A Franklin Ohio Stock Option Agreement refers to a legally binding contract that grants an individual or entity the right to purchase or sell stocks of a company at a predetermined price within a specific time frame. This agreement allows the stock option holder to capitalize on potential financial gains or hedge against potential losses. The Franklin Ohio Stock Option Agreement is a type of financial contract commonly utilized by companies based in Franklin, Ohio, within the United States. It is designed to provide employees, executives, consultants, or investors the opportunity to purchase company stock at a specified price, often lower than the prevailing market rate. This offers the option holder the potential to benefit when the stock price increases. There are various types of Franklin Ohio Stock Option Agreements, with the most common ones being: 1. Incentive Stock Options (SOS): These are primarily granted to employees and have statutory tax advantages. SOS can only be granted to employees of the company and must adhere to specific conditions set by the Internal Revenue Service (IRS). 2. Non-Qualified Stock Options (SOS): Unlike SOS, SOS do not meet the criteria set by the IRS for preferential tax treatment. They are often granted to employees, directors, consultants, or contractors and are subject to less restrictive conditions. 3. Restricted Stock Options: This type of stock option agreement includes certain restrictions on the stock, such as a vesting period or performance-related milestones that need to be achieved before the stock is fully owned by the option holder. 4. Stock Appreciation Rights (SARS): While not considered traditional stock options, SARS are similar in nature. This agreement entitles the option holder to receive a cash payment equivalent to the increase in the stock price during a specific period, rather than granting the right to purchase the stock. 5. Employee Stock Purchase Plans (ESPN): These agreements allow employees of a company to purchase company stock at a discounted price, usually through regular payroll deductions. ESPN often offer tax advantages and may have specific eligibility criteria or holding periods. It is essential for both parties involved, the option holder and the company, to clearly outline the terms and conditions of the Franklin Ohio Stock Option Agreement. This includes provisions such as the exercise price, the expiration date, any restrictions or vesting schedules, and other administrative details relating to the agreement. It is advisable for all parties involved to seek legal and tax advice to ensure compliance with applicable laws and regulations.

Franklin Ohio Stock Option Agreement

Description

How to fill out Franklin Ohio Stock Option Agreement?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Franklin Stock Option Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Franklin Stock Option Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Franklin Stock Option Agreement:

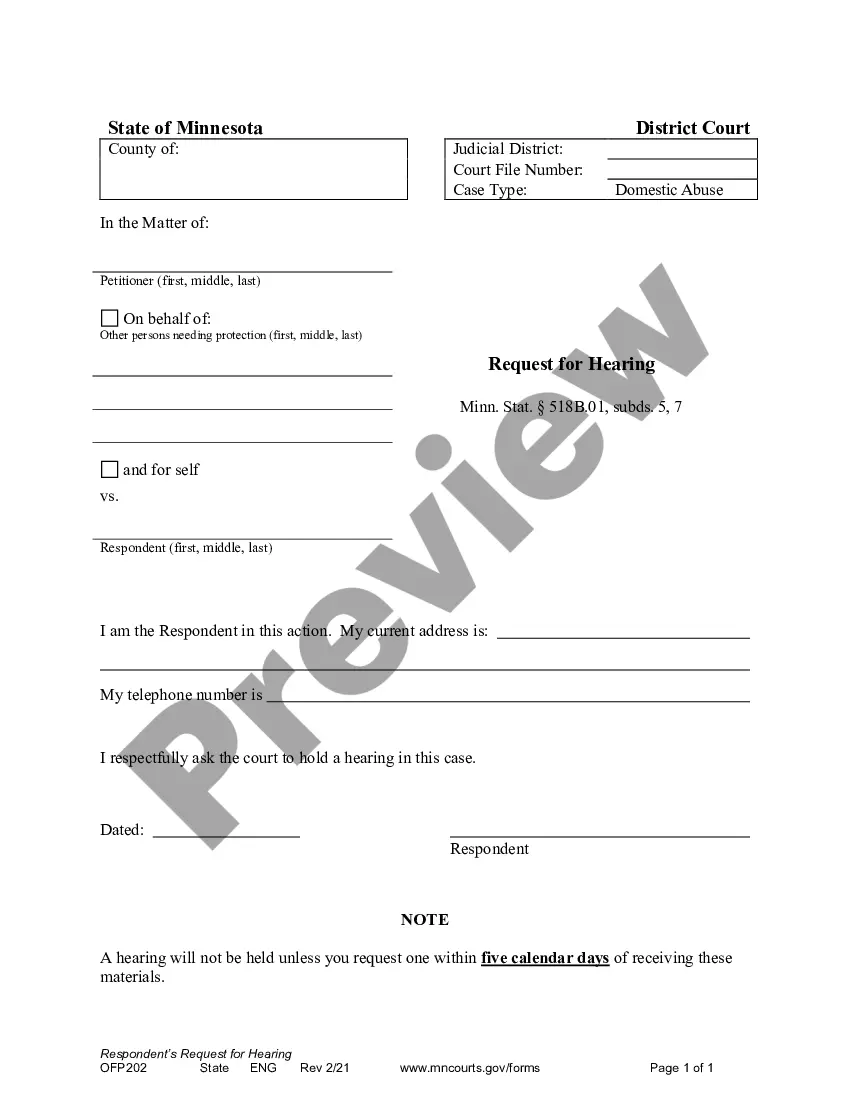

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!