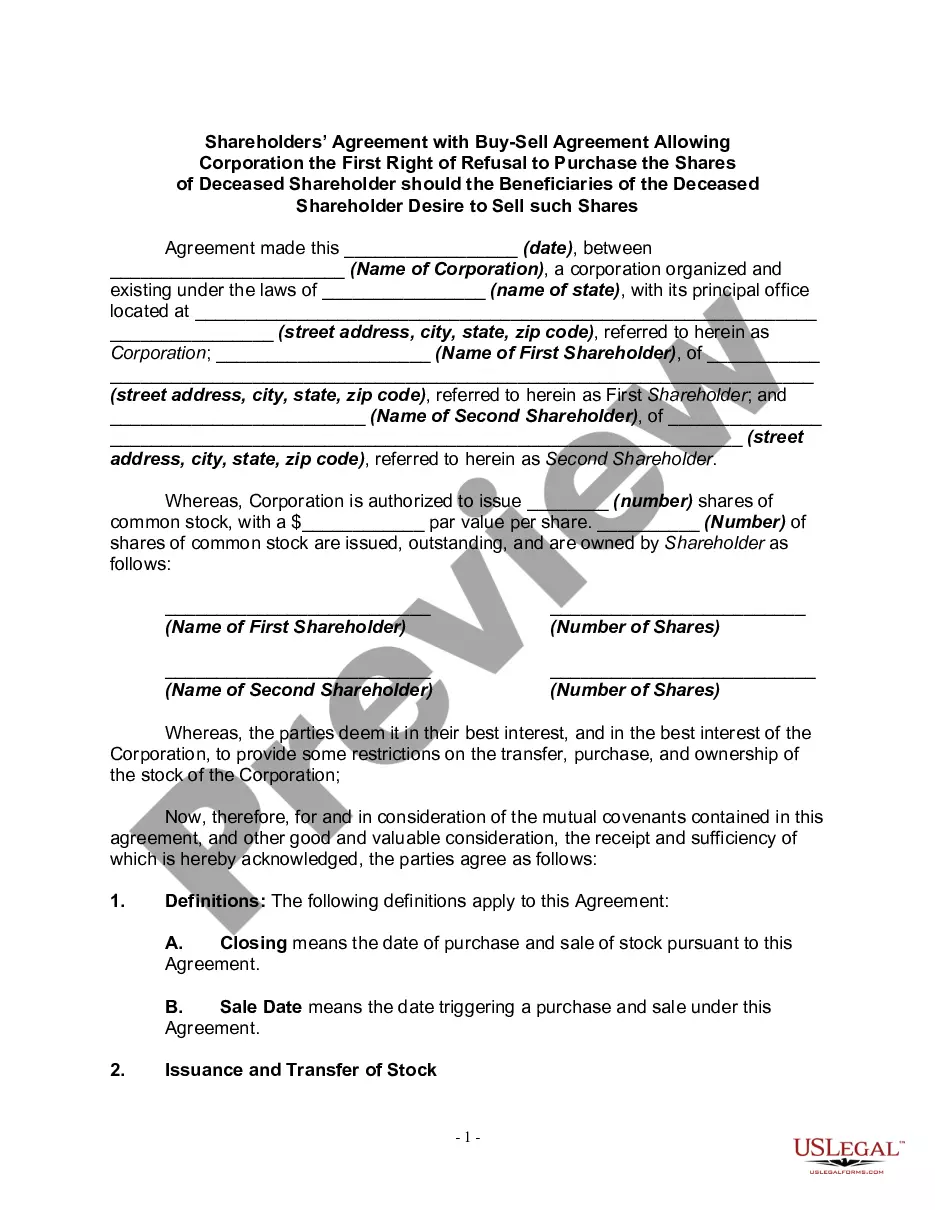

Houston Texas Stock Option Plan is a financial incentive offered by companies in Houston, Texas, to their employees in the form of stock options. A stock option is a contractual agreement that allows employees to purchase a specified number of company stocks at a predetermined price within a specific time frame. It serves as a reward for their dedication and contribution towards the company's success, encouraging them to stay committed and motivated. By granting employees the right to purchase company stocks, the Houston Texas Stock Option Plan aligns the interests of employees with shareholders, fostering loyalty and a sense of ownership. This plan aims to attract and retain talented individuals, as it offers the potential for financial growth and wealth accumulation tied to the company's performance. There are different types of Houston Texas Stock Option Plans, including: 1. Incentive Stock Options (SOS): These are tax-advantaged stock options that qualify for certain favorable tax treatment, subject to specific requirements outlined by the Internal Revenue Code. SOS provide employees with the potential to purchase company stocks at a discounted price, if exercised within a set period. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not adhere to the tax-advantaged regulations set forth by the Internal Revenue Code. They offer more flexibility in terms of grant prices, exercise periods, and transferability. However, they also subject employees to ordinary income tax upon exercise. 3. Restricted Stock Units (RSS): RSS are a form of compensation where employees receive units that convert into company stocks after vesting periods are completed. It grants employees the right to receive shares in the future, with no upfront cost. RSS provide employees with a sense of ownership in the company, as they directly benefit from its growth. 4. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company stocks at a discounted price, often offering tax advantages. These plans typically encompass a defined offering period during which eligible employees can contribute a portion of their salary towards purchasing company stocks at a predetermined price, often lower than the market value. Houston Texas Stock Option Plans vary in terms of eligibility, vesting schedules, exercise prices, and tax implications. It is crucial for both employers and employees to understand the specific details and provisions outlined in each plan to make informed decisions regarding their participation.

Houston Texas Stock Option Plan

Description

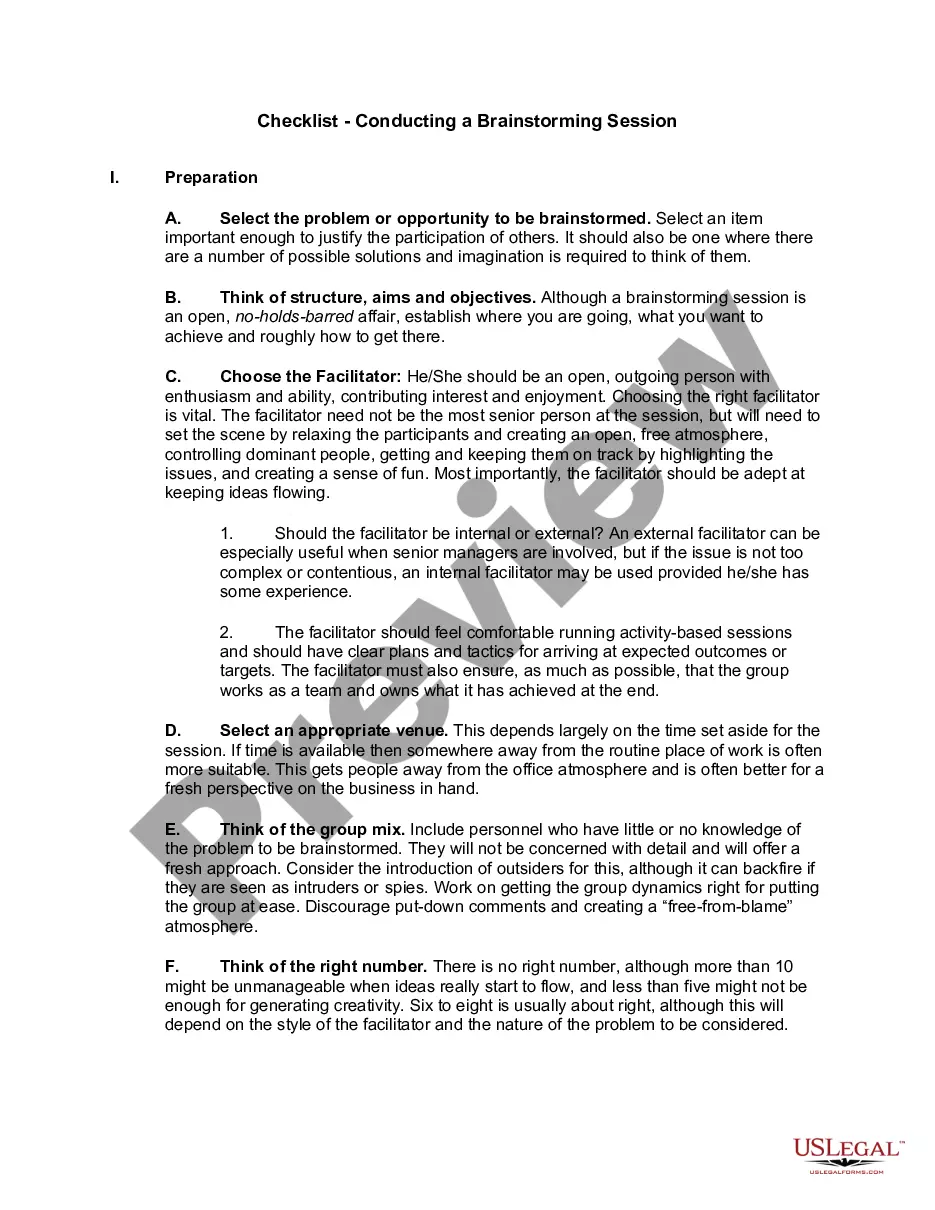

How to fill out Houston Texas Stock Option Plan?

Drafting documents for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Houston Stock Option Plan without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Houston Stock Option Plan on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Houston Stock Option Plan:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!