating this percentage is significant to ensure the entrepreneur retains a fair portion of the company's ownership and control. 4. Liquidation Preferences: This section defines the order in which the venture capital investor will be paid back in the event of a liquidation or exit, ensuring they receive their investment capital back first before others. 5. Dividend Rights: The term sheet may include provisions for dividend payments to the venture capital firm, which gives them income distribution rights if the company generates profits. 6. Board Representation: It outlines the number of seats the venture capital firm will have on the Board of Directors. This appointment grants them the power to influence business decisions and strategy. 7. Anti-Dilution Protection: This provision protects the venture capital investment from dilution in case the company issues additional shares in future financing rounds at a lower valuation. Different Types of Maricopa Arizona Term Sheets for Venture Capital Investment: 1. Series Seed Term Sheet: Typically used for early-stage startups, this term sheet focuses on providing seed capital to help the company achieve specific milestones. 2. Series A Term Sheet: Designed for startups aiming to scale their business, it involves larger funding rounds and more detailed terms compared to Series Seed term sheets. 3. Series B Term Sheet: This term sheet is relevant for companies that have established a market position and are seeking additional capital to fuel their growth. Understanding the intricacies of a Maricopa Arizona Term Sheet for Venture Capital Investment is vital for both entrepreneurs and venture capitalists. It is advisable to seek professional legal advice to navigate these documents and negotiate favorable terms that align with the company's vision and the investor's objectives.

Maricopa Arizona Term Sheet for Venture Capital Investment

Description

How to fill out Maricopa Arizona Term Sheet For Venture Capital Investment?

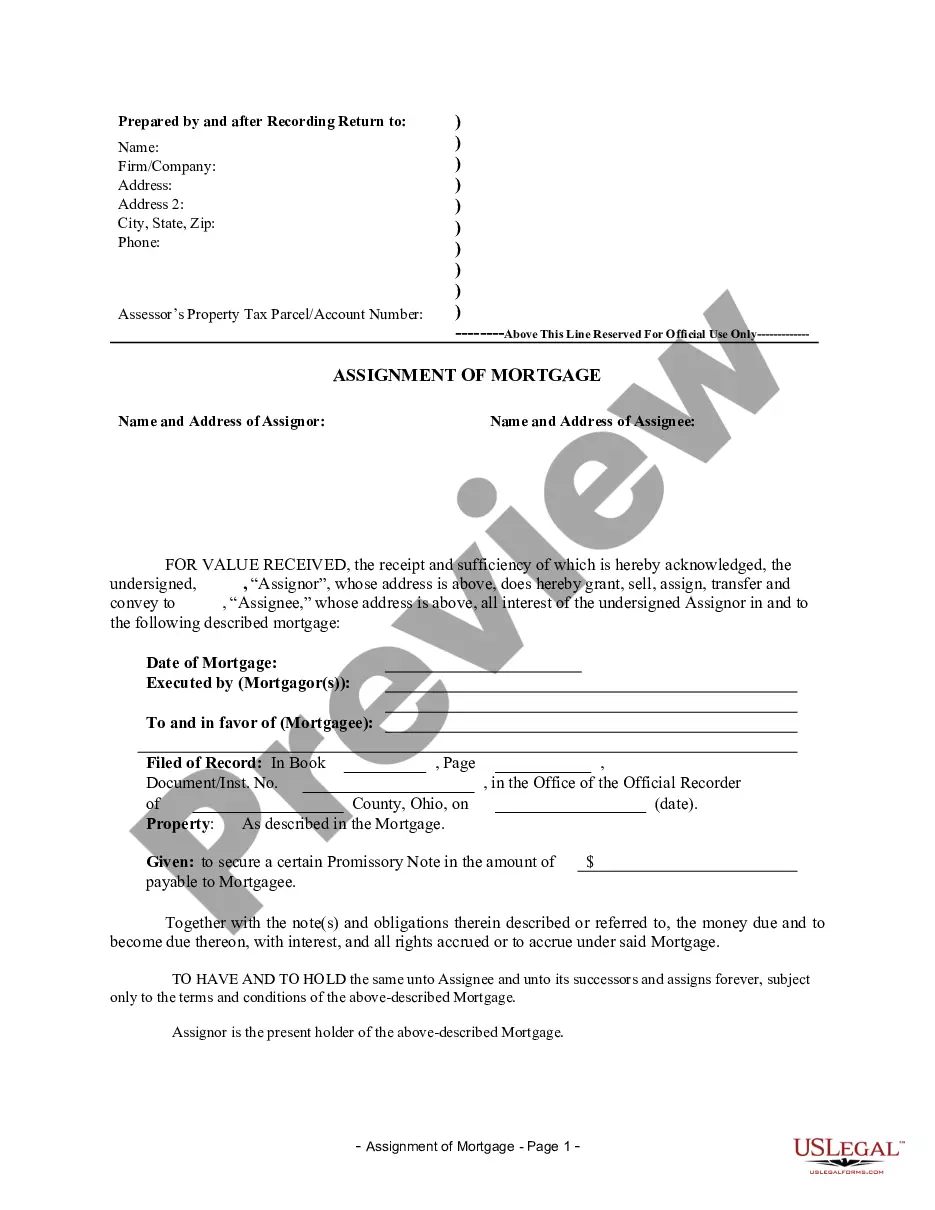

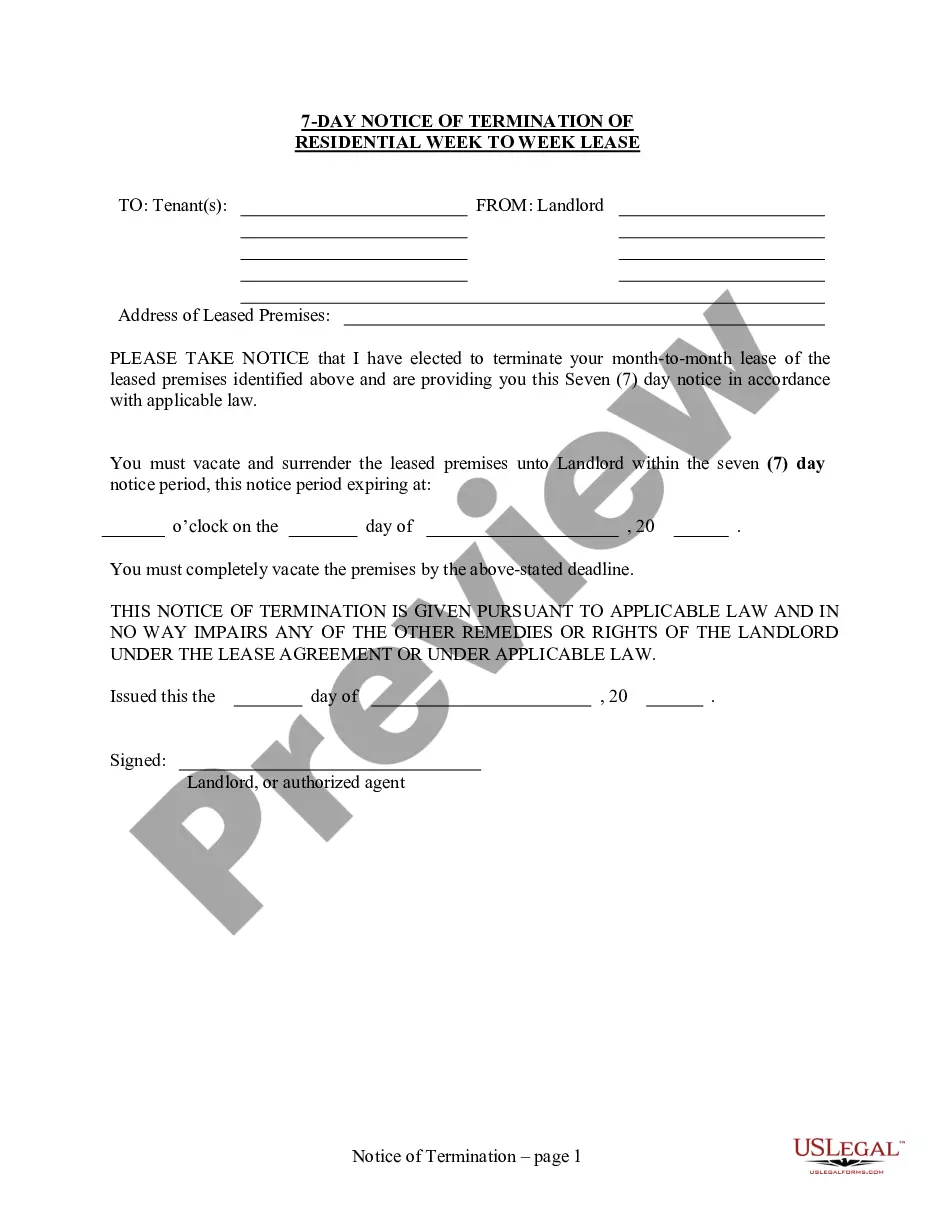

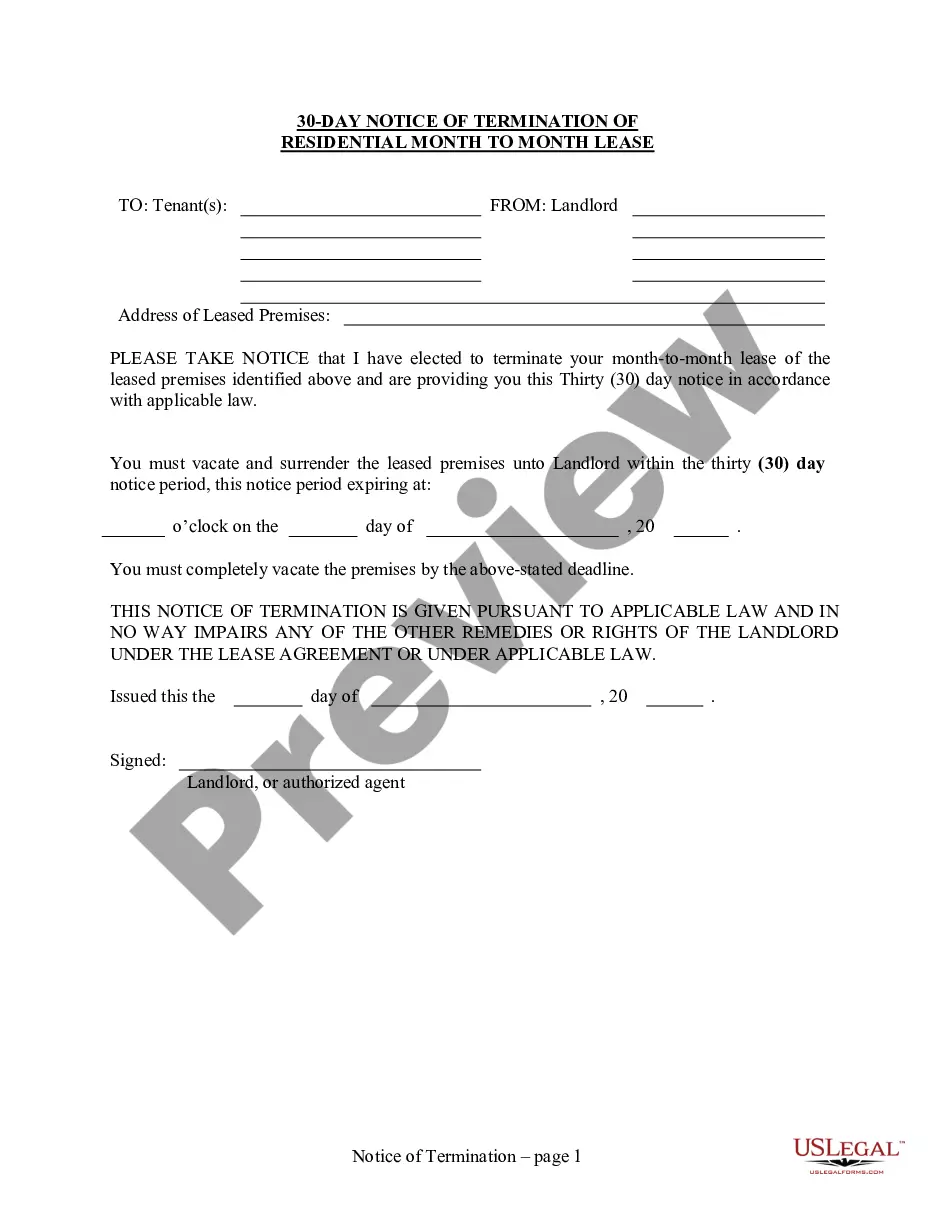

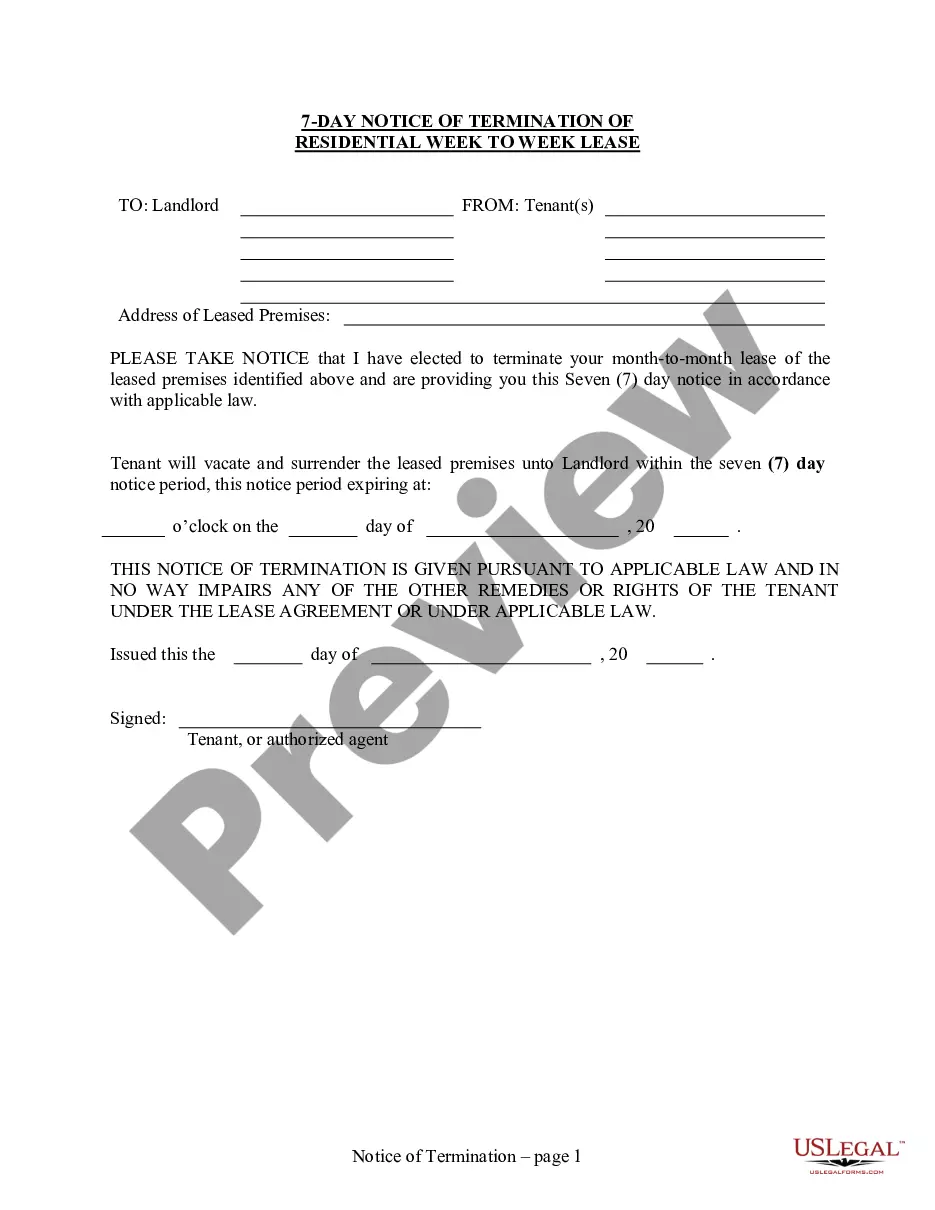

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Term Sheet for Venture Capital Investment is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Maricopa Term Sheet for Venture Capital Investment. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Term Sheet for Venture Capital Investment in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!