Oakland Michigan Stock Option Agreement is a legal contract that governs the terms and conditions of stock options granted by a company to its employees or other individuals. This agreement outlines the rights and obligations of both parties involved in the stock option transactions. It is used to specify the exercise price, vesting period, stock option expiration date, and other important details related to the stock options. In Oakland, Michigan, there may be different types of Stock Option Agreements based on various factors such as the nature of the company, the industry it operates in, and the specific terms negotiated between the parties. Some common types of Stock Option Agreements in Oakland, Michigan, include: 1. Employee Stock Option Agreement: This type of agreement is typically offered to employees of a company, giving them the right to purchase company stock at a predetermined price during a specified period. The agreement will outline the vesting schedule, exercise price, and any other conditions or restrictions related to the stock options. 2. Non-Employee Stock Option Agreement: Also known as consultant or contractor stock option agreements, these are offered to individuals who provide services to a company but are not considered employees. The terms and conditions are similar to employee stock option agreements, but may include additional clauses to address the unique relationship between the company and the non-employee. 3. Incentive Stock Option Agreement: This type of agreement is granted to employees and is intended to provide tax advantages. Incentive Stock Options (SOS) are subject to certain requirements outlined by the Internal Revenue Service (IRS). The agreement will specify the necessary conditions for the options to qualify as SOS and the potential tax implications for the employee. 4. Non-Qualified Stock Option Agreement: Non-Qualified Stock Options (SOS) are granted to employees or non-employees and do not meet the requirements set by the IRS for incentive stock options. The agreement will outline the exercise price, vesting period, and any applicable tax implications associated with SOS. 5. Director Stock Option Agreement: This type of agreement is specifically tailored for members of a company's board of directors. It outlines the terms and conditions for stock options granted to directors as part of their compensation package. The agreement may include provisions related to the director's responsibilities, fiduciary duties, and potential conflicts of interest. It is essential to consult with legal professionals specializing in securities law and corporate governance to ensure that any Stock Option Agreement in Oakland, Michigan, complies with applicable laws and covers all necessary provisions to protect the rights of both parties involved.

Oakland Michigan Stock Option Agreement

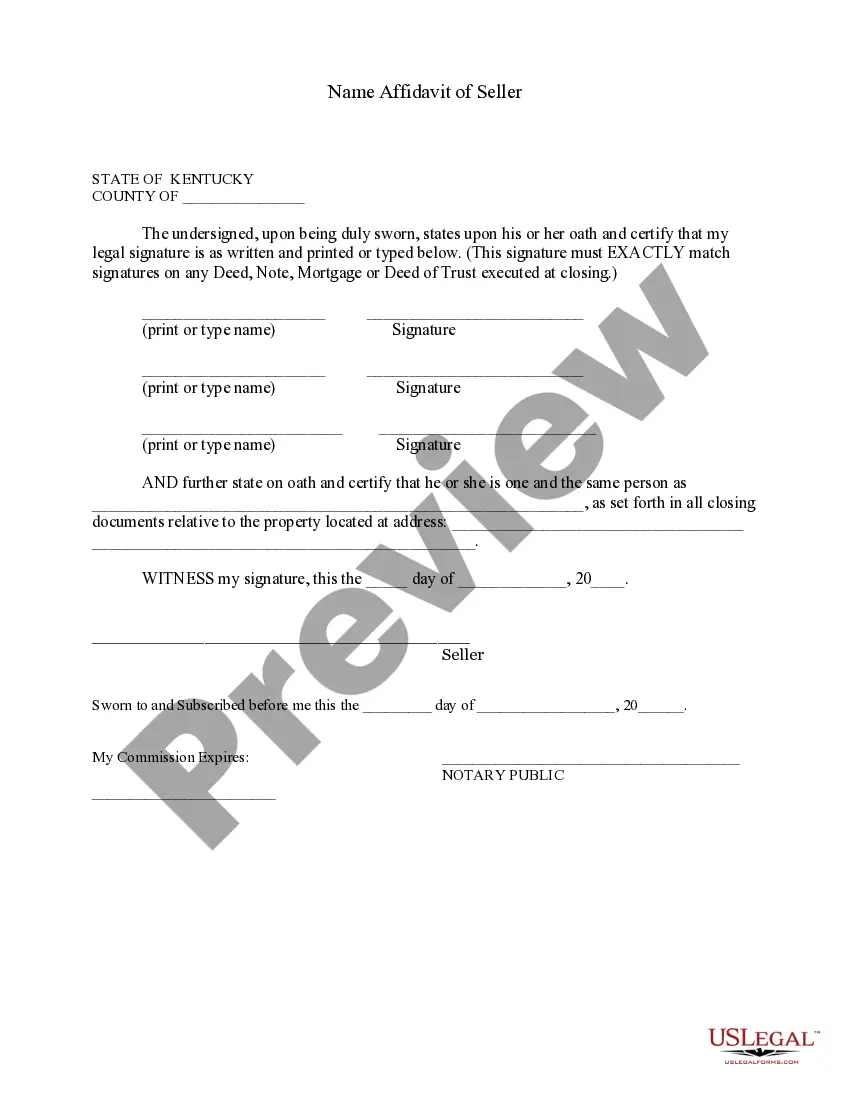

Description

How to fill out Oakland Michigan Stock Option Agreement?

Creating forms, like Oakland Stock Option Agreement, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Oakland Stock Option Agreement form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Oakland Stock Option Agreement:

- Ensure that your form is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Oakland Stock Option Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and get the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!