Nassau New York Stock Option Agreement is a legally binding document that outlines the terms and conditions associated with buying or selling stock options in Nassau County, New York. It serves as a contractual agreement between two parties, the option granter and the option holder, specifying the details of the stock options being granted. This agreement typically covers important aspects such as the number of stock options being granted, the exercise price, vesting schedule, expiration date, and any additional terms or restrictions. It ensures that both parties are aware of their rights and obligations regarding the stock options. There are various types of Nassau New York Stock Option Agreements that may be used depending on the specific circumstances and needs of the parties involved. Some common types include: 1. Non-Qualified Stock Option Agreement: This type of agreement involves stock options that do not meet the requirements for special tax treatment. Non-qualified stock options are typically granted to employees or consultants as a form of compensation. 2. Incentive Stock Option Agreement: This agreement is used when granting stock options that meet the requirements specified by the Internal Revenue Service (IRS) for favorable tax treatment. Incentive stock options are usually granted to employees with certain limitations and conditions. 3. Restricted Stock Option Agreement: This type of agreement is applicable when stock options are subject to certain restrictions or conditions. These restrictions may include a vesting period or performance-based criteria that must be met before the stock options can be exercised. 4. Stock Option Exercise Agreement: This agreement is used when the option holder decides to exercise their stock options and purchase the underlying shares. It outlines the steps and procedures for exercising the options, including the payment of the exercise price and any applicable taxes. In conclusion, Nassau New York Stock Option Agreements are essential legal documents that govern the terms and conditions of buying or selling stock options in Nassau County, New York. Different types of agreements exist to accommodate the unique needs and requirements of the parties involved, ensuring a clear understanding of the rights and obligations associated with the stock options.

Nassau New York Stock Option Agreement

Description

How to fill out Nassau New York Stock Option Agreement?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Nassau Stock Option Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Stock Option Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Nassau Stock Option Agreement:

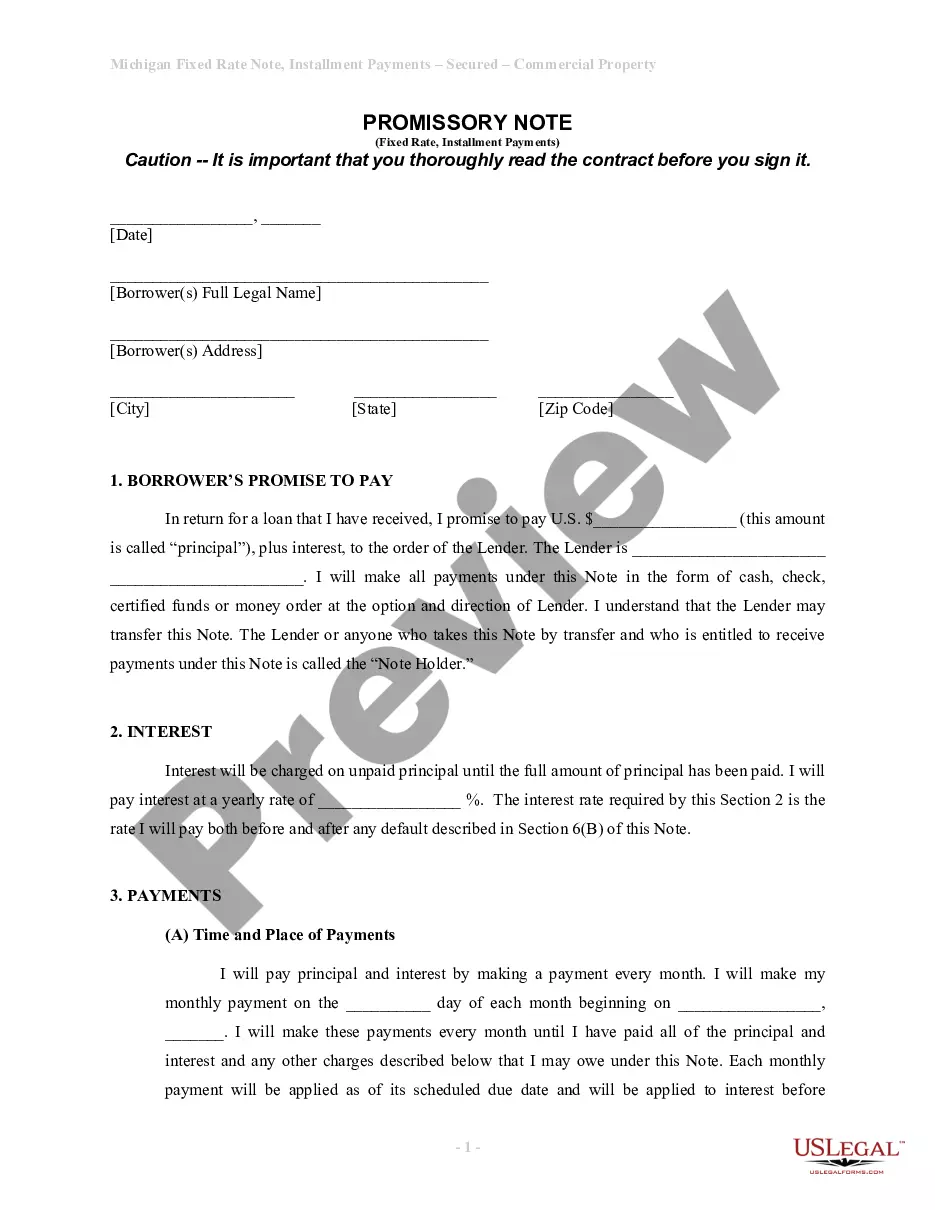

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!