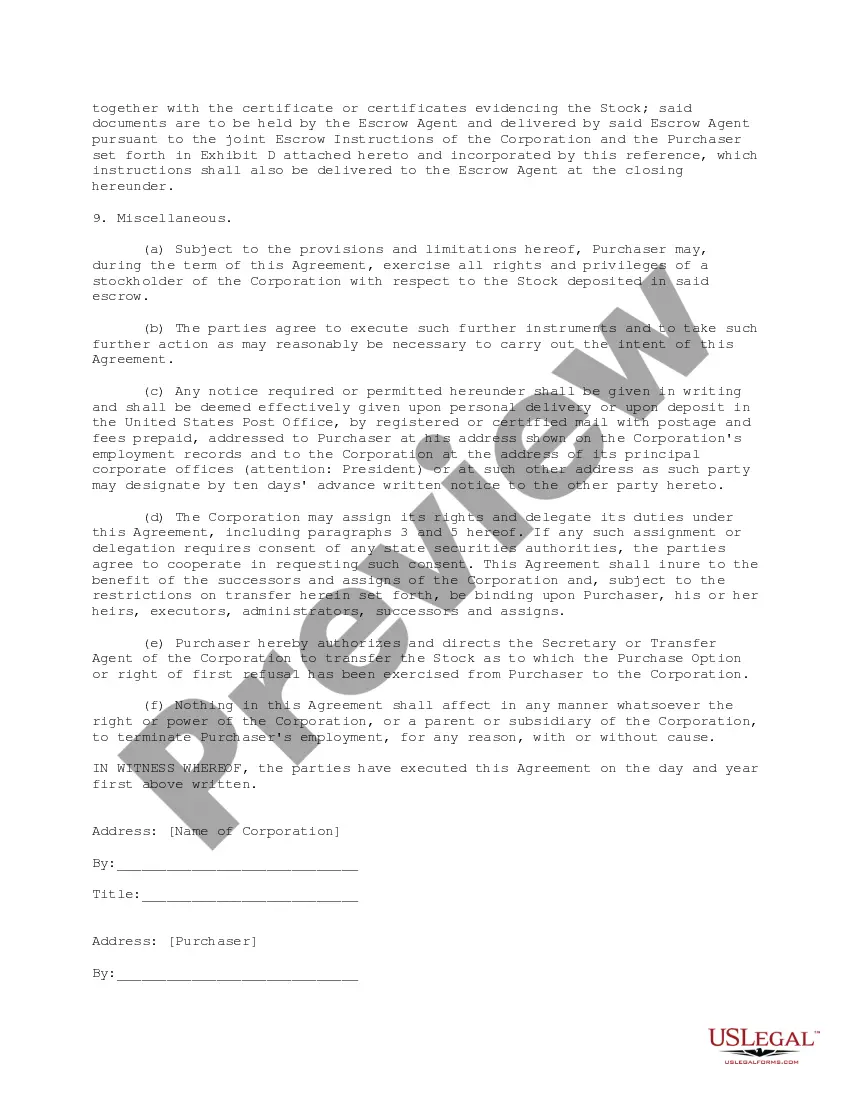

A Fairfax Virginia Employee Restricted Stock Purchase Agreement is a legal document that outlines the terms and conditions under which an employee of a company based in Fairfax, Virginia, can purchase restricted stock options. This agreement is a common method used by employers to provide employees with the opportunity to acquire company shares at a predetermined price. The primary purpose of the Employee Restricted Stock Purchase Agreement is to incentivize and reward employees by allowing them to share in the company's success and potential financial growth. By offering the purchase of restricted stock, employers aim to align the interests of employees with those of the company, as employees become partial owners and shareholders. Key elements of a typical Fairfax Virginia Employee Restricted Stock Purchase Agreement may include: 1. Grant of Restricted Stock: This section outlines the number of shares the employee is entitled to purchase and the terms of the grant, such as the vesting period, sometimes subject to specific criteria like tenure or performance milestones. 2. Purchase Price: The agreement specifies the price at which the employee can purchase the restricted stock. This price is often set at a discount to the market value of the company's shares to provide employees with a financial incentive. 3. Vesting Schedule: The vesting schedule details when the employee's ownership of the restricted stock becomes fully realized. This can occur over time (e.g., four-year vesting with a one-year cliff) or at specific milestones (e.g., upon achieving a certain position or meeting performance goals). Vesting is designed to promote employee retention and loyalty to the company. 4. Rights and Restrictions: This section outlines any restrictions or obligations associated with the ownership of the restricted stock. For instance, the employee may be prohibited from selling or transferring the shares before a specific date or without prior company approval. It may also clarify any voting rights or dividend entitlements during the restricted period. 5. Termination or Change in Employment: In the event the employee's employment is terminated or there is a change in control of the company, this section provides guidance on how the restricted stock will be treated. It may specify conditions for acceleration of vesting, partial or full buyback options, or other relevant provisions. Different types of Employee Restricted Stock Purchase Agreements in Fairfax, Virginia may vary based on specific factors and companies' requirements. Some examples may include: 1. Incentive Stock Option (ISO) Agreement: This agreement addresses stock options eligible for favorable tax treatment according to Internal Revenue Service (IRS) guidelines. 2. Non-Qualified Stock Option (NO) Agreement: This agreement pertains to stock options that do not meet the requirements for SOS and may have different tax implications for both the company and the employee. 3. Restricted Stock Unit (RSU) Agreement: This agreement outlines the grant of units that represent an ownership interest in the company, subject to vesting and potential conversion into company shares in the future. In conclusion, a Fairfax Virginia Employee Restricted Stock Purchase Agreement is a significant document that allows employees in Fairfax, Virginia, to purchase restricted stock in their company under specific conditions. This agreement fosters employee engagement, loyalty, and alignment of interests with the company's success.

Fairfax Virginia Employee Restricted Stock Purchase Agreement

Description

How to fill out Fairfax Virginia Employee Restricted Stock Purchase Agreement?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Fairfax Employee Restricted Stock Purchase Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Employee Restricted Stock Purchase Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Fairfax Employee Restricted Stock Purchase Agreement:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!