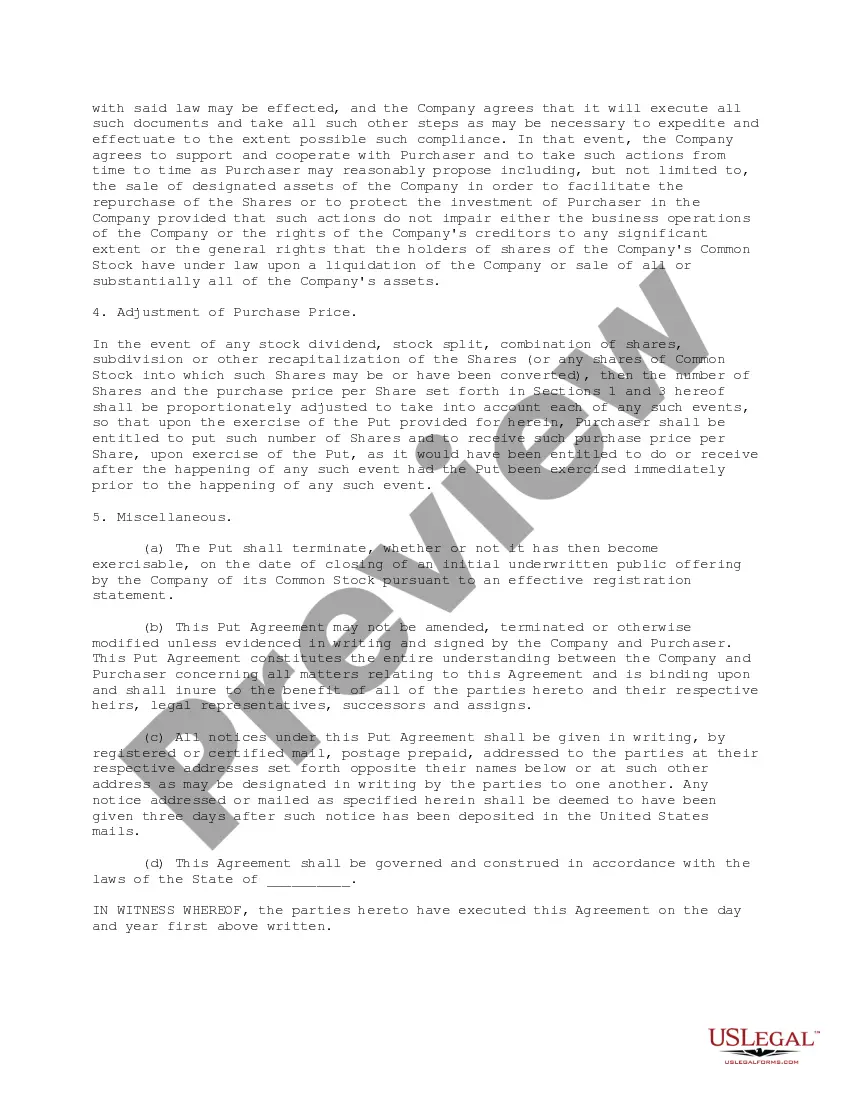

The Clark Nevada Put Agreement is a legal arrangement that outlines the specific terms and conditions governing the sale of certain securities. It is commonly used in the financial industry and provides protection to the investor by allowing them to "put" or sell back the securities to the issuer or another designated party at a predetermined price within a specified period. The Clark Nevada Put Agreement ensures that the investor has the right to sell the securities at a fixed price, regardless of market fluctuations. This feature makes it an attractive option for risk-averse investors who want to have an exit strategy in place in case the value of the securities decreases significantly. One type of Clark Nevada Put Agreement is the Traditional Put Agreement, where the investor has the right to put back the securities to the issuer. This can be beneficial if the investor believes that the market conditions are unfavorable and wants to lock in a guaranteed selling price. Another type is the Third-Party Put Agreement, where the investor can sell the securities to a designated third party instead of the original issuer. This type provides additional flexibility to the investor as they have the option to find a willing buyer outside the issuer if they wish to exercise the put right. The Clark Nevada Put Agreement includes various key components, such as the put price (the predetermined selling price), the put period (the timeframe during which the investor can exercise the put right), and any applicable fees or penalties associated with the put option. Investors should carefully review the terms and conditions of the Clark Nevada Put Agreement before entering into the agreement. It is crucial to understand any limitations or restrictions, as well as the potential financial implications of exercising the put option. In summary, the Clark Nevada Put Agreement is a legal tool that allows investors to protect themselves against potential downside risks by giving them the right to sell securities back to the issuer or a designated third party at a predetermined price within a specified period. Understanding the various types and components of the agreement is essential to make informed investment decisions.

Clark Nevada Put Agreement

Description

How to fill out Clark Nevada Put Agreement?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Clark Put Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the Clark Put Agreement. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Put Agreement in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

The filing code refers to whatever it is that you're filing (motion, memorandum, affidavit, complaint, etc.).

File for a Divorce? Divorces are granted to NEVADA STATE residents only. Information on filing for divorce can be obtained through the Clark County Family Law Self-Help Center located on the first floor of the Family Courts and Services Center, 601 N. Pecos, Las Vegas.

Lead document: In the context of eFiling, a lead document is any document that requires its own file stamp. For example: Motion, Points & Authorities and a Declaration should all be submitted in one ?envelope? but as separate ?lead? documents.

Generally, it takes one to four weeks for a joint petition divorce to be granted in Clark County, Nevada when both parties sign the papers. How busy the court happens to be when your case is filed affects this timeline, as well as how busy your judge is at the time they are assigned the case.

You can file for divorce in the district court in the county where either spouse lives. See NV Rev. Stat. § 125.020 (2020).

Once your forms are filled out and you are ready to file, be prepared to pay a $314.00 filing fee, or if indigent bring a fee waiver form. There is an informative consumer information pamphlet available online from the Washington State Bar Association that provides some general information for dissolution of marriage.

What is the Client Reference Number? The Client Reference Number is to help attorneys associate filings with internal firm records. For example, you can enter your client's name or account number, or the purpose of the filing to help you reconcile your filings with your firm records.

The Clerk of the Court allows parties to file and serve documents on-line using Odyssey File & Serve. The electronic system allows parties to search by full case number or use party search to access a case and begin the electronic filing and service process.

You can obtain a packet of forms used for filing a dissolution at the clerk's office for a fee, or you may download forms and instructions from the Administrator for the Courts. A checklist for dissolution with or without children is available for download from the Family Court Facilitator web page.

To get a Clark County divorce, you or your spouse must reside in the county and file your paperwork with the local court.