Orange California Put Agreement is a legal contract that allows an investor to sell shares of a security at a predetermined price before a specific date. This agreement provides a vital safeguard to investors by giving them the right to sell their investments in the Orange, California market at a specific price, known as the put price. Let's dive deeper into the components and types of Orange California Put Agreement. 1. Definition of Orange California Put Agreement: An Orange California Put Agreement is a financial contract between an investor and a counterparty that grants the investor the option to sell a specific security, typically stocks or bonds, at a predetermined price within a specified time frame. The primary purpose of executing this agreement is to protect investors from potential declines in the security's value. 2. Key Components of Orange California Put Agreement: — Exercise Price: This is the predetermined price at which the investor can sell the security. — Put Price or Strike Price: The price at which the investor can sell the security specified in the agreement. — Premium: The amount paid by the investor to the counterparty for obtaining the right to sell the security. — Expiration Date: The specified date by which the investor must decide whether to exercise the put option. — Counterparty: The other party involved in the agreement who undertakes the obligation to purchase the security at the put price. 3. Types of Orange California Put Agreement: a) American Put Option: This type of put option allows the investor to exercise their right to sell the underlying security at any point until the expiration date. b) European Put Option: In contrast, the European put option only allows the investor to exercise their right to sell the security on the expiration date itself. c) Cash-Secured Put: This variation of the Orange California Put Agreement obligates the investor to have enough cash in their account to cover the purchase of the security if they choose to exercise the put option. d) Naked Put Option: This involves selling a put option without holding the underlying security, potentially exposing the investor to higher risks. Overall, Orange California Put Agreement provides a valuable tool for investors in the Orange, California market to protect their investments by allowing them to sell securities at a predetermined price before a specific date. Understanding the various types and components of this agreement is essential for investors aiming to utilize this strategy effectively.

Orange California Put Agreement

Description

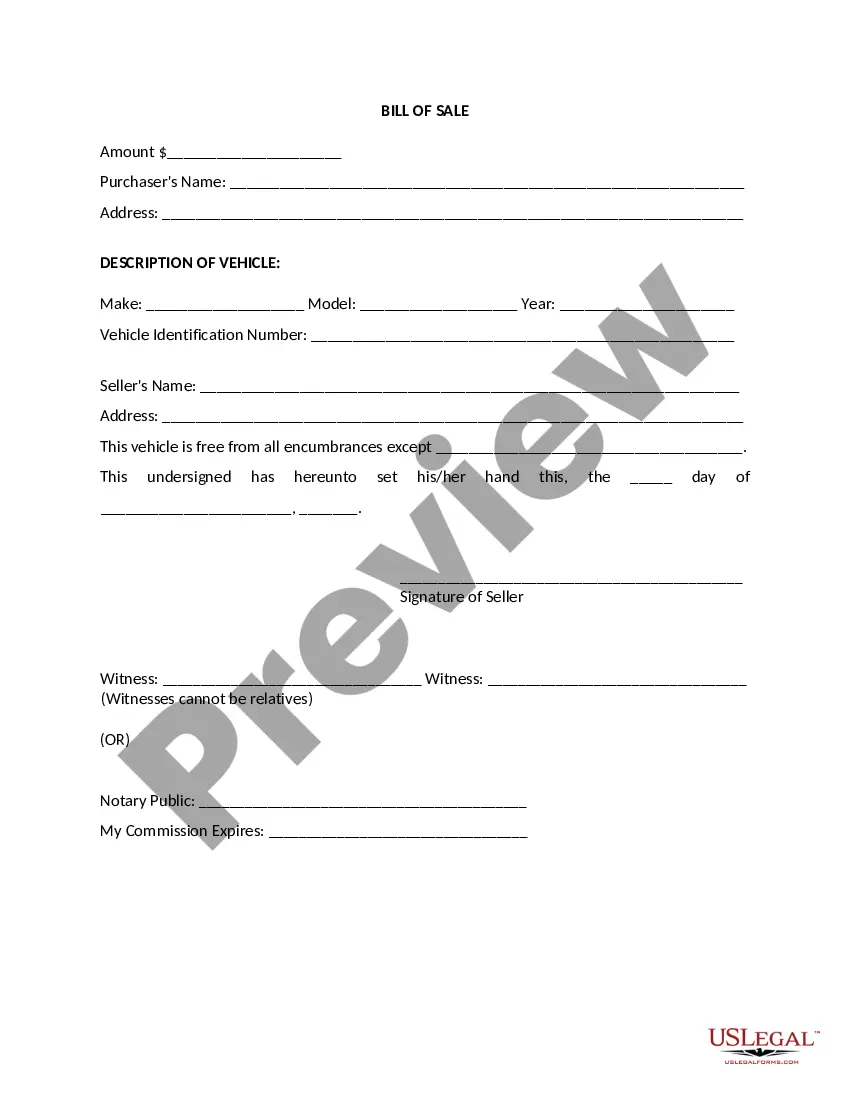

How to fill out Orange California Put Agreement?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Orange Put Agreement.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Orange Put Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Orange Put Agreement:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Orange Put Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

FCOJ futures have traded in New York since 1966, first on the New York Cotton Exchange, then on the successor New York Board of Trade and now on ICE Futures U.S. Options on FCOJ futures were introduced in 1985.

A popular way to invest in orange juice is through the use of a contract for difference (CFD) derivative instrument. CFDs allow investors to speculate on the price of FCOJ. The value of a CFD is the difference between the price of FCOJ at the time of purchase and its current price.

Of Trade Page 4 4 Frozen Concentrated Orange Juice (FCOJ) is a relatively modern form of a basic agricultural commodity.

FCOJ futures have traded in New York since 1966, first on the New York Cotton Exchange, then on the successor New York Board of Trade and now on ICE Futures U.S. Options on FCOJ futures were introduced in 1985.

Combined with the expansion of modern home refrigeration, frozen concentrated orange juice (FCOJ) brought orange juice to millions of consumers. Today, FCOJ is a popular global commodity traded on futures exchanges and part of the multi-billion dollar orange juice industry.

The short answer: yes. Frozen concentrated orange juice trading is actually a thing. Traders don't pull up with carts full of little metal cans. Instead, they trade contracts that state they'll deliver a certain amount of orange juice (15,000 pounds at a time, not in little cans) at the agreed-upon price.

The FCOJ-A futures contract is the world benchmark contract for the global frozen concentrated orange juice market. The contract prices physical delivery of U.S. Grade A juice (with grading performed by the U.S. Department of Agriculture), in storage in exchange licensed warehouse in several U.S. delivery points.

There is no ETF that specifically invests in orange juice. However, the Elements Rogers International Commodity Agriculture Total Return ETN trades in a very broad basket of commodities. Orange juice represents less than 2% of the holdings in this fund.

Frozen concentrate orange juice futures and options are traded at the Intercontinental Exchange (ICE). The ICE orange juice futures contract calls for the delivery of 15,000 pounds of orange solids and is priced in terms of cents per pound.