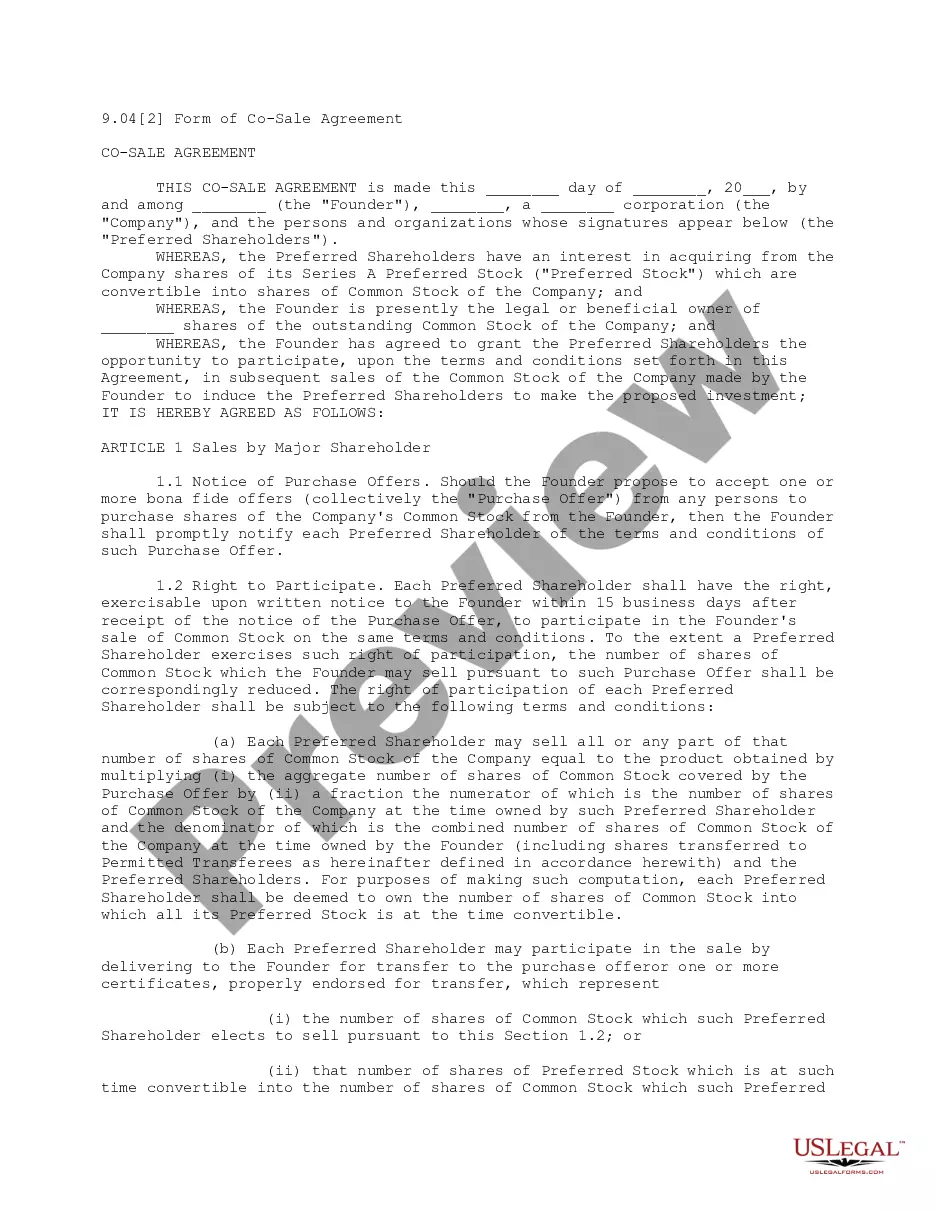

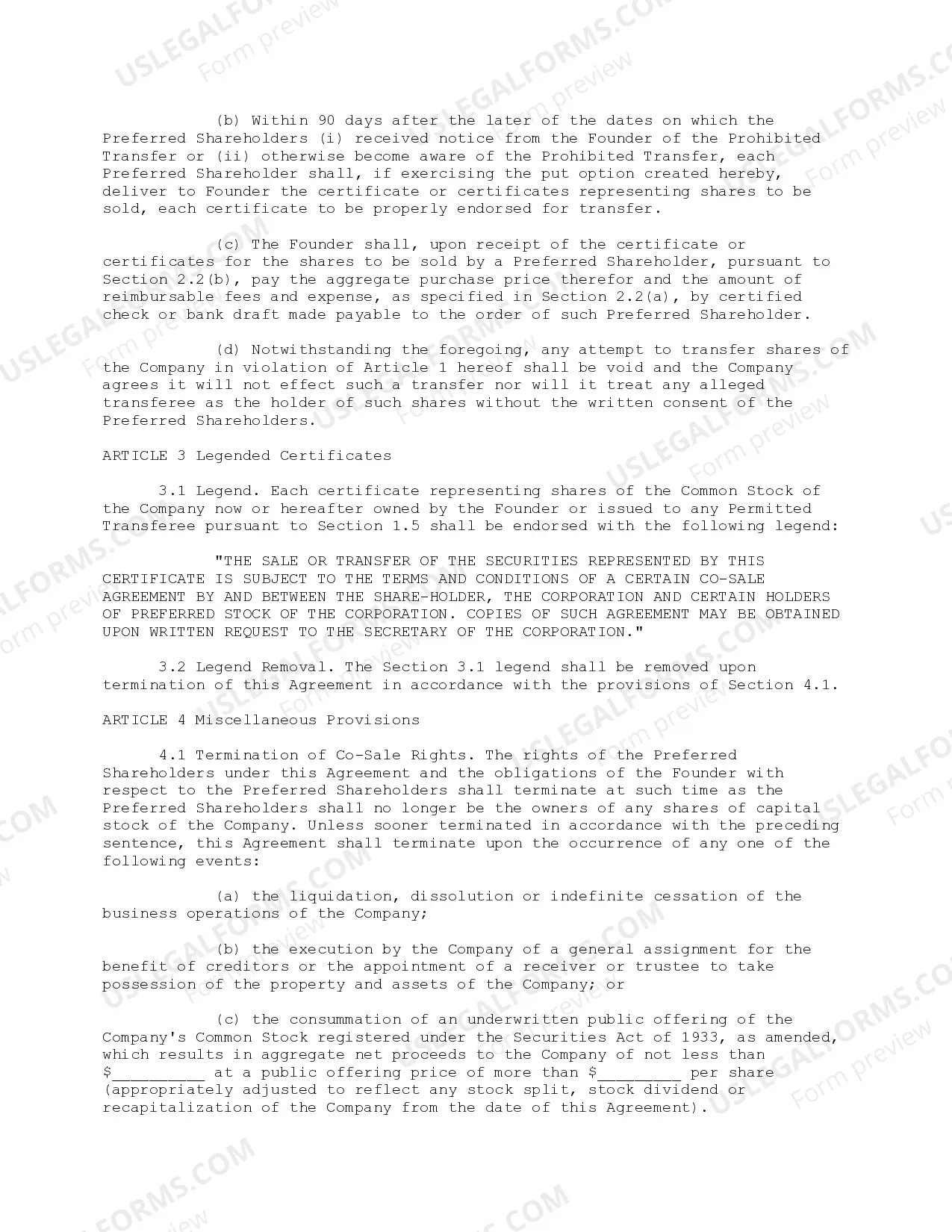

A King Washington Co-Sale Agreement is a legal contract between shareholders or investors of a company, allowing them to sell their shares in the event of a sale by the majority shareholder or a controlling party. This agreement ensures that minority shareholders have the opportunity to sell their shares on the same terms and conditions as the majority shareholders. Keywords: King Washington Co-Sale Agreement, legal contract, shareholders, investors, sell shares, majority shareholder, controlling party, minority shareholders, terms and conditions. There are two types of King Washington Co-Sale Agreements: 1. Traditional Co-Sale Agreement: This type of agreement is commonly used when multiple shareholders are involved in a company. It allows minority shareholders to participate in the sale of their shares if a majority shareholder decides to sell their stake. The co-sale agreement ensures that minority shareholders are not left behind or disadvantaged in the sale process. 2. Reverse Co-Sale Agreement: In certain situations, a reverse co-sale agreement may be employed. This type of agreement grants the minority shareholders the right to force the majority shareholder to sell their shares if certain predefined events occur, such as a breach of contract, bankruptcy, or violation of shareholder agreements. Reverse co-sale agreements provide minority shareholders with protection and an exit strategy if the controlling party fails to meet its obligations. Both types of King Washington Co-Sale Agreements aim to provide protection and fair treatment to minority shareholders, ensuring their rights are preserved when significant ownership changes occur within a company. These agreements are especially important during mergers and acquisitions or when significant investments are made in the company.

King Washington Co-Sale Agreement

Description

How to fill out King Washington Co-Sale Agreement?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your county, including the King Co-Sale Agreement.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the King Co-Sale Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the King Co-Sale Agreement:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the King Co-Sale Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Virtually any agreement can be recorded if the signature of the property owner has been notarized and if the document is in recordable form.

An assignment of contract occurs on a property that is currently under contract, and has not yet been purchased. First, the assignor finds a property, and enters into a sales agreement with the buyer to purchase the property. The home's price, closing date, seller, and buyer are listed in this contract.

What Should Be Contained in a Valid Sales Agreement? A good sales agreement should contain all the basic information related to the transaction including: Names and contact info of the parties; sales quantities and prices; description of the goods to be transferred; terms of payment and shipping; and return policies.

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

An assignment of contract occurs on a property that is currently under contract, and has not yet been purchased. First, the assignor finds a property, and enters into a sales agreement with the buyer to purchase the property. The home's price, closing date, seller, and buyer are listed in this contract.

In Washington, the requirements for a Quitclaim deed are simple: it must be in writing, contain a legal description of the property, be signed by the grantor, and the grantor's signature must be notarized.

The Washington State Archives has begun to put some of their records, including land records online. They are available on the Washington State Digital Archives web site.

Though they sound similar, a PSA is different from a purchase agreement. PSAs define the terms of the transaction and include the date of closing and other details. Signing a PSA does not complete the sale of the home. Signing a purchase agreement, however, does complete the home sale.

Once the purchase agreement is signed and the earnest money is deposited, the buyer has the legal right to purchase the property should all agreed upon conditions be satisfied.

You can record a document by bringing it in person to the King County Recorder's Office, sending it by mail, or by e-recording. If you arrive at our office before , you may request immediate scanning of your document (maximum of three documents at a time) so that you may leave with the orginal.