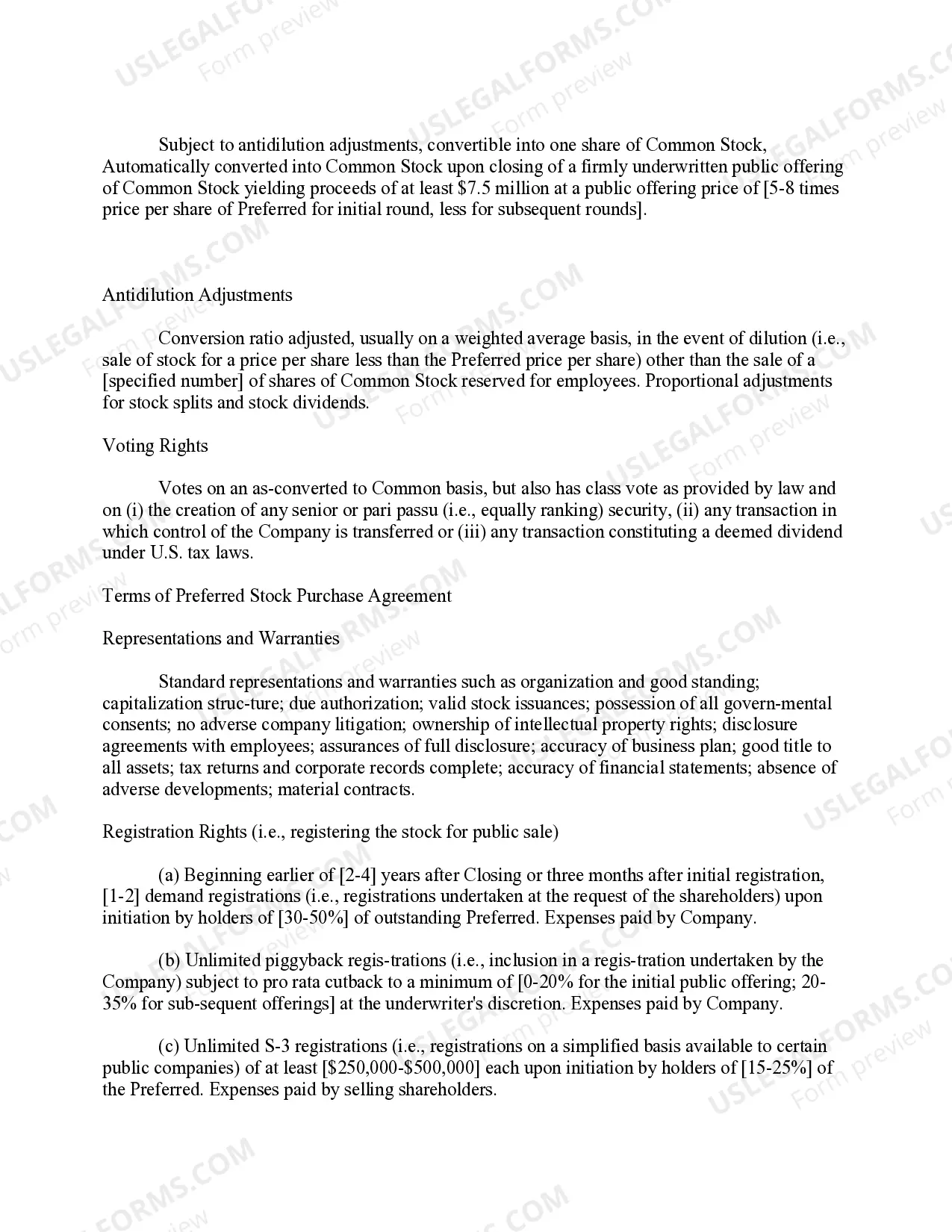

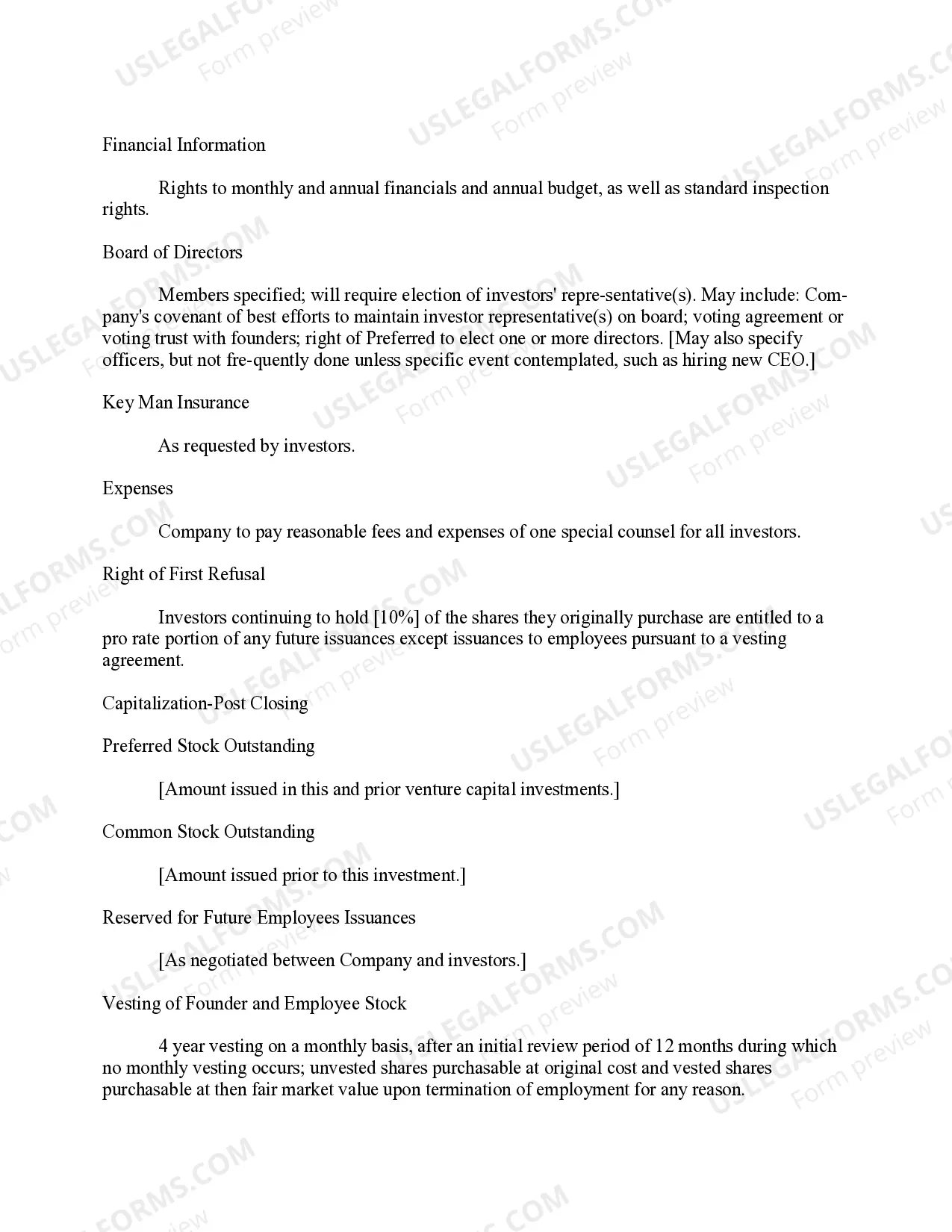

Riverside California Term Sheet for Venture Capital Investment serves as a crucial document outlining the key terms and conditions associated with a venture capital investment made in the city of Riverside, California. This term sheet specifies the rights, obligations, and expectations of both the venture capital firm and the startup seeking investment. It serves as a preliminary agreement for further negotiations and due diligence before finalizing the investment deal. The Riverside California Term Sheet for Venture Capital Investment typically includes various components, such as: 1. Investment Amount: The term sheet specifies the total amount of investment offered by the venture capital firm to the startup, which reflects the capital required to fuel growth and development. 2. Valuation and Ownership Percentage: This section outlines the pre-investment valuation of the startup and determines the equity stake the venture capital firm will hold after the investment. It also defines any potential anti-dilution provisions preserving the investor's ownership percentage in subsequent financing rounds. 3. Liquidation Preference: The term sheet may establish the order of distribution of funds among different stakeholders in the event of an exit or liquidation, safeguarding the investor's initial capital and providing them with priority rights over other shareholders. 4. Board of Directors: It specifies the composition of the startup's board of directors, outlining the number of director seats granted to the venture capital firm and any provisions for observer rights or influential board positions. 5. Protective Provisions: The term sheet may include protective provisions that allow the venture capital firm to maintain certain controls over significant company decisions, such as changes to the capital structure, liquidation, mergers, or acquisitions. 6. Dividend and Distribution Rights: This section outlines whether the venture capital firm will receive preferential dividends or any rights to participate in future distributions of profits alongside the startup's founders and other shareholders. 7. Information and Reporting Requirements: The term sheet can establish the frequency and nature of financial and operational reporting, ensuring transparency and allowing the venture capital firm to actively monitor the startup's progress. 8. Restrictive Covenants: It may include constraints imposed on the startup, such as limitations on incurring additional debt, making significant business decisions, or engaging in competitive activities that pose potential conflicts of interest. Different types of Riverside California Term Sheet for Venture Capital Investment may exist based on the specific terms and preferences of the venture capital firm. These can include specific focus areas like technology investments, healthcare startups, sustainable initiatives, or other sectors prioritized by the investors. Additionally, term sheets can vary based on the investment stage (seed, early stage, or growth-stage) and the particular investment strategies and requirements of the venture capital firm.

Riverside California Term Sheet for Venture Capital Investment

Description

How to fill out Riverside California Term Sheet For Venture Capital Investment?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, locating a Riverside Term Sheet for Venture Capital Investment meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Riverside Term Sheet for Venture Capital Investment, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Riverside Term Sheet for Venture Capital Investment:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Riverside Term Sheet for Venture Capital Investment.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

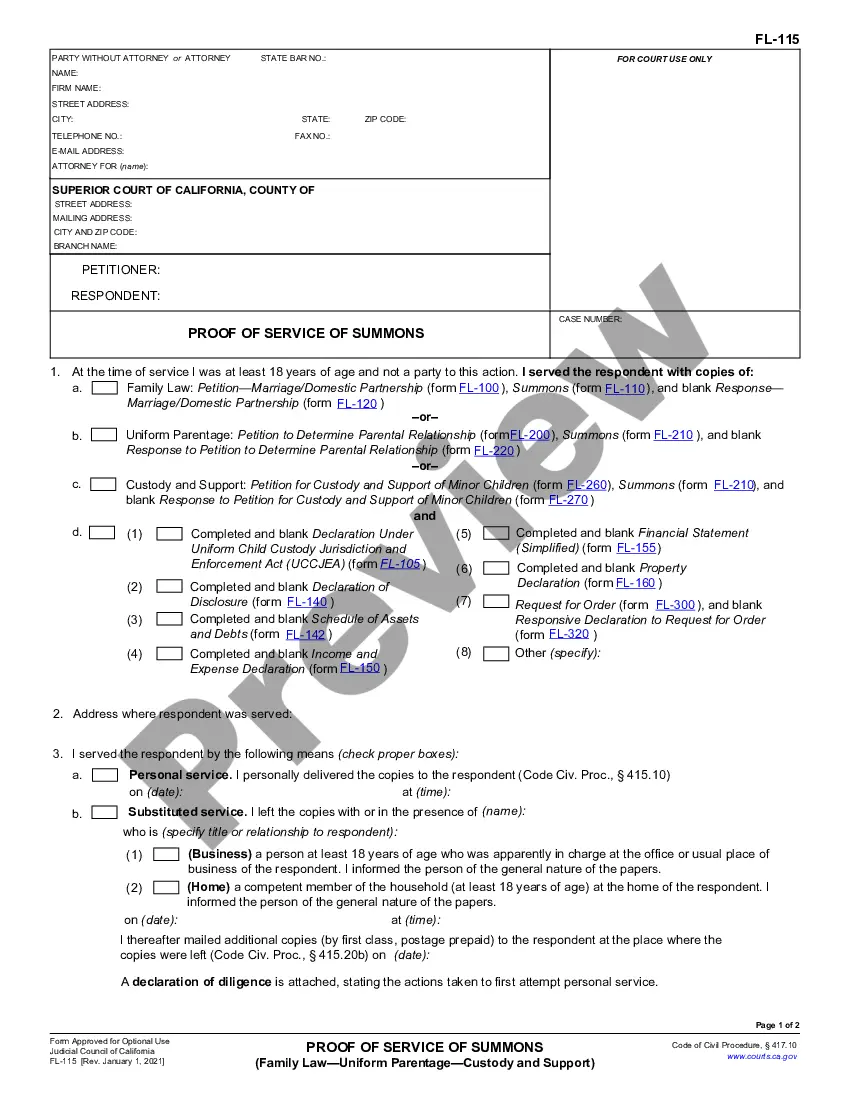

List the Offering Terms Closing date and conditions to closing. The issuer of the document (the founder of the startup) Amount of the offering, including the price per share. Investors involved. Securities. Pre-money valuation.

The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. Term sheets tend to consist of three sections: funding, corporate governance and liquidation. (For more details, please see Understanding a term sheet.)

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A term sheet is a document which sets out certain terms of a transaction agreed in principle between parties, and is typically negotiated and signed at the beginning of a transaction. Term sheets evidence serious intent, but generally are not legally binding.

The VC term sheet is a non-binding legal document that forms the basis of more enduring and legally binding documents, such as the Stock Purchase Agreement and Voting Agreement.

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

This term sheet is not a contract or a binding agreement but just an expression of a possible business transaction between the Target and the Buyer. No party will be bound for a transaction until and unless definitive agreements are executed by the parties to this transaction.