Salt Lake City, Utah Stock Option Plan: A Comprehensive Overview Salt Lake City, the capital and largest city of Utah, offers various stock option plans to its residents and businesses. These plans enable companies to incentivize their employees by granting them the opportunity to purchase company stock at a predetermined price within a specific time frame. Stock option plans are an attractive form of compensation as they allow employees to reap financial benefits if the company's stock price increases over time. One of the most common types of stock option plans in Salt Lake City, Utah is the Employee Stock Option Plan (ESOP). Sops are designed to promote employee ownership within a company by offering employees the right to purchase company stock. These plans can have a significant impact on employee morale, retention, and dedication, as they align employee and shareholder interests. Another type of stock option plan is the Incentive Stock Option (ISO) plan. SOS are typically granted to executives and key employees and provide tax advantages to the recipient. Under an ISO plan, employees have the opportunity to purchase company stock at a favorable price without paying immediate taxes on the difference between the exercise price and the market value of the stock at the time of exercise. Salt Lake City businesses also employ Non-Qualified Stock Options (Nests) as part of their compensation packages. Nests, unlike SOS, do not receive preferential tax treatment. However, they still provide employees with the ability to purchase company stock at a predetermined price and potentially benefit from an increase in stock value. It's worth noting that stock option plans can vary significantly in their terms, vesting schedules, and eligibility criteria. Some plans may have a graded vesting schedule, where employees earn the right to exercise a portion of their options over time, while others may have a cliff vesting schedule, where employees become fully vested after a specific period. Salt Lake City's thriving economy, home to various industries such as technology, finance, and healthcare, has made stock option plans an instrumental tool for attracting and retaining top talent. By offering employees the opportunity to become shareholders and share in the company's growth, Salt Lake City businesses can foster a culture of innovation, loyalty, and commitment. In conclusion, Salt Lake City, Utah stock option plans, including the Employee Stock Option Plan, Incentive Stock Option, and Non-Qualified Stock Option, play a crucial role in motivating and rewarding employees. These plans empower employees to become stakeholders in their companies, driving growth, and enhancing overall company performance. As Salt Lake City's economy continues to thrive, stock option plans provide an effective way for businesses to attract and retain talented individuals in this competitive market.

Salt Lake Utah Stock Option Plan

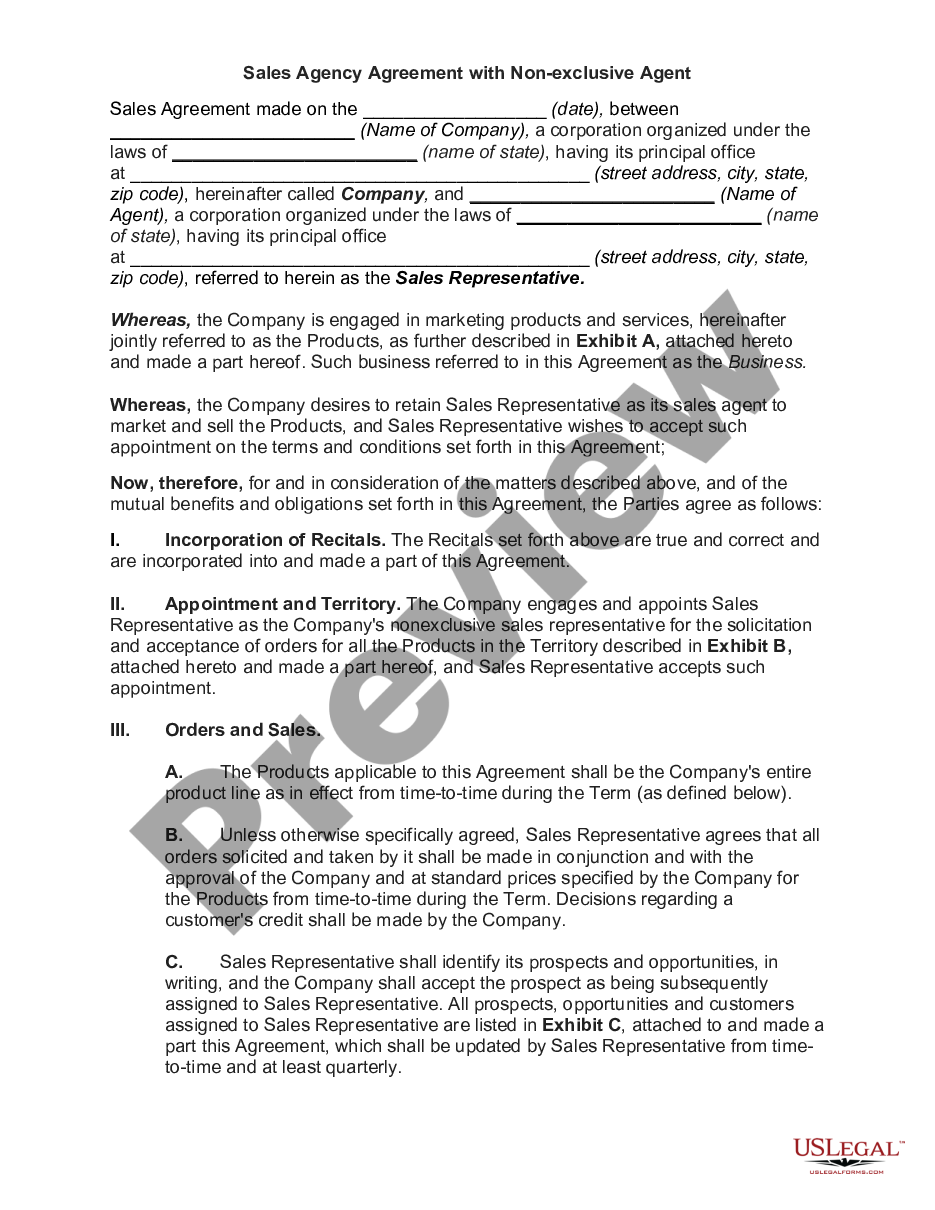

Description

How to fill out Salt Lake Utah Stock Option Plan?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a Salt Lake Stock Option Plan suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Salt Lake Stock Option Plan, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Salt Lake Stock Option Plan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Salt Lake Stock Option Plan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!