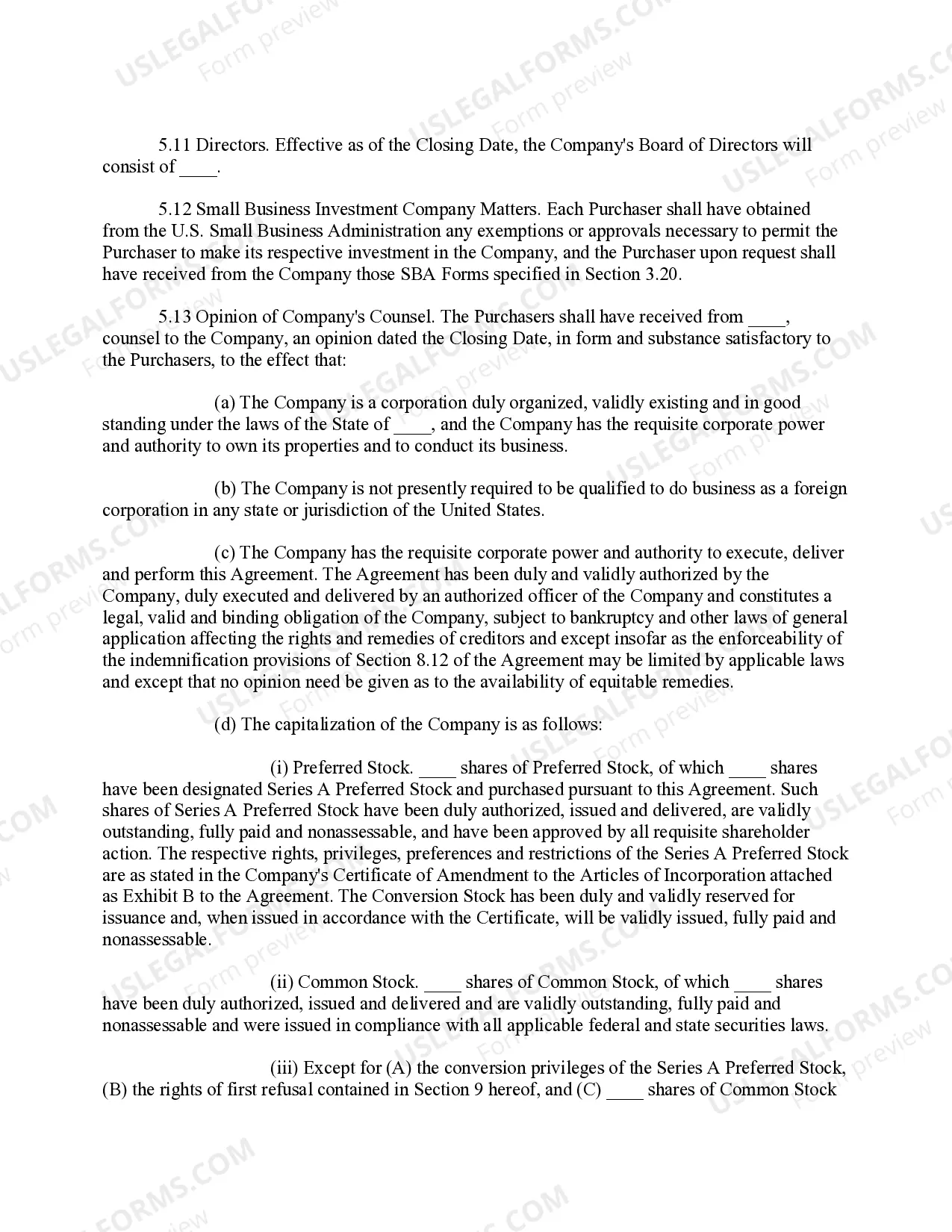

This is a Preferred Stock Purchase Agreement between a startup company and venture capital investors. This form is oriented for investors and contains the agreement to sell and purchase, the closing, delivery and payment options, representations and warranties, and the schedule of purchasers, among other things.

A Dallas Texas Investor Stock Purchase Agreement refers to a legally binding contract between an investor and a company or corporation in Dallas, Texas, for the purchase of stocks or shares. This agreement outlines the terms and conditions of the stock transaction, protecting the rights and interests of both parties involved. The Dallas Texas Investor Stock Purchase Agreement typically includes several key elements. Firstly, it establishes the identities of the buyer (investor) and the seller (company) and provides their contact details. It also specifies the number of shares being purchased, the purchase price per share, and the total purchase price for the transaction. Furthermore, the agreement includes provisions for any representations and warranties made by the seller regarding the stock being sold, such as the stock's validity and legal compliance. It may also outline any restrictions or limitations on the transfer or sale of the stocks. In addition to these general terms, it's important to note that there may be different variations or types of Dallas Texas Investor Stock Purchase Agreements, depending on the specific nature of the transaction or the parties involved. Some possible variations may include: 1. Common Stock Purchase Agreement: This type of agreement is used when an investor purchases common stocks, which represent ownership in a company and offer voting rights but may have limited or no dividend rights. 2. Preferred Stock Purchase Agreement: This agreement is applicable when an investor purchases preferred stocks, which typically have additional benefits like a fixed dividend rate or preferred treatment during company liquidation. 3. Restricted Stock Purchase Agreement: This type of agreement is used when the investor purchases restricted stocks, which are subject to specific restrictions on their transferability or sale, usually for a certain period or until certain conditions are met. 4. Convertible Stock Purchase Agreement: This agreement applies when an investor purchases stocks that have the option to be converted into a different class of stock or different securities at a later date. 5. Contingent Stock Purchase Agreement: This variation of the agreement is used when the purchase of stocks is contingent upon certain events or conditions, such as regulatory approvals or the achievement of specific milestones. It's important for both the investor and the company to carefully review and negotiate the terms and conditions of the Dallas Texas Investor Stock Purchase Agreement to ensure a fair and mutually beneficial transaction. Seeking legal advice from a skilled attorney experienced in securities law and stock transactions is highly recommended ensuring the agreement is properly drafted and reflects the desired intentions of all parties involved.