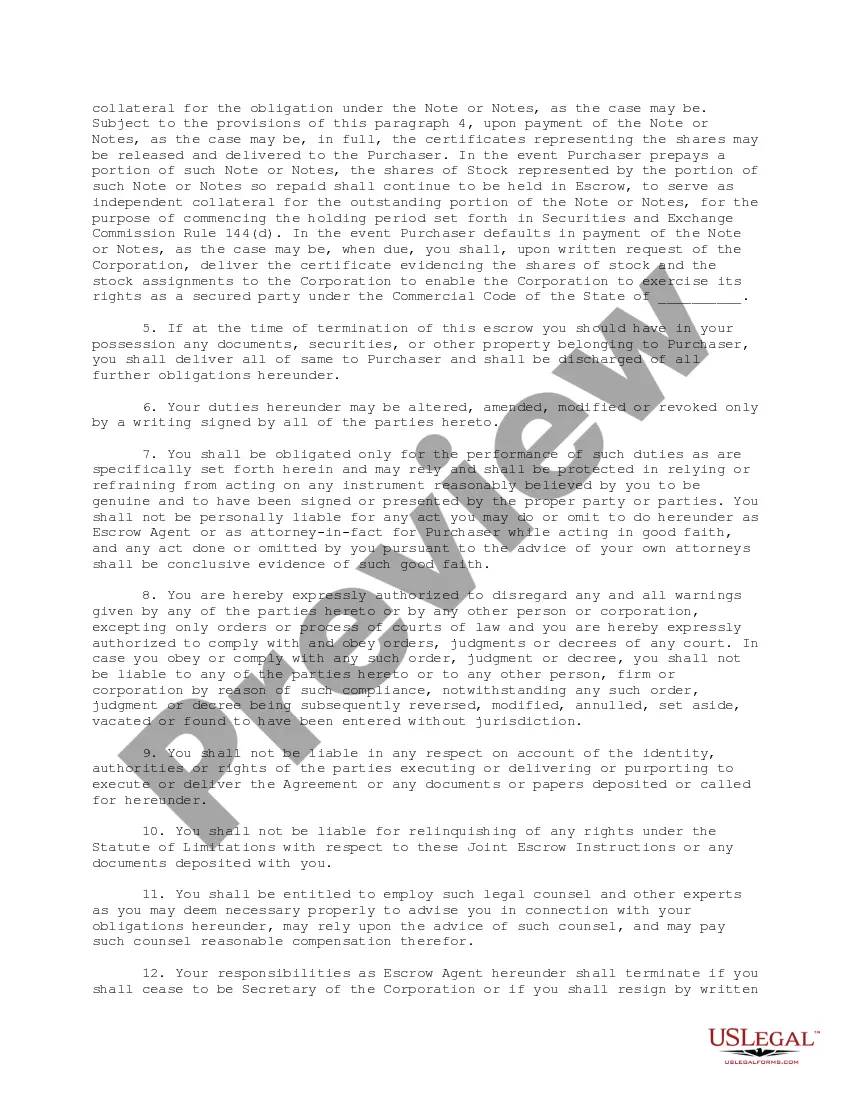

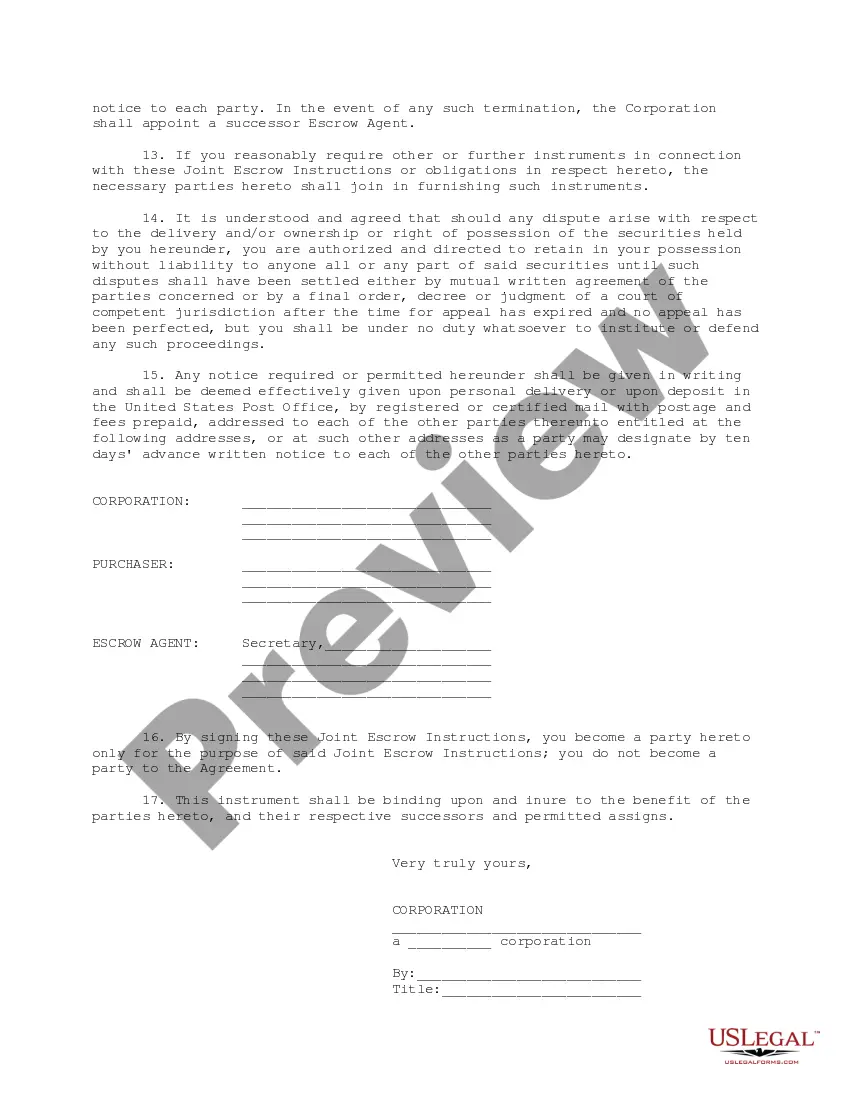

Suffolk New York Escrow Instructions for Escrow of Employee Stock play a crucial role in safeguarding the interests of both the employer and the employee during the transfer of stock ownership. It establishes guidelines and conditions for the escrow process, ensuring a smooth and legally compliant transaction. One type of Suffolk New York Escrow Instructions for Escrow of Employee Stock is the Single Party Escrow. In this scenario, the employer is the sole party involved in the escrow agreement. It outlines the terms regarding the release of stock to the employee once certain conditions, such as vesting periods or performance targets, are met. Another type is the Dual Party Escrow, which involves both the employer and the employee. This type of escrow agreement defines the terms and conditions for the stock transfer process, including any restrictions, obligations, or rights of the employee. It may outline provisions for the release of stock upon termination of the employee or expiration of contractual obligations. Suffolk New York Escrow Instructions for Escrow of Employee Stock often include the following essential elements: 1. Stock Description: Detailed information about the stock being held in escrow, including the type of stock (common, preferred), the number of shares, and any associated rights or limitations. 2. Escrow Agent: Designation of a qualified and impartial escrow agent responsible for overseeing the escrow process, ensuring compliance with applicable regulations, and facilitating communication between the parties. 3. Conditions for Release: Clearly outlined conditions, such as specific dates, milestones, or performance metrics, upon which the stock will be released to the employee. These conditions act as safeguards to protect the employer's interests. 4. Termination Provision: Provisions outlining the circumstances under which the escrow agreement can be terminated, including events like completion of vesting periods, change of control, or termination of employment. 5. Dispute Resolution: Establishing a mechanism for resolving any disputes or conflicts that may arise during the escrow period, such as arbitration or mediation procedures. 6. Tax and Legal Considerations: A section addressing tax implications and legal obligations associated with the transfer of stock ownership and any potential consequences for the employee. By diligently following Suffolk New York Escrow Instructions for Escrow of Employee Stock, employers and employees can ensure a fair and protected transaction process. These instructions help establish clear expectations, facilitate compliance with relevant laws, and ultimately promote a smooth transfer of ownership.

Suffolk New York Escrow Instructions for Escrow of Employee Stock

Description

How to fill out Suffolk New York Escrow Instructions For Escrow Of Employee Stock?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Suffolk Escrow Instructions for Escrow of Employee Stock.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Suffolk Escrow Instructions for Escrow of Employee Stock will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Suffolk Escrow Instructions for Escrow of Employee Stock:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Suffolk Escrow Instructions for Escrow of Employee Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!